Connecticut Conveyance Tax Form

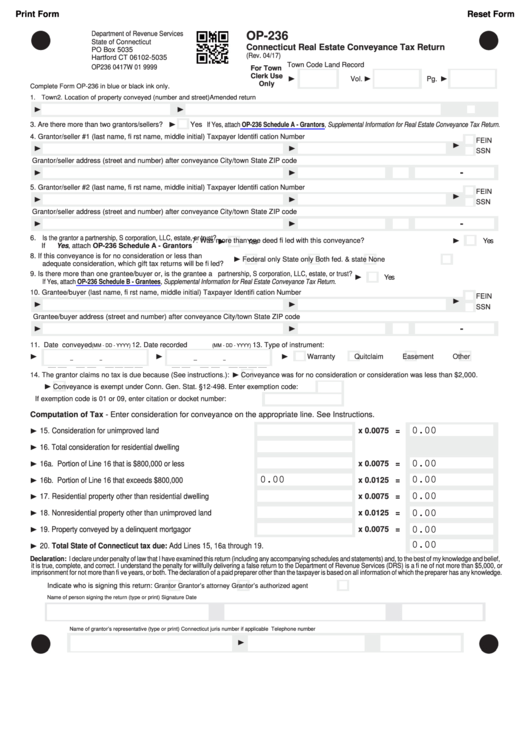

Connecticut Conveyance Tax Form - The marginal tax brackets for residential real property are as follows: Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Download this form and complete using adobe acrobat. Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Up to and including $800,000: Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Web supplemental information for connecticut real estate conveyance tax return (rev. Web ct open data portal.

If the grantee is a partnership, Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Web beginning july 1, 2020 (cite: Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Forms for state of connecticut/department of administrative services Web ct open data portal. Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Download this form and complete using adobe acrobat. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code

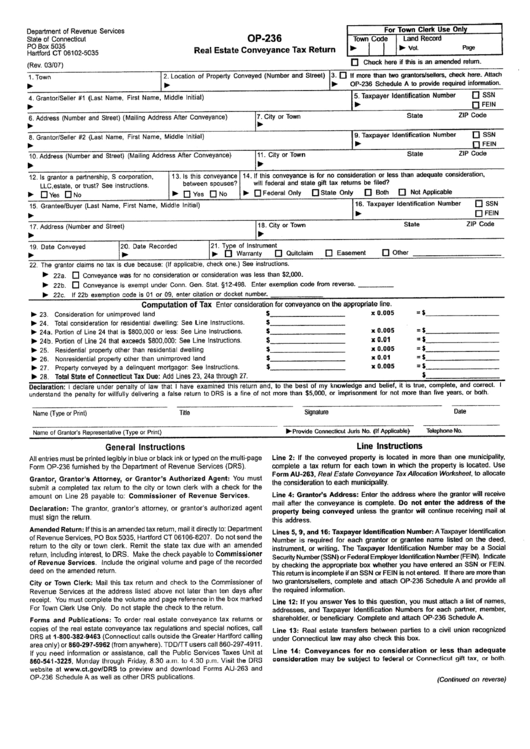

Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Forms for state of connecticut/department of administrative services Web connecticut real estate conveyance tax return (rev. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web line instructions line 2: The marginal tax brackets for residential real property are as follows: Download this form and complete using adobe acrobat. Web beginning july 1, 2020 (cite:

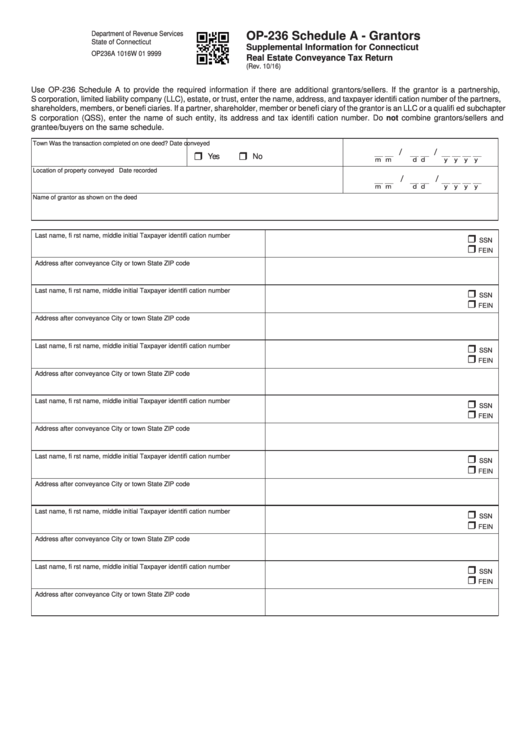

Form Op236 Schedule A Grantors Supplemental Information For

The marginal tax brackets for residential real property are as follows: Forms for state of connecticut/department of administrative services Web ct open data portal. Web line instructions line 2: Web connecticut real estate conveyance tax return (rev.

Connecticut's Tax System Staff Briefing

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web connecticut real estate conveyance tax return (rev. Forms for state of connecticut/department of.

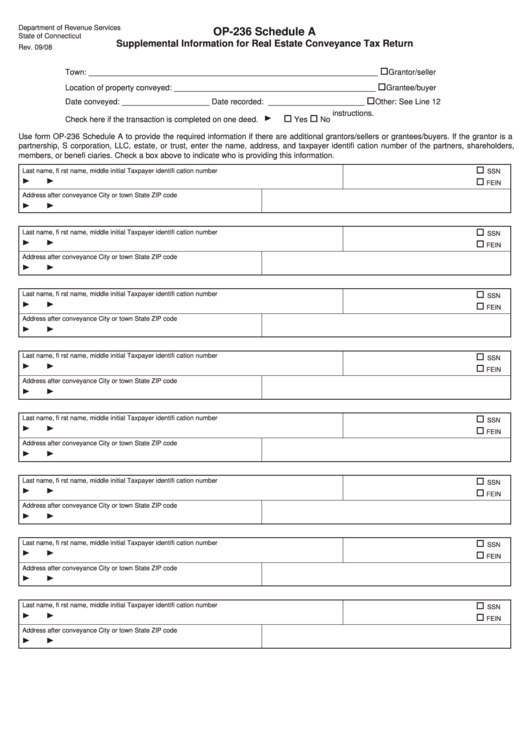

Schedule A (Form Op236) Supplemental Information For Real Estate

Web ct open data portal. Forms for state of connecticut/department of administrative services The marginal tax brackets for residential real property are as follows: Download this form and complete using adobe acrobat. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn

Medina County Auditor Forms

Web supplemental information for connecticut real estate conveyance tax return (rev. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn The marginal tax brackets for residential real property are as follows: Web connecticut real estate conveyance tax return (rev. Web 1.25% rate applies to (1).

Fill Free fillable OP236 Connecticut Real Estate Conveyance Tax

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million..

Connecticut conveyance Fill out & sign online DocHub

Download this form and complete using adobe acrobat. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Web beginning july 1, 2020 (cite: Grantor/seller #1 (last name, fi rst name, middle.

Fillable Form Op236 Connecticut Real Estate Conveyance Tax Return

Forms for state of connecticut/department of administrative services Web connecticut real estate conveyance tax return (rev. Web ct open data portal. Up to and including $800,000: Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10.

Fill Free fillable forms State of Connecticut/Department of

Web line instructions line 2: Web beginning july 1, 2020 (cite: Web connecticut real estate conveyance tax return (rev. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Forms for state.

Form Op236 Real Estate Conveyance Tax Return printable pdf download

Download this form and complete using adobe acrobat. If the grantee is a partnership, Forms for state of connecticut/department of administrative services Web connecticut real estate conveyance tax return (rev. Web line instructions line 2:

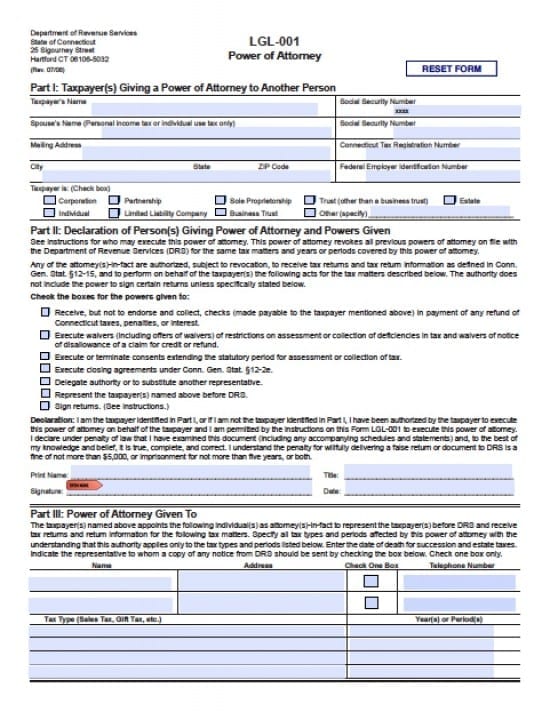

Connecticut Tax Power of Attorney Form Power of Attorney Power of

If the grantee is a partnership, Web line instructions line 2: Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Web connecticut real estate conveyance tax return (rev. The marginal tax brackets for residential real property are as follows:

Web Line Instructions Line 2:

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web beginning july 1, 2020 (cite: Web ct open data portal. Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10.

If The Grantee Is A Partnership,

The marginal tax brackets for residential real property are as follows: Web connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev. Forms for state of connecticut/department of administrative services

Web Supplemental Information For Connecticut Real Estate Conveyance Tax Return (Rev.

Download this form and complete using adobe acrobat. Up to and including $800,000: Web connecticut real estate conveyance tax return (rev. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million.

Grantor/Seller #1 (Last Name, First Name, Middle Initial) Taxpayer Identification Number Grantor/Seller Address (Street And Number) After Conveyance City/Town State Zip Code

If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million.