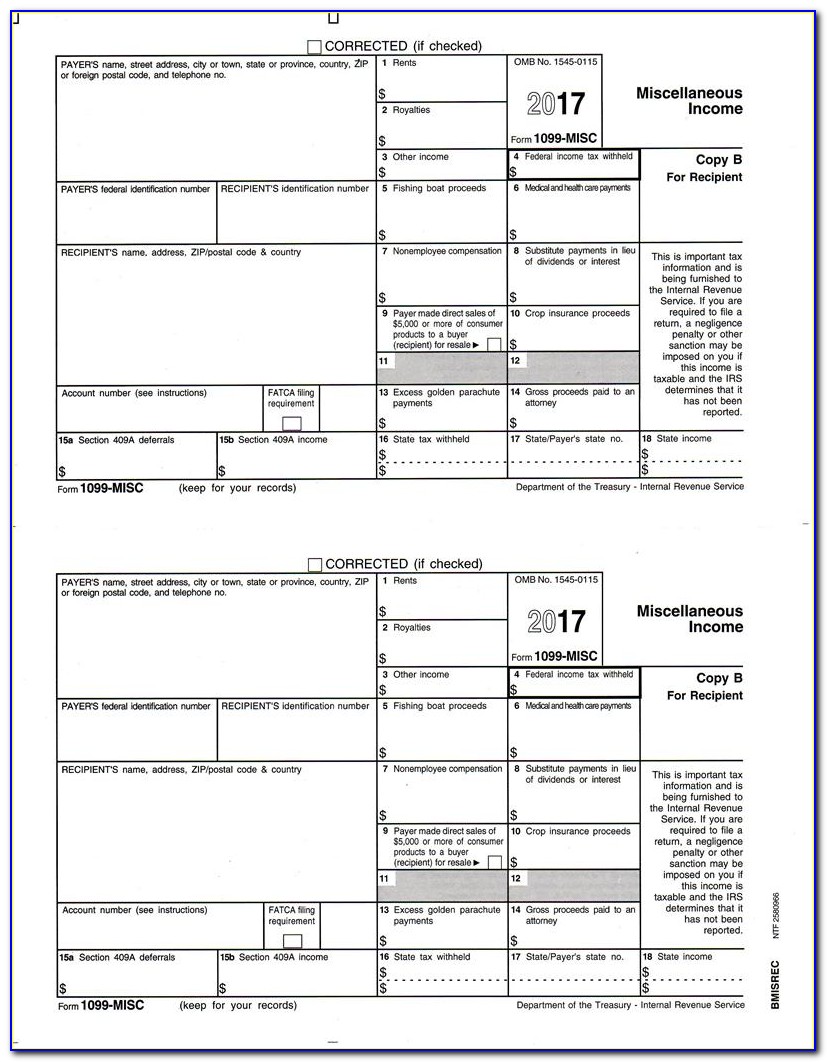

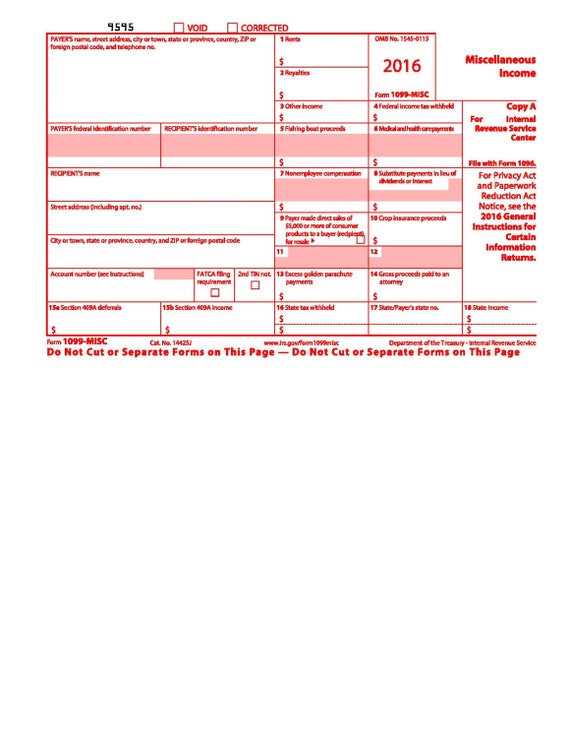

Fillable 1099 Misc Form 2016

Fillable 1099 Misc Form 2016 - Web where can i get a 1099 misc form for 2016? At least $10 in royalties (see the instructions for box 2) or broker. Go to www.irs.gov/freefile to see. Web up to $40 cash back 1 log in. Web what is the 1099 misc 2016 form? Web what's new for 2016. File this form for each person to whom you made certain types of payment during the tax year. Get your 1099 misc form for 2016 from checkpaystub.com. (see instructions for details.) note:. Click start free trial and create a profile if necessary.

Use the add new button. Add and customize text, images, and fillable areas, whiteout unnecessary details, highlight the important. Ad access irs tax forms. Gather all necessary information, such as the payer's. 31, 2015, which the recipient will file a tax return for in 2016. Get your 1099 misc form for 2016 from checkpaystub.com. Click start free trial and create a profile if necessary. Web what is the 1099 misc 2016 form? Web schedule se (form 1040). Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has.

Web up to $40 cash back for information on the tin matching system offered by the irs see the 2016 general instructions. Gather all necessary information, such as the payer's. Fill, edit, sign, download & print. Web what is the 1099 misc 2016 form? Then upload your file to the system from your device,. (see instructions for details.) note:. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has. Ad get the latest 1099 misc online. Use the add new button. Web get a 1099 misc.

1099MISC Form Printable and Fillable PDF Template

Complete irs tax forms online or print government tax documents. Then upload your file to the system from your device,. Gather all necessary information, such as the payer's. File this form for each person to whom you made certain types of payment during the tax year. At least $10 in royalties (see the instructions for box 2) or broker.

Free Printable 1099 Misc Form 2016 Form Resume Examples eaZDYRb579

Click start free trial and create a profile if necessary. Complete irs tax forms online or print government tax documents. Fill, edit, sign, download & print. Web where can i get a 1099 misc form for 2016? Web get a 1099 misc.

Free Fillable 1099 Form Form Resume Examples Bw9j7O3Y7X

25 rows web up to $40 cash back how to fill out blank 2016 1099 form: Go to www.irs.gov/freefile to see. Web where can i get a 1099 misc form for 2016? Ad get the latest 1099 misc online. Web up to $40 cash back 1 log in.

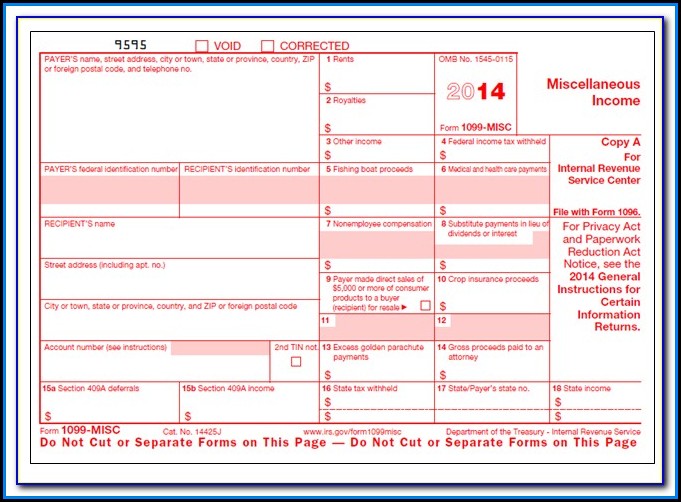

Free Online Fillable 1099 Misc Form 2014 Form Resume Examples

Complete irs tax forms online or print government tax documents. At least $10 in royalties (see the instructions for box 2) or broker. (see instructions for details.) note:. Go to www.irs.gov/freefile to see. Add and customize text, images, and fillable areas, whiteout unnecessary details, highlight the important.

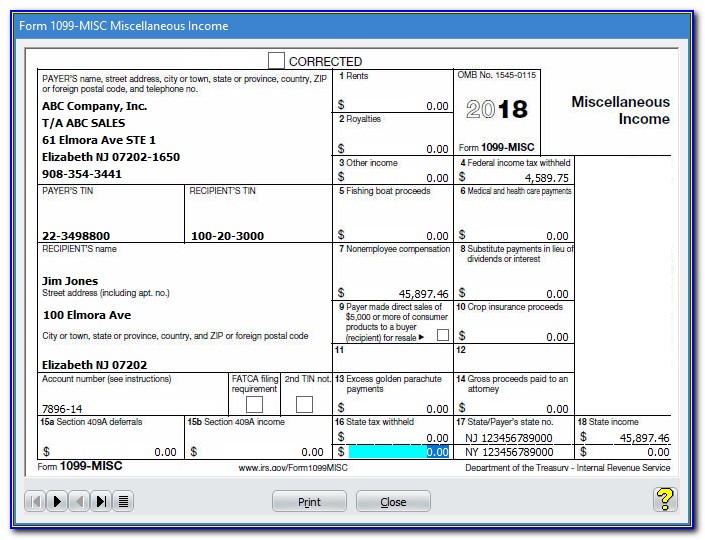

W 9 Form Ct New Free Fillable 1099 Misc Form 2018 Form 892

Web where can i get a 1099 misc form for 2016? 31, 2015, which the recipient will file a tax return for in 2016. Go to www.irs.gov/freefile to see. Then upload your file to the system from your device,. Do not miss the deadline

1099 Misc 2016 Fillable Form Free Universal Network

Do not miss the deadline Complete, edit or print tax forms instantly. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has. Web get a 1099 misc. Web up to $40 cash back 1 log in.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

Use the add new button. Complete irs tax forms online or print government tax documents. (see instructions for details.) note:. 25 rows web up to $40 cash back how to fill out blank 2016 1099 form: Click start free trial and create a profile if necessary.

1099 Misc Form 2014 Fillable Free Universal Network

Do not miss the deadline Add and customize text, images, and fillable areas, whiteout unnecessary details, highlight the important. File this form for each person to whom you made certain types of payment during the tax year. Web get a 1099 misc. Fill, edit, sign, download & print.

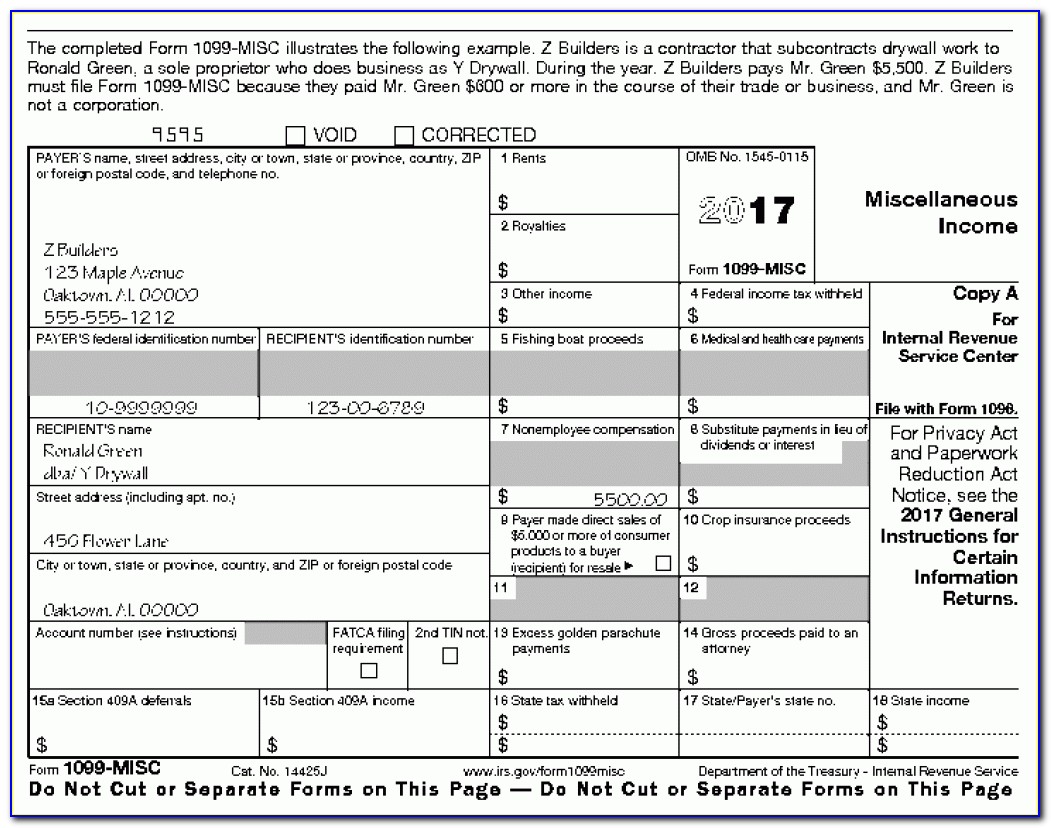

Form Fillable PDF for 2016 1099MISC Form.

Gather all necessary information, such as the payer's. File this form for each person to whom you made certain types of payment during the tax year. (see instructions for details.) note:. Add and customize text, images, and fillable areas, whiteout unnecessary details, highlight the important. Web where can i get a 1099 misc form for 2016?

Fillable And Printable 1099 Misc Form 2017 Form Resume Examples

Web fully customizable template fields and easy to adjust form fields. 25 rows web up to $40 cash back how to fill out blank 2016 1099 form: (see instructions for details.) note:. Web get a 1099 misc. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has.

File This Form For Each Person To Whom You Made Certain Types Of Payment During The Tax Year.

Web fully customizable template fields and easy to adjust form fields. Web up to $40 cash back for information on the tin matching system offered by the irs see the 2016 general instructions. Web schedule se (form 1040). 31, 2015, which the recipient will file a tax return for in 2016.

Go To Www.irs.gov/Freefile To See.

Gather all necessary information, such as the payer's. Complete, edit or print tax forms instantly. Web up to $40 cash back 1 log in. Web where can i get a 1099 misc form for 2016?

Ad Get The Latest 1099 Misc Online.

Ad access irs tax forms. (see instructions for details.) note:. Add and customize text, images, and fillable areas, whiteout unnecessary details, highlight the important. Get your 1099 misc form for 2016 from checkpaystub.com.

Fill, Edit, Sign, Download & Print.

Web get a 1099 misc. Complete irs tax forms online or print government tax documents. Web www.irs.gov/form1099c instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has. At least $10 in royalties (see the instructions for box 2) or broker.