Fill Out Form 4506 T Online

Fill Out Form 4506 T Online - Fillable forms eliminate the need for manual handwriting, reducing the risk of. Web complete these lines on the form: Citizenship and immigration services will publish a revised version of form i. Ad access irs tax forms. Naturally, you'll also need to. Social security number of filer if a joint return complete lines 2a and 2b with spouse. Enter your name as it's shown on your tax returns. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Enjoy smart fillable fields and interactivity. Web irs form 4506 is a request to receive copies of tax returns filed in previous years.

Fillable forms eliminate the need for manual handwriting, reducing the risk of. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web complete these lines on the form: Get ready for tax season deadlines by completing any required tax forms today. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Naturally, you'll also need to. Web how to fill out and sign a form online? Social security number of filer if a joint return complete lines 2a and 2b with spouse. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). See the product list below.

Web to complete the 4506‐t, please complete the following lines: Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Enjoy smart fillable fields and interactivity. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). See the product list below. Web complete these lines on the form: Web irs form 4506 is a request to receive copies of tax returns filed in previous years. Get ready for tax season deadlines by completing any required tax forms today. Social security number of filer if a joint return complete lines 2a and 2b with spouse.

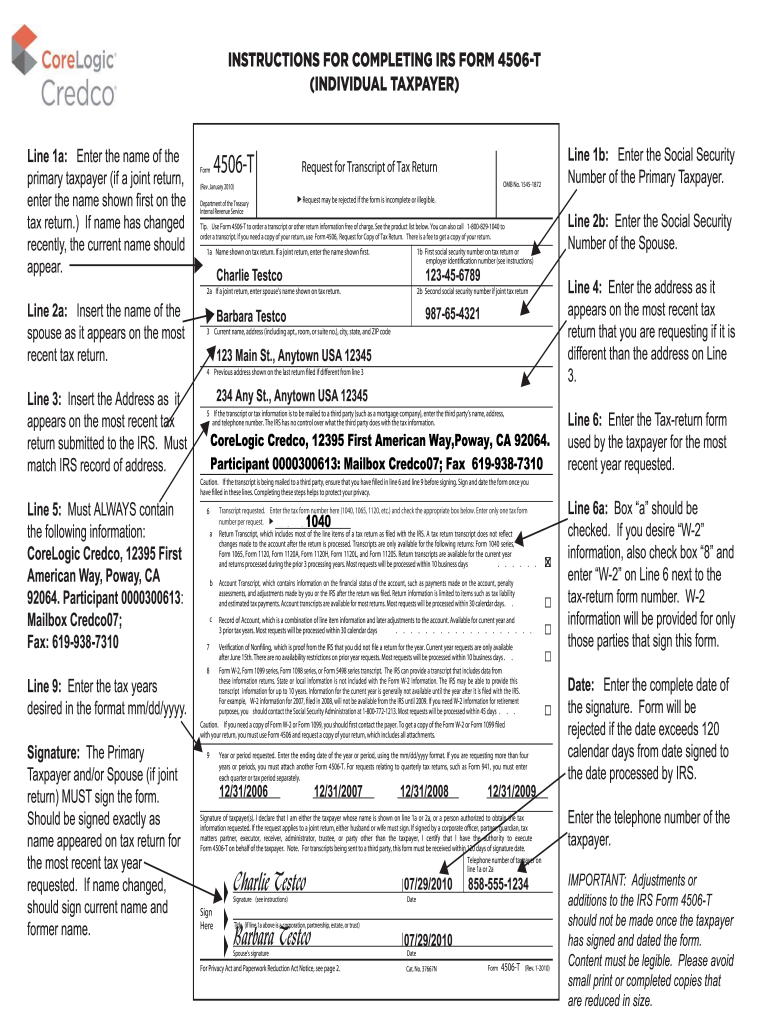

INSTRUCTIONS FOR COMPLETING IRS FORM 4506T Fill out & sign online

Web irs form 4506 is a request to receive copies of tax returns filed in previous years. Get ready for tax season deadlines by completing any required tax forms today. Enjoy smart fillable fields and interactivity. Ad access irs tax forms. Get your online template and fill it in using progressive features.

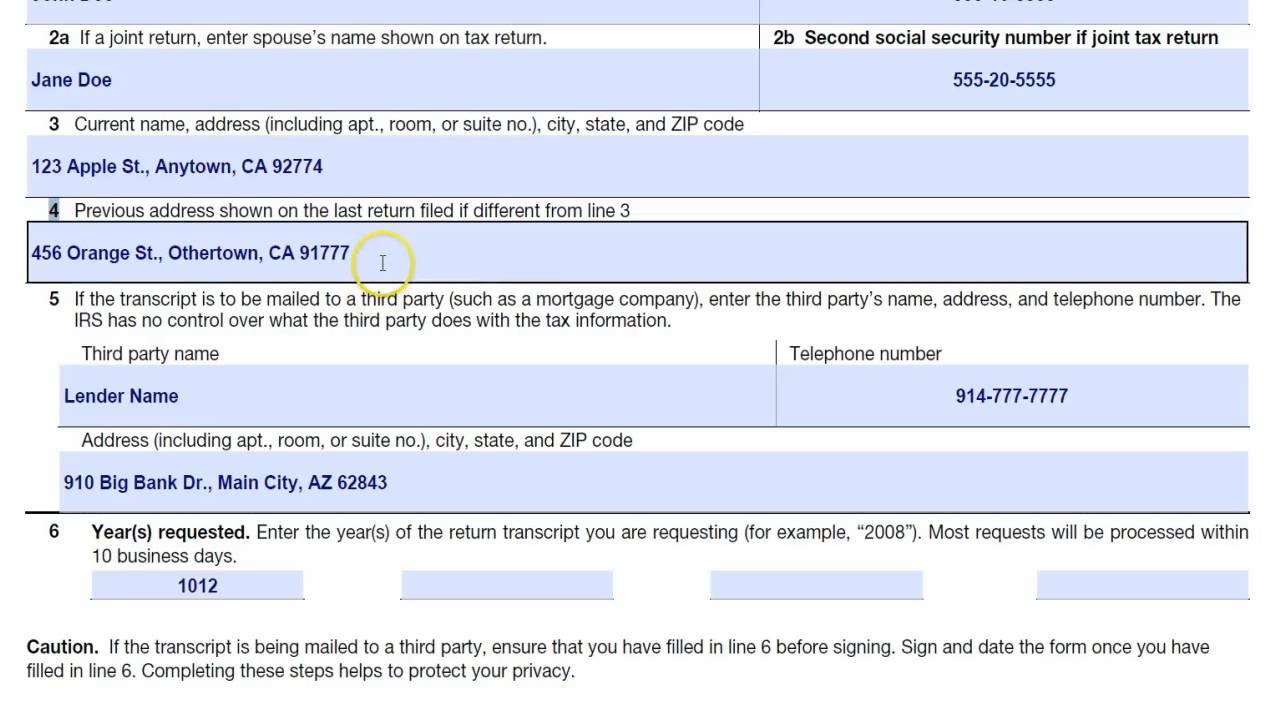

How to Fill in US Form 4506T Correctly PDF.co

Ad access irs tax forms. Form 4506 is used by. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. See the product list below. It is available as a pdf document that you can download, print, and file by.

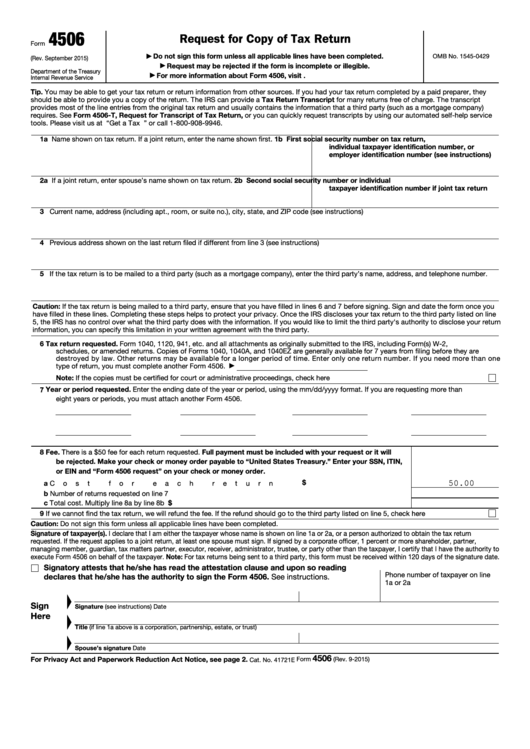

Fillable Form 4506 Request For Copy Of Tax Return printable pdf download

Ad access irs tax forms. Name of tax filer 1b. Complete, edit or print tax forms instantly. Form 4506 is used by. It is available as a pdf document that you can download, print, and file by.

2020 Form IRS 4506 Fill Online, Printable, Fillable, Blank pdfFiller

Name of tax filer 1b. See the product list below. Complete, edit or print tax forms instantly. Web how to fill out and sign a form online? Naturally, you'll also need to.

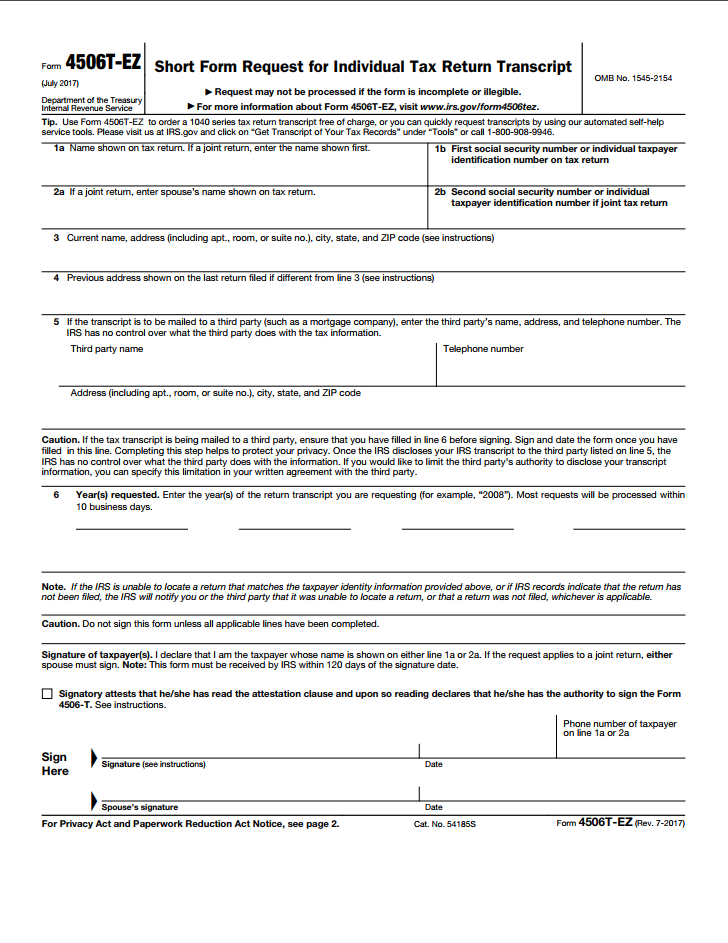

How to fill out the 4506T EZ Form YouTube

Name of tax filer 1b. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). There are two address charts:. Web the european union says etias approval will stay valid for three years.

4506TEZ (2017) Edit Forms Online PDFFormPro

It is available as a pdf document that you can download, print, and file by. Name of tax filer 1b. Form 4506 is used by. See the product list below. Enter your social security number.

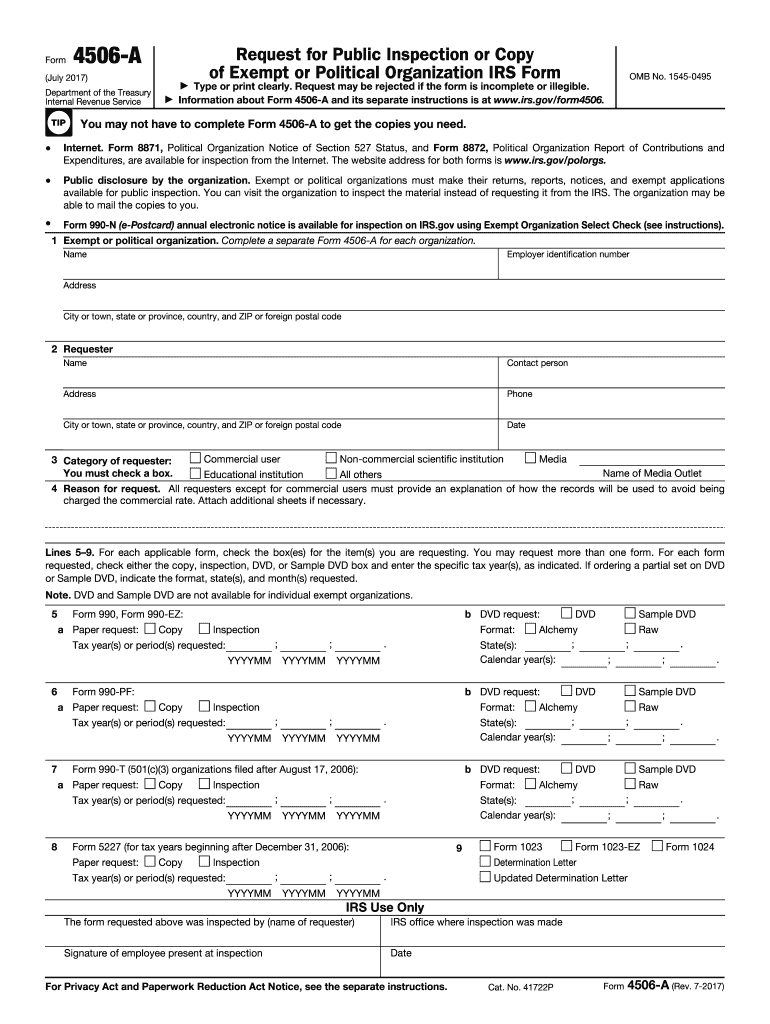

20182020 Form IRS 4506A Fill Online, Printable, Fillable, Blank

Complete, edit or print tax forms instantly. Enter your social security number. See the product list below. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Complete, edit or print tax forms instantly.

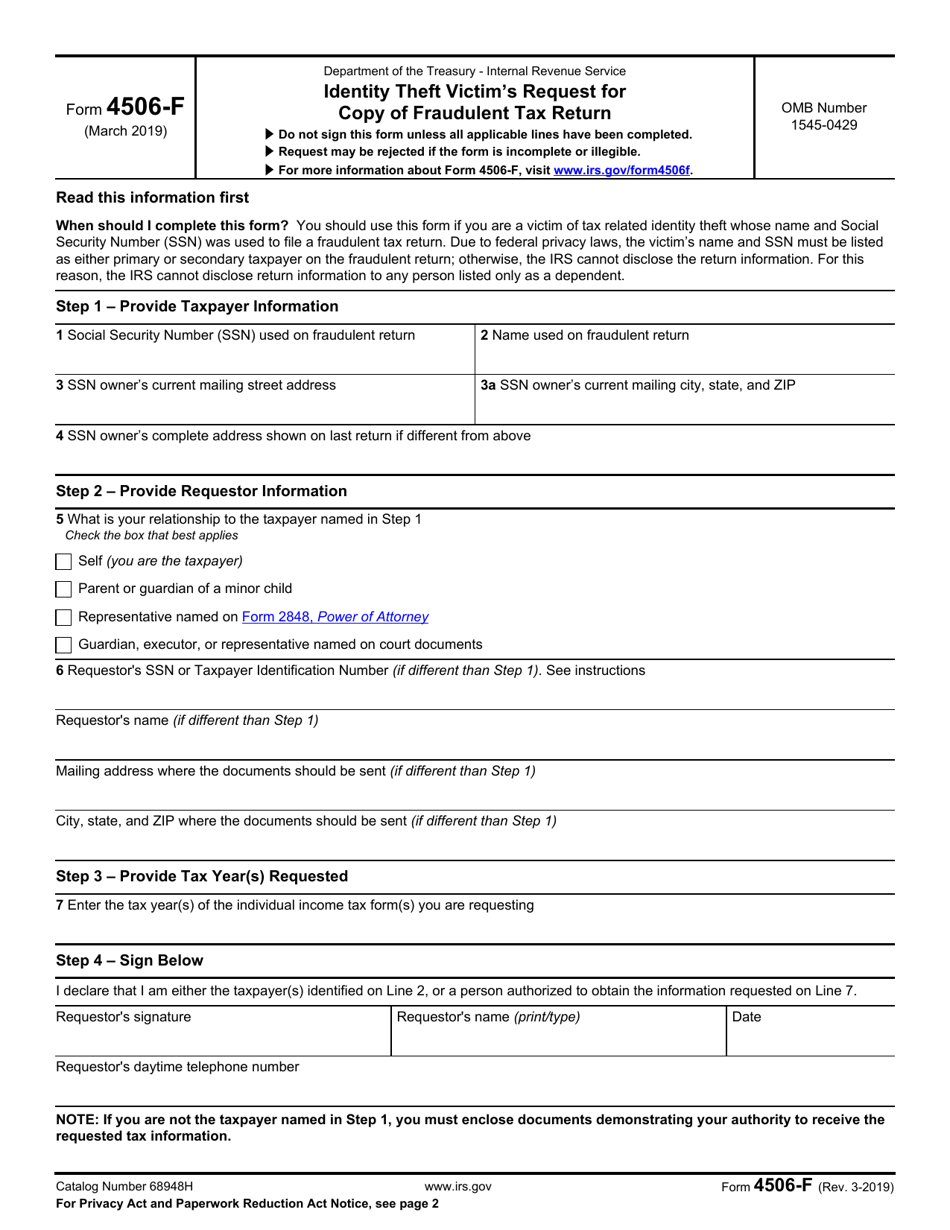

IRS Form 4506F Download Fillable PDF or Fill Online Identity Theft

Enter your social security number. Complete, edit or print tax forms instantly. Web to complete the 4506‐t, please complete the following lines: Social security number of filer if a joint return complete lines 2a and 2b with spouse. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Form 4506 a Fill Out and Sign Printable PDF Template signNow

There are two address charts:. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Form 4506 is used by. Naturally, you'll also need to. See the product list below.

IRS Form 4506 and 4506T How mortgage lenders verify a prospective

Complete, edit or print tax forms instantly. Web irs form 4506 is a request to receive copies of tax returns filed in previous years. Web to complete the 4506‐t, please complete the following lines: Get ready for tax season deadlines by completing any required tax forms today. Enter your name as it's shown on your tax returns.

Complete, Edit Or Print Tax Forms Instantly.

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Name of tax filer 1b. See the product list below. Fillable forms eliminate the need for manual handwriting, reducing the risk of.

Get Your Online Template And Fill It In Using Progressive Features.

Enjoy smart fillable fields and interactivity. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. It is available as a pdf document that you can download, print, and file by. Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad access irs tax forms. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Citizenship and immigration services will publish a revised version of form i. Web how to fill out and sign a form online?

Web Complete These Lines On The Form:

Naturally, you'll also need to. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web to complete the 4506‐t, please complete the following lines: