Card Authorization Form

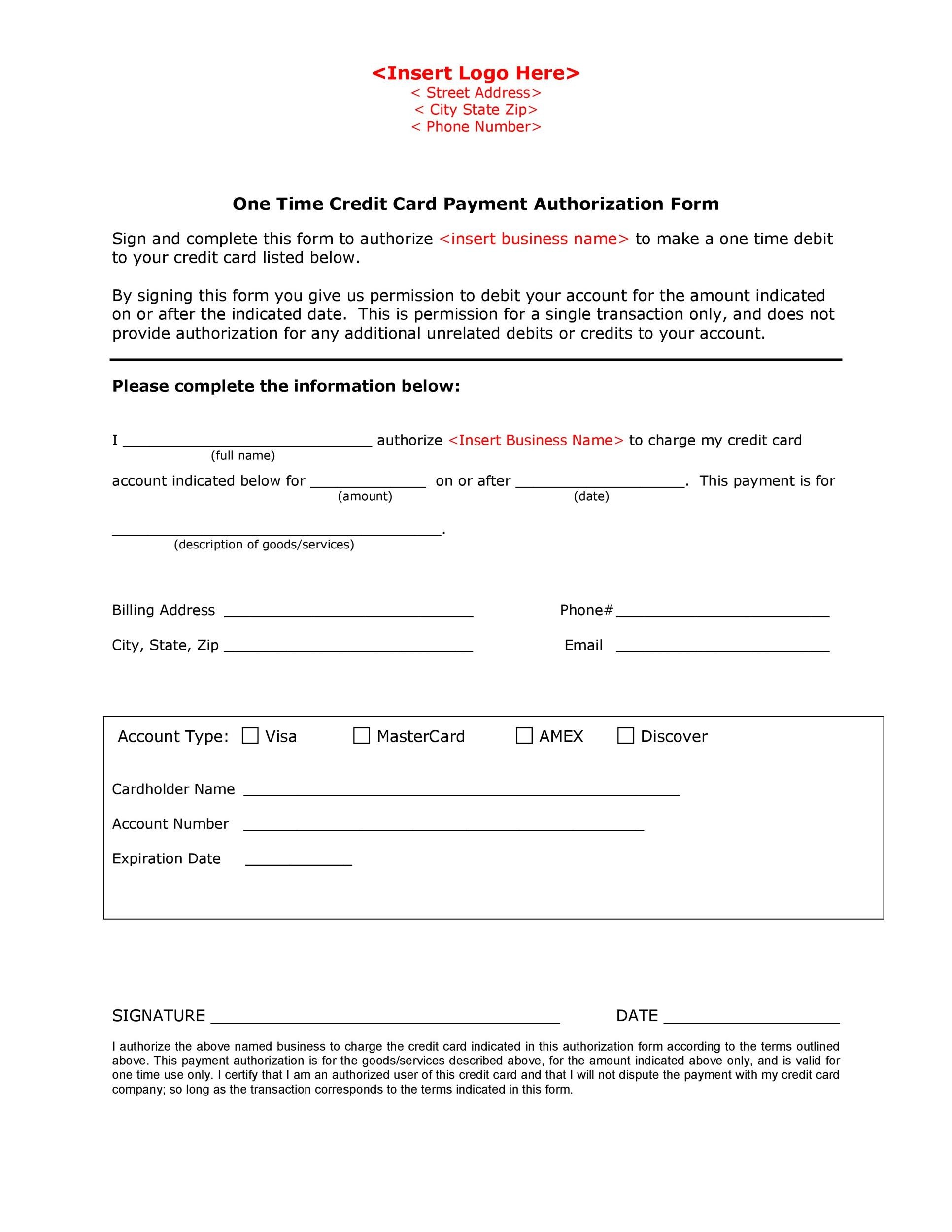

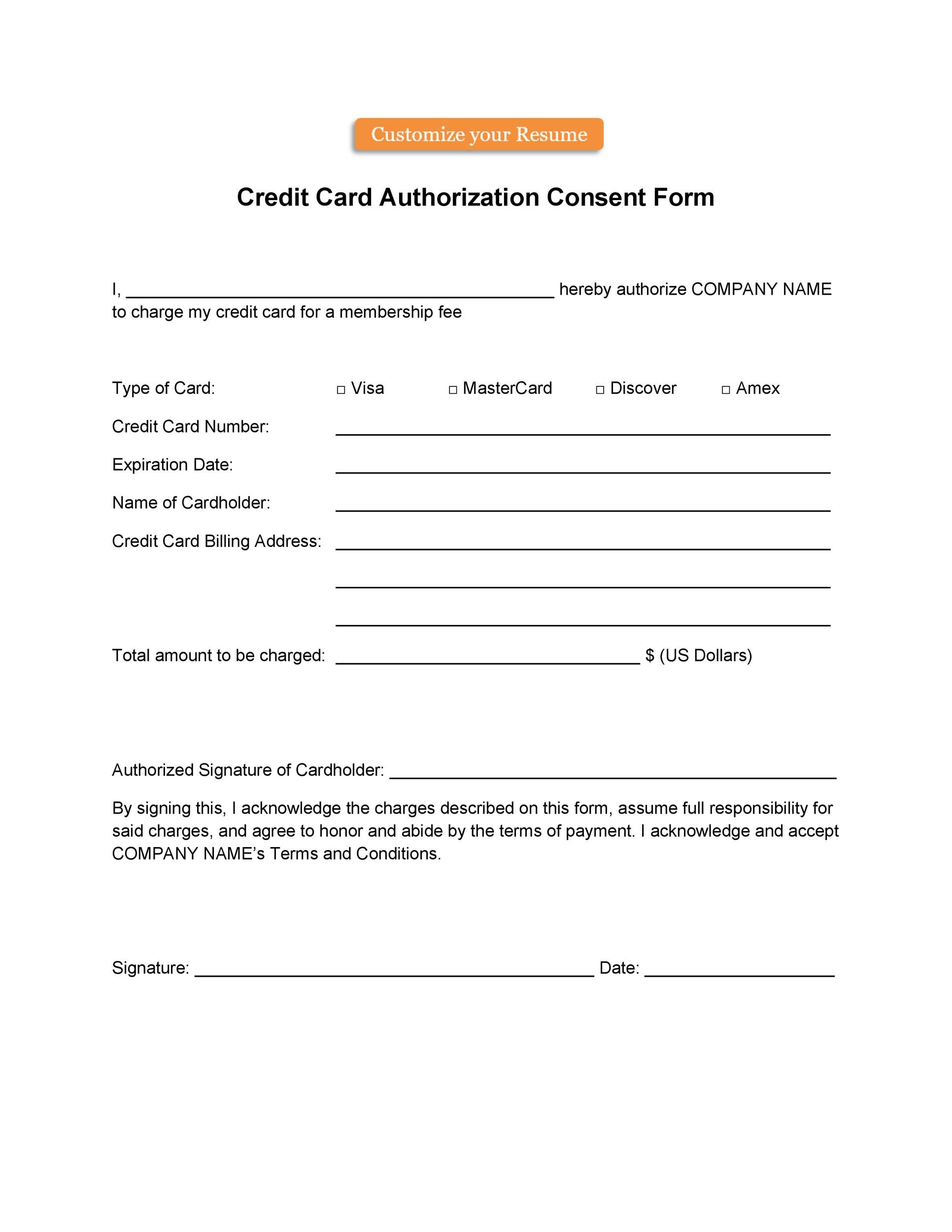

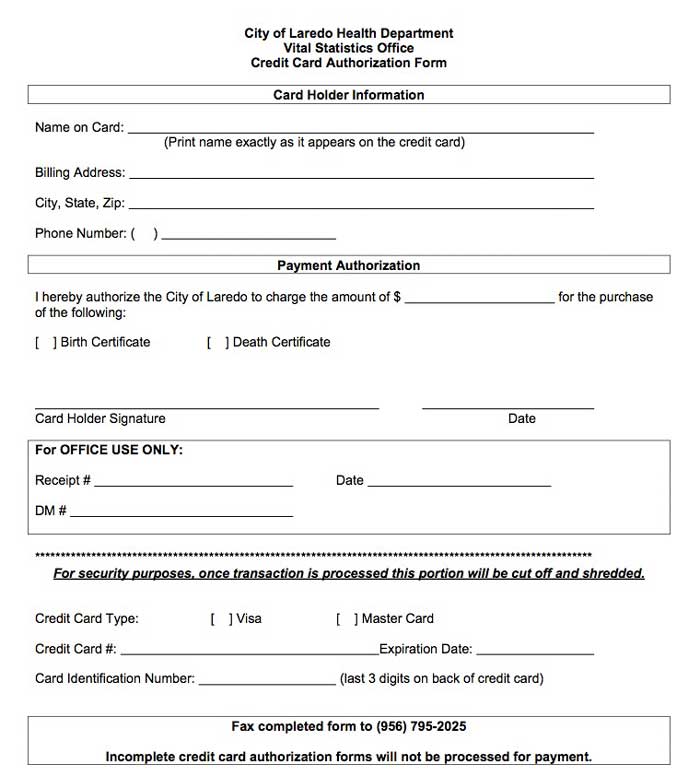

Card Authorization Form - A credit card authorization form is a document that allows a third party to make payments by using another individual’s written consent and credit card credentials. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Bank, if you are filing: You will need to apply for an ead if you: If you are like most businesses, you first collect signatures for new or renewed contracts and then you send a credit card authorization form with a request for payment. Please refer to the form(s) you are filing for additional information, or you may call the uscis customer contact number at. You may pay your filing fee and biometric services fee, if applicable, with a credit card issued by a u.s. Web credit card authorization forms. Web credit card (ach) authorization form. Web card authorization is approval from a credit or debit card issuer (usually a bank or credit union) that states the cardholder has sufficient funds or the available credit needed to cover the cost of a transaction they’re using a card to complete.

You may pay your filing fee and biometric services fee, if applicable, with a credit card issued by a u.s. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Web uscis will charge your credit card up to the amount you authorize below. Or to apply for a special certificate of naturalization as a u.s. If you are like most businesses, you first collect signatures for new or renewed contracts and then you send a credit card authorization form with a request for payment. Citizen to be recognized by a. A credit card authorization form is a document that allows a third party to make payments by using another individual’s written consent and credit card credentials. Web a credit card authorization form is one way to protect yourself against chargebacks. An application, petition, or request with a uscis lockbox; Web card authorization is approval from a credit or debit card issuer (usually a bank or credit union) that states the cardholder has sufficient funds or the available credit needed to cover the cost of a transaction they’re using a card to complete.

If you are like most businesses, you first collect signatures for new or renewed contracts and then you send a credit card authorization form with a request for payment. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Request payments and signatures in one step. Web card authorization is approval from a credit or debit card issuer (usually a bank or credit union) that states the cardholder has sufficient funds or the available credit needed to cover the cost of a transaction they’re using a card to complete. Web uscis will charge your credit card up to the amount you authorize below. Or to apply for a special certificate of naturalization as a u.s. A credit card authorization form allows a third party to make a payment by using a person’s written consent and credit card information. Web use this form to apply for a replacement declaration of intention; Please refer to the form(s) you are filing for additional information, or you may call the uscis customer contact number at. Bank, if you are filing:

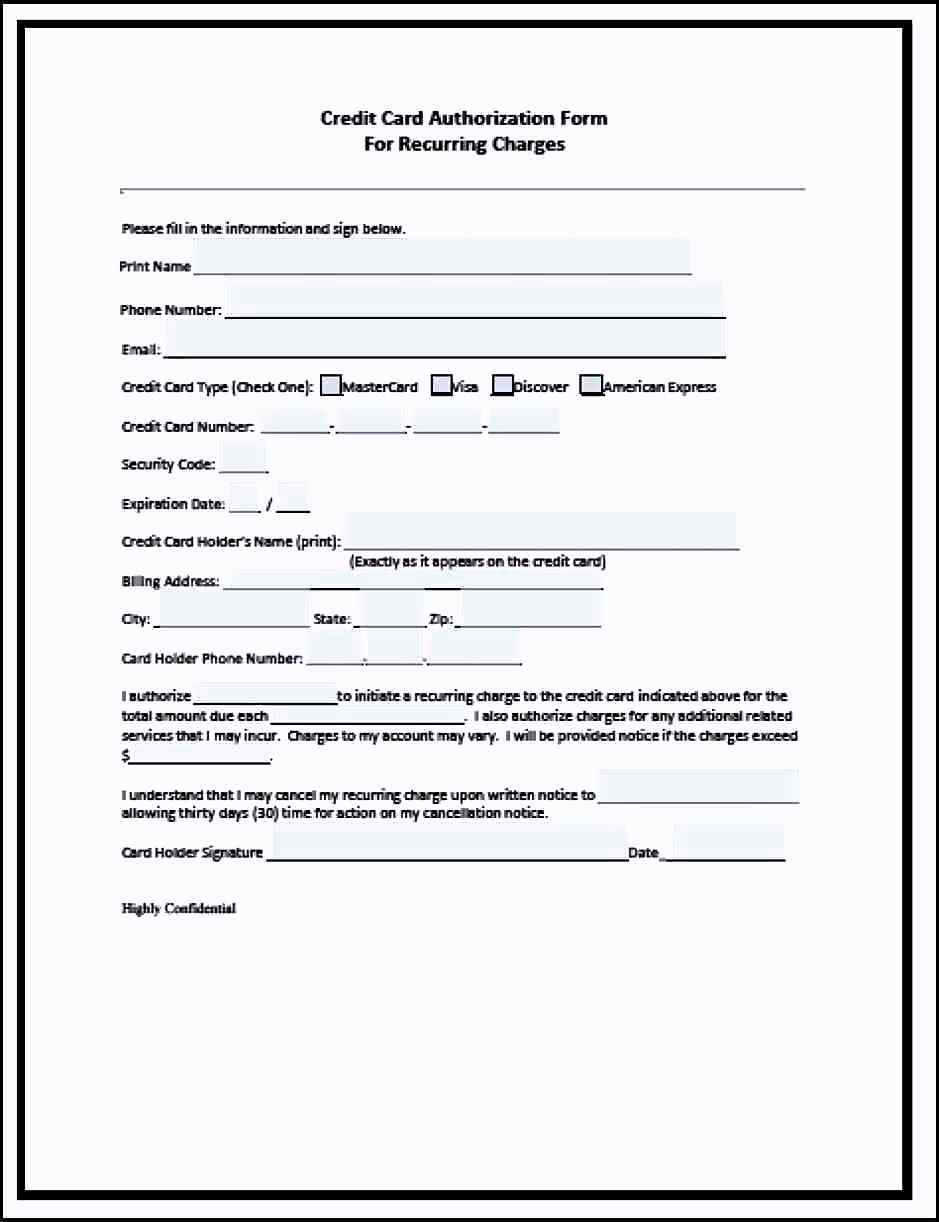

Credit Card Authorization Form Fotolip

Request payments and signatures in one step. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Web a credit card authorization form is one way to protect yourself against chargebacks. Please refer.

Credit Card Authorization Form Fotolip

Web credit card authorization forms. Or to apply for a special certificate of naturalization as a u.s. Web uscis will charge your credit card up to the amount you authorize below. An application, petition, or request with a uscis lockbox; Request payments and signatures in one step.

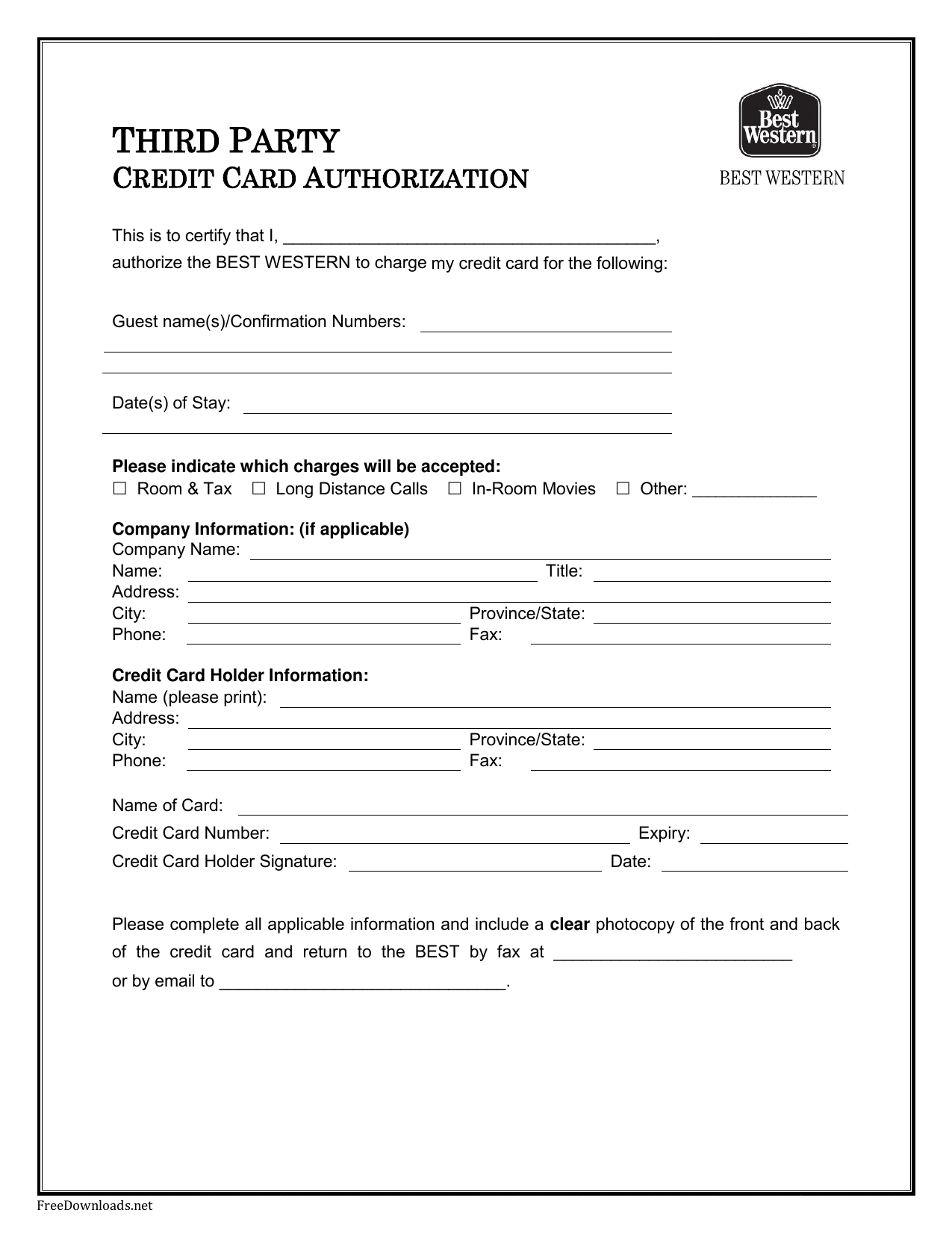

Download Best Western Credit Card Authorization Form Template PDF

Citizen to be recognized by a. Web uscis will charge your credit card up to the amount you authorize below. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Request payments and.

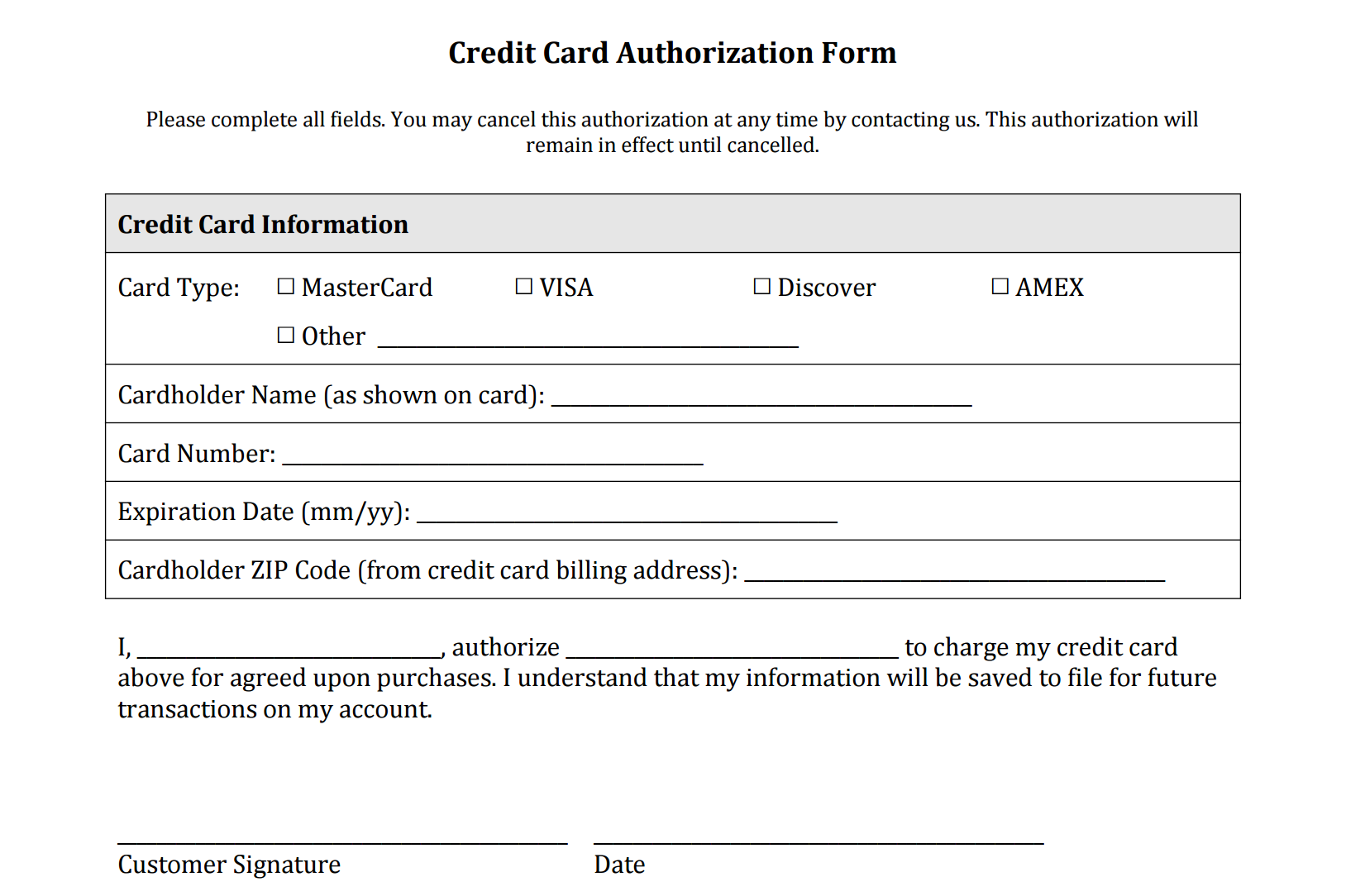

2 Free Credit Card Authorization Form Templates Free Sample Templates

Request payments and signatures in one step. Web there's no need for a credit card authorization form with docusign payments. Web credit card authorization forms. Web use this form to apply for a replacement declaration of intention; You will need to apply for an ead if you:

43 Credit Card Authorization Forms Templates {ReadytoUse}

A credit card authorization form is a document that allows a third party to make payments by using another individual’s written consent and credit card credentials. Citizen to be recognized by a. You may pay your filing fee and biometric services fee, if applicable, with a credit card issued by a u.s. An application, petition, or request with a uscis.

43 Credit Card Authorization Forms Templates {ReadytoUse}

Web uscis will charge your credit card up to the amount you authorize below. Request payments and signatures in one step. Are authorized to work in the united states because of your immigration status or circumstances (for example, you are an asylee, refugee, or u nonimmigrant) and need evidence of that employment authorization, or Web a credit card authorization form.

10+ Credit Card Authorization Form Template Free Download!!

Web uscis will charge your credit card up to the amount you authorize below. You will need to apply for an ead if you: If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less.

43 Credit Card Authorization Forms Templates {ReadytoUse}

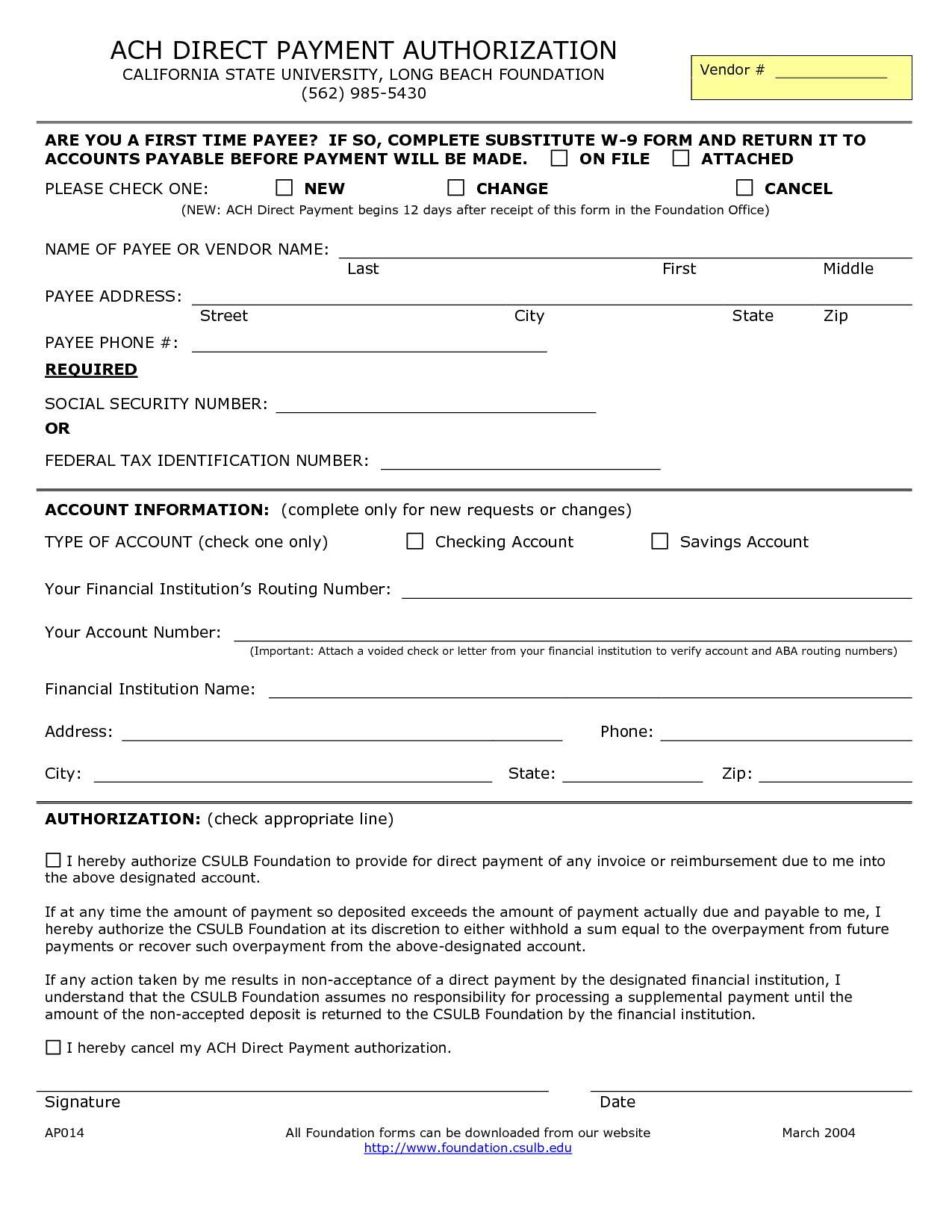

Web use this form to apply for a replacement declaration of intention; If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Web credit card (ach) authorization form. You may pay your filing.

5 Credit Card Authorization Form Templates Free Sample Templates

A credit card authorization form allows a third party to make a payment by using a person’s written consent and credit card information. Or to apply for a special certificate of naturalization as a u.s. Web card authorization is approval from a credit or debit card issuer (usually a bank or credit union) that states the cardholder has sufficient funds.

Credit Card Authorization Form Templates [Download]

Web there's no need for a credit card authorization form with docusign payments. A credit card authorization form is a document that allows a third party to make payments by using another individual’s written consent and credit card credentials. If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your.

Web Use This Form To Apply For A Replacement Declaration Of Intention;

A credit card authorization form allows a third party to make a payment by using a person’s written consent and credit card information. If you are like most businesses, you first collect signatures for new or renewed contracts and then you send a credit card authorization form with a request for payment. Web uscis will charge your credit card up to the amount you authorize below. Request payments and signatures in one step.

Citizen To Be Recognized By A.

An application, petition, or request with a uscis lockbox; Are authorized to work in the united states because of your immigration status or circumstances (for example, you are an asylee, refugee, or u nonimmigrant) and need evidence of that employment authorization, or Or to apply for a special certificate of naturalization as a u.s. Web credit card (ach) authorization form.

Bank, If You Are Filing:

If you have a signed document from the cardholder that gives you permission to charge their card for services rendered, your chances of winning your case with the card issuer are much more likely and less complicated. Please refer to the form(s) you are filing for additional information, or you may call the uscis customer contact number at. Web a credit card authorization form is one way to protect yourself against chargebacks. A credit card authorization form is a document that allows a third party to make payments by using another individual’s written consent and credit card credentials.

You May Pay Your Filing Fee And Biometric Services Fee, If Applicable, With A Credit Card Issued By A U.s.

Web credit card authorization forms. Web there's no need for a credit card authorization form with docusign payments. You will need to apply for an ead if you: Web card authorization is approval from a credit or debit card issuer (usually a bank or credit union) that states the cardholder has sufficient funds or the available credit needed to cover the cost of a transaction they’re using a card to complete.

![Credit Card Authorization Form Templates [Download]](https://jumbotron-production-f.squarecdn.com/assets/6814dc69872db2281019.jpg)