Capital Group Rollover Form

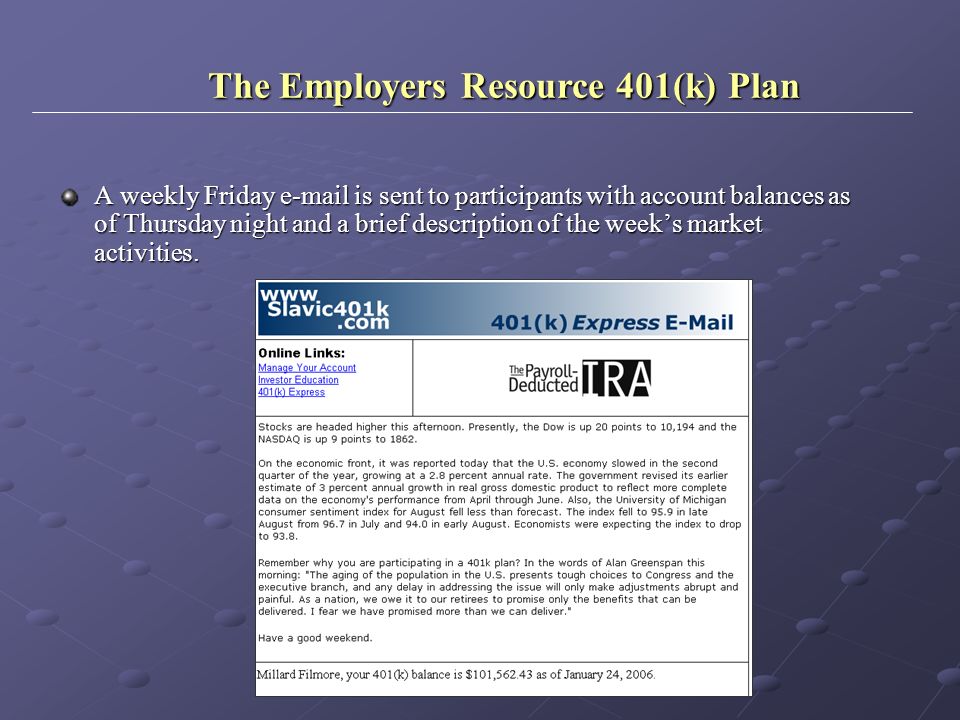

Capital Group Rollover Form - Click the loans & withdrawals tab. Web get the basics about how to rollover, how much you can rollover, how rollovers can affect your taxes, and more. Know your options (pdf) ; Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. While you’re anticipating all the adjustments and challenges ahead, however, don’t. Web if you’re 50 or older, you can contribute up to $7,500 in 2023. Web inherited ira beneficiary change. Web additional help what if i have more questions about what i should do with my retirement plan money? Manage your accounts online instead of submitting a form. I want to roll my retirement assets over.

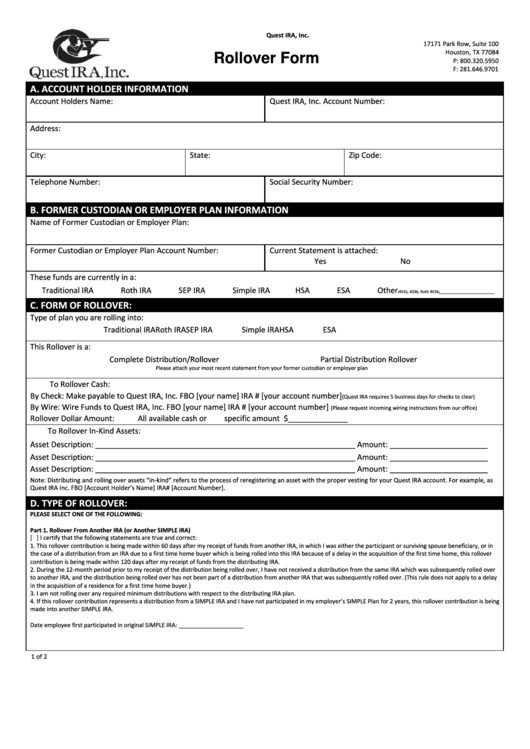

Web additional help what if i have more questions about what i should do with my retirement plan money? You can avoid required minimum distributions (rmds). May 2023 fill in/print not available to order enter quantities for one or more titles and click add all to cart. Web since 1931, we’ve been working with advisors like you to help achieve client goals. I want to roll my retirement assets over. 403(b) direct rollover request from a cb&t. Log in to your portfolio. While you’re anticipating all the adjustments and challenges ahead, however, don’t. This form should only be used for. Web incoming rollover request participant:

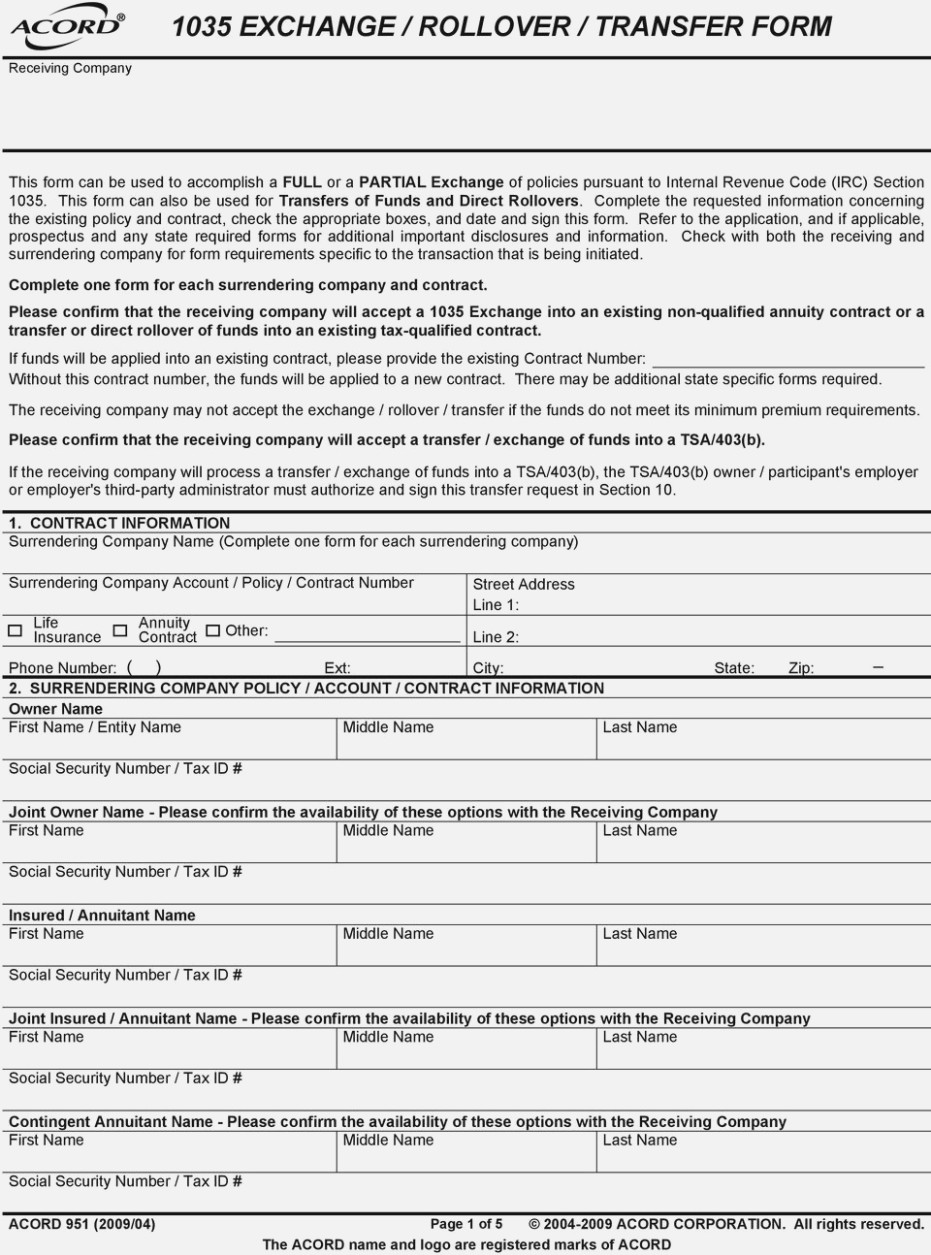

You can avoid required minimum distributions (rmds). All other company and product names mentioned are. Log in to your portfolio. Click the loans & withdrawals tab. Web incoming rollover request participant: Web if you need forms, contact your benefits department to obtain them. Web investors can use this form to roll an ira or qualified plan distribution back to a qualified plan or ira within 60 days of receiving the assets. Request for transfer of assets or direct. Participants can use this form to request a transfer or direct rollover from an external ira. Manage your accounts online instead of submitting a form.

Capital Gold Group TV Commercial, 'IRA Rollover, 401K Rollover' iSpot.tv

I want to roll my retirement assets over. Click the loans & withdrawals tab. Form used by existing investors to change or designate the beneficiaries on a cb&t inherited ira (traditional, roth or simple) that contains. Web get forms for buying, selling and exchanging your american funds shares, and for linking your mutual fund and bank accounts. Web all capital.

401k Rollover Form 1040 Universal Network

403(b) direct rollover request from a cb&t. Of course, you don’t have to roll over money to open an ira. Web results based on your option and account type. Web if you need forms, contact your benefits department to obtain them. Participants can use this form to request a transfer or direct rollover from an external ira.

Our Clients The Ricciardi Group

Participants can use this form to request a transfer or direct rollover from an external ira. I want to roll my retirement assets over. Web form used to request a rollover from a 529 plan to collegeamerica. Web inherited ira beneficiary change. Web since 1931, we’ve been working with advisors like you to help achieve client goals.

Rollover Business StartUp Investment Accounts Alpha Capital

Request for transfer of assets or direct. Form used by existing investors to change or designate the beneficiaries on a cb&t inherited ira (traditional, roth or simple) that contains. Of course, you don’t have to roll over money to open an ira. Manage your accounts online instead of submitting a form. Web we′re here to help.

Ask Miranda Capital Gains Rollover — Paris Property Group

Form used by existing investors to change or designate the beneficiaries on a cb&t inherited ira (traditional, roth or simple) that contains. Request for transfer of assets or direct. You may also be able to download forms by logging in to your plan account. Web rollovers | capital group rollovers leaving a job or retiring is a big change in.

401k Rollover Form 5498 Universal Network

Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. Participants can use this form to request a transfer or direct rollover from an external ira. All other company and product names mentioned are. How do i do that? Web for simple ira accounts, use the request for transfer of assets.

Fillable Rollover Form Quest Ira printable pdf download

Of course, you don’t have to roll over money to open an ira. Web get the basics about how to rollover, how much you can rollover, how rollovers can affect your taxes, and more. Web we′re here to help. Click the loans & withdrawals tab. Web results based on your option and account type.

401k Rollover Tax Form Universal Network

Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. Web inherited ira beneficiary change. Click the loans & withdrawals tab. Web rollovers | capital group rollovers leaving a job or retiring is a big change in your life. Web if you’re 50 or older, you can contribute up to $7,500.

OPEN Share Group * Rollover * Share top 4 24 / 7 Rollover Share Group

Web incoming rollover request participant: While you’re anticipating all the adjustments and challenges ahead, however, don’t. Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. Manage your accounts online instead of.

Ira Rollover Form 5498 Universal Network

How do i do that? Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. Click the loans & withdrawals tab. Web get the basics about how to rollover, how much you can rollover, how rollovers can affect your taxes, and more. This form should only be used for.

Web Rollovers | Capital Group Rollovers Leaving A Job Or Retiring Is A Big Change In Your Life.

Web get the basics about how to rollover, how much you can rollover, how rollovers can affect your taxes, and more. Request for transfer of assets or direct. Web use this form to move assets from an american funds ira (traditional, simple or sep/sarsep) to another financial institution or to another american funds account. Web financial professionals can view, download or order sales literature, as well as account applications and account related forms.

Web Form Used To Request A Rollover From A 529 Plan To Collegeamerica.

Web results based on your option and account type. Manage your accounts online instead of submitting a form. All other company and product names mentioned are. You may also be able to download forms by logging in to your plan account.

Web If You’re 50 Or Older, You Can Contribute Up To $7,500 In 2023.

Request for transfer of assets or direct rollover. Web financial professionals can view, download or order sales literature, as well as account applications and account related forms. How do i do that? Web if you need forms, contact your benefits department to obtain them.

Typically There Are Four Options When.

Log in to your portfolio. Once this form is signed by your employer, keep a copy and attach it to any additional paperwork that may be required by the financial. Web investors can use this form to roll an ira or qualified plan distribution back to a qualified plan or ira within 60 days of receiving the assets. If the institution holding the funds will.