Carta Form 3921

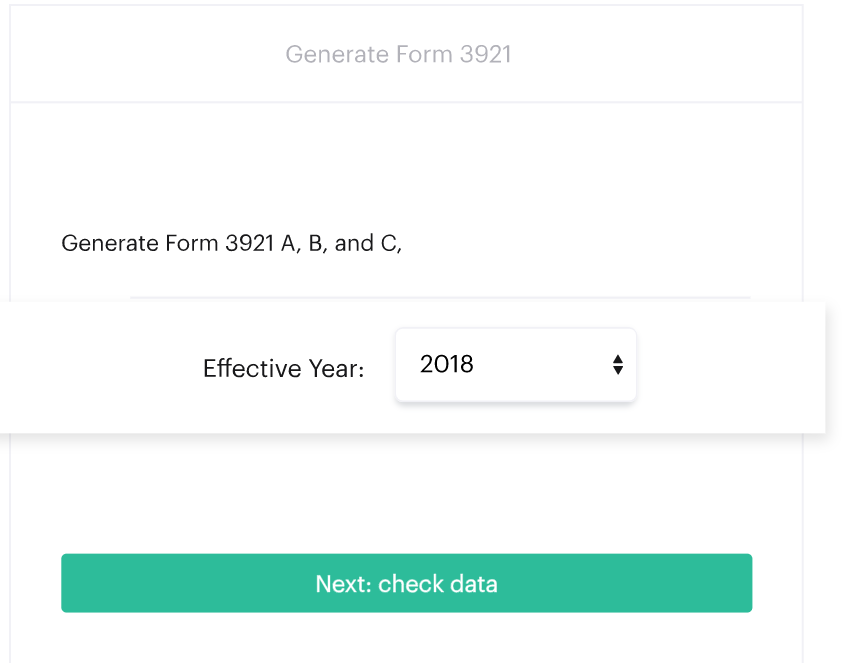

Carta Form 3921 - Web who must file. Our checks include rule 701, rule 144, and the iso $100k limit. Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code) with form 4419. Follow the workflow outlined below to exclude. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. 409a audit support asc 718. Get a fillable carta 3921 template online. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web feb 1, 2023 in certain cases, a company may wish to exclude one or more transactions from form 3921. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

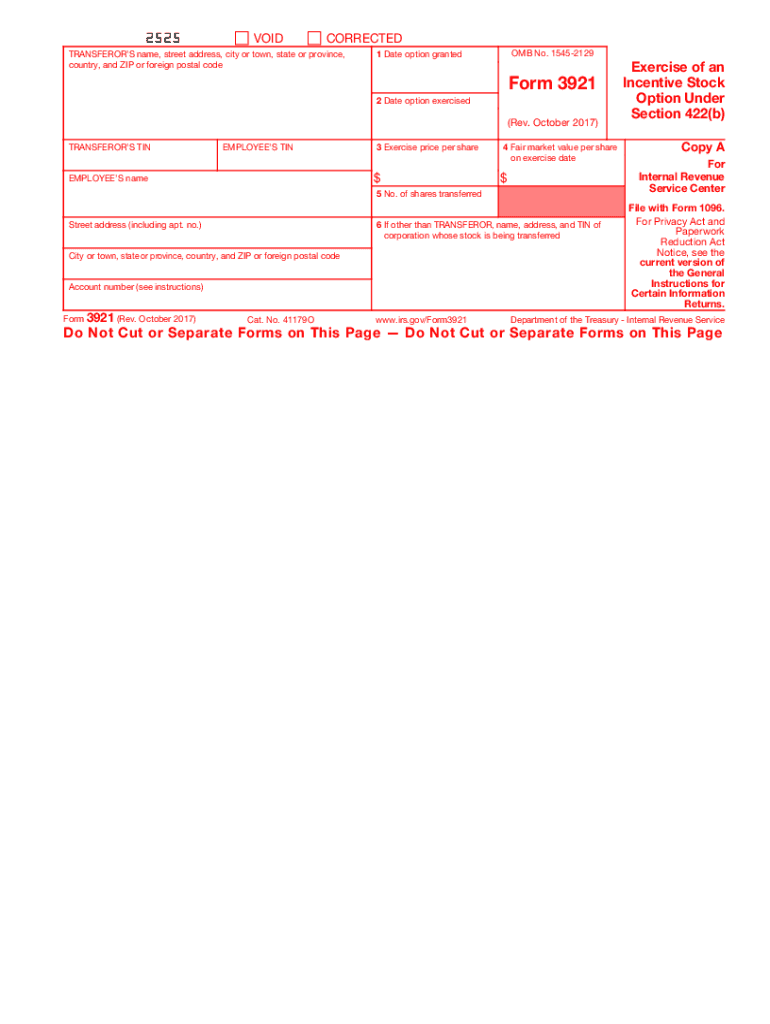

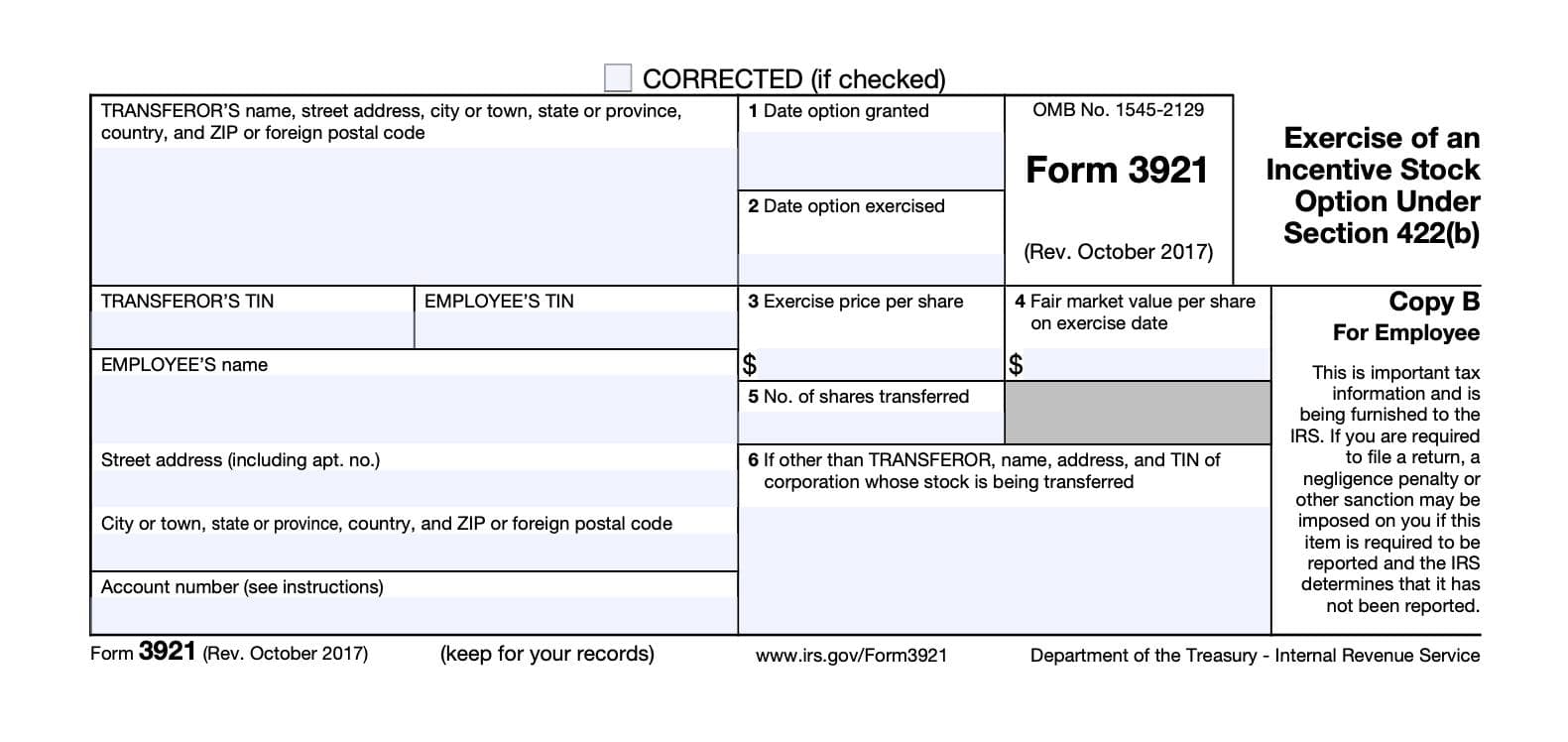

Web form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. Web may 11, 2023 if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Securities and exchange commission as a transfer. (“carta”) is registered with the u.s. Individual copy b’s are still available to download if required. Web who must file. Get everything done in minutes. Web generating form 3921 in carta (legal admin) 7446 views jul 17, 2023 using carta's exercise ledger 831 views jun 12, 2023 form 3921 walkthrough 7364 views.

Web generating form 3921 in carta (admin). Web the information on form 3921 will help in determining your cost or other basis as well as your holding period. Web form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. 409a audit support asc 718. Web feb 1, 2023 in certain cases, a company may wish to exclude one or more transactions from form 3921. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Individual copy b’s are still available to download if required. You have received form 3291 because. Web may 11, 2023 if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every. Get everything done in minutes.

Updated Form 3921 Dashboard with Consolidated 3921 Statements

Individual copy b’s are still available to download if required. Get everything done in minutes. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Every corporation which in any calendar year transfers to any person a share of.

Carta Form 3921 Fill Out and Sign Printable PDF Template signNow

(“carta”) is registered with the u.s. Web section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee by january 31 of the year following the year of exercise of an. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

409a audit support asc 718. (“carta”) is registered with the u.s. Web feb 1, 2023 in certain cases, a company may wish to exclude one or more transactions from form 3921. Web generating form 3921 in carta (admin). Get everything done in minutes.

Generating Form 3921 in Carta (Admin)

There are a few things you should note here: Web section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee by january 31 of the year following the year of exercise of an. Web in order to file your 3921s on carta, you will first need to apply for a tcc (transmitter control code).

Generating Form 3921 in Carta (Admin)

You have received form 3291 because. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. There are a few things you should note here: Web section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee by january 31 of the year following the year of exercise of an..

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee by january 31 of the year following the year of exercise of an. Standard 409a valuation and refreshes: You have received form 3291 because. Web specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web feb 1, 2023 in certain cases, a company may wish to exclude one or more transactions from form 3921. Web the information on form 3921 will help in determining your cost or other basis as well as your holding period. Web generating form 3921 in carta (admin). 409a audit support asc 718. Web may 11, 2023 if employees exercised.

Carta Reviews, Cost & Features GetApp Australia 2022

Follow the workflow outlined below to exclude. Web may 11, 2023 if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every. Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of.

Carta Form 3921 Fill Out and Sign Printable PDF Template signNow

Web carta now aggregates individual form 3921’s for iso exercises into consolidated statements for ease of use. Get a fillable carta 3921 template online. Web generating form 3921 in carta (legal admin) 7446 views jul 17, 2023 using carta's exercise ledger 831 views jun 12, 2023 form 3921 walkthrough 7364 views. Get everything done in minutes. Web section 6039 of.

Form 3921 Everything you need to know

You have received form 3291 because. (“carta”) is registered with the u.s. Our checks include rule 701, rule 144, and the iso $100k limit. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Get everything done in minutes.

Securities And Exchange Commission As A Transfer.

(“carta”) is registered with the u.s. Our checks include rule 701, rule 144, and the iso $100k limit. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web may 11, 2023 if employees exercised incentive stock options (isos) last tax year, the issuing company will need to file irs form 3921 in the first quarter of every.

Web Generating Form 3921 In Carta (Legal Admin) 7446 Views Jul 17, 2023 Using Carta's Exercise Ledger 831 Views Jun 12, 2023 Form 3921 Walkthrough 7364 Views.

Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web carta now aggregates individual form 3921’s for iso exercises into consolidated statements for ease of use. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

Web Home Forms And Instructions About Form 3921, Exercise Of An Incentive Stock Option Under Section 422 (B) About Form 3921, Exercise Of An Incentive Stock.

There are a few things you should note here: Web form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. Web section 6039 of the internal revenue code requires companies to provide 3921 forms to the employee by january 31 of the year following the year of exercise of an. Follow the workflow outlined below to exclude.

You Have Received Form 3291 Because.

Individual copy b’s are still available to download if required. Web the information on form 3921 will help in determining your cost or other basis as well as your holding period. Web feb 1, 2023 in certain cases, a company may wish to exclude one or more transactions from form 3921. Web generating form 3921 in carta (admin).