Dissolution Of Trust Form California

Dissolution Of Trust Form California - Simply answer a few questions. Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax return. Certificate of election to wind up. Web up to $40 cash back a trust dissolution form is a legal document used to terminate a trust. Notice of revocation of petition for summary dissolution (family law—summary. December 7, 2021 estate planning trusts can be a powerful estate planning tool. Dissolution can be accomplished by either filing an action with the. Web to complete dissolution, all domestic public benefit, religious, and mutual benefit corporations holding charitable assets in a trust must obtain a dissolution waiver from. Vote by nonprofit board or majority of corporation ’s membership to. If the above box is not checked, a.

The usual way is called. We'll create & file the articles of dissolution for you. Notice of revocation of petition for summary dissolution (family law—summary. Web in california, the procedures to voluntarily wind up operations are called “dissolution” of the nonprofit corporation. Web (a) on petition by a trustee or beneficiary, if the court determines that the fair market value of the principal of a trust has become so low in relation to the cost of administration that. Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax return. Simply answer a few questions. Ad real estate, landlord tenant, estate planning, power of attorney, affidavits and more! This is a california form and can be. Web statutory filing provisions are found in california corporations code section 17356.

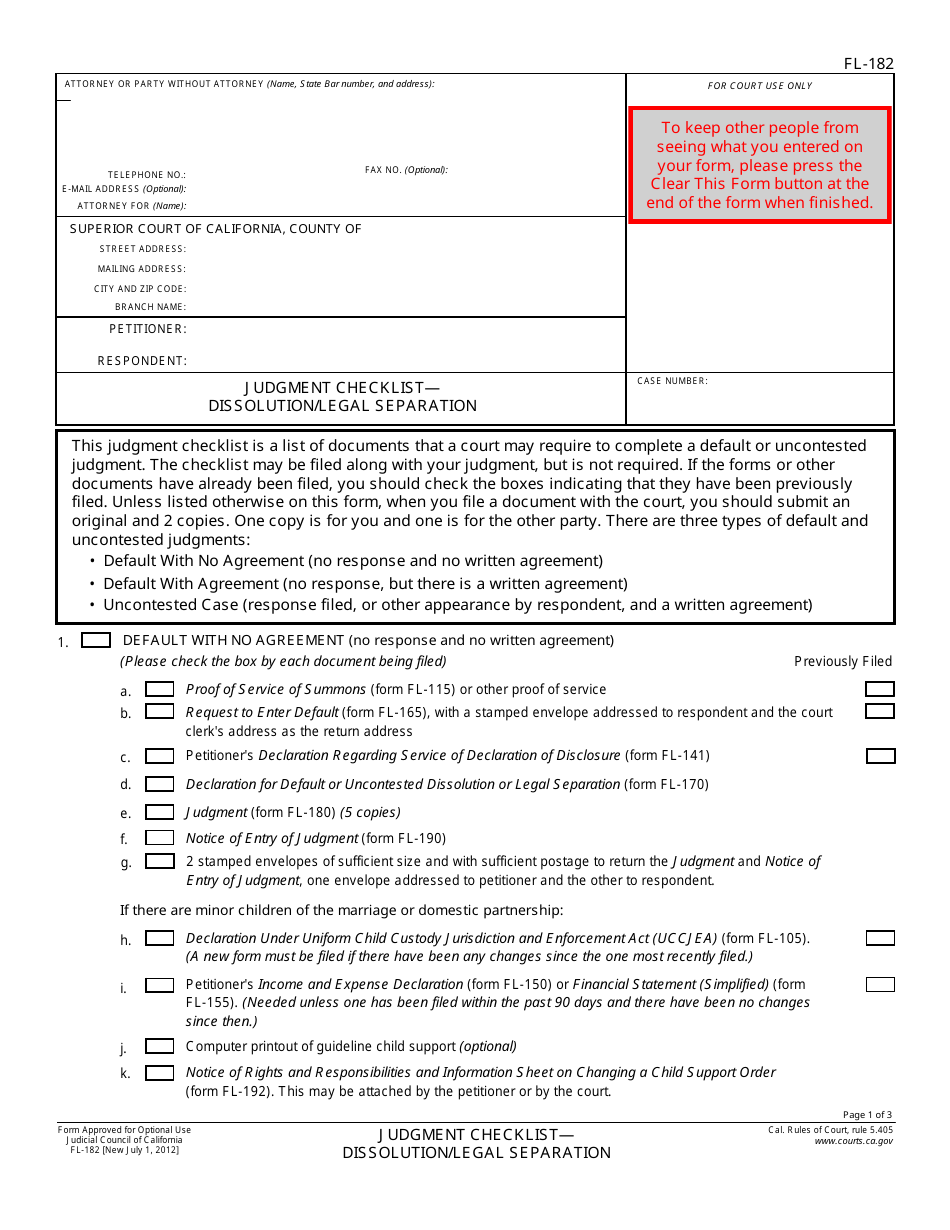

Prepare trust dissolution documents that include the name of the trust,. There are two ways of getting a divorce, or dissolution, in california. Web charity & charitable trust forms initial registration forms, guides and instructions all entities that are required to register with the attorney general's registry of charitable. Web unveiling the process of terminating or dissolving irrevocable trusts in california. January 17, 2020] family code, § 2336 www.courts.ca.gov. Web here are the basic steps to follow to dissolve a california nonprofit corporation: December 7, 2021 estate planning trusts can be a powerful estate planning tool. The usual way is called. Ad when it's time to move on from your business, we're here to help through the process. Web statutory filing provisions are found in california corporations code section 17356.

Ssurvivor Living Trust Amendment Form California

If the above box is not checked, a. There are two ways of getting a divorce, or dissolution, in california. It must be signed by all parties involved in the trust agreement, as well as any beneficiaries. Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax return. Web in california,.

Dissolution Of An LLC Law Advocate Group LLP California

December 7, 2021 estate planning trusts can be a powerful estate planning tool. Web statutory filing provisions are found in california corporations code section 17356. Select popular legal forms & packages of any category. Web in california, the procedures to voluntarily wind up operations are called “dissolution” of the nonprofit corporation. Prepare trust dissolution documents that include the name of.

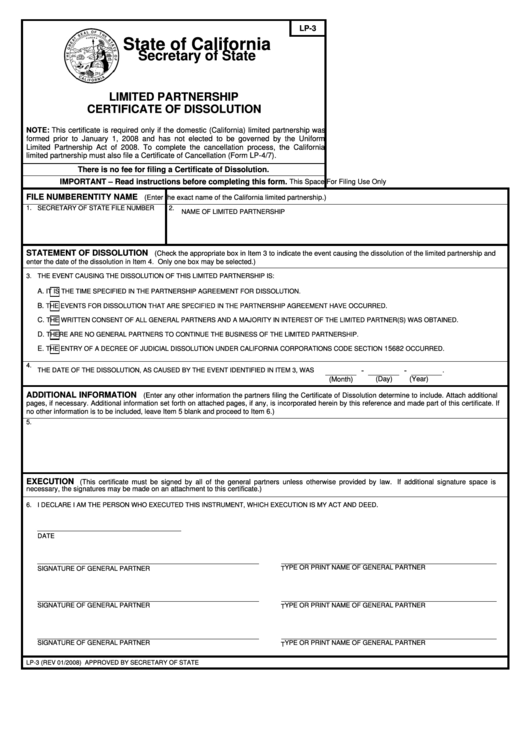

Fillable Form Lp3 Limited Partnership Certificate Of Dissolution

December 7, 2021 estate planning trusts can be a powerful estate planning tool. July 17, 2023 | albertson & davidson, llp | trust administration. Select popular legal forms & packages of any category. Web statutory filing provisions are found in california corporations code section 17356. This is a california form and can be.

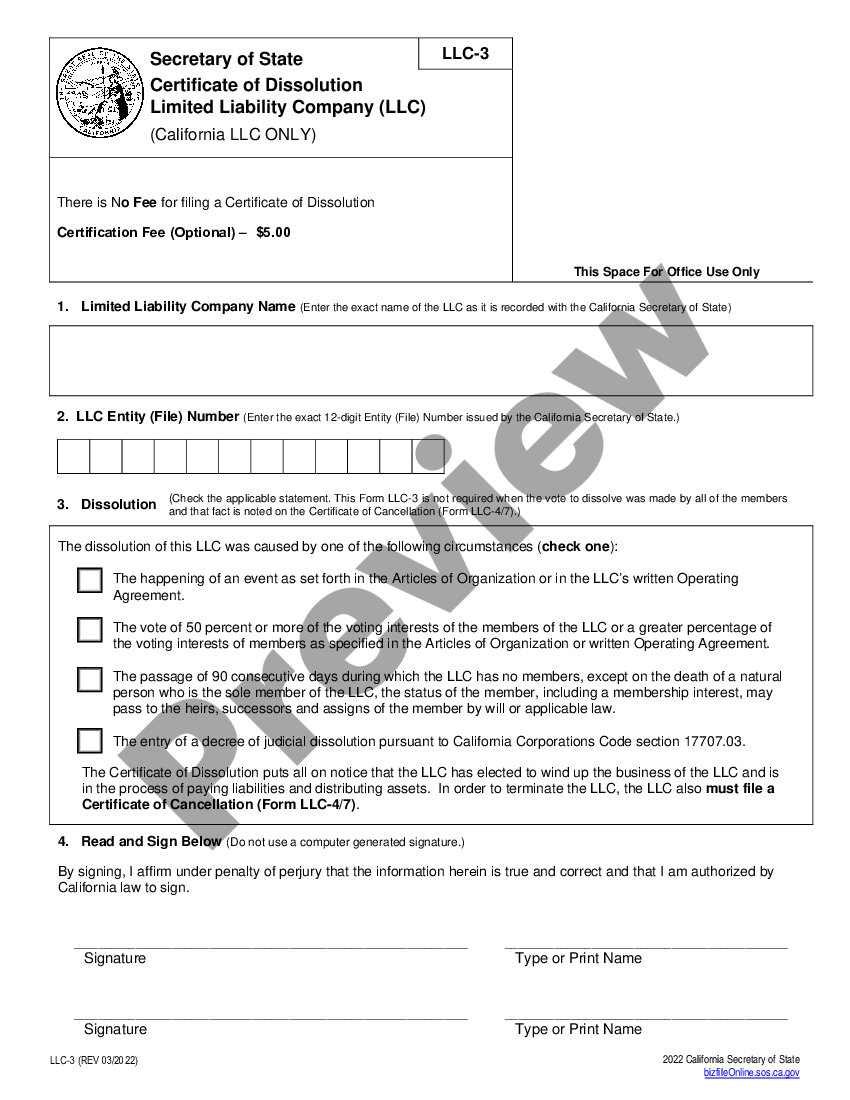

California Dissolution Package to Dissolve Limited Liability Company

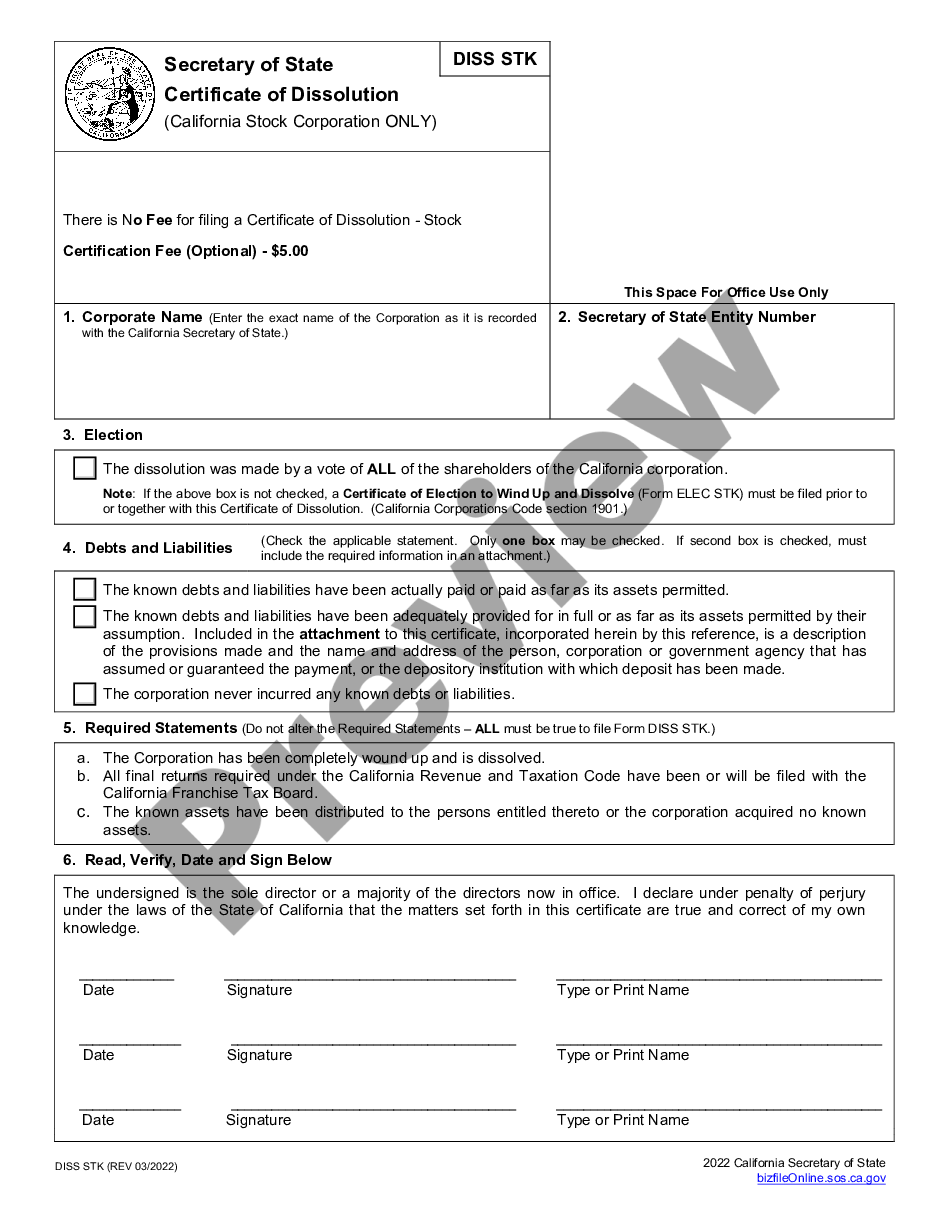

Web the dissolution was made by a vote of. Certificate of election to wind up. Web statutory filing provisions are found in california corporations code section 17356. Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax return. Web up to $40 cash back a trust dissolution form is a legal.

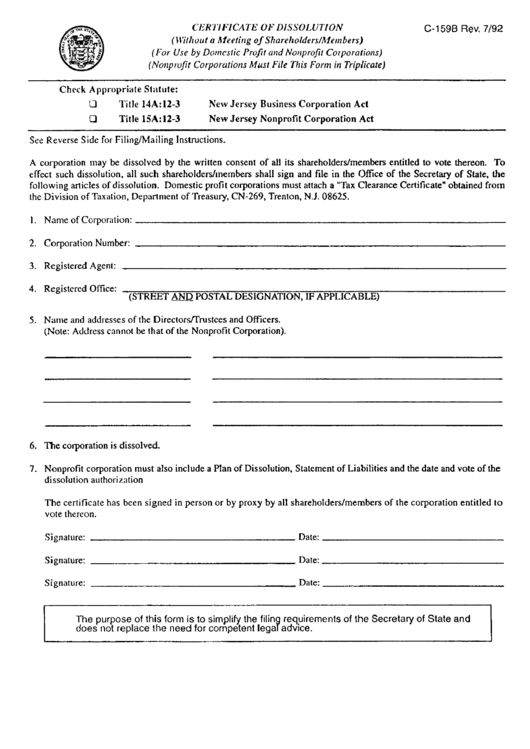

Fillable Form C159b Certificate Of Dissolution (Without A Meeting Of

Currently, llcs can submit termination forms online. July 17, 2023 | albertson & davidson, llp | trust administration. There are two ways of getting a divorce, or dissolution, in california. Dissolution can be accomplished by either filing an action with the. Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax.

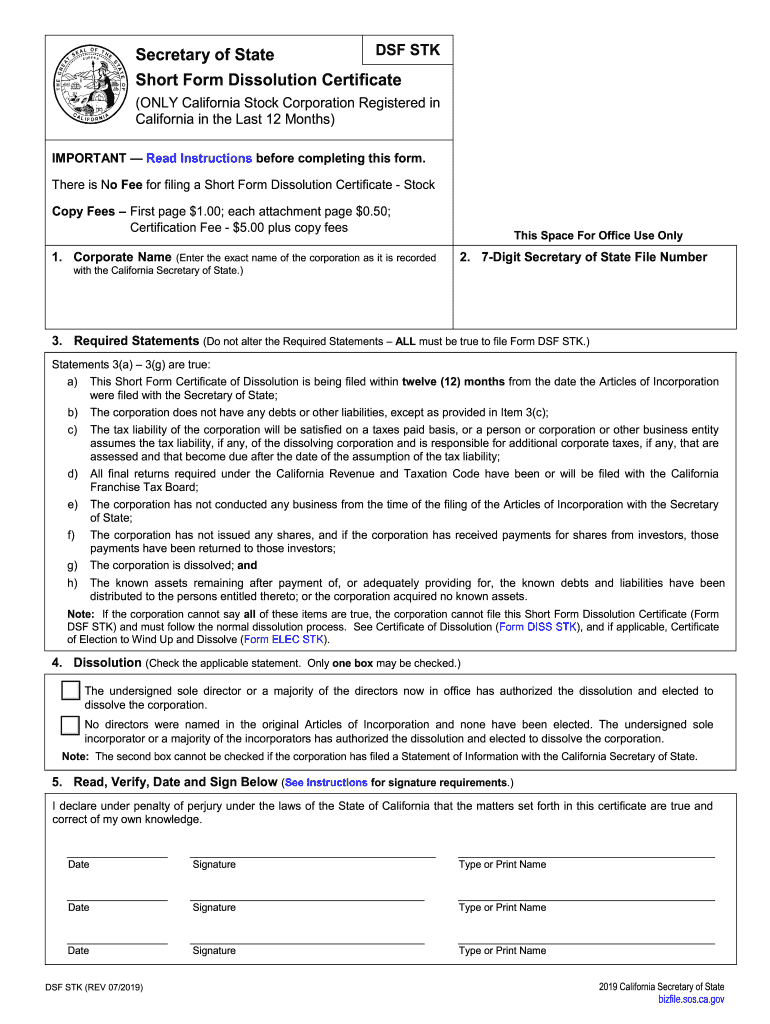

Form Dsf Stk Fill Out and Sign Printable PDF Template signNow

Certificate of election to wind up. Simply answer a few questions. Prepare trust dissolution documents that include the name of the trust,. Web unveiling the process of terminating or dissolving irrevocable trusts in california. If the above box is not checked, a.

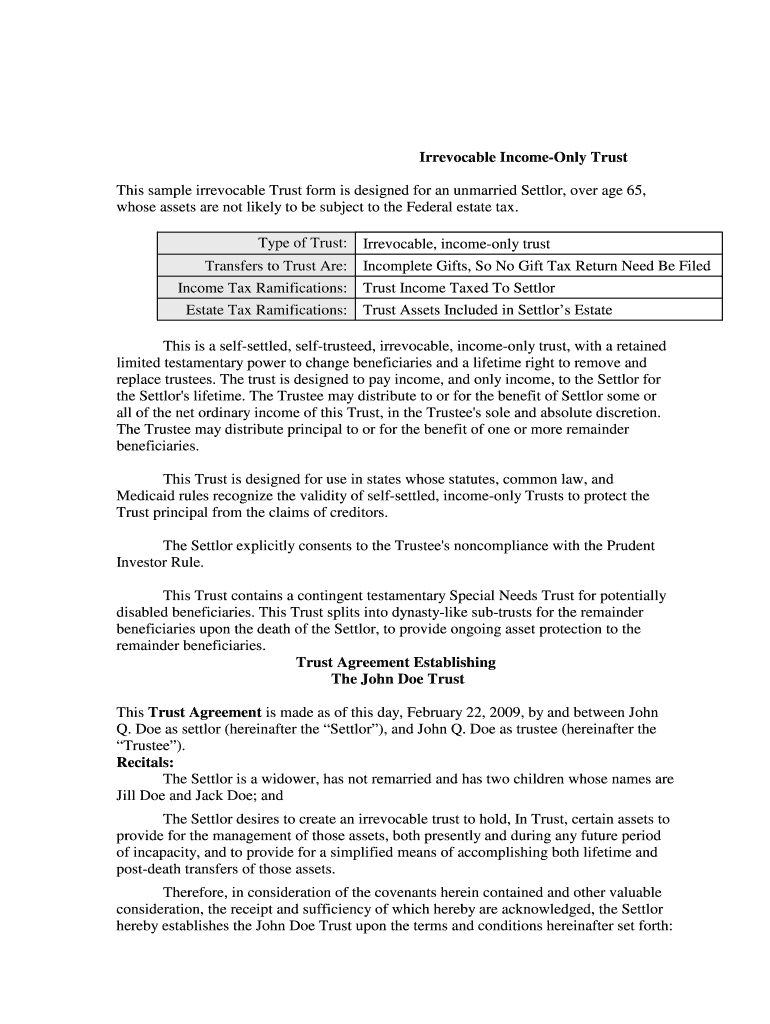

California Irrevocable Living Trust Pdf 20202021 Fill and Sign

January 17, 2020] family code, § 2336 www.courts.ca.gov. Web (a) on petition by a trustee or beneficiary, if the court determines that the fair market value of the principal of a trust has become so low in relation to the cost of administration that. Certificate of election to wind up. Web to complete dissolution, all domestic public benefit, religious, and.

Form FL182 Download Fillable PDF or Fill Online Judgment Checklist

Vote by nonprofit board or majority of corporation ’s membership to. July 17, 2023 | albertson & davidson, llp | trust administration. It must be signed by all parties involved in the trust agreement, as well as any beneficiaries. Web in california, the procedures to voluntarily wind up operations are called “dissolution” of the nonprofit corporation. Dissolution can be accomplished.

California Dissolution Package to Dissolve Corporation Dissolve

Notice of revocation of petition for summary dissolution (family law—summary. Ad when it's time to move on from your business, we're here to help through the process. Of the shareholders of the california corporation. Web (a) on petition by a trustee or beneficiary, if the court determines that the fair market value of the principal of a trust has become.

California Dissolution Package to Dissolve Corporation Form Online

Web to complete dissolution, all domestic public benefit, religious, and mutual benefit corporations holding charitable assets in a trust must obtain a dissolution waiver from. Web the dissolution was made by a vote of. Of the shareholders of the california corporation. Web (a) on petition by a trustee or beneficiary, if the court determines that the fair market value of.

Web Obtain Signed Documents From The Beneficiaries Acknowledging Their Receipt Of Trust Distributions.

The usual way is called. Ad when it's time to move on from your business, we're here to help through the process. Prepare trust dissolution documents that include the name of the trust,. July 17, 2023 | albertson & davidson, llp | trust administration.

Certificate Of Election To Wind Up.

Currently, llcs can submit termination forms online. Web in california, the procedures to voluntarily wind up operations are called “dissolution” of the nonprofit corporation. Web the dissolution was made by a vote of. Web here are the basic steps to follow to dissolve a california nonprofit corporation:

Web Statutory Filing Provisions Are Found In California Corporations Code Section 17356.

Web up to $40 cash back a trust dissolution form is a legal document used to terminate a trust. Ad real estate, landlord tenant, estate planning, power of attorney, affidavits and more! January 17, 2020] family code, § 2336 www.courts.ca.gov. Web (a) on petition by a trustee or beneficiary, if the court determines that the fair market value of the principal of a trust has become so low in relation to the cost of administration that.

Web Charity & Charitable Trust Forms Initial Registration Forms, Guides And Instructions All Entities That Are Required To Register With The Attorney General's Registry Of Charitable.

Dissolution can be accomplished by either filing an action with the. Simply answer a few questions. It must be signed by all parties involved in the trust agreement, as well as any beneficiaries. Web to complete dissolution, all domestic public benefit, religious, and mutual benefit corporations holding charitable assets in a trust must obtain a dissolution waiver from.