Does Form 8300 Trigger An Audit

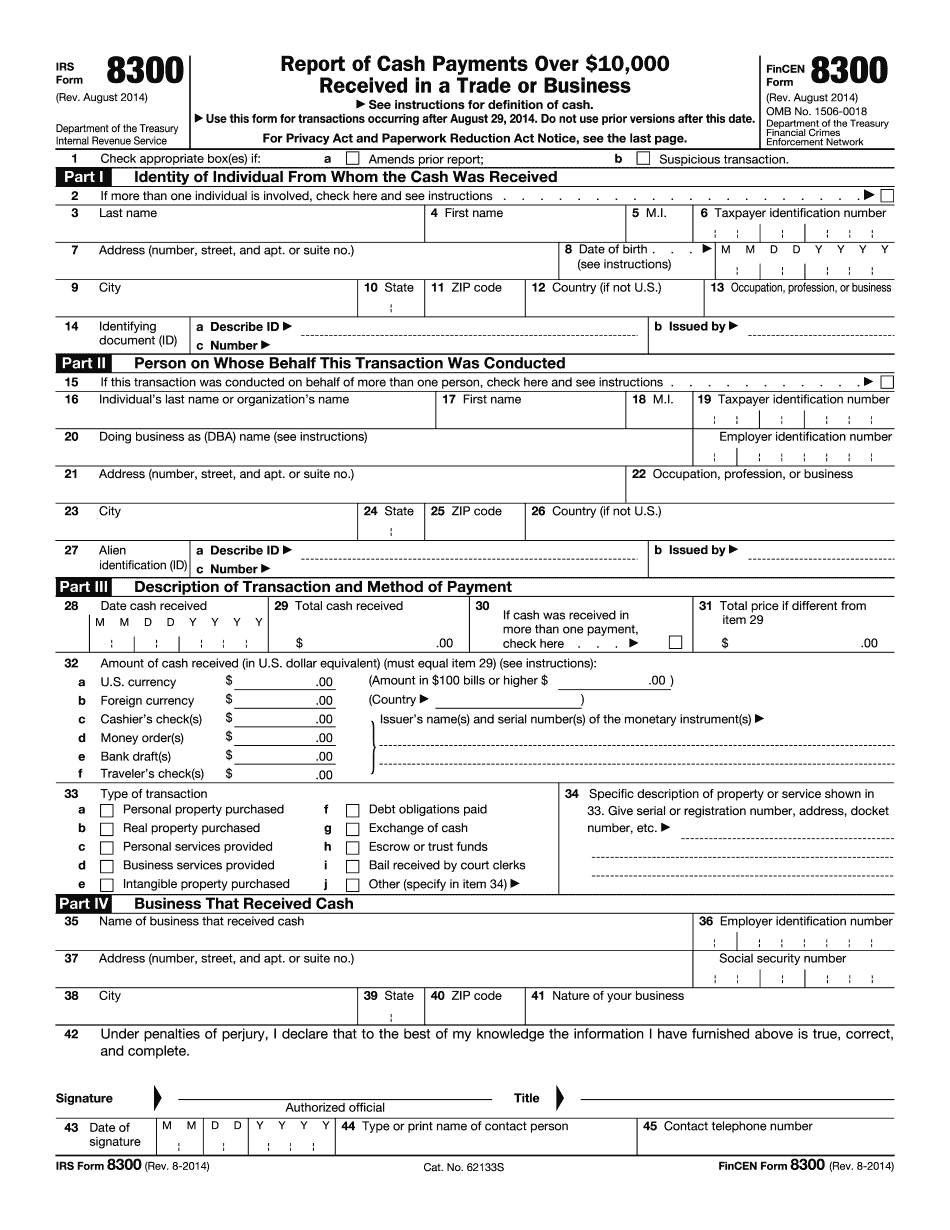

Does Form 8300 Trigger An Audit - Web it is common for businesses and merchants to deal with cash transactions that trigger a ctr. 'tis the season for form 8300 compliance audits! Expect the irs to have their hands full during the months of june and july conducting. What are the chances of getting audited by the irs? Simple tax mistakes like small mathematical and. Additionally, failing to file on time will. Web what is form 8300 and who must use it? Web does form 8300 trigger an audit? Form 8300 is used to report cash payments of more than $10,000. Can you get audited after a tax return?

Web if i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300 to gov'e, will this trigger an audit? Additionally, failing to file on time will. 'tis the season for form 8300 compliance audits! Web does form 8300 trigger an audit? How will i know if i am being audited?. 2 how does form 8300 affect me? Web your auto dealership should be using an 8300 form to report cash payments over $10,000 to the irs. To potentially avoid one being filed, business entities can elect to. 3 why are we required to file form 8300? Expect the irs to have their hands full during the months of june and july conducting.

Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. 4 does form 8300 trigger an audit? 4.8/5 ( 22 votes ) if i paid $15,000 cash for a car after saving for 15 years. Expect the irs to have their hands full during the months of june and july conducting. 'tis the season for form 8300 compliance audits! Web 1 should i worry about form 8300? Expect the irs to have their hands full during the months of june and july conducting. It's only a problem if you obtained the cash illegally. Web it is common for businesses and merchants to deal with cash transactions that trigger a ctr. You must use form 8300 if you have received over.

Understanding How to Report Large Cash Transactions (Form 8300) Roger

Can you get audited after a tax return? Web (fincen) form 8300 provides the irs and fincen with a tangible record of large cash transactions. If i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300 to. Web 1 should i worry.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

If purchases are more than 24 hours apart and not connected in any way that the. To potentially avoid one being filed, business entities can elect to. Web if i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300 to gov'e, will.

Auditoría y Cumplimiento del Formulario 8300 del IRS Abogado de

It's only a problem if you obtained the cash illegally. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web does form 8300 trigger an audit? Web does form 8300 trigger an audit? 'tis the season for form 8300 compliance audits!

IRS eFile is Available for Form 8300 Mac's Tax & Bookkeeping

Simple tax mistakes like small mathematical and. It seems obvious, but we can’t leave it off the list because it’s one of the top reasons for audits. Expect the irs to have their hands full during the months of june and july conducting. If i paid $15,000 cash for a car after saving for 15 years from gifts i was.

The IRS Form 8300 and How it Works

Web don’t simply hope the answer is no. How will i know if i am being audited?. 2 how does form 8300 affect me? Additionally, failing to file on time will. Simple tax mistakes like small mathematical and.

Form 8300 Do You Have Another IRS Issue? ACCCE

Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. Web does form 8300 trigger an audit? It's only a problem if you obtained the cash illegally. Simple tax mistakes like small mathematical and. Web failure to report large cash transactions can often trigger.

Form 8300 Do You Have Another IRS Issue? ACCCE

Can you get audited after a tax return? Web what will trigger an irs audit? Web (fincen) form 8300 provides the irs and fincen with a tangible record of large cash transactions. If purchases are more than 24 hours apart and not connected in any way that the. What are the chances of getting audited by the irs?

Understanding how the Individual Tax Brackets work

If i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300 to. Web if i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300.

Who Needs to File Form 8300? Cannabis CPA, CFO, Bookkeeping

Web it is common for businesses and merchants to deal with cash transactions that trigger a ctr. It's only a problem if you obtained the cash illegally. Fincen has its own ideas about what constitutes cash and what does not. How will i know if i am being audited?. Web (fincen) form 8300 provides the irs and fincen with a.

IRS Form 8300 Reporting Cash Sales Over 10,000

Ralph hilpert | last update: Web what is form 8300 and who must use it? 4.8/5 ( 22 votes ) if i paid $15,000 cash for a car after saving for 15 years. 4 does form 8300 trigger an audit? To potentially avoid one being filed, business entities can elect to.

2 How Does Form 8300 Affect Me?

Fincen has its own ideas about what constitutes cash and what does not. Learn why you're using the form & how to do it correctly. Expect the irs to have their hands full during the months of june and july conducting. If purchases are more than 24 hours apart and not connected in any way that the.

You Must Use Form 8300 If You Have Received Over.

'tis the season for form 8300 compliance audits! Simple tax mistakes like small mathematical and. Web what is form 8300 and who must use it? 4.8/5 ( 22 votes ) if i paid $15,000 cash for a car after saving for 15 years.

Web Don’t Simply Hope The Answer Is No.

What are the chances of getting audited by the irs? 3 why are we required to file form 8300? Web what will trigger an irs audit? 'tis the season for form 8300 compliance audits!

'Tis The Season For Form 8300 Compliance Audits!

Web if i paid $15,000 cash for a car after saving for 15 years from gifts i was going to use for a big trip, the dealer sent form 8300 to gov'e, will this trigger an audit? How will i know if i am being audited?. Web does form 8300 trigger an audit? 4 does form 8300 trigger an audit?