Clark County Tax Cap Form

Clark County Tax Cap Form - Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property tax caps on residential properties, and. The assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in. Web a clark county assessor addresses the property tax cap situation. Clarke was a sixth kansas cavalry captain. Web las vegas, nev. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web the clark county assessor's office just finished mailing out tax cap abatement notices. Web (fox5) by alexis fernandez published:

Web this is referred to as the tax cap. However, time is running out for this fiscal year. It's important to fill out the card or your tax rate could increase by. Clarke was a sixth kansas cavalry captain. The form can be printed from pdfor word format. Grand central parkway or emailed to. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. The county was named after charles f.

Clarke was a sixth kansas cavalry captain. Web return this form by mail or email to: Grand central parkway or emailed to. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage. Clark county is located in the. Web the recorder's office provides the following blank forms search for file name: 27, 2023 at 4:53 pm pdt las vegas, nev. Web the clark county assessor's office just finished mailing out tax cap abatement notices. Web a clark county assessor addresses the property tax cap situation. It's important to fill out the card or your tax rate could increase by.

Clark County Tax Cap Form {June 2022} Find Essential Details!

Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence. Web (fox5) by alexis fernandez published: Property owners have been lined up outside. Web las vegas, nev. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was.

Clark County's Property Tax Cap...What You Need to Know YouTube

Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage. Web return this form by mail or email to: Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county.

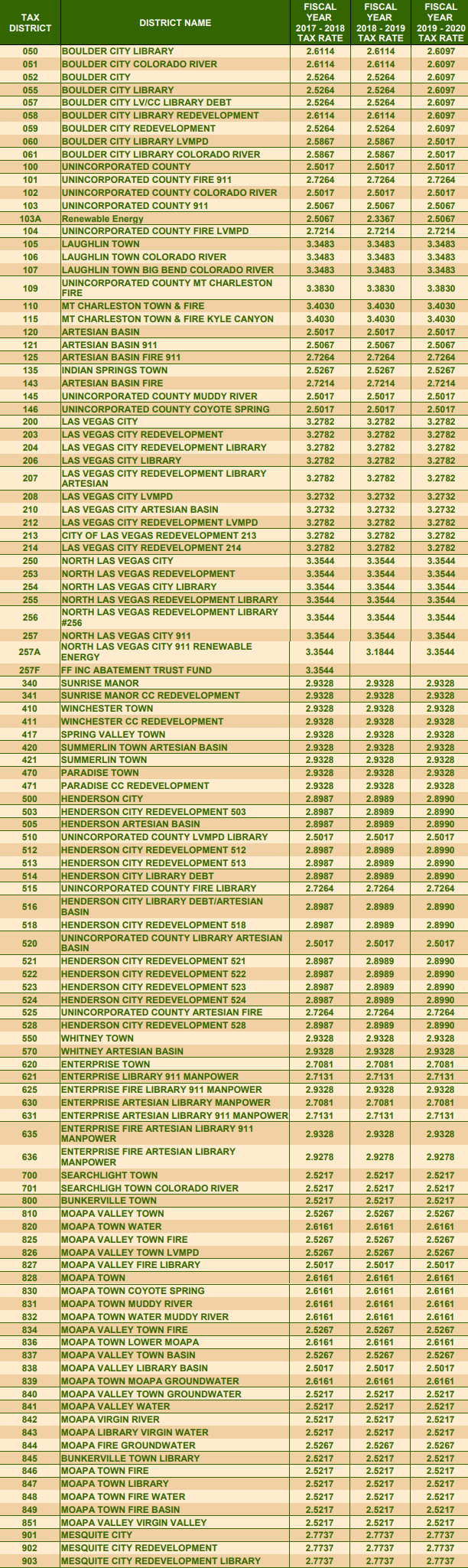

Clark County Tax Rates for 2019/2020

Web this is referred to as the tax cap. 27, 2023 at 4:53 pm pdt las vegas, nev. Web las vegas, nev. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web under state law as a property owner, you can apply for a three percent tax.

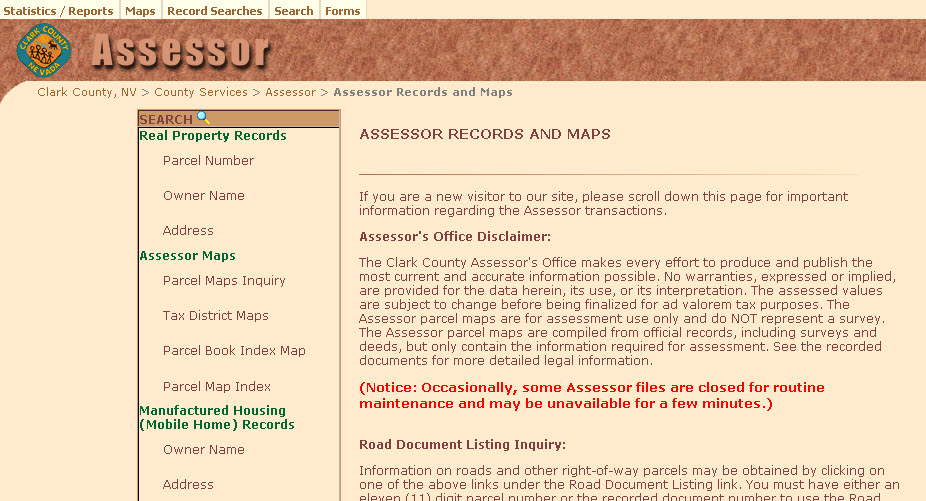

Clark County assessor AmanaAiofe

Web a clark county assessor addresses the property tax cap situation. People still have until next year to apply for the 3 percent tax cap. The form can be printed from pdfor word format. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web the clark county assessor's office just finished mailing out tax cap abatement notices.

Clark County PDF

Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. The form can be printed from pdfor word format. People still have until next year to apply for the 3 percent tax cap. Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence. Property owners have.

Clark County Tax Cap Form Clark County Assessors Office EveDonusFilm

Web it was a part of ford county previously. Grand central parkway or emailed to. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the.

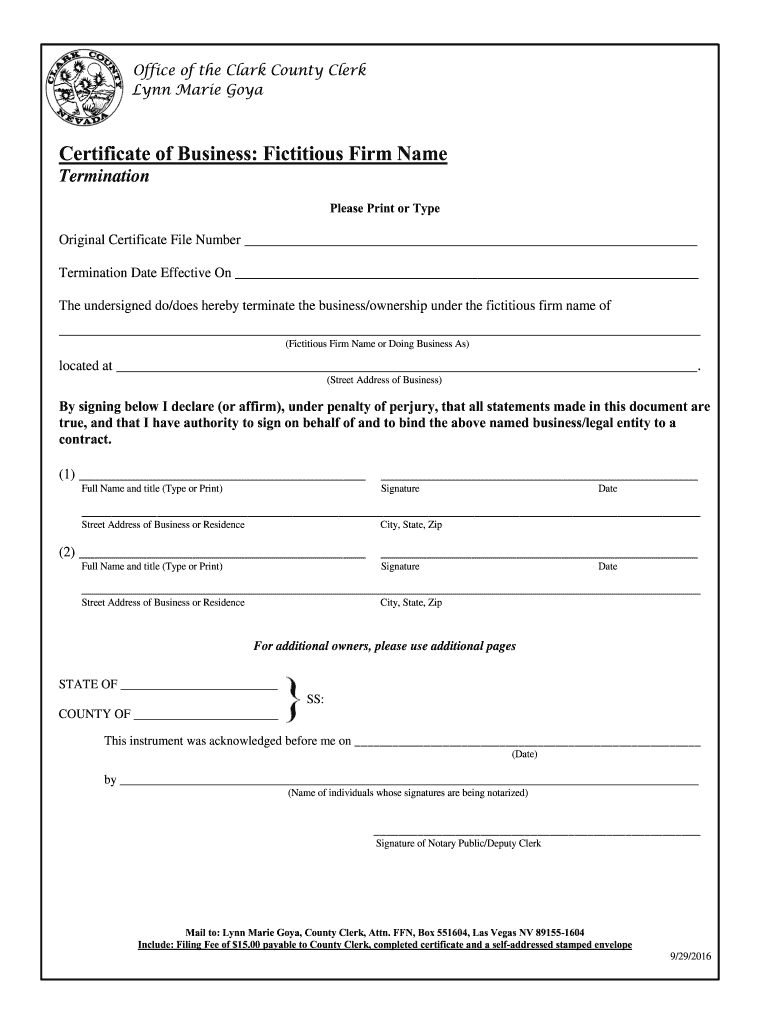

Clark County Fictitious Firm Name Search Form Fill Out and Sign

Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Property owners have been lined up outside. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web residents will receive either a tax bill if they do not pay their.

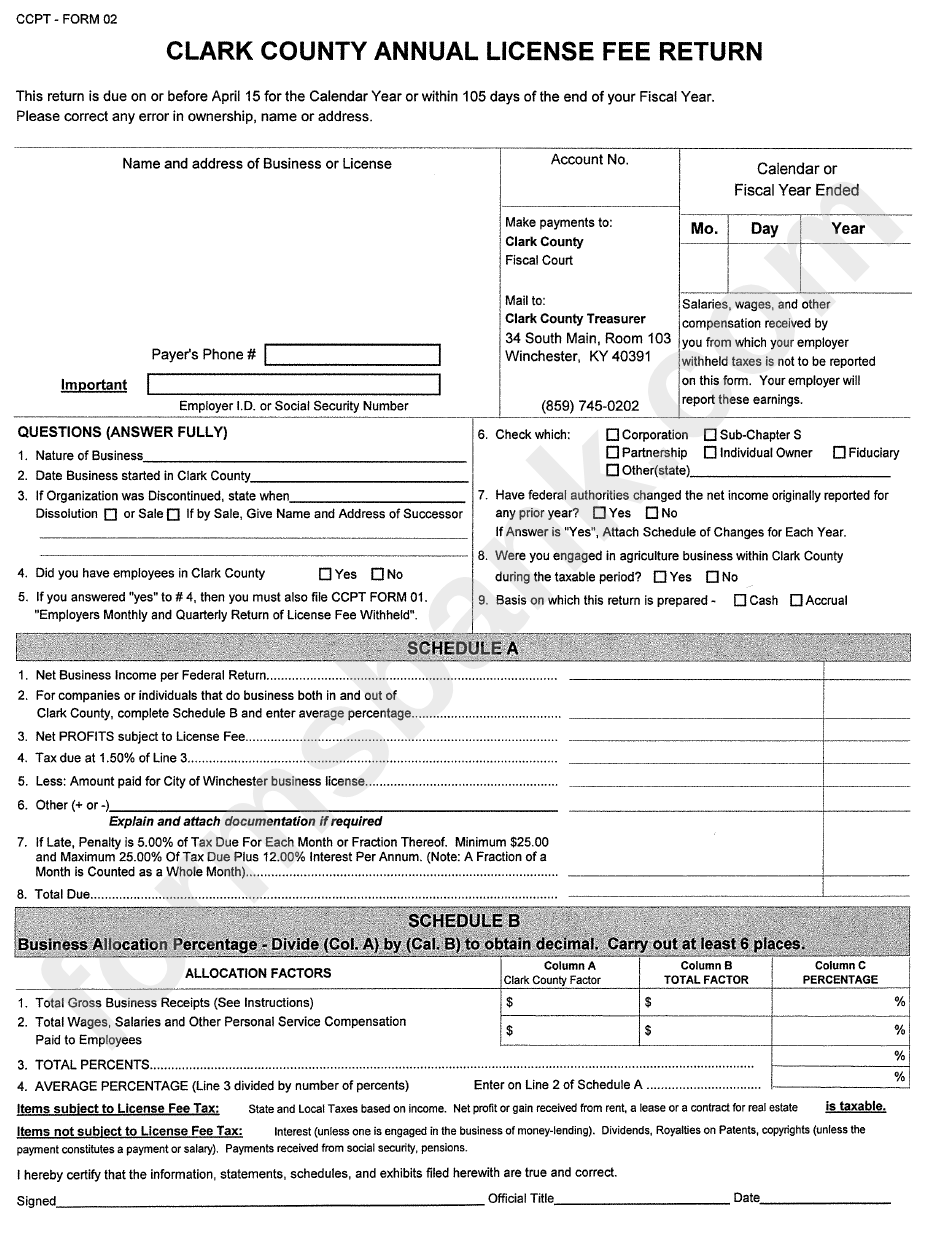

Ccpt Form 02 Annual License Fee Return Clark Country printable pdf

Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web under state law as a property owner, you can apply for a three.

Clark County Alarm Permit Form Fill Out and Sign Printable PDF

It's important to fill out the card or your tax rate could increase by. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill. Web a clark county assessor addresses the property tax cap situation. Web the form is at.

Clark County Assessor’s Office to mail out property tax cap notices

Web more information on the requirements can be found on the exemption page. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. The assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in. Web the form is.

Web Ahead Of June 30 Of This Year, A Significant Number Of Residents Submitted Forms To The Clark County Assessor To Correct Property Tax Caps On Residential Properties, And.

Grand central parkway or emailed to. It's important to fill out the card or your tax rate could increase by. The county was named after charles f. Web this is referred to as the tax cap.

This Site Is Best Viewed Using Chrome, Firefox, Edge, Internet Explorer Version 10 Or Version 11.

The form can be printed from pdfor word format. Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage.

Clarke Was A Sixth Kansas Cavalry Captain.

Property owners have been lined up outside. Web the recorder's office provides the following blank forms search for file name: The assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov).

Clark County Is Located In The.

Real property excess proceeds application. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill. However, time is running out for this fiscal year. Web it was a part of ford county previously.