Debt Calendar

Debt Calendar - Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. Enter your debts, monthly payment, and see the results, schedule, and summary. Why is the national debt so high? Web us national debt clock : Motivation is a big factor in paying off debt. Financial writer dave ramsey has made this technique more popular over recent years. Web interest rate (apr) % balance, $ minimum payment, $ payoff strategy: Use one to find your debt payoff. Web download printable debt payoff charts and trackers for excel and pdf. All pages are 100% free.

The debt ceiling is expected on oct. Web calculate how long it will take to pay off your debts using the debt snowball method. Easily create a debt reduction schedule based on the. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. How the debt snowball calculator works. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Government's money to run out. Enter your debts, monthly payment, and see the results, schedule, and summary. 17, but it will take a few more days for the u.s. National debt climbed to $34 trillion for the first time in december 2023, up from about $31.42 trillion one year earlier.

How the debt snowball calculator works. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. Web calculate how long it will take to pay off your debts using the debt snowball method. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. What is the national debt right now? Web us national debt clock : Use the form above to add a new debt. Why is the national debt so high? National debt climbed to $34 trillion for the first time in december 2023, up from about $31.42 trillion one year earlier.

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Benefits of the snowball technique. Motivation is a big factor in paying off debt. Web the calculator below estimates the amount of time required to pay back one or more debts. Easily create a debt reduction schedule based on the. 17, but it will take a few more days for the u.s.

Debt Payoff Planner Free Printable

Track your debt payoff goals. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. The debt snowball calculator follows the debt snowball payoff method, which simplifies the process of paying down. Web interest rate (apr) % balance, $ minimum payment, $ payoff strategy: Why is.

Free Printable Debt Tracker Use This To Payoff Your Debts Quicker

Enter your debts, monthly payment, and see the results, schedule, and summary. America's growing debt is the result of simple math — each year, there is a mismatch between spending and revenues. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Benefits.

Monthly Debt Trackers, Printable Debt Planner, Debt Progress Trackers

Enter your debts, monthly payment, and see the results, schedule, and summary. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Web use this free debt calculator to determine the fastest and easiest way to pay down your debts. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal.

FREE PRINTABLE! Use this Debt Repayment printable to pay down your debt

How much will you have to pay per month to pay off a debt in a certain amount of time? Enter your debts, monthly payment, and see the results, schedule, and summary. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. Web a debt tracker, whether a hard copy or an app,.

Debt Planner Printable

Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. 17, but it will take a few more days for the u.s. National debt climbed to $34 trillion for the first time in december 2023, up from about $31.42 trillion one year earlier..

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. Motivation is a big factor in paying off debt. How the debt snowball calculator works. Track your debt payoff goals. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense.

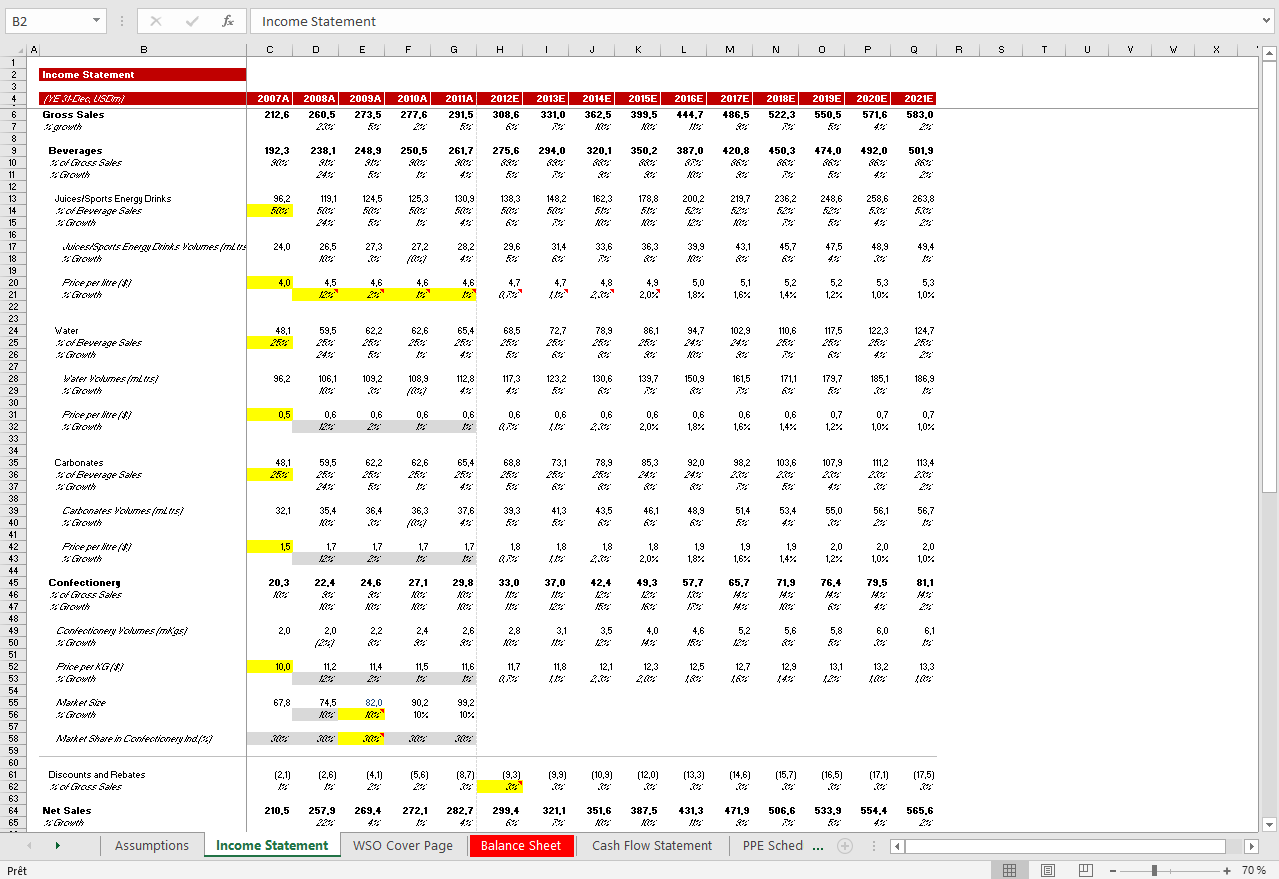

Debt Schedule Excel Model Template Eloquens

Web us national debt clock : For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Financial writer dave.

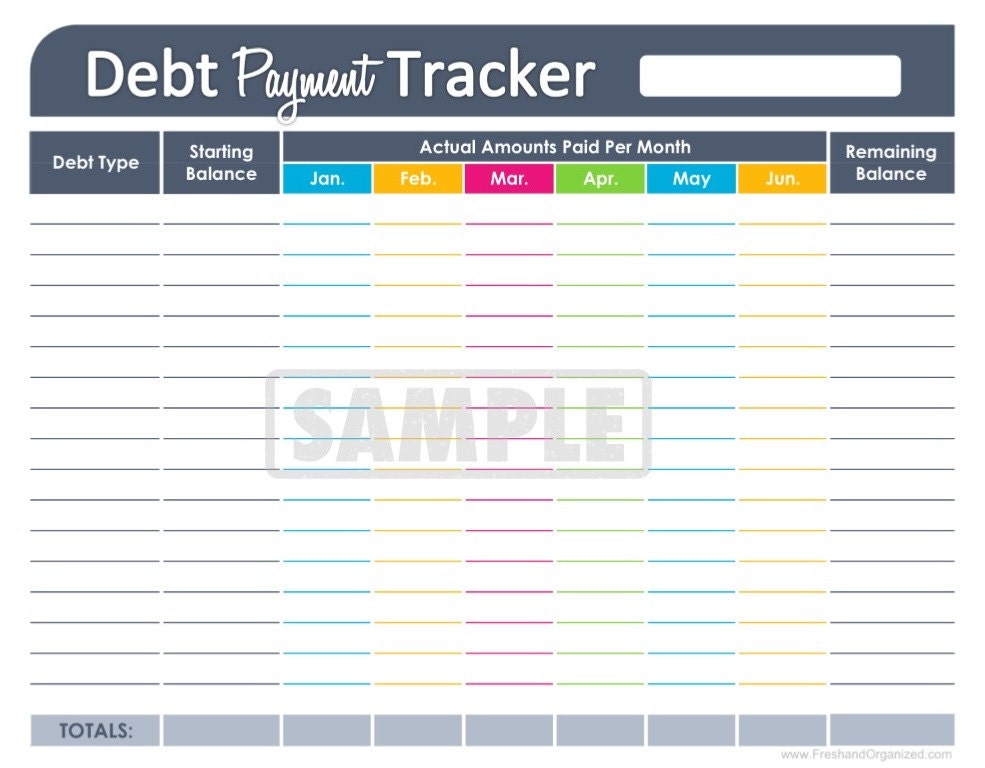

Debt Payment Tracker EDITABLE Personal by

For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. Web the calculator below estimates the amount of time required to pay back one or more debts. America's growing debt is the result of simple math — each year, there is a mismatch between spending and.

Free Debt Tracker Printable

Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Government's money to run out. The debt snowball calculator follows the debt snowball payoff method, which simplifies the process of paying down. Web the calculator below estimates the amount of time required to pay back one or more debts. Use one.

All Pages Are 100% Free.

How the debt snowball calculator works. Web a debt tracker, whether a hard copy or an app, can help you stay on top of your accounts, balances and payment due dates. Web us national debt clock : Web the issuance calendar provides the market participants with a secure basis for their investment decisions.

Web Calculate How Long It Will Take To Pay Off Your Debts Using The Debt Snowball Method.

Use one to find your debt payoff. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Motivation is a big factor in paying off debt. Government's money to run out.

Web The Calculator Below Estimates The Amount Of Time Required To Pay Back One Or More Debts.

Web use this free debt calculator to determine the fastest and easiest way to pay down your debts. Why is the national debt so high? Web download printable debt payoff charts and trackers for excel and pdf. The debt ceiling is expected on oct.

The Debt Snowball Calculator Follows The Debt Snowball Payoff Method, Which Simplifies The Process Of Paying Down.

Financial writer dave ramsey has made this technique more popular over recent years. Track your debt payoff goals. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance.

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)