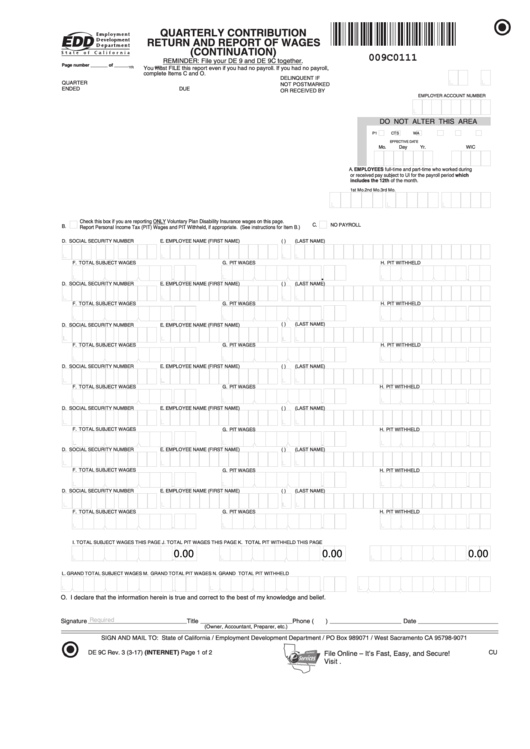

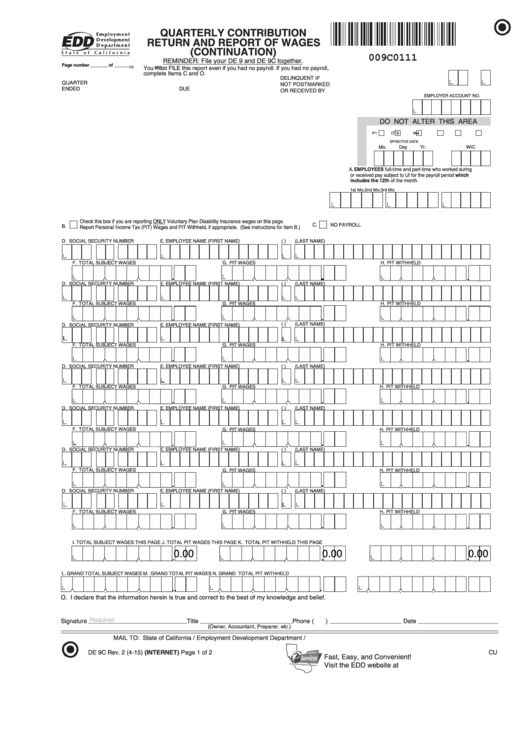

De 9C Form

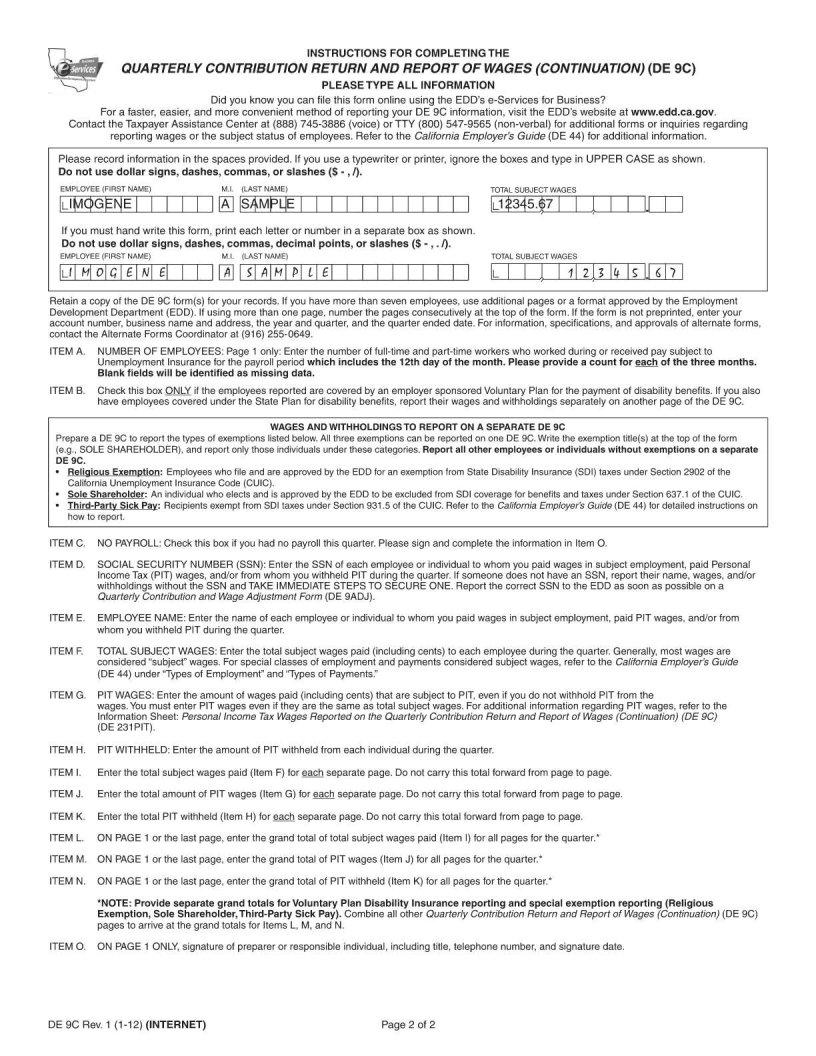

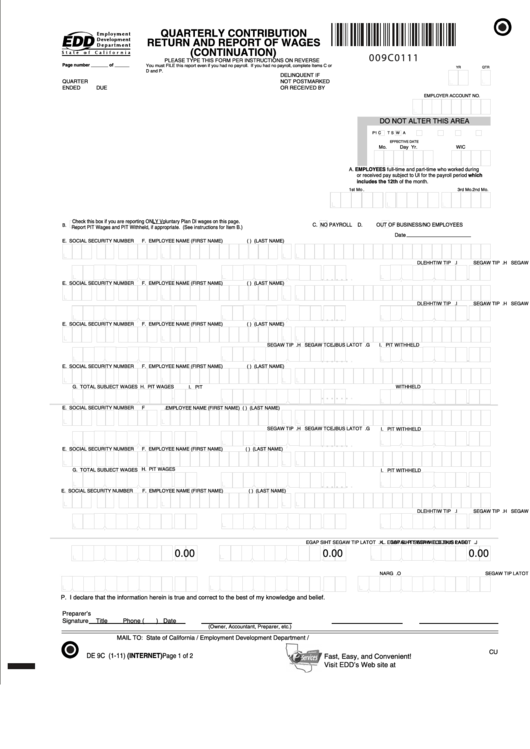

De 9C Form - Web have employees covered under the state plan for disability benefits, report their wages and withholdings separately on another page of the de 9c. All three exemptions can be reported on one de 9c. Quarterly contribution return and report of wages (de 9) and/or. Web (form 540) with the franchise tax board. Data may be imported from the 941 payroll data previously entered. This module contains california form de 9c, contribution return and report of wages (continuation). Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c). Web mail the de 9 and de 9c together to this address: Web quarterly contribution and wage adjustment form de 9adj ( ) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is. Enter the amount of pit withheld from each individual during the quarter.

Wages and withholdings to report on a separate de 9c prepare a de 9c to report the types of exemptions listed below. It may be helpful to keep in mind the purpose for the This module contains california form de 9c, contribution return and report of wages (continuation). Data may be imported from the 941 payroll data previously entered. Quarterly contribution return and report of wages (de 9) and/or. Used to request corrections to a previously reported. Web (form 540) with the franchise tax board. You must specify the quarter on the report or deposit. Web return and report of wages (continuation) (de 9c), as this may delay processing and result in erroneous penalty and interest charges. Web personal income tax wages reported on the quarterly contribution return and report of wages (continuation) (de 9c) (de 231pit).

Web quarterly contribution and wage adjustment form de 9adj ( ) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is. Web have employees covered under the state plan for disability benefits, report their wages and withholdings separately on another page of the de 9c. Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c). The table below includes the instructions for completing a paper de 9adj. This module contains california form de 9c, contribution return and report of wages (continuation). All three exemptions can be reported on one de 9c. Used to request corrections to a previously reported. Data may be imported from the 941 payroll data previously entered. Quarterly contribution return and report of wages (continuation) (de 9c). Enter the amount of pit withheld from each individual during the quarter.

Fillable Form De 9c Quarterly Contribution Return And Report Of Wages

This module contains california form de 9c, contribution return and report of wages (continuation). The table below includes the instructions for completing a paper de 9adj. To avoid delays in processing, do not mail your de 88all with the de 9 and de 9c. You must specify the quarter on the report or deposit. Web personal income tax wages reported.

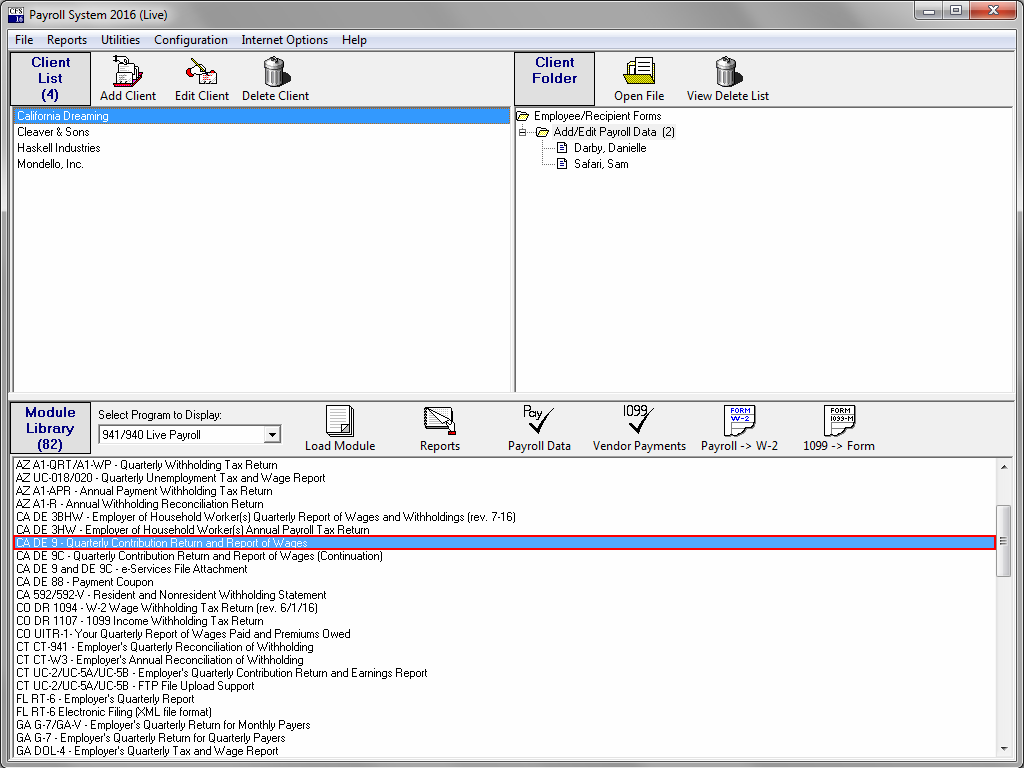

CA Forms DE 9 and DE 9C CFS Tax Software, Inc.

Web return and report of wages (continuation) (de 9c), as this may delay processing and result in erroneous penalty and interest charges. You must specify the quarter on the report or deposit. Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit).

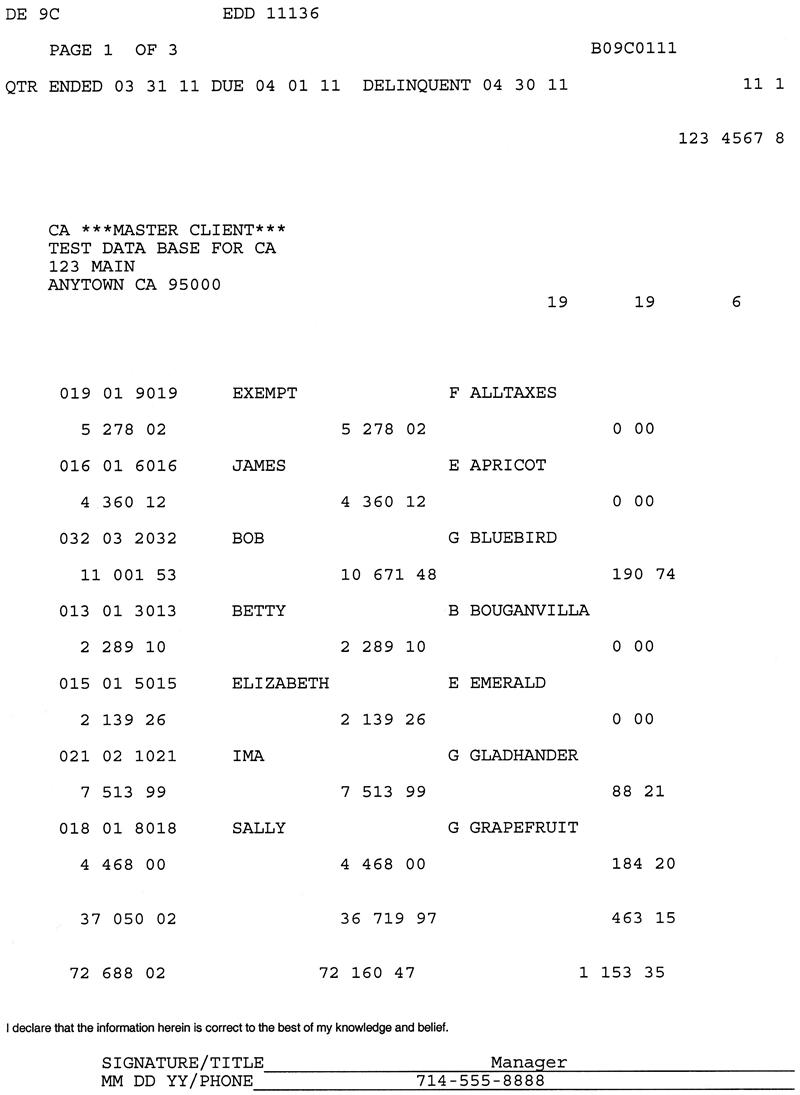

California DE 9 and DE 9C Fileable Reports

Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c). Web (form 540) with the franchise tax board. Enter the amount of pit withheld from each.

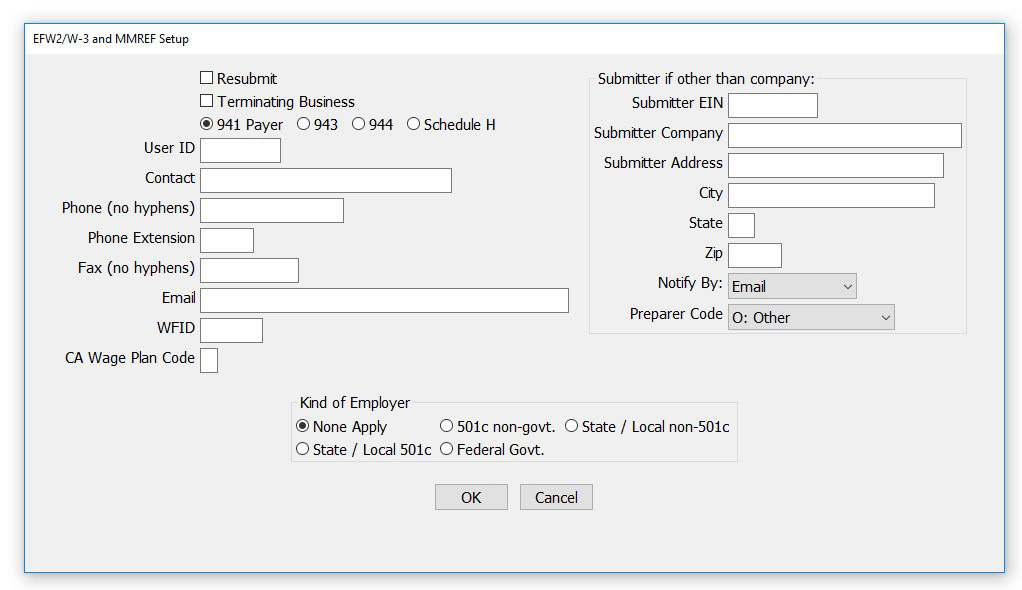

How to Print California DE9C MMREF File in CheckMark Payroll

This module contains california form de 9c, contribution return and report of wages (continuation). Data may be imported from the 941 payroll data previously entered. Web have employees covered under the state plan for disability benefits, report their wages and withholdings separately on another page of the de 9c. All three exemptions can be reported on one de 9c. Web.

Looking for DE9C report

Wages and withholdings to report on a separate de 9c prepare a de 9c to report the types of exemptions listed below. Data may be imported from the 941 payroll data previously entered. Quarterly contribution return and report of wages (de 9) and/or. The table below includes the instructions for completing a paper de 9adj. Web return and report of.

Looking for DE9C report

Enter the total subject wages paid (item f) for each separate page. Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c). To avoid delays in.

Form De 9c With Instructions Quarterly Contribution Return And Report

Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c). Data may be imported from the 941 payroll data previously entered. Web (form 540) with the.

De 9C Form ≡ Fill Out Printable PDF Forms Online

Web if filing an adjustment to a previously filed de 9 or de 9c on paper, complete a quarterly contribution and wage adjustment form (de 9adj). You must specify the quarter on the report or deposit. Quarterly contribution return and report of wages (continuation) (de 9c). Mandatory electronic funds transfer (eft) lers must remit all sdi/pit deposits by eft to.

Fillable Form De 9c Quarterly Contribution Return And Report Of Wages

Web if filing an adjustment to a previously filed de 9 or de 9c on paper, complete a quarterly contribution and wage adjustment form (de 9adj). Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the.

Click Save & Print to generate the upload file and to display

Enter the total subject wages paid (item f) for each separate page. Web have employees covered under the state plan for disability benefits, report their wages and withholdings separately on another page of the de 9c. Data may be imported from the 941 payroll data previously entered. Web mail the de 9 and de 9c together to this address: You.

Web Mail The De 9 And De 9C Together To This Address:

Enter the total subject wages paid (item f) for each separate page. Web personal income tax wages reported on the quarterly contribution return and report of wages (continuation) (de 9c) (de 231pit). Used to request corrections to a previously reported. Web if filing an adjustment to a previously filed de 9 or de 9c on paper, complete a quarterly contribution and wage adjustment form (de 9adj).

Mandatory Electronic Funds Transfer (Eft) Lers Must Remit All Sdi/Pit Deposits By Eft To Avoid A Noncompliance Penalty.

Web return and report of wages (continuation) (de 9c), as this may delay processing and result in erroneous penalty and interest charges. The table below includes the instructions for completing a paper de 9adj. Web quarterly contribution and wage adjustment form de 9adj ( ) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is. This module contains california form de 9c, contribution return and report of wages (continuation).

Quarterly Contribution Return And Report Of Wages (De 9) And/Or.

Data may be imported from the 941 payroll data previously entered. Quarterly contribution return and report of wages (continuation) (de 9c). You must specify the quarter on the report or deposit. All three exemptions can be reported on one de 9c.

Web Have Employees Covered Under The State Plan For Disability Benefits, Report Their Wages And Withholdings Separately On Another Page Of The De 9C.

To avoid delays in processing, do not mail your de 88all with the de 9 and de 9c. Enter the amount of pit withheld from each individual during the quarter. Web (form 540) with the franchise tax board. Web contribution return and report of wages (continuation) (de 9c) the purpose of this information sheet is to explain the requirement to report california personal income tax (pit) wages in item h on the quarterly contribution return and reports of wages (continuation) (de 9c).

.jpg)