Charles Schwab 401K Rollover Form

Charles Schwab 401K Rollover Form - These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Web discover your 401k rollover options: For example, if you move a traditional 401(k) into a traditional ira or a roth 401(k) into a roth ira. Available only if your plan’s adoption agreement permits hardship distributions. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. If you want to open a new schwab account, please attach a completed new account application to this form. Hardship distributions are not eligible for rollover. Plan termination distribution of rollover contribution Web find the forms you need in one convenient place.

Open an account, roll over an ira, and more. Transferring, tax advantages, fees, and more. Web an example of a rollover would be a former employer's 401(k) account into an ira. Plan termination distribution of rollover contribution Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Web hardship select for distribution due to hardship as described in the basic plan document, section 5.01(c)(2). Web find the forms you need in one convenient place. Web discover your 401k rollover options: For example, if you move a traditional 401(k) into a traditional ira or a roth 401(k) into a roth ira. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan.

Hardship distributions are not eligible for rollover. These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Transferring, tax advantages, fees, and more. Web hardship select for distribution due to hardship as described in the basic plan document, section 5.01(c)(2). Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Acts as the recordkeeper for plans with $10m+ in assets under management and charles schwab trust bank acts as your plan's custodian and trustee. Web an example of a rollover would be a former employer's 401(k) account into an ira. Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. Plan termination distribution of rollover contribution Available only if your plan’s adoption agreement permits hardship distributions.

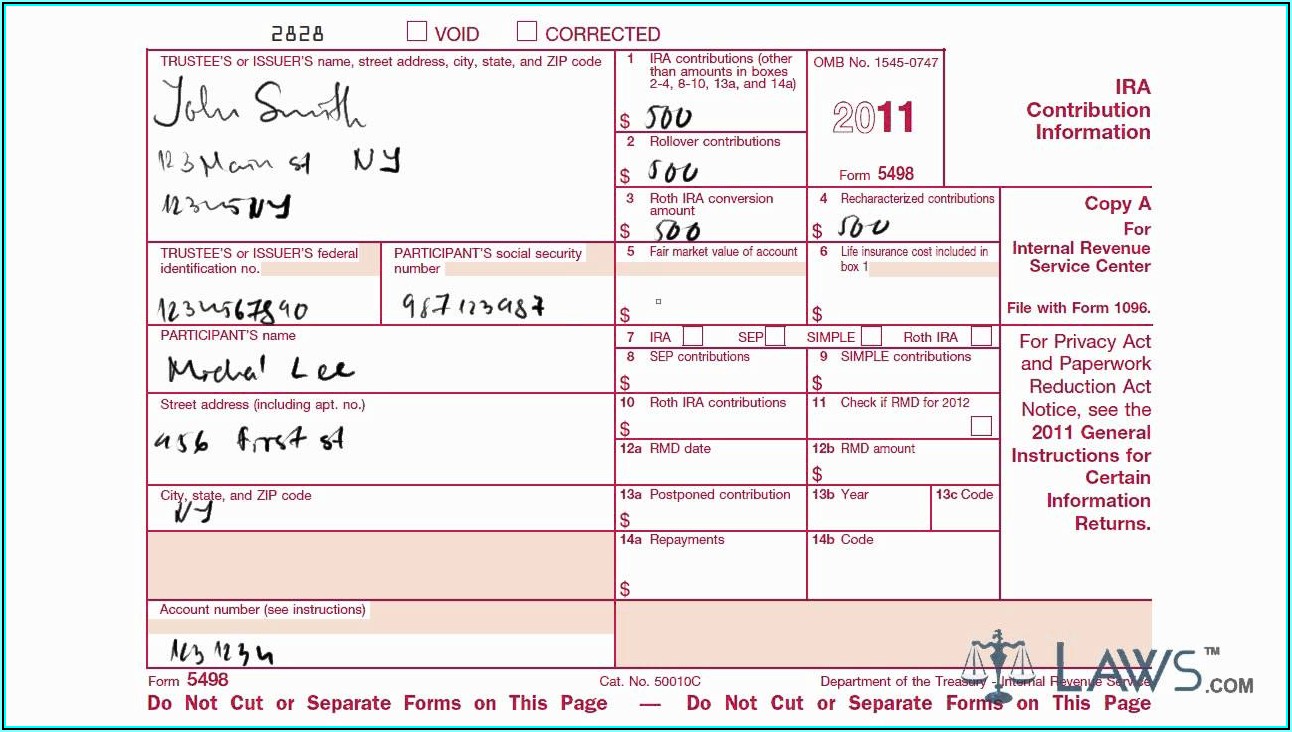

401k Rollover Form 5498 Form Resume Examples Kw9kbZZ2JN

Hardship distributions are not eligible for rollover. These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. Open an account, roll over an ira, and more. Web hardship select for distribution due to hardship as described in the.

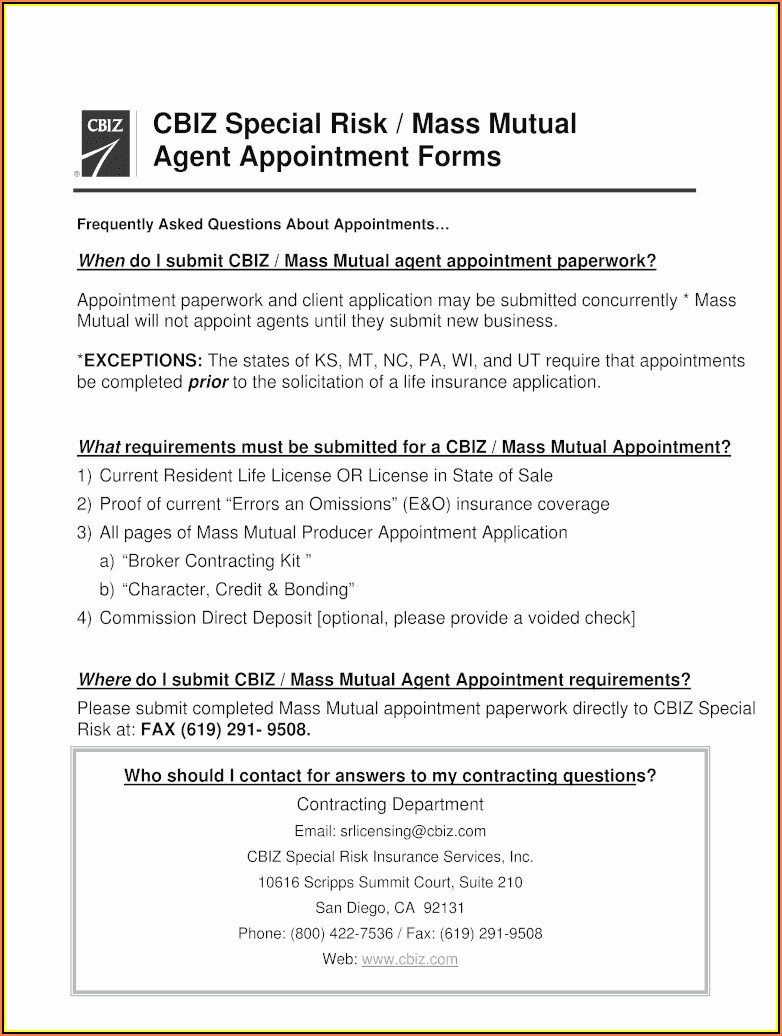

Massmutual 401k Rollover Form Form Resume Examples djVawgE9Jk

Web an example of a rollover would be a former employer's 401(k) account into an ira. Web find the forms you need in one convenient place. Hardship distributions are not eligible for rollover. Open an account, roll over an ira, and more. Plan termination distribution of rollover contribution

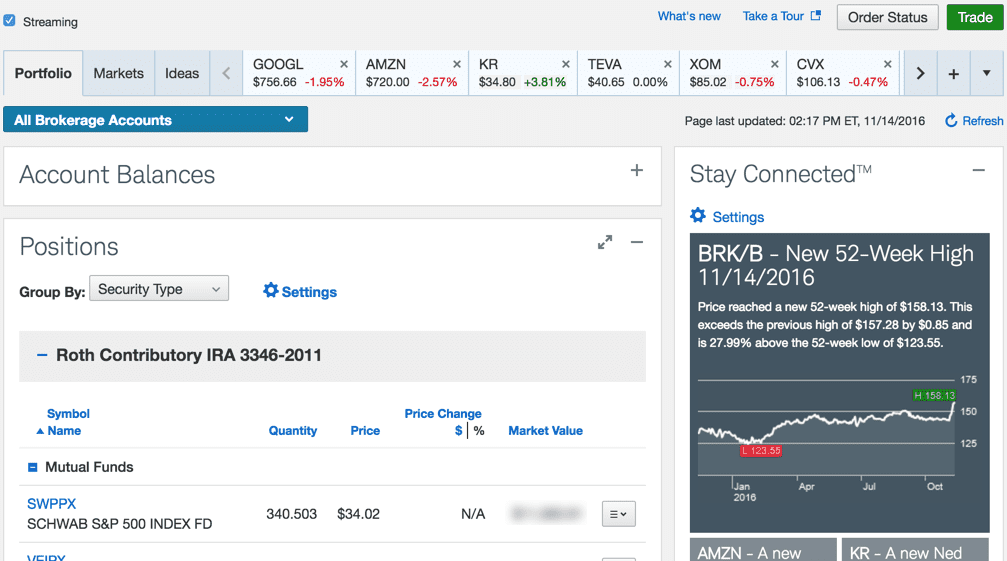

Paychex 401k Beneficiary Form Universal Network

Transferring, tax advantages, fees, and more. Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. Web hardship select for distribution due to hardship as described in the basic plan document, section 5.01(c)(2). Plan termination distribution of rollover contribution Web discover your 401k rollover options:

Trade School Tuition Fidelity Pre Market Trading

Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Acts as the recordkeeper for plans with $10m+ in assets under management and charles schwab trust bank acts as your plan's custodian and trustee. Web hardship select for distribution due to hardship as described in the basic plan document,.

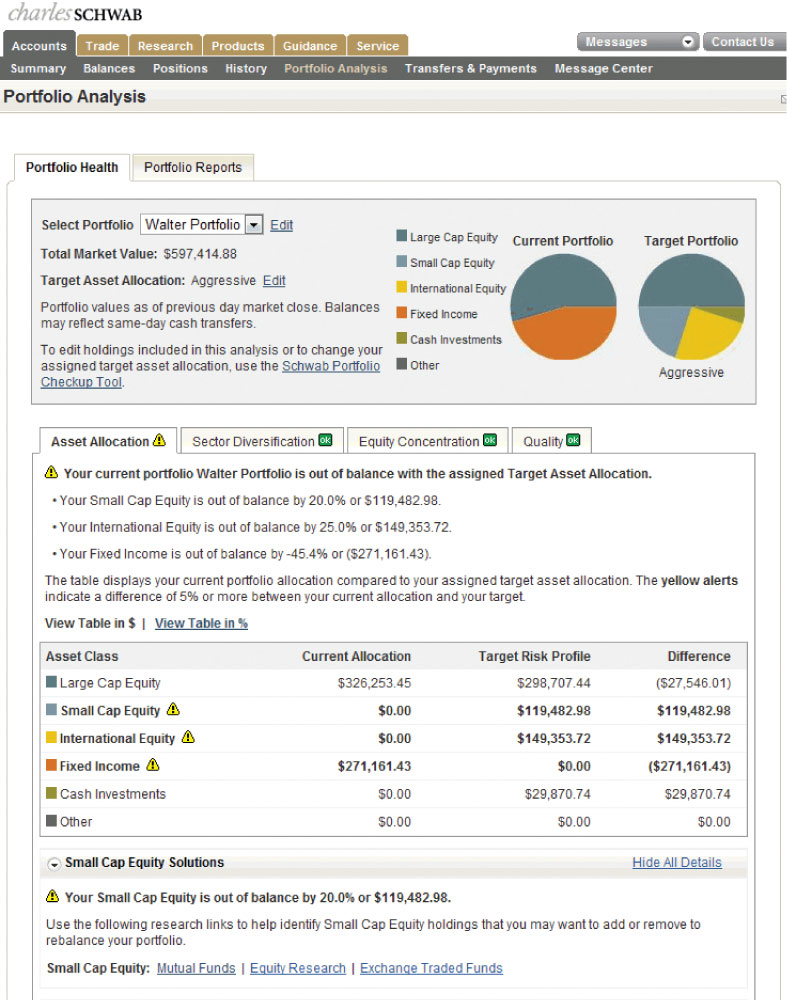

Charles Schwab 401k Investment Options

If you want to open a new schwab account, please attach a completed new account application to this form. Web an example of a rollover would be a former employer's 401(k) account into an ira. For example, if you move a traditional 401(k) into a traditional ira or a roth 401(k) into a roth ira. Hardship distributions are not eligible.

401k Rollover Tax Form Universal Network

Open an account, roll over an ira, and more. Web hardship select for distribution due to hardship as described in the basic plan document, section 5.01(c)(2). Transferring, tax advantages, fees, and more. Web an example of a rollover would be a former employer's 401(k) account into an ira. Learn how to roll over your old 401k into an ira to.

Massmutual Change Of Beneficiary Form

These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Hardship distributions are not eligible for rollover. For example, if you move a traditional 401(k) into a traditional.

401k Enrollment Form Template Form Resume Examples WjYDeBjVKB

Web find the forms you need in one convenient place. Transferring, tax advantages, fees, and more. Acts as the recordkeeper for plans with $10m+ in assets under management and charles schwab trust bank acts as your plan's custodian and trustee. Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. Available only if your plan’s adoption agreement permits hardship.

401k Rollover Form Vanguard Form Resume Examples ojYqLKr9zl

Web an example of a rollover would be a former employer's 401(k) account into an ira. These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Hardship distributions are not eligible for rollover. Plan termination distribution of rollover contribution Web hardship select for distribution due to hardship as described.

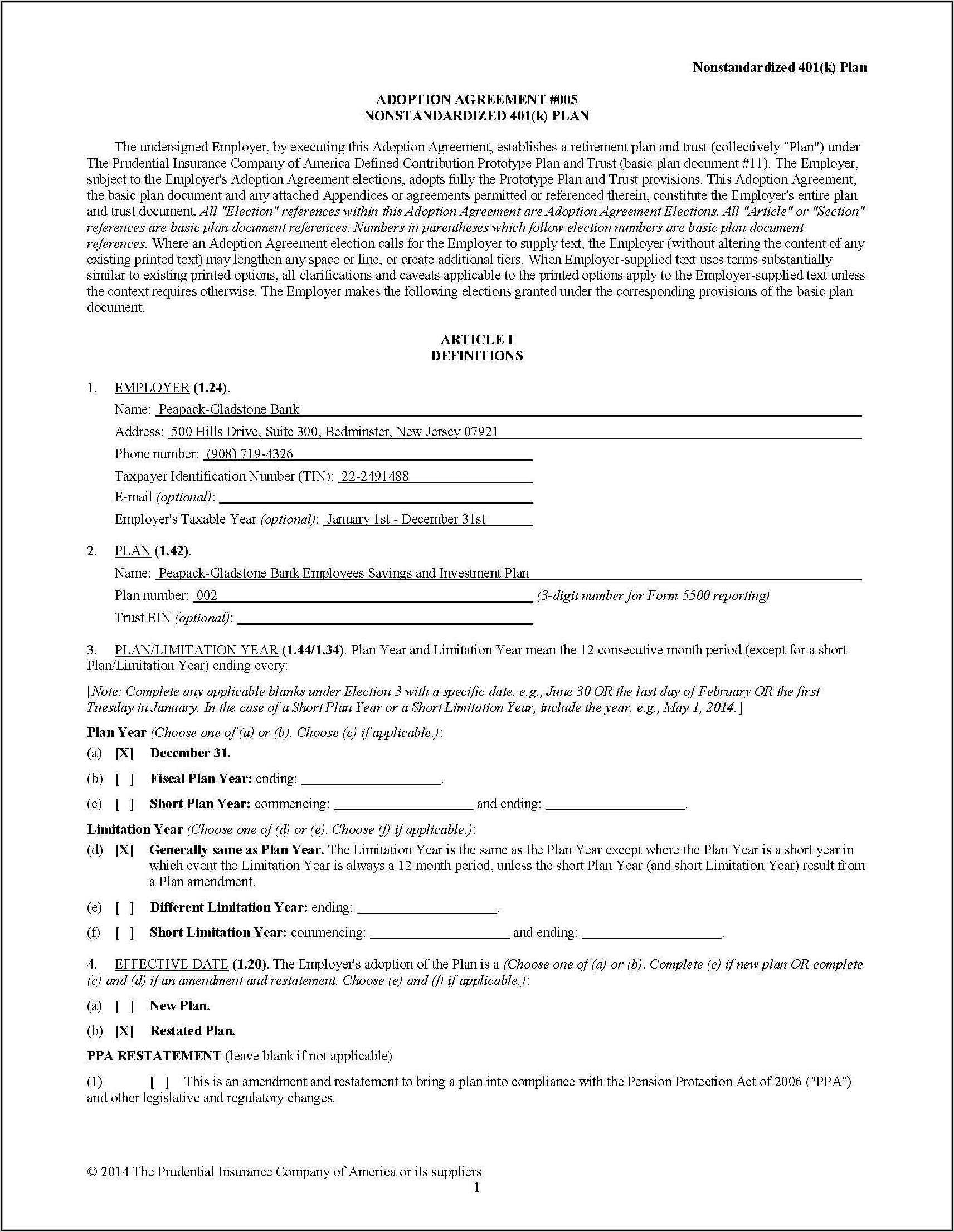

401k Rollover Form Charles Schwab Form Resume Examples MoYo65B9ZB

Transferring, tax advantages, fees, and more. Web an example of a rollover would be a former employer's 401(k) account into an ira. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. If you.

Plan Termination Distribution Of Rollover Contribution

Web discover your 401k rollover options: Web comprehensive 401(k) plan services overview schwab retirement plan services, inc. Learn how to roll over your old 401k into an ira to maximize your benefits. Web hardship select for distribution due to hardship as described in the basic plan document, section 5.01(c)(2).

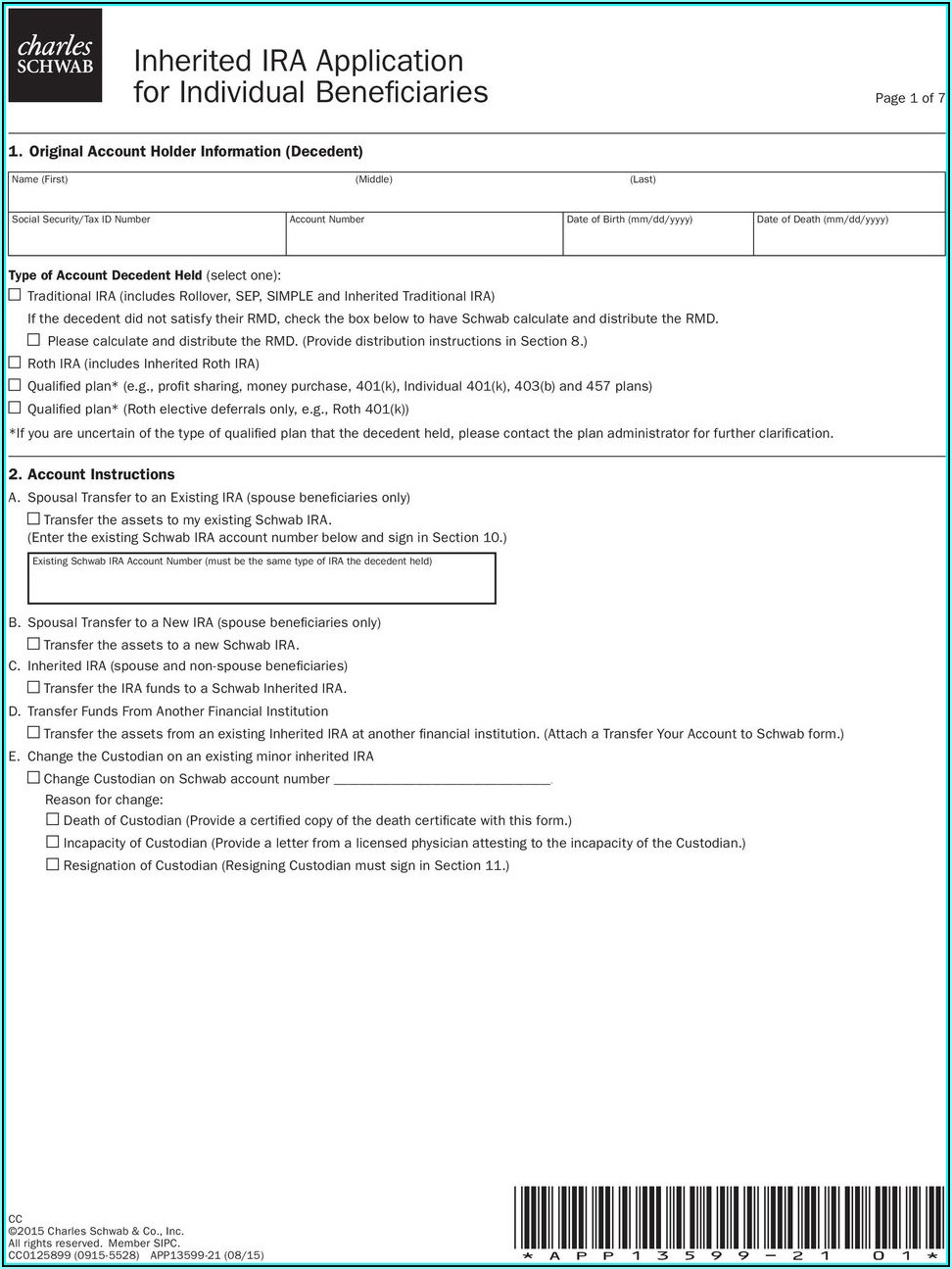

Web Use This Form To Request A New Distribution From Or Change An Existing Distribution Instruction For Your Schwab Ira Account.

For example, if you move a traditional 401(k) into a traditional ira or a roth 401(k) into a roth ira. Acts as the recordkeeper for plans with $10m+ in assets under management and charles schwab trust bank acts as your plan's custodian and trustee. Web an example of a rollover would be a former employer's 401(k) account into an ira. Hardship distributions are not eligible for rollover.

Web Individual 401(K) Distribution Request Form This Notice Contains Important Information About The Payment Of Your Vested Account Balance In Your Employer's Individual 401(K) Plan.

If you want to open a new schwab account, please attach a completed new account application to this form. Transferring, tax advantages, fees, and more. These transfers may generate a 1099 tax form but are not taxable if both accounts are of the same tax status. Available only if your plan’s adoption agreement permits hardship distributions.

Web Find The Forms You Need In One Convenient Place.

Open an account, roll over an ira, and more.