Fiscal Year Calendar Year

Fiscal Year Calendar Year - A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Here’s a quick and easy breakdown of the core differences between fiscal and calendar years: It can be any date as long as the fiscal year is. Web key differences between fiscal year vs calendar year. Returns the last day of the fiscal year, which. Learn when you should use each. It's used differently by the government and businesses, and does need to correspond to a. 31 for those using the gregorian calendar). Most other countries begin their year at a different calendar. Returns the first day of the fiscal year, which is always in the previous calendar year.

It can also help you select a list or range of dates based on. Here’s a quick and easy breakdown of the core differences between fiscal and calendar years: A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Most other countries begin their year at a different calendar. Web the federal government’s fiscal year runs from the first day of october of one calendar year through the last day of september of the next. A fiscal year can vary from company. Returns the first day of the fiscal year, which is always in the previous calendar year. A calendar year always begins on new year’s day and ends on the last day of the month (jan. This year can differ from.

Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. Companies can choose whether to use a calendar year or fiscal year for. Web using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and. A calendar year always begins on new year’s day and ends on the last day of the month (jan. Returns the first day of the fiscal year, which is always in the previous calendar year. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web key differences between fiscal year vs calendar year. Most other countries begin their year at a different calendar. 31 for those using the gregorian calendar). Web what is a fiscal year?

Navigating The Fiscal Landscape Understanding The Government Fiscal

Web this calculator is designed to help you create and manage a financial calendar for any year in a fiscal year format. A calendar year always begins on new year’s day and ends on the last day of the month (jan. It can also help you select a list or range of dates based on. 31 for those using the.

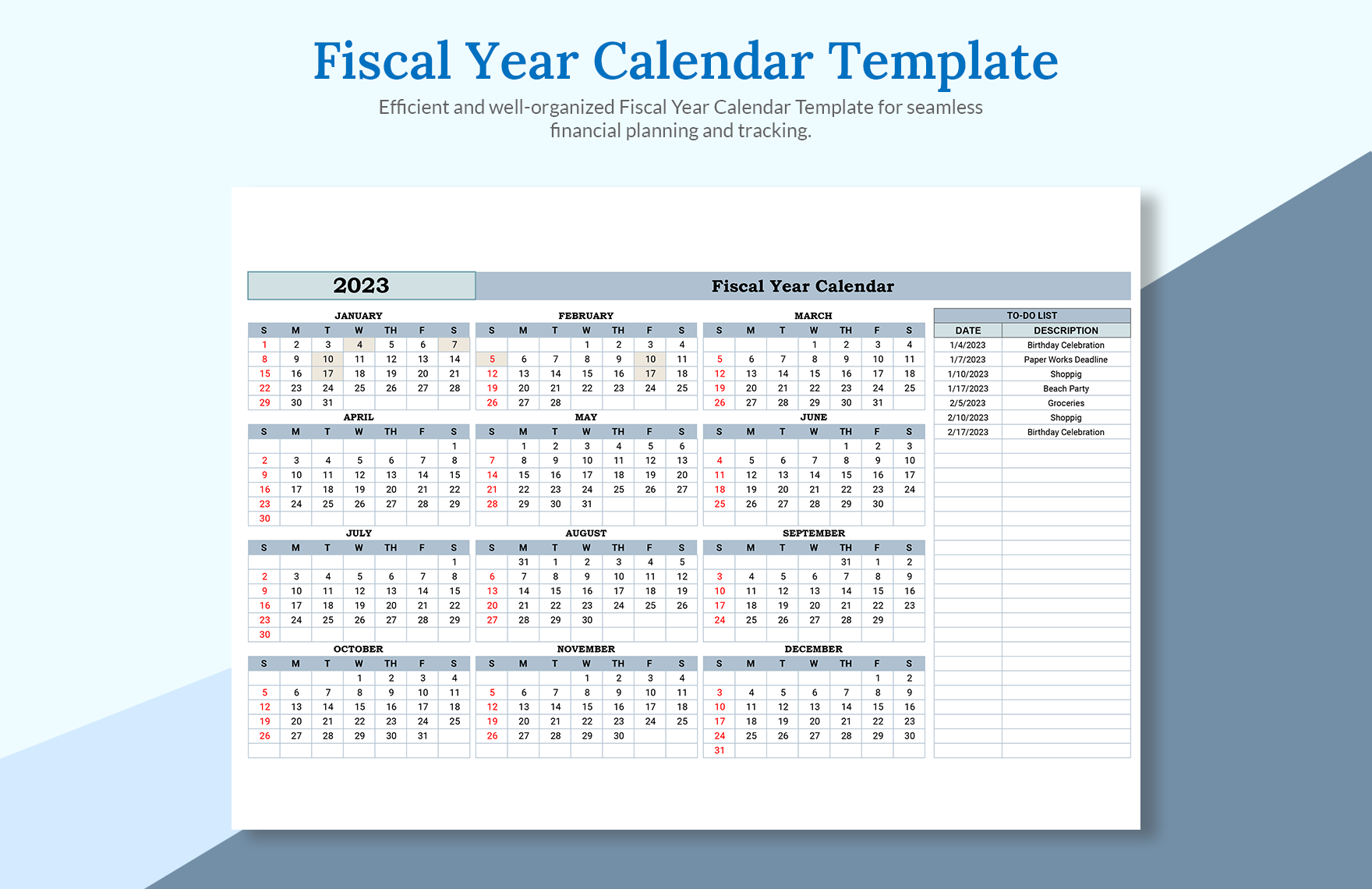

Fiscal Year Calendar Template in Excel, Google Sheets Download

This year can differ from. Most other countries begin their year at a different calendar. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. It can also help you select a list or range of dates based on. A fiscal year can vary from company.

How to Convert a Date into Fiscal Year ExcelNotes

It can be any date as long as the fiscal year is. Companies can choose whether to use a calendar year or fiscal year for. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting pe… A fiscal year (also known as a financial year, or sometimes budget.

What is a Fiscal Year? Your GoTo Guide

Web what is a fiscal year? Web key differences between fiscal year vs calendar year. A fiscal year can vary from company. Here’s a quick and easy breakdown of the core differences between fiscal and calendar years: Web the federal government’s fiscal year runs from the first day of october of one calendar year through the last day of september.

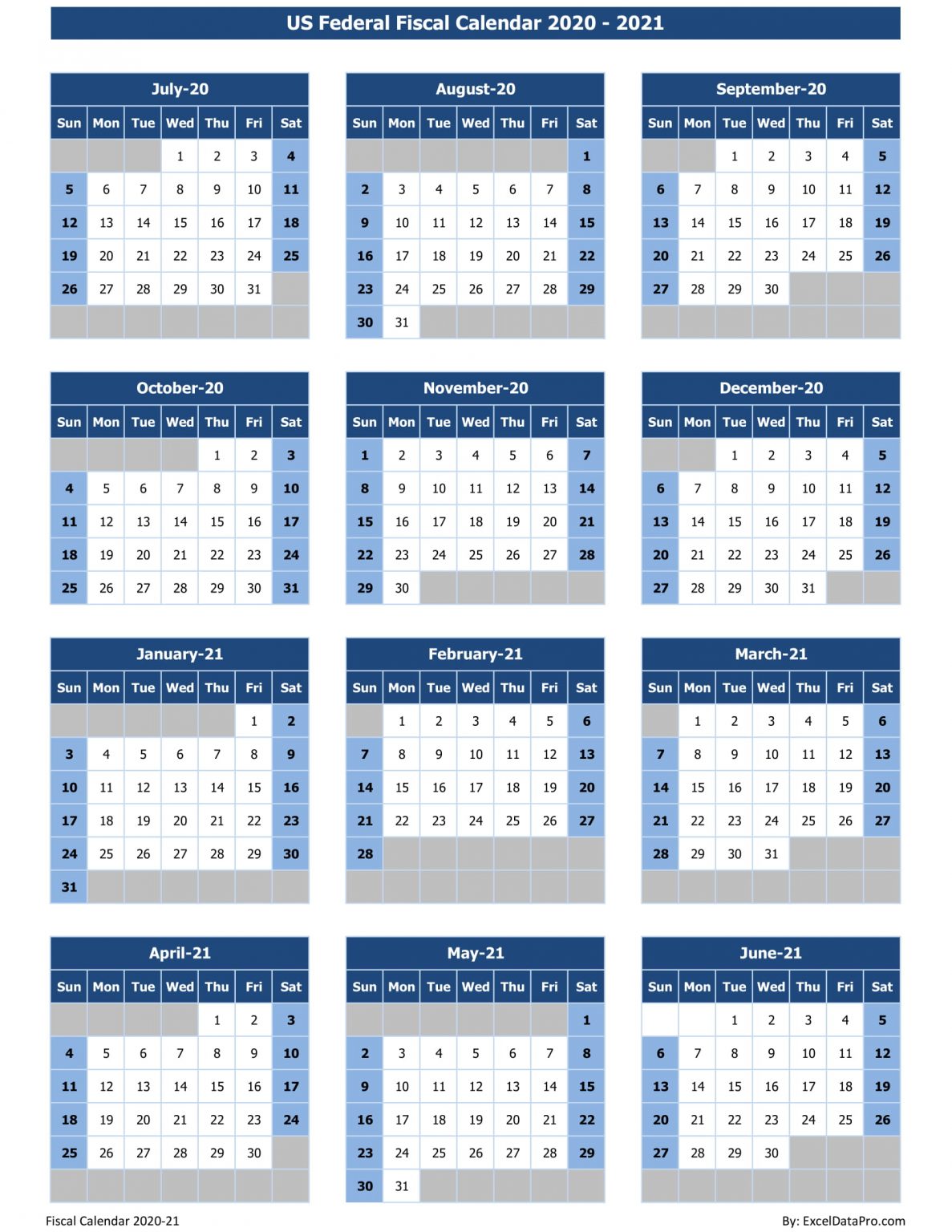

Download US Federal Fiscal Calendar 202021 Excel Template ExcelDataPro

A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting pe… It's used differently by the government and businesses, and does need.

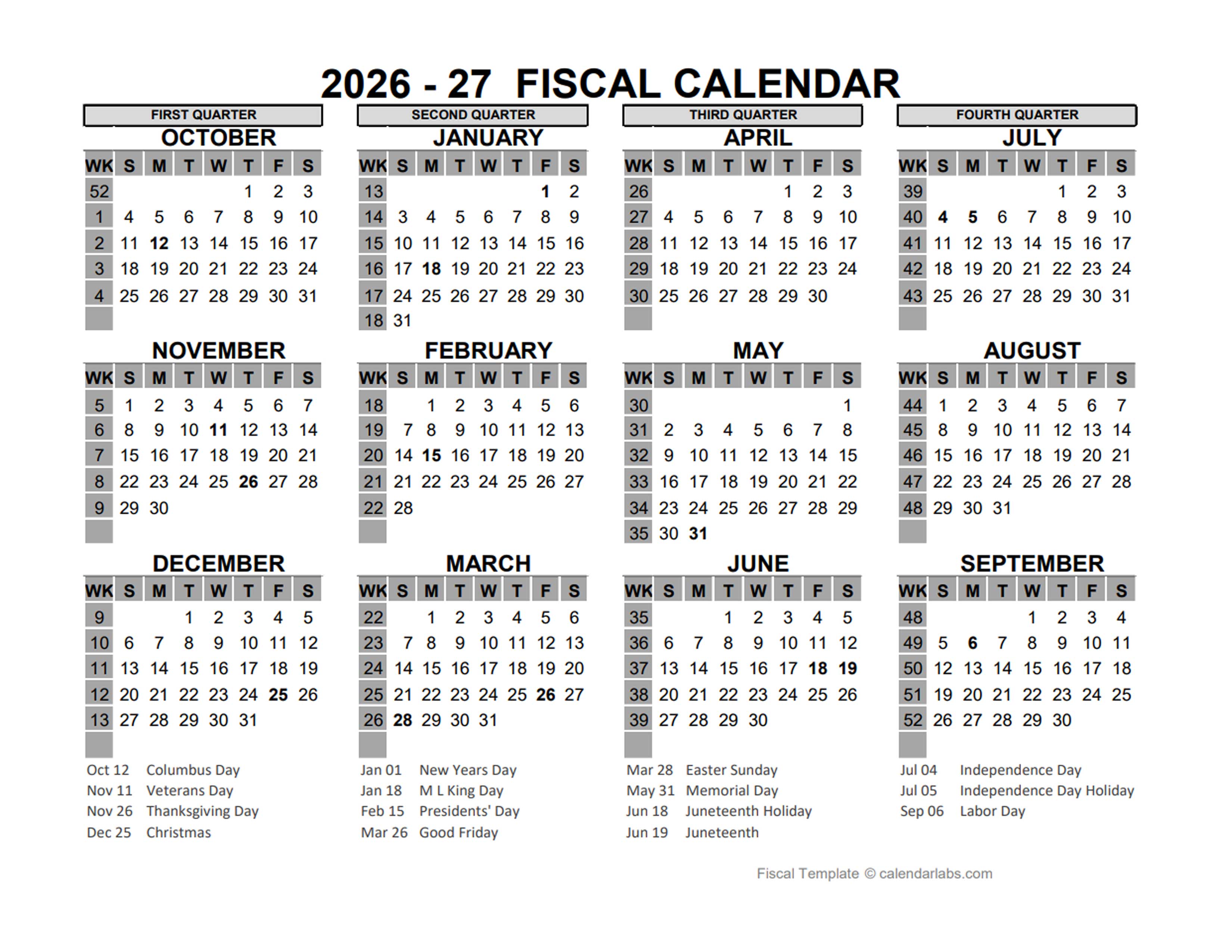

2026 US Fiscal Year Template Free Printable Templates

Web key differences between fiscal year vs calendar year. It is also used for financial reporting by businesses and other organizations. Web what is a fiscal year? Most other countries begin their year at a different calendar. A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and.

Download Printable Fiscal Year Calendar Template PDF

Web key differences between fiscal year vs calendar year. It can also help you select a list or range of dates based on. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. You can use most of. Web this calculator is designed to.

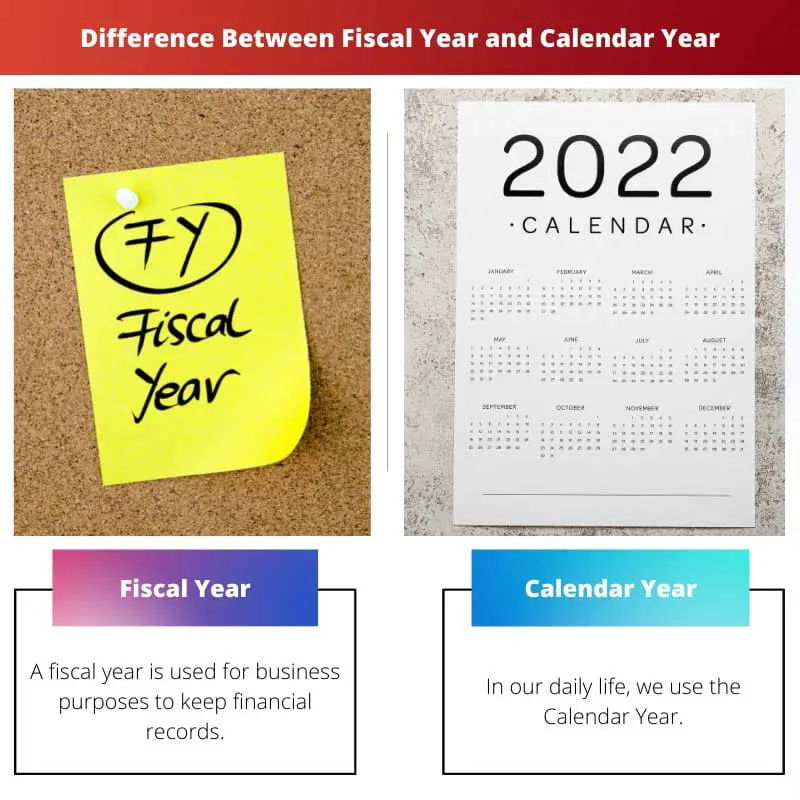

What is the Difference Between Fiscal Year and Calendar Year

Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. A calendar year always begins on new year’s day and ends on the last day of the month (jan. Web the federal government’s fiscal year runs from the first day.

Fiscal Year vs Calendar Year Difference and Comparison

31 for those using the gregorian calendar). Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. Web.

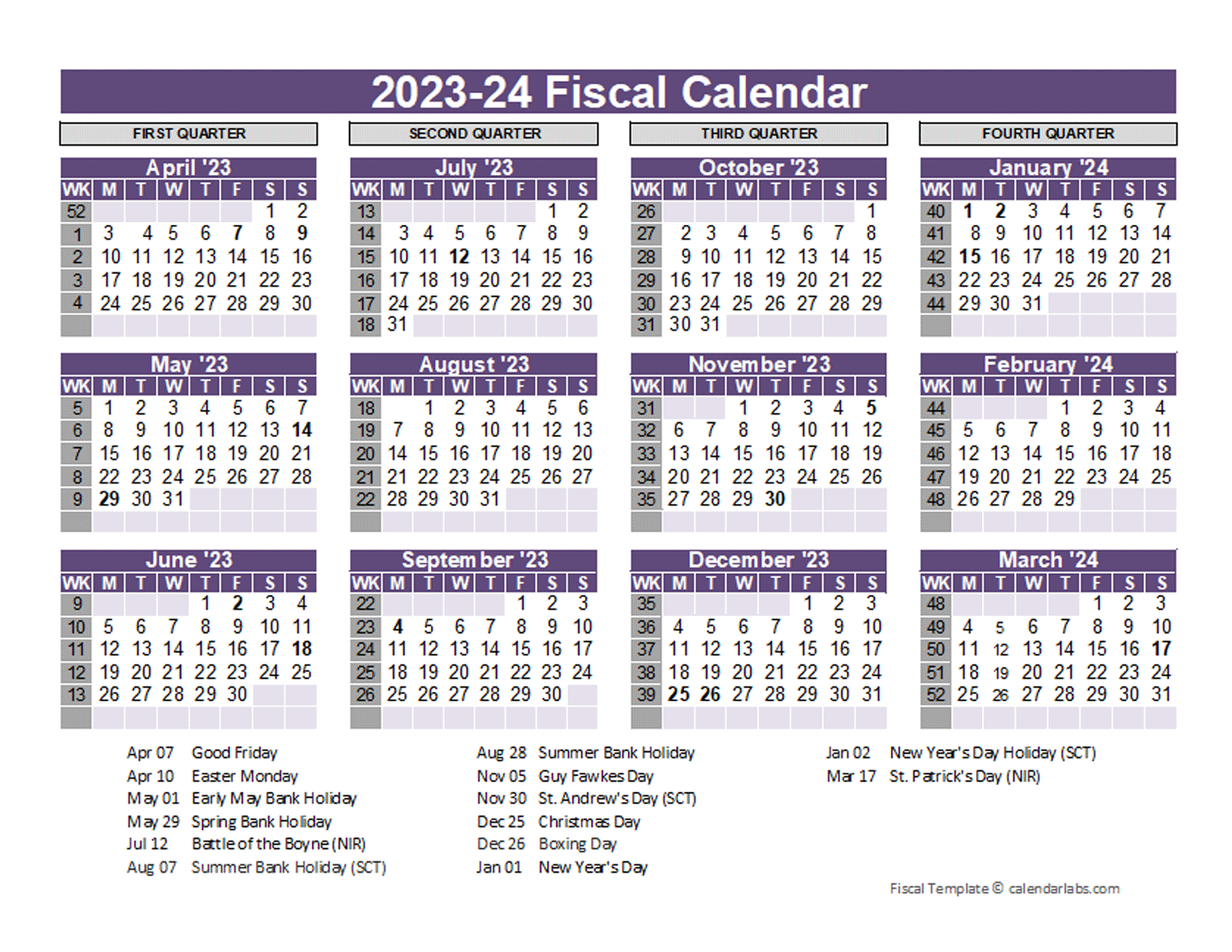

UK Fiscal Calendar Template 20232024 Free Printable Templates

It can be any date as long as the fiscal year is. Learn when you should use each. 31 for those using the gregorian calendar). Most other countries begin their year at a different calendar. Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year.

Web The Fiscal Year, A Period Of 12 Months Ending On The Last Day Of The Month, Does Not Line Up With The Traditional Calendar Year.

Web key differences between fiscal year vs calendar year. Web this calculator is designed to help you create and manage a financial calendar for any year in a fiscal year format. You can use most of. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes.

Returns The First Day Of The Fiscal Year, Which Is Always In The Previous Calendar Year.

Returns the last day of the fiscal year, which. This year can differ from. Most other countries begin their year at a different calendar. 31 for those using the gregorian calendar).

Web Using A Different Fiscal Year Than The Calendar Year Lets Seasonal Businesses Choose The Start And End Dates That Better Align With Their Revenue And.

It's used differently by the government and businesses, and does need to correspond to a. A fiscal year can vary from company. Web a fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that begins on january 1st. Companies can choose whether to use a calendar year or fiscal year for.

Web The Federal Government’s Fiscal Year Runs From The First Day Of October Of One Calendar Year Through The Last Day Of September Of The Next.

Learn when you should use each. It can also help you select a list or range of dates based on. A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations.