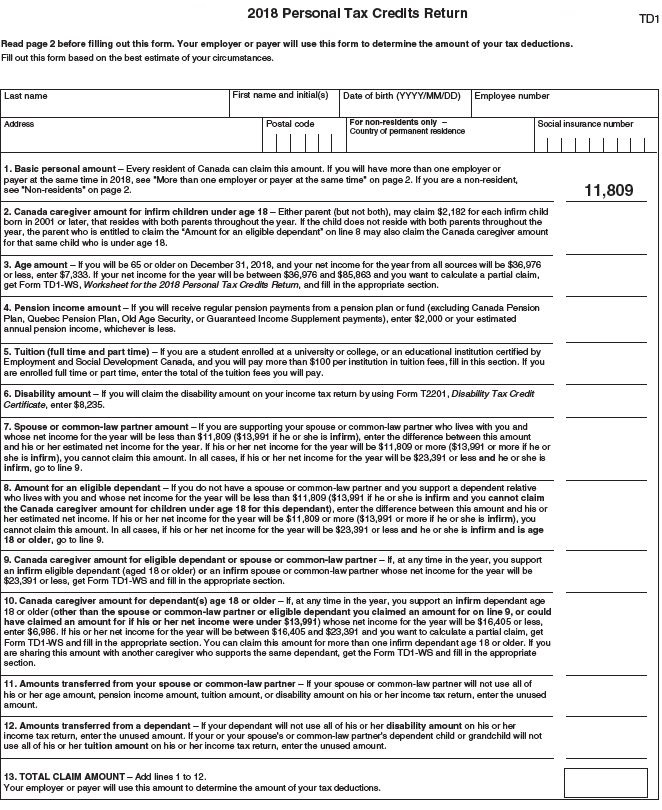

Canada Td1 Form

Canada Td1 Form - Unfortunately, they aren’t magically calculated on your employee’s behalf. Here is everything you need to know about the td1 form. Web if your net income from all sources for the year will be $150,473 or less, enter$13,229. To know how much tax to deduct, each. Web what is a td1 tax form? The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. Web a td1 federal form, officially the personal tax credits form, is used to determine the amount of tax to deduct from your income. Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required.

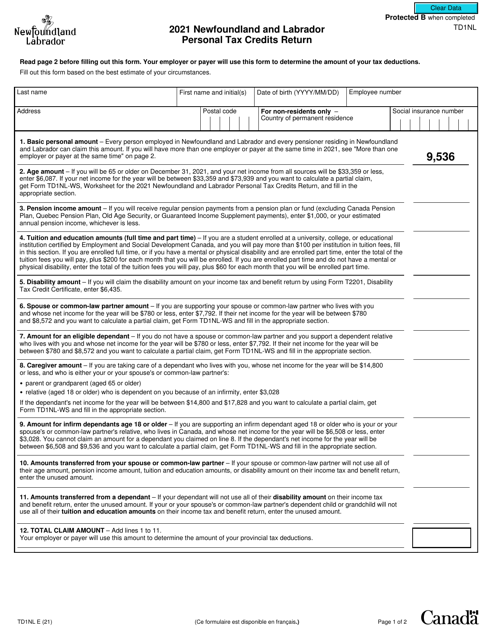

Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income. Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Simply put, a td1, personal tax credits return, is a form that is necessary for. Unfortunately, they aren’t magically calculated on your employee’s behalf. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Web what is a td1 tax form? The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021.

Web what is a td1 tax form? Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. January 6, 2023 tax credits! Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Web the td1 personal tax credit return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension. Web a td1 federal form, officially the personal tax credits form, is used to determine the amount of tax to deduct from your income. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. However, if your net income from all sources will be greater. The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Simply put, a td1, personal tax credits return, is a form that is necessary for.

Important Forms & Documents »

Web the use of td1 forms enables the canada revenue agency to collect the appropriate amount of tax every time an employee is paid, rather than as a lump sum at the end of. January 6, 2023 tax credits! Learn about td1 forms on cra’s website. Unfortunately, they aren’t magically calculated on your employee’s behalf. Web what is a td1.

If you work in Canada, you should know this. Form TD1 (Part 1) YouTube

January 6, 2023 tax credits! Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Web create federal and provincial or territorial forms td1, following the.

Form TD1NL Download Fillable PDF or Fill Online Newfoundland and

Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web if your net income from all sources for the year.

HOW TO Fill a TD1 Form Canada (2023) YouTube

Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Web the td1 personal tax credit return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension. Web form.

How to stop paying the Tax Man too much VazOxlade Toronto Star

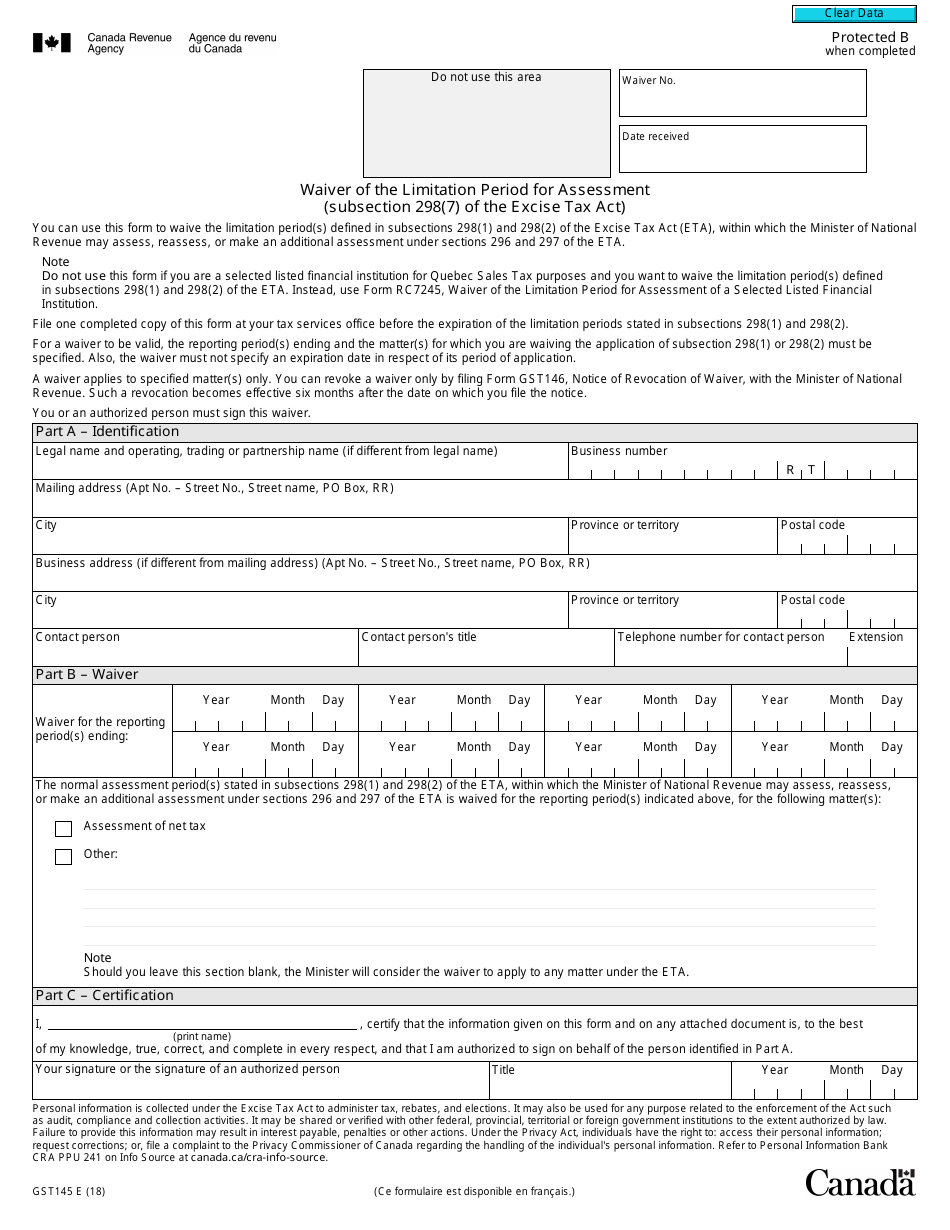

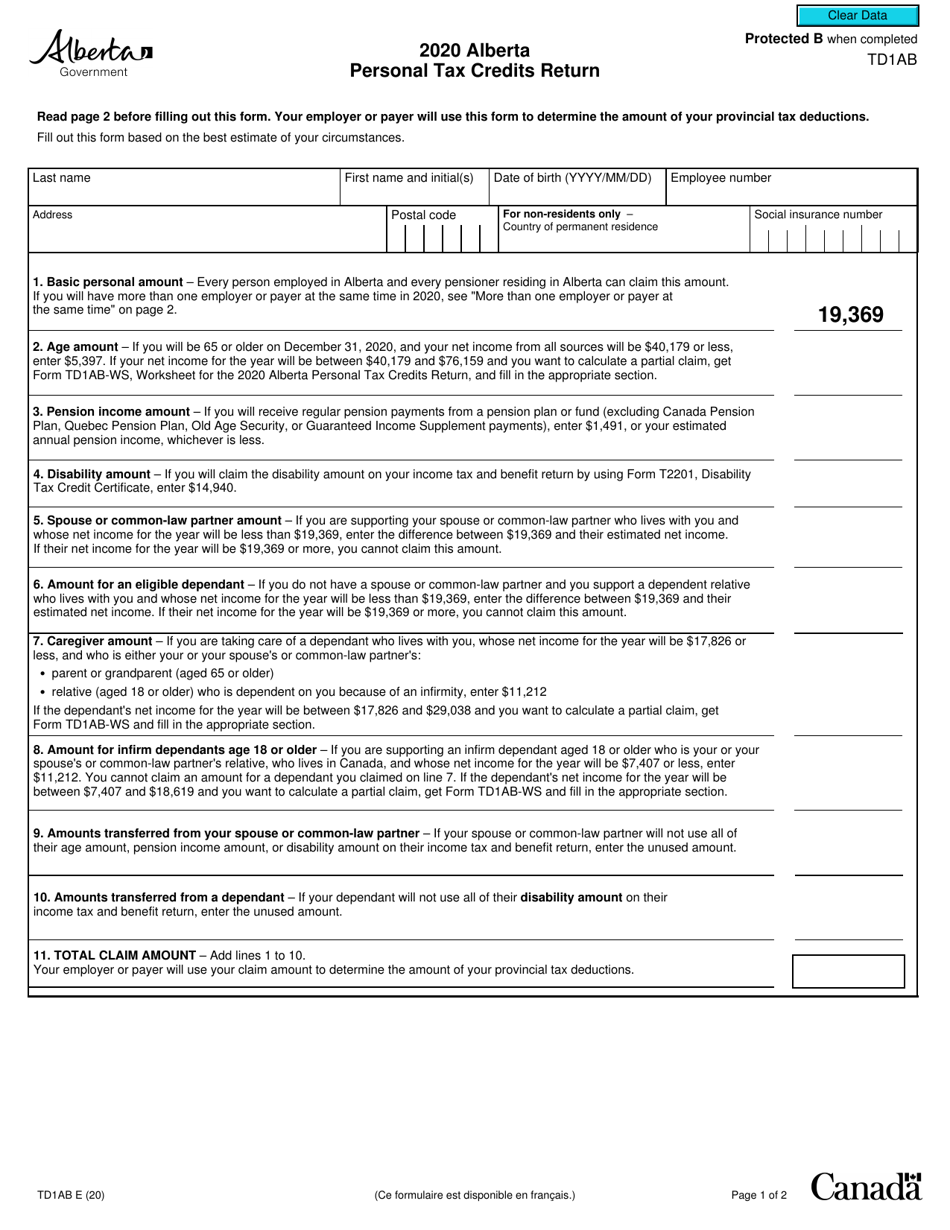

Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. Web the use of td1 forms enables the canada revenue.

Form GST145 Download Fillable PDF or Fill Online Waiver of the

There are td1 federal forms. Web if your net income from all sources for the year will be $150,473 or less, enter$13,229. However, if your net income from all sources will be greater. January 6, 2023 tax credits! Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate.

What is a TD1 Form & Why Do You Need It?

Web if your net income from all sources for the year will be $150,473 or less, enter$13,229. Learn about td1 forms on cra’s website. Simply put, a td1, personal tax credits return, is a form that is necessary for. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase.

How to Fill out a TD1 Form (2021)

Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021. Here is everything you need to know about the td1 form. Learn about td1 forms.

Form TD1AB Download Fillable PDF or Fill Online Personal Tax Credits

There are td1 federal forms. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. If your net.

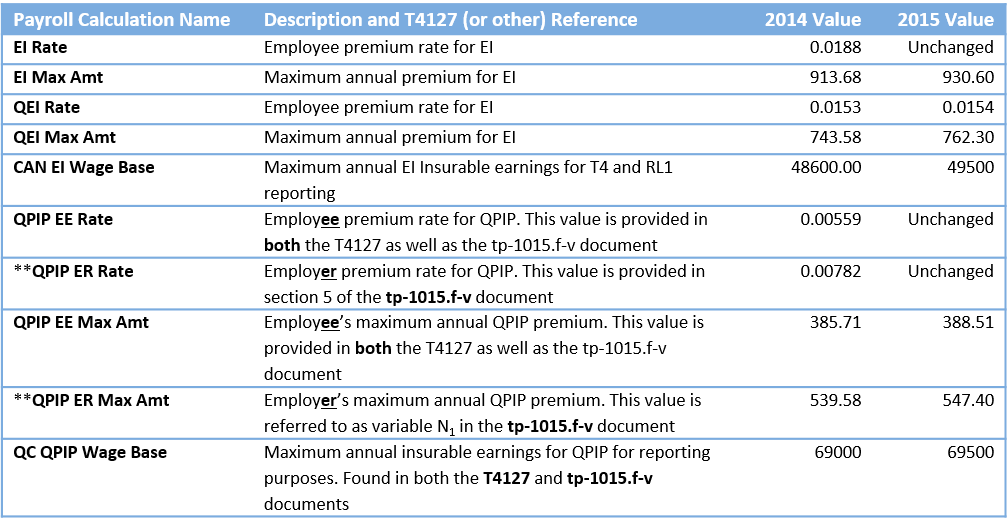

2015 Canadian Statutory Deduction Changes LOKI Systems

Here is everything you need to know about the td1 form. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. To know how much tax to deduct, each. Web a td1 federal form, officially the personal tax credits form, is used to determine the amount of.

Here Is Everything You Need To Know About The Td1 Form.

Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income. Web what is a td1 form? Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as.

Web If Your Net Income From All Sources For The Year Will Be $150,473 Or Less, Enter$13,229.

Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. To know how much tax to deduct, each. Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial.

Web Get The Completed Td1 Forms.

Unfortunately, they aren’t magically calculated on your employee’s behalf. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Learn about td1 forms on cra’s website. Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021.

Web The Use Of Td1 Forms Enables The Canada Revenue Agency To Collect The Appropriate Amount Of Tax Every Time An Employee Is Paid, Rather Than As A Lump Sum At The End Of.

January 6, 2023 tax credits! The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Web the td1 personal tax credit return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension.