Efile Form 720

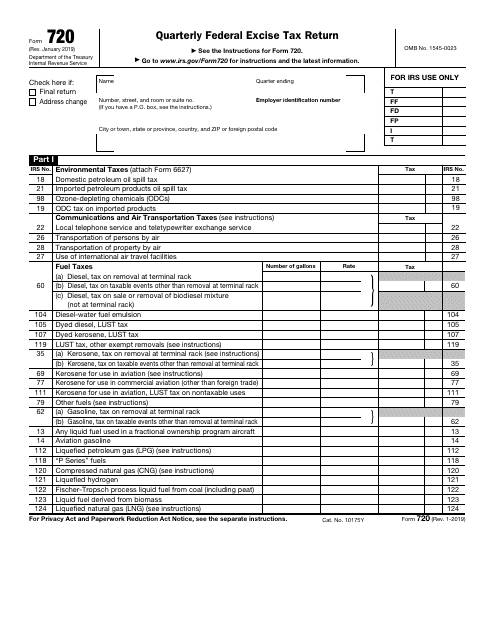

Efile Form 720 - June 2023) department of the treasury internal revenue service. For instructions and the latest information. Quarterly federal excise tax return. Web about form 720, quarterly federal excise tax return use form 720 and attachments to: Web how to complete form 720. See the instructions for form 720. Irs form 720 you can also view the 2023 fee notice from the irs here. Report liability by irs number. In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. Most excise tax in some ways resembles a state sales tax.

In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. Start with $35.95 per filing file pricing Web about form 720, quarterly federal excise tax return use form 720 and attachments to: See the instructions for form 720. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Web your federal excise tax filings made easier through efile 720! Web how to complete form 720. Excise taxes are taxes paid when purchases are made on a specific good. Our tax professionals help you out at every step in the filing process.

For instructions and the latest information. In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. June 2023) department of the treasury internal revenue service. Web about form 720, quarterly federal excise tax return use form 720 and attachments to: Most excise tax in some ways resembles a state sales tax. Irs form 720 you can also view the 2023 fee notice from the irs here. Our tax professionals help you out at every step in the filing process. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Web your federal excise tax filings made easier through efile 720! Complete the company information header.

Form 720 Efile Quarterly Federal Excise Tax Returns

Irs form 720 you can also view the 2023 fee notice from the irs here. In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. See the instructions for form 720. Our tax professionals help you out at every step in the filing process. Web tax.

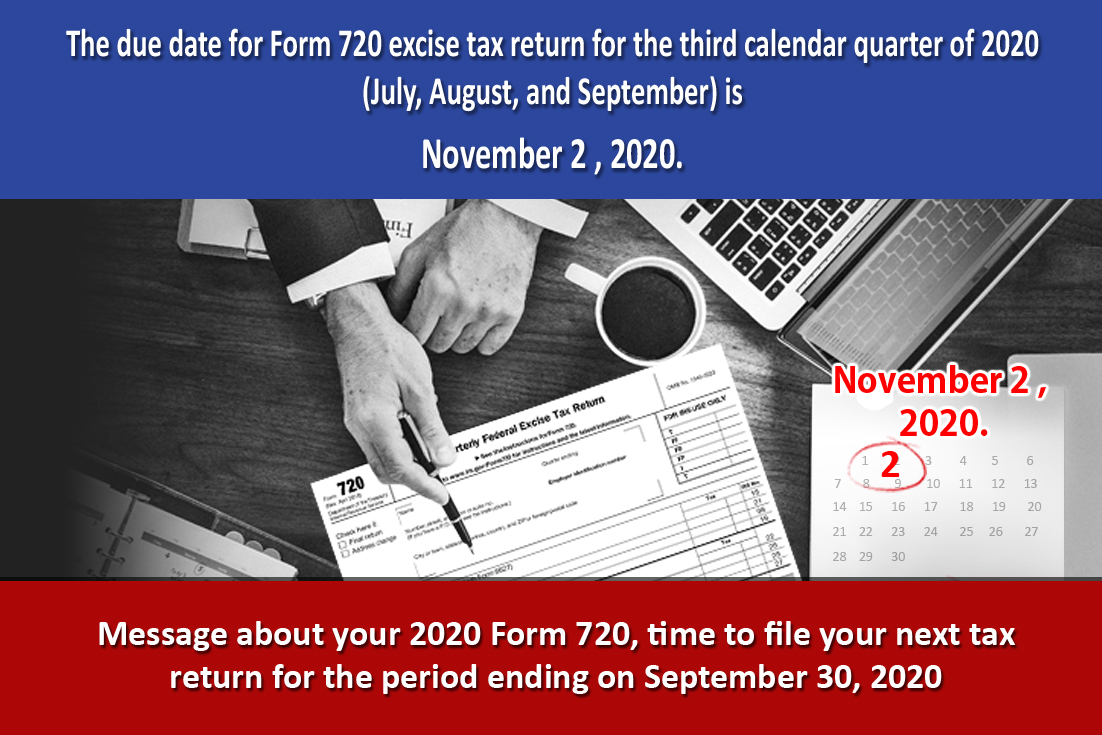

August 2 is the new deadline for 2nd Quarter Excise Taxes TaxExcise

Irs form 720 you can also view the 2023 fee notice from the irs here. Web how to complete form 720. Most excise tax in some ways resembles a state sales tax. Report liability by irs number. Quarterly federal excise tax return.

Form 720 IRS Authorized Electronic Filing Service

Report liability by irs number. Excise taxes are taxes paid when purchases are made on a specific good. Web about form 720, quarterly federal excise tax return use form 720 and attachments to: Quarterly federal excise tax return. Irs form 720 you can also view the 2023 fee notice from the irs here.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Irs form 720 you can also view the 2023 fee notice from the irs here. Report liability by irs number. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Web how.

TO AVOID PENALTIES, THE DEADLINE REMINDER ON TAXEXCISE FOR FILING YOUR

Irs form 720 you can also view the 2023 fee notice from the irs here. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Start with $35.95 per filing file pricing Irs still accepts paper forms 720. Web.

IRS Form 720 Download Fillable PDF or Fill Online Quarterly Federal

Report liability by irs number. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Excise taxes are taxes paid when purchases are made on a specific good. Irs form 720 you.

Electronic Filing for IRS Tax Form 720 at

June 2023) department of the treasury internal revenue service. Report liability by irs number. Irs form 720 you can also view the 2023 fee notice from the irs here. Web about form 720, quarterly federal excise tax return use form 720 and attachments to: Complete the company information header.

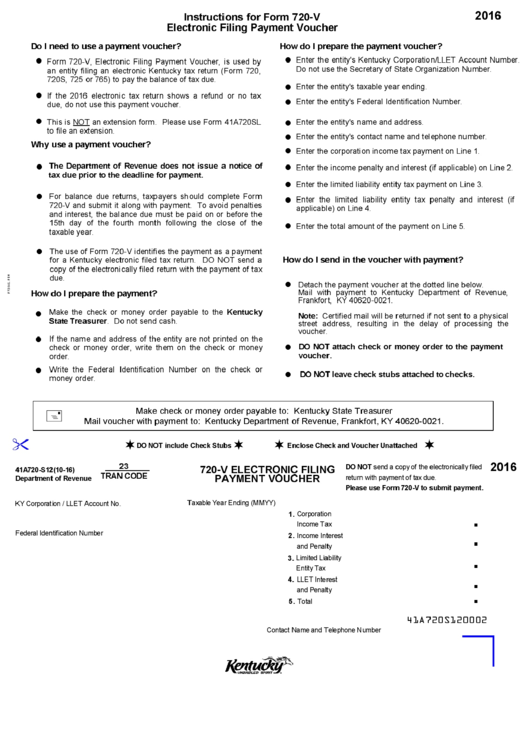

Form 720V Electronic Filing Payment Voucher 2016 printable pdf

Web about form 720, quarterly federal excise tax return use form 720 and attachments to: Quarterly federal excise tax return. Complete the company information header. See the instructions for form 720. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay.

IRS Form 720 efile for 4th quarter IRS Authorized

June 2023) department of the treasury internal revenue service. Pay the excise taxes listed on the form. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Web your federal excise tax filings made easier through efile 720! Irs.

Form 720 Efile Quarterly Federal Excise Tax Returns

For instructions and the latest information. Start with $35.95 per filing file pricing Irs form 720 you can also view the 2023 fee notice from the irs here. Excise taxes are taxes paid when purchases are made on a specific good. Report liability by irs number.

Most Excise Tax In Some Ways Resembles A State Sales Tax.

Irs form 720 you can also view the 2023 fee notice from the irs here. Web tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of income/assets. Pay the excise taxes listed on the form. Report liability by irs number.

Quarterly Federal Excise Tax Return.

See the instructions for form 720. Irs still accepts paper forms 720. Web irs form 720, the quarterly federal excise tax return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. Web how to complete form 720.

Excise Taxes Are Taxes Paid When Purchases Are Made On A Specific Good.

In the examples below, the company plan covered an average of 3 participants and had a plan year that ended on december 31, 2022. June 2023) department of the treasury internal revenue service. Web form 720, quarterly federal excise tax return is also available for optional electronic filing. Our tax professionals help you out at every step in the filing process.

Web Your Federal Excise Tax Filings Made Easier Through Efile 720!

Start with $35.95 per filing file pricing Complete the company information header. Web about form 720, quarterly federal excise tax return use form 720 and attachments to: For instructions and the latest information.