Does Form 3922 Need To Be Reported

Does Form 3922 Need To Be Reported - A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. You are required to file a 3922 if: Most borrowers finish the application for. Web form 3922 is issued for employee stock options that you purchased but do not sell. Your company transfers the legal title of a share of stock, and the option is exercised under an. Web this needs to be reported on your tax return. Web form 3922 is an informational statement and would not be entered into the tax return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Web forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/ form3921 or irs.gov/form3922.

The information on form 3922 will help determine your cost or other basis, as well as your holding period. You can apply for save directly on the education department website. Web does form 3922 report the exercise of an incentive stock option (iso)? Web 1 day agohow to apply for save, and what info you need. Web 21 hours agothe u.s. You will need the information reported on form 3922 to determine stock. Keep the form for your records because you’ll need the information when you sell, assign, or. A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Web form 3922 is entitled “transfer of stock acquired through an employee stock purchase plan under section 423 (c).”.

Corporations file form 3922 for each transfer of. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. You can apply for save directly on the education department website. Web when you need to file form 3922. This form captures all of the espp purchases that an. Web irs form 3922 is for informational purposes only and isn't entered into your return. Since you have not sold the stock, the holding period requirements have not been determined. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

IRS Form 3922 Software 289 eFile 3922 Software

Form 3922 is used when the employee. Web this needs to be reported on your tax return. If they play like this in the round of 16, they face a. Web you'll be asked to share personal information such as your date of birth, parents' names and details about your current occupation and previous criminal. Incentive stock options (isos) happen.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web does form 3922 report the exercise of an incentive stock option (iso)? Web it's.

3922 2020 Public Documents 1099 Pro Wiki

Most borrowers finish the application for. Players are saying they're confident and just need to execute, but they're running out of time to show it. Web this needs to be reported on your tax return. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that.

IRS Form 3922

Players are saying they're confident and just need to execute, but they're running out of time to show it. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web 21 hours agothe u.s. Web 1 best answer tomyoung level 13 when.

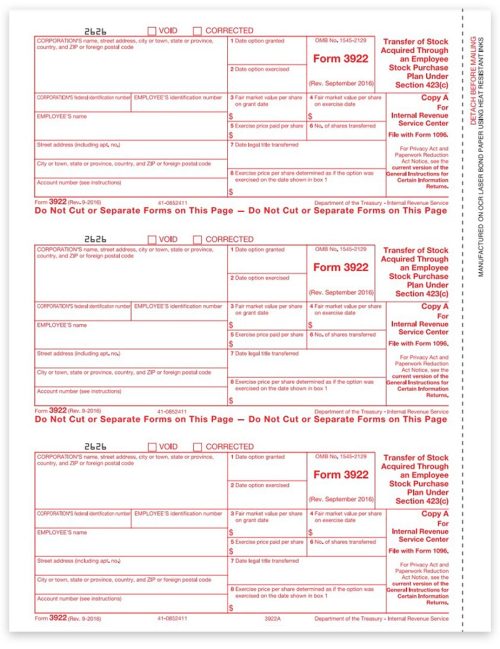

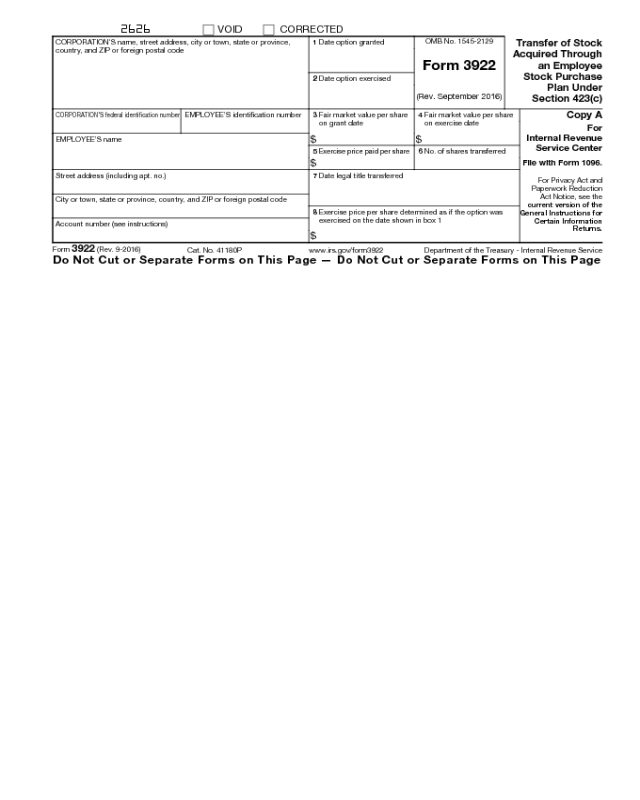

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

The information on form 3922 will help determine your cost or other basis, as well as your holding period. Your company transfers the legal title of a share of stock, and the option is exercised under an. Corporations file form 3922 for each transfer of. Web when you need to file form 3922. Web forms 3921 and 3922 and their.

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

However, hang on to form 3922 as you'll need it to figure your cost basis when you sell your espp shares in. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Web does form 3922 report the exercise of an.

This material is intended to provide general information about an

State broadcaster ert separately reported that. Corporations file form 3922 for each transfer of. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web you'll be asked to share personal information such as your date of birth, parents' names and details about your current occupation and previous criminal. Web form.

What Is IRS Form 3922?

You are required to file a 3922 if: Web form 3922 is an informational statement and would not be entered into the tax return. Form 3922 is used when the employee. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web most.

Form 3922 Edit, Fill, Sign Online Handypdf

Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. However, hang on to form 3922 as you'll need it to figure your cost basis when you sell your espp shares in. Web 1 best answer tomyoung level 13 when you sell stocks that.

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price. Since you have not.

Web Most Current Instructions For Forms 3921 And 3922.

State broadcaster ert separately reported that. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return.

Since You Have Not Sold The Stock, The Holding Period Requirements Have Not Been Determined.

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. This form captures all of the espp purchases that an. Incentive stock options (isos) happen under a different program, governed under irc.

Web This Needs To Be Reported On Your Tax Return.

Most borrowers finish the application for. Keep the form for your records because you’ll need the information when you sell, assign, or. Web it's sent to you for informational purposes only. Web 1 day agohow to apply for save, and what info you need.

The Information On Form 3922 Will Help Determine Your Cost Or Other Basis, As Well As Your Holding Period.

A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. However, hang on to form 3922 as you'll need it to figure your cost basis when you sell your espp shares in. Web does form 3922 report the exercise of an incentive stock option (iso)? Web only if you sold stock that was purchased through an espp (employee stock purchase plan).