Delaware Dissolution Short Form

Delaware Dissolution Short Form - In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general 8, § 391 (2023).) if you don't meet the above requirements, then you'll need to submit the standard form. The instructions will be numbered to correspond with the article it is referencing. Both dissolution forms require the following basic information: This can vary depending on whether a certified copy is requested as evidence and whether expedited services are chosen. Your tax payment must accompany the certificate of dissolution. The date the dissolution was authorized, and Web as of 2023, the fee to file the short form is only $10. The certificate of dissolution carries a $204 filing fee. However, the short form version, filed according to section 391, is only $10 plus applicable taxes.

However, the short form version, filed according to section 391, is only $10 plus applicable taxes. Both dissolution forms require the following basic information: The following instructions will help you in correctly completing your dissolution certificate. In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general The date the dissolution was authorized, and Web the corporation organized and existing under the general corporation law of the state of delaware. The name of the corporation; Web delaware has two statutory methods by which a corporation can dissolve: The instructions will be numbered to correspond with the article it is referencing. Contact the department of state, franchise tax section to find the exact amount of tax owed also at the time of dissolution.

The certificate of dissolution carries a $204 filing fee. Both dissolution forms require the following basic information: The name of the corporation; The current name of the corporation exactly as it appears. This can vary depending on whether a certified copy is requested as evidence and whether expedited services are chosen. Contact the department of state, franchise tax section to find the exact amount of tax owed also at the time of dissolution. Web delaware has two statutory methods by which a corporation can dissolve: However, the short form version, filed according to section 391, is only $10 plus applicable taxes. The following instructions will help you in correctly completing your dissolution certificate. The dissolution of said has been duly authorized in accordance with the provisions of section 276(a) of the general corporation law of the state of delaware.

Delaware Dissolution Package to Dissolve Limited Liability Company LLC

In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general 8, § 391 (2023).) if you don't meet the above requirements, then you'll need to submit the standard form. The certificate of dissolution carries a $204 filing fee..

Delaware Dissolution Package to Dissolve Limited Liability Company LLC

Contact the department of state, franchise tax section to find the exact amount of tax owed also at the time of dissolution. Web the standard ( not short form) delaware state filing fee for dissolution is $204 plus applicable taxes. Web as of 2023, the fee to file the short form is only $10. Web the “short” form cost $10..

Delaware Short Form Certificate of Dissolution Download Fillable PDF

The date the dissolution was authorized, and The following instructions will help you in correctly completing your dissolution certificate. The following instructions will help you in correctly completing your dissolution certificate. Web certificate of dissolution short form. Web the standard ( not short form) delaware state filing fee for dissolution is $204 plus applicable taxes.

"Short Form" Delaware "Operating Agreement" / "Short Form" Delaware

Does hereby certify as follows: The following instructions will help you in correctly completing your dissolution certificate. In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general Web certificate of dissolution short form. Web the standard ( not.

Articles Of Dissolution 2020 Fill and Sign Printable Template Online

Web the corporation organized and existing under the general corporation law of the state of delaware. The dissolution of said has been duly authorized in accordance with the provisions of section 276(a) of the general corporation law of the state of delaware. The instructions will be numbered to correspond with the article it is referencing. The date the dissolution was.

Delaware Dissolution Package to Dissolve Limited Liability Company LLC

However, the short form version, filed according to section 391, is only $10 plus applicable taxes. Web as of 2023, the fee to file the short form is only $10. Web delaware has two statutory methods by which a corporation can dissolve: The certificate of dissolution carries a $204 filing fee. In reply to your recent request, attached is a.

Fillable Online STATE OF DELAWARE SHORT FORM CERTIFICATE OF DISSOLUTION

Web as of 2023, the fee to file the short form is only $10. The date the dissolution was authorized, and The dissolution of said has been duly authorized in accordance with the provisions of section 276(a) of the general corporation law of the state of delaware. However, the short form version, filed according to section 391, is only $10.

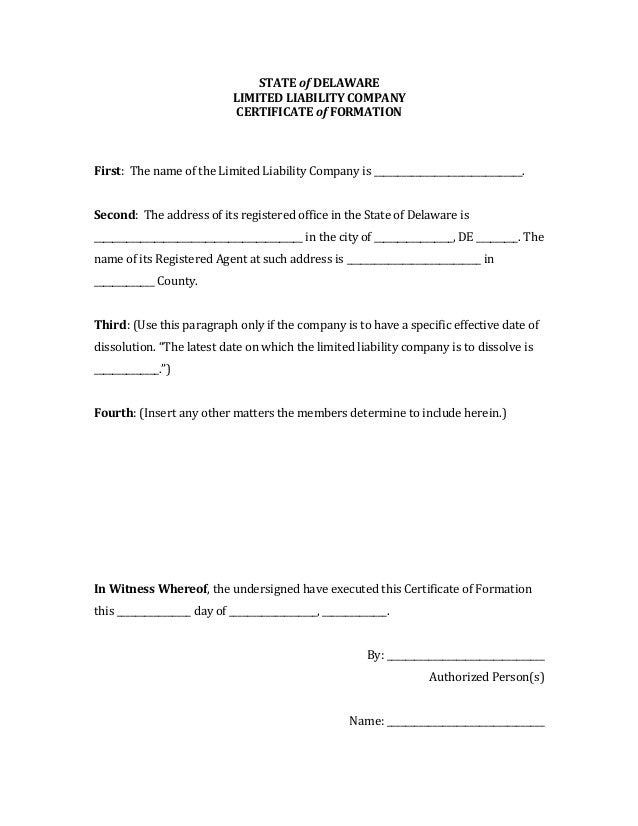

Delaware LLC Formation Document

Web the “short” form cost $10. The certificate of dissolution carries a $204 filing fee. In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general The name of the corporation; The following instructions will help you in correctly.

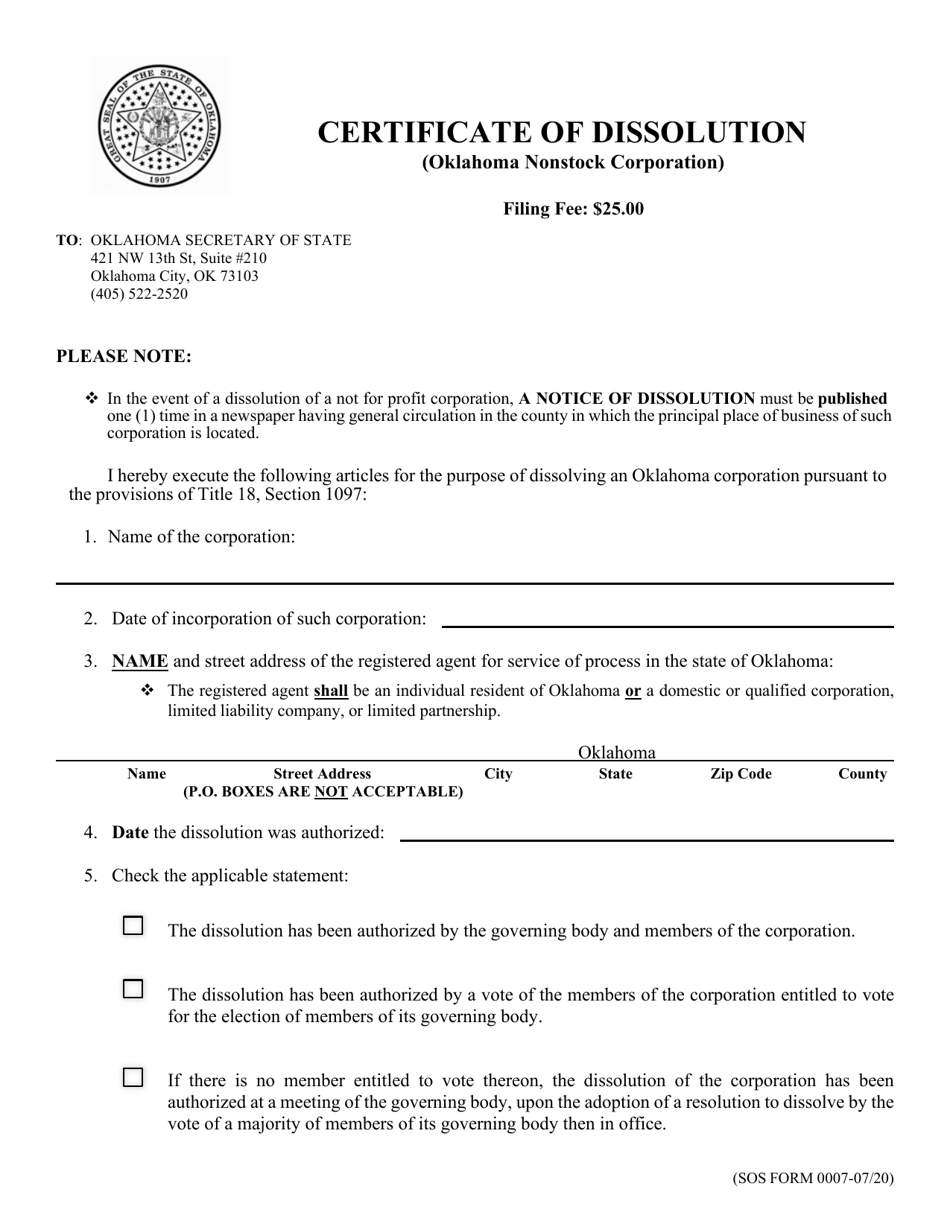

SOS Form 0007 Download Fillable PDF or Fill Online Certificate of

This can vary depending on whether a certified copy is requested as evidence and whether expedited services are chosen. Web the corporation organized and existing under the general corporation law of the state of delaware. Contact the department of state, franchise tax section to find the exact amount of tax owed also at the time of dissolution. Web as of.

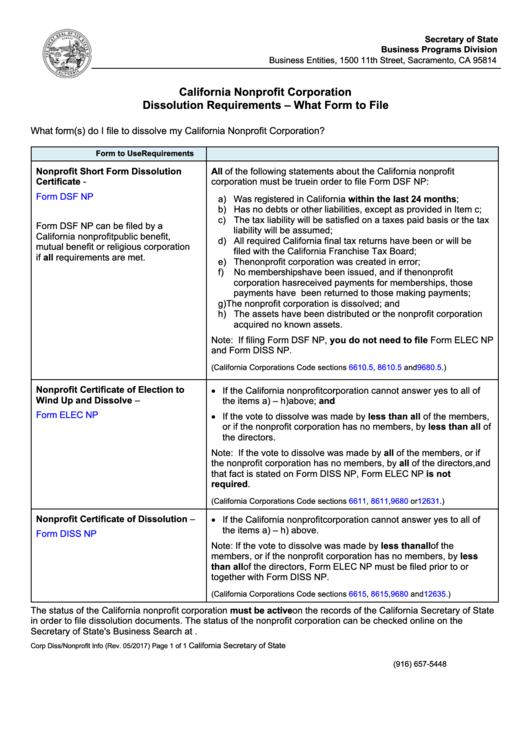

Fillable Form Dsf Np Nonprofit Short Form Dissolution Certificate

The instructions will be numbered to correspond with the article it is referencing. The instructions will be numbered to correspond with the article it is referencing. Does hereby certify as follows: Web delaware has two statutory methods by which a corporation can dissolve: The certificate of dissolution carries a $204 filing fee.

The Dissolution Of Said Has Been Duly Authorized In Accordance With The Provisions Of Section 276(A) Of The General Corporation Law Of The State Of Delaware.

The instructions will be numbered to correspond with the article it is referencing. 8, § 391 (2023).) if you don't meet the above requirements, then you'll need to submit the standard form. However, the short form version, filed according to section 391, is only $10 plus applicable taxes. The instructions will be numbered to correspond with the article it is referencing.

The Following Instructions Will Help You In Correctly Completing Your Dissolution Certificate.

The certificate of dissolution carries a $204 filing fee. Web the standard ( not short form) delaware state filing fee for dissolution is $204 plus applicable taxes. The current name of the corporation exactly as it appears. Both dissolution forms require the following basic information:

The Following Instructions Will Help You In Correctly Completing Your Dissolution Certificate.

In reply to your recent request, attached is a copy of short form certificate of dissolution to be filed in accordance with section 275 and 391 (a) (5) (b) of the general Your tax payment must accompany the certificate of dissolution. The name of the corporation; Web the “short” form cost $10.

Does Hereby Certify As Follows:

Web as of 2023, the fee to file the short form is only $10. Contact the department of state, franchise tax section to find the exact amount of tax owed also at the time of dissolution. Web certificate of dissolution short form. Web the corporation organized and existing under the general corporation law of the state of delaware.