Financial Year Vs Calendar Year

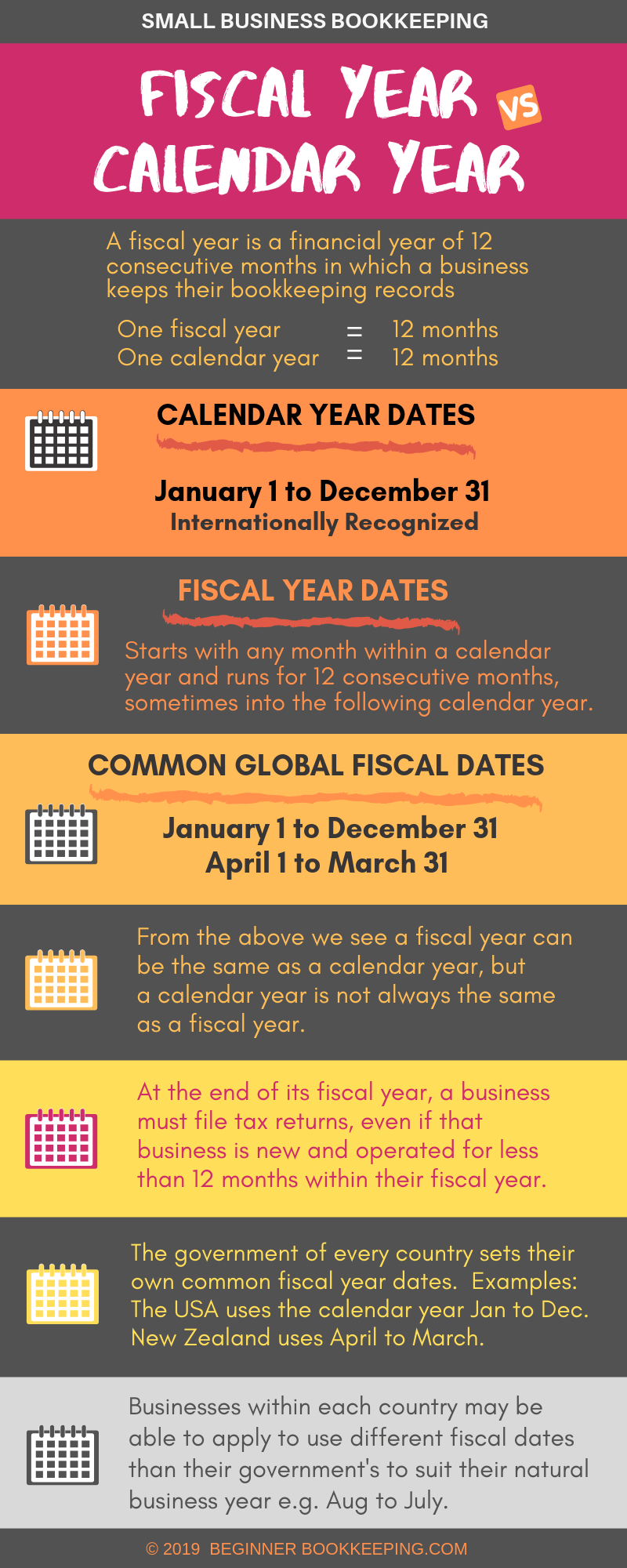

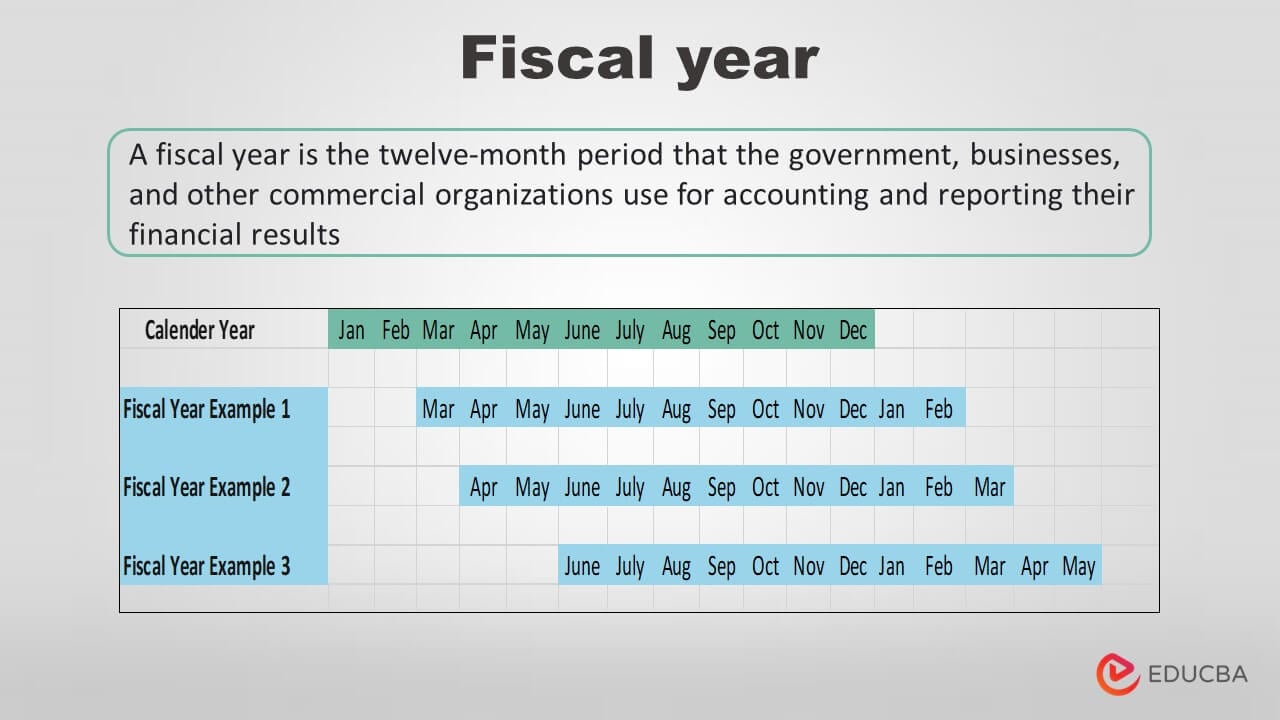

Financial Year Vs Calendar Year - Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. It's used differently by the government and businesses, and does need to. A calendar year always runs from january 1 to december 31. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. Learn when you should use each. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. In this article, we define a fiscal and calendar year, list the.

Learn when you should use each. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A calendar year always runs from january 1 to december 31. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life. Fiscal years can differ from a calendar year and. In this article, we define a fiscal and calendar year, list the. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period.

A calendar year always runs from january 1 to december 31. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Learn when you should use each. The terms fiscal year and financial year are synonymous, i.e. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. They are a period that governments use for accounting and budget. Most other countries begin their year at a different calendar. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. In this article, we define a fiscal and calendar year, list the. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two.

How to Convert a Date into Fiscal Year ExcelNotes

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Most other countries begin their.

Fiscal Year Definition for Business Bookkeeping

Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. It's used differently by the government and businesses, and does need to. Web a.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Fiscal years can differ from a calendar year and. They are a period that governments use for accounting and budget. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows.

Fiscal Year Vs. Calendar Maximizing Financial Planning Training for

Fiscal years can differ from a calendar year and. They are a period that governments use for accounting and budget. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web understanding what each involves can help you determine which.

Fiscal Year Vs Financial Year What Is The Difference?

A calendar year always runs from january 1 to december 31. They are a period that governments use for accounting and budget. Fiscal years can differ from a calendar year and. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life. Web the irs distinguishes a.

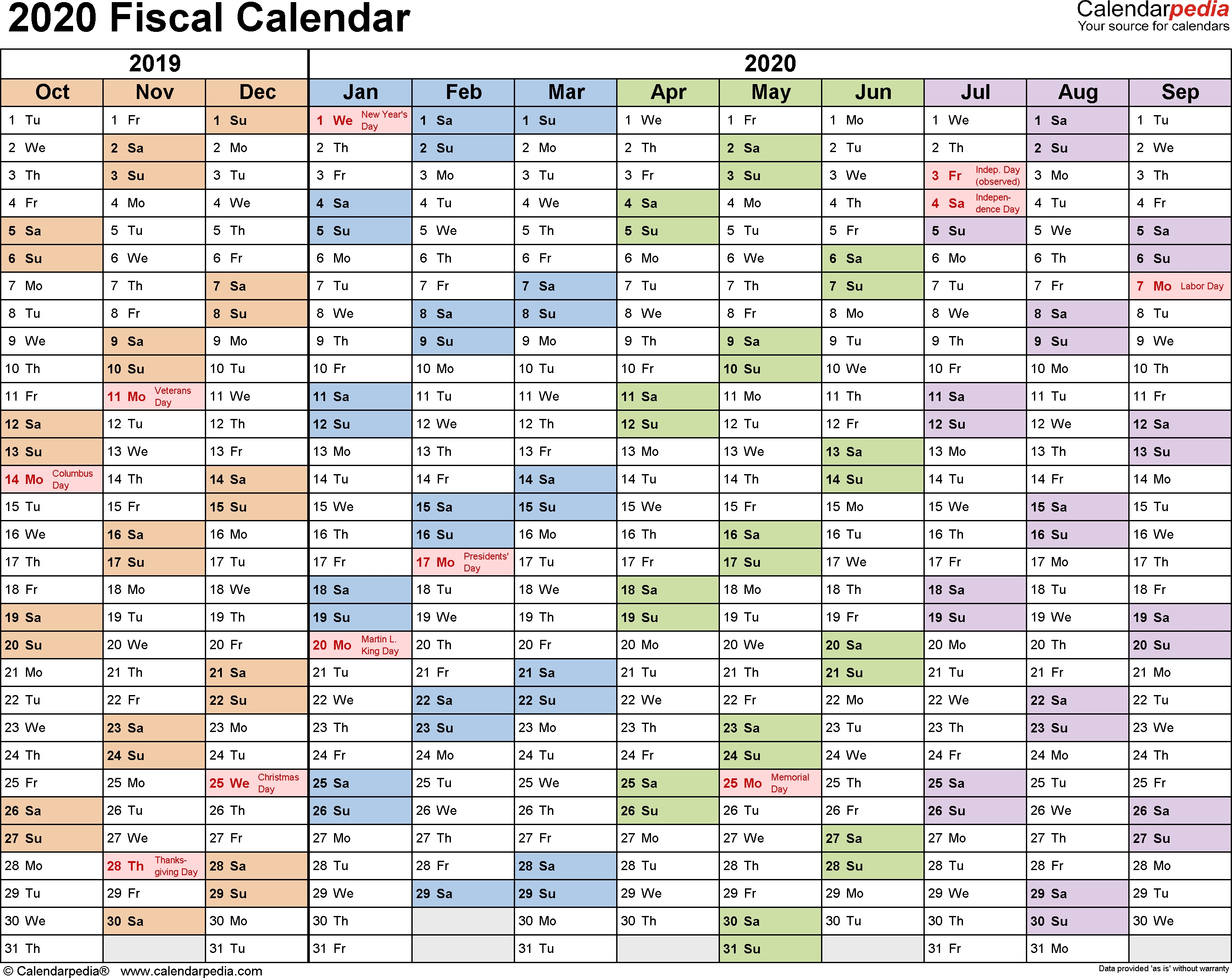

Financial Year Calendar With Week Numbers Lyndy Nanine

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Learn when you should use each. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life..

Financial Year Vs Assessment Year for Tax TDS Vs Advance Tax

Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web a geschäftsjahr (financial year) that differs from the normal.

Fiscal Year Vs Calendar Andy Maegan

On the other hand, a. Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. The terms fiscal year and financial year are synonymous, i.e. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web a fiscal year (also.

What is a Fiscal Year? Your GoTo Guide

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web a geschäftsjahr (financial year) that differs from the normal calendar year.

Service Year Vs Calendar Year Ruth Wright

Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. On the other hand, a. A calendar.

Most Other Countries Begin Their Year At A Different Calendar.

Web understanding what each involves can help you determine which to use for accounting or tax purposes. Learn when you should use each. A calendar year always runs from january 1 to december 31. On the other hand, a.

Web A Geschäftsjahr (Financial Year) That Differs From The Normal Calendar Year Allows Entrepreneurs To Prepare Their Annual Accounts At A Time Of Their Choosing, Rather.

Web a fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web the irs distinguishes a fiscal year as separate from the calendar year, defining it as either 12 consecutive months ending on the last day of any month. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis.

The Terms Fiscal Year And Financial Year Are Synonymous, I.e.

In this article, we define a fiscal and calendar year, list the. Fiscal years can differ from a calendar year and. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months. They are a period that governments use for accounting and budget.

Web A Fiscal Year Keeps Income And Expenses Together On The Same Tax Return, While A Calendar Year Splits Them Into Two.

Web a fiscal year spans 12 months and corresponds with a company’s budgeting process and financial reporting periods. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. It's used differently by the government and businesses, and does need to. Web in summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of time used in everyday life.

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)