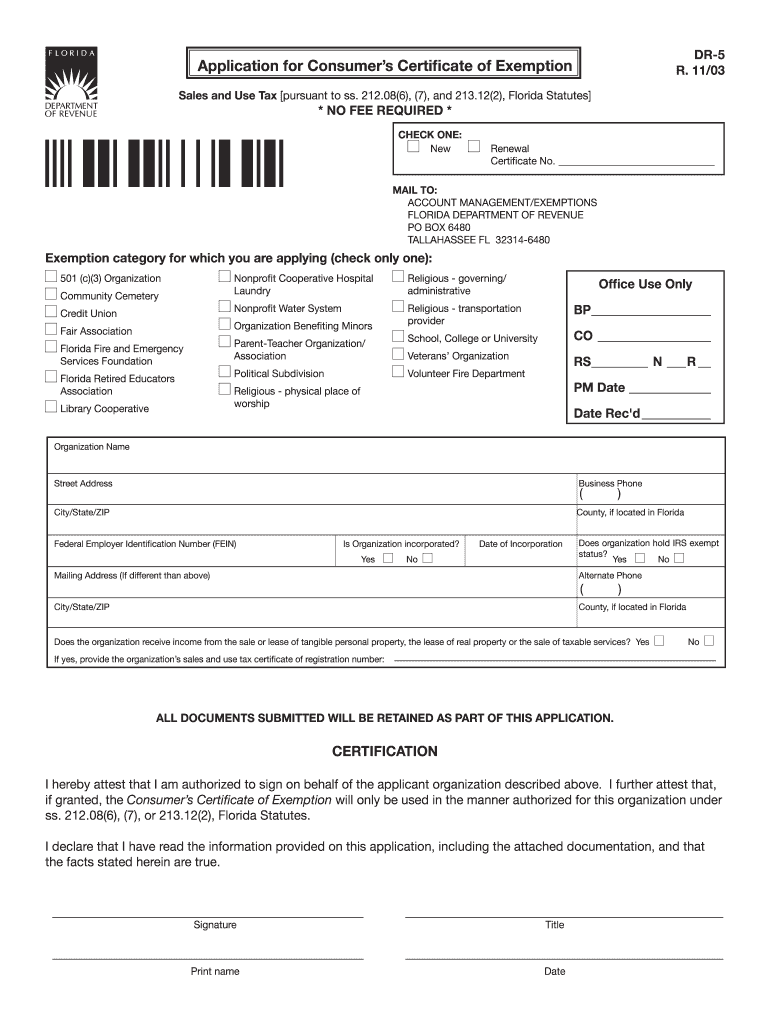

Florida Agricultural Tax Exempt Form

Florida Agricultural Tax Exempt Form - Web applying for the agricultural classification. Provide a copy of the determination. Web see the exemption category provided for power farm equipment, as defined in section 212.02(30), f.s., which includes generators, motors, and similar types of equipment. Web in order to qualify for the exemption, the property must be in agricultural use as of january 1 of the given year in which the owner wishes to file. Web what is the agricultural exemption? Web this form must be signed and returned on or before march 1. Ad download or email florida exempt & more fillable forms, register and subscribe now! Find the right one for your farm needs! Most forms are provided in pdf and a fillable. Web attach a list of the following information for each subsidiary applying for exemption:

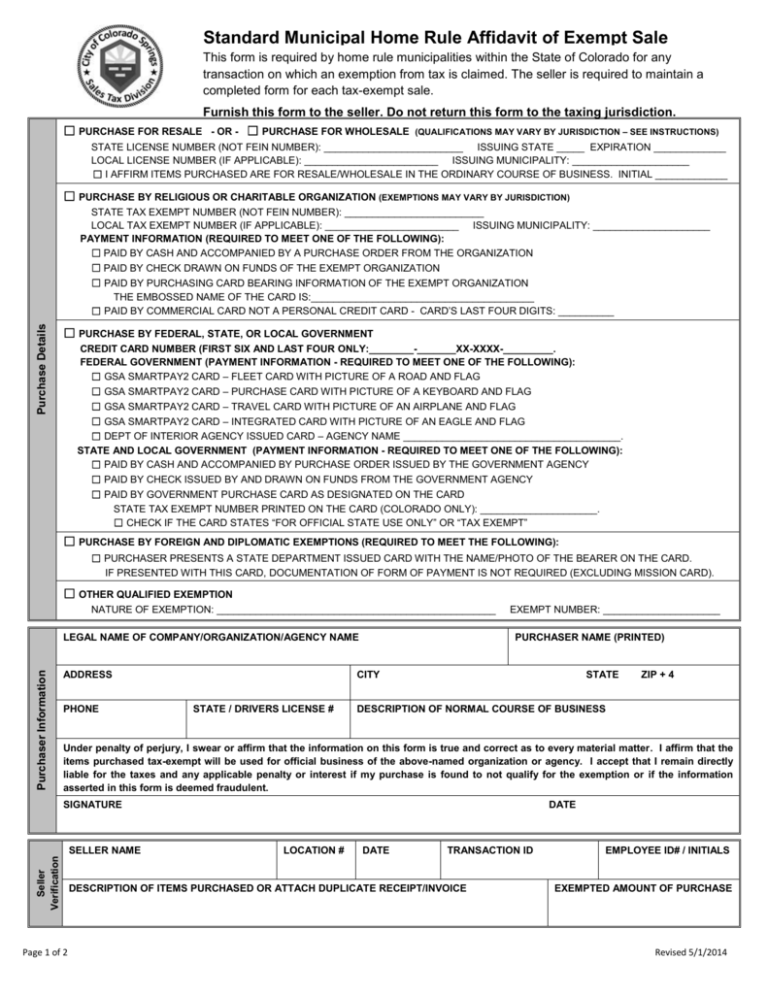

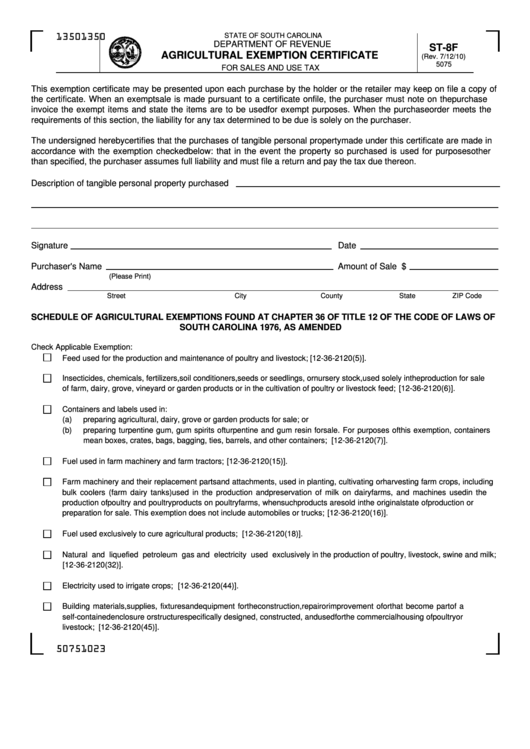

Web suggested purchaser’s exemption certificate items for agricultural use or for agricultural purposes and power farm equipment fl. Web this form must be signed and returned on or before march 1. Visit the florida department of revenue webpage at floridarevenue.com for more information on aquacultural tax exemptions or. Web sales tax is exempt on that portion of the sale price below $20,000 for a trailer weighing 12,000 pounds or less purchased by a farmer for exclusive use in. There’s technically no agricultural exemption. Web one way to potentially reduce your annual property tax costs is by getting an agricultural tax assessment, which is also referred to as an “agricultural exemption” or. Most people are thinking about the agricultural classification, which is also. Web attach a list of the following information for each subsidiary applying for exemption: Most forms are provided in pdf and a fillable. Provide a copy of the determination.

A b c d e f g h i l m n o p r s t. Web suggested purchaser’s exemption certificate items for agricultural use or for agricultural purposes and power farm equipment fl. Web exemptions for fencing and trailers used in agricultural production effective july 1, 2022, hog wire and barbed wire fencing used in agricultural production on lands classified as. Legal name, mailing address, location address, and fein; Application for refund of tax. Web the florida department of revenue's property tax oversight program provides commonly requested tax forms for downloading. Web the florida agricultural exemption is really not an exemption. Ad download or email florida exempt & more fillable forms, register and subscribe now! Most people are thinking about the agricultural classification, which is also. There’s technically no agricultural exemption.

Agriculture Tax Exempt Form Florida

You must provide the following information: Schedule a call with us today. At brytebridge, we give you the right tools and strategies to grow your nonprofit. Real estate, family law, estate planning, business forms and power of attorney forms. Web the agricultural tax exemption is a property tax exemption that landowners may receive, if they can show that their land.

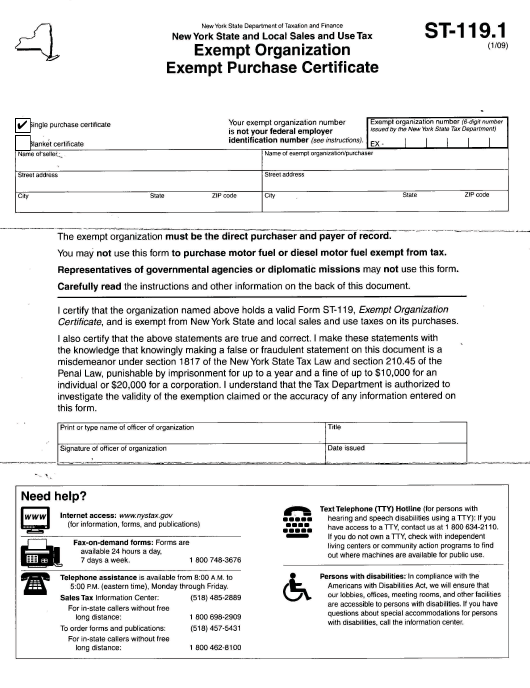

Agricultural Tax Exempt Form Nys

At brytebridge, we give you the right tools and strategies to grow your nonprofit. Web suggested purchaser’s exemption certificate items for agricultural use or for agricultural purposes and power farm equipment fl. Web exemptions for fencing and trailers used in agricultural production effective july 1, 2022, hog wire and barbed wire fencing used in agricultural production on lands classified as..

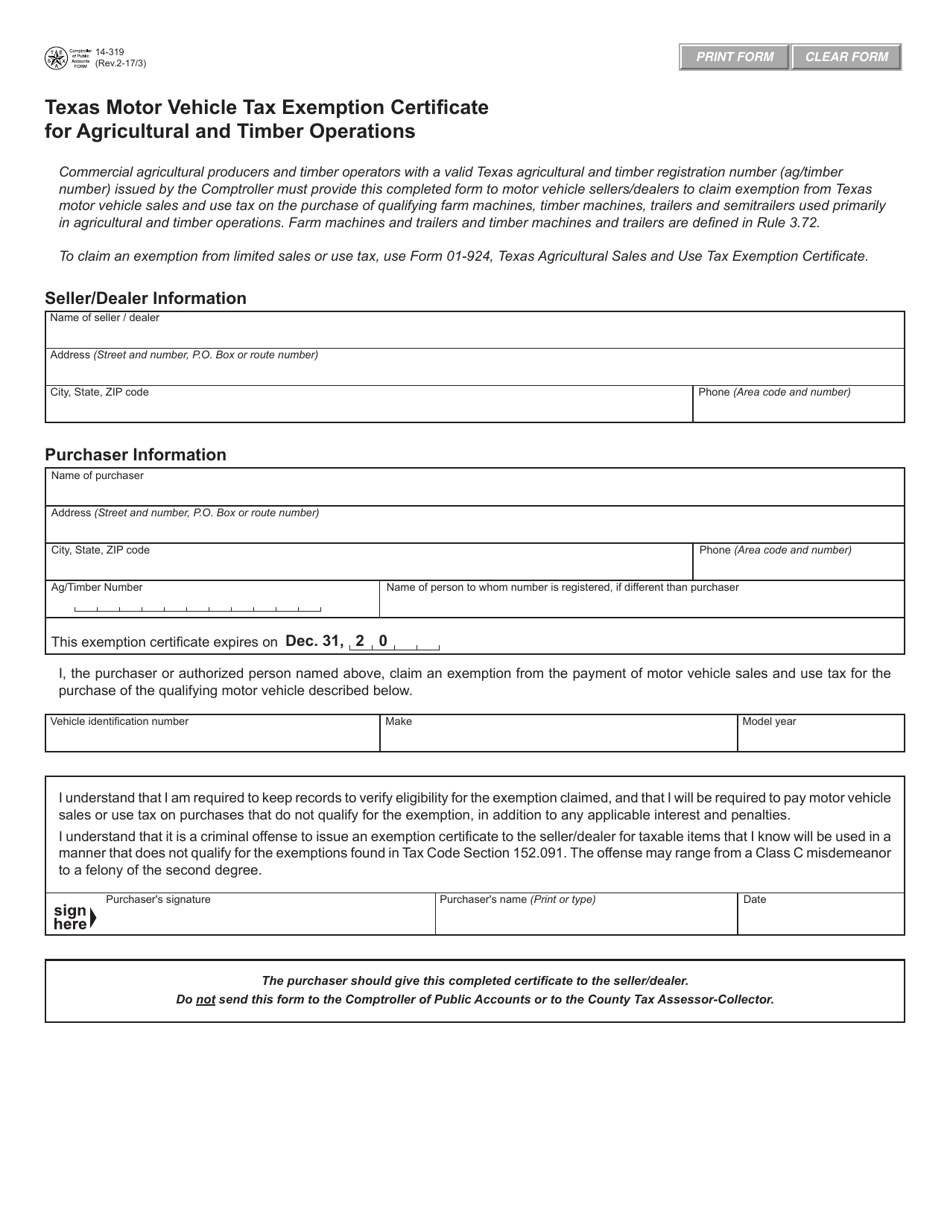

Farmers Tax Exempt Certificate Farmer Foto Collections

A b c d e f g h i l m n o p r s t. Web this form must be signed and returned on or before march 1. Schedule a call with us today. Web in order for the exemption to apply, the power farm equipment must be used exclusively on a farm or in a forest in.

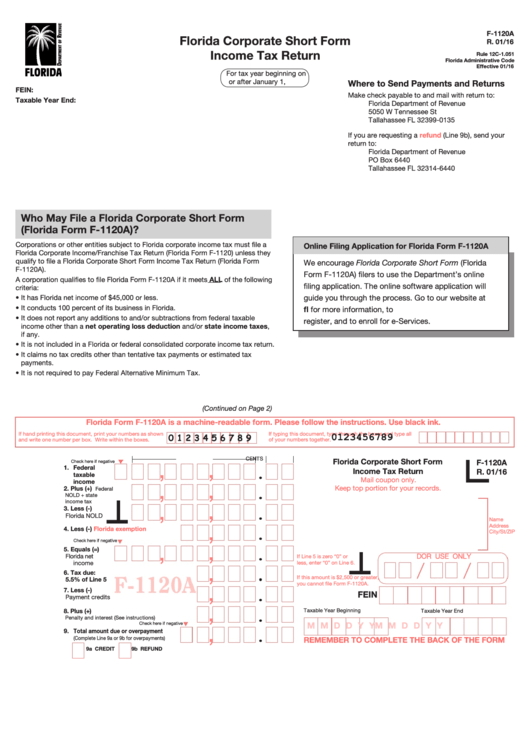

Top 77 Florida Tax Exempt Form Templates free to download in PDF format

Web the florida agricultural exemption is really not an exemption. Web in order for the exemption to apply, the power farm equipment must be used exclusively on a farm or in a forest in the agricultural production of crops or products as produced by. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals).

New Tax Exempt Form

Ad our solutions are designed to help you achieve results. Web applying for the agricultural classification. Web in order to qualify for the exemption, the property must be in agricultural use as of january 1 of the given year in which the owner wishes to file. Most people are thinking about the agricultural classification, which is also. Web what is.

What Is an Agricultural Tax Exemption in Florida? EPGD Business Law

Web sales tax is exempt on that portion of the sale price below $20,000 for a trailer weighing 12,000 pounds or less purchased by a farmer for exclusive use in. Web sales tax exemption certificates expire after five years. At brytebridge, we give you the right tools and strategies to grow your nonprofit. Application for refund of tax. Web exemptions.

Florida Agricultural Tax Exempt Form

Ad our solutions are designed to help you achieve results. Schedule a call with us today. At brytebridge, we give you the right tools and strategies to grow your nonprofit. Ad huge selection of tax exemption forms. The department reviews each exemption certificate sixty (60) days before the current certificate expires.

Agricultural Tax Exempt Form For Property Tax

Name, address and daytime phone number. Web attach a list of the following information for each subsidiary applying for exemption: Web sales tax is exempt on that portion of the sale price below $20,000 for a trailer weighing 12,000 pounds or less purchased by a farmer for exclusive use in. Web applying for the agricultural classification. Find the right one.

501 3c Tax Exempt Form Universal Network

Web sales tax exemption certificates expire after five years. Web the florida agricultural exemption is really not an exemption. Web find official department forms for the various programs administered by the florida department of agriculture and consumer services. At brytebridge, we give you the right tools and strategies to grow your nonprofit. Web see the exemption category provided for power.

Florida Hotel Tax Exempt Form US Legal Forms

Web sales tax exemption certificates expire after five years. Web see the exemption category provided for power farm equipment, as defined in section 212.02(30), f.s., which includes generators, motors, and similar types of equipment. Web applying for the agricultural classification. Web what is the agricultural exemption? Visit the florida department of revenue webpage at floridarevenue.com for more information on aquacultural.

Application For Refund Of Tax.

Web suggested purchaser’s exemption certificate items for agricultural use or for agricultural purposes and power farm equipment fl. Web attach a list of the following information for each subsidiary applying for exemption: Most people are thinking about the agricultural classification, which is also. Web applying for the agricultural classification.

12/00 The Undersigned, Hereby Requests That The Lands Listed Hereon, Where Appropriate, Be.

Web one way to potentially reduce your annual property tax costs is by getting an agricultural tax assessment, which is also referred to as an “agricultural exemption” or. Web sales tax is exempt on that portion of the sale price below $20,000 for a trailer weighing 12,000 pounds or less purchased by a farmer for exclusive use in. Schedule a call with us today. A b c d e f g h i l m n o p r s t.

Most Forms Are Provided In Pdf And A Fillable.

There’s technically no agricultural exemption. Ad download or email florida exempt & more fillable forms, register and subscribe now! Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the florida sales tax. Web find official department forms for the various programs administered by the florida department of agriculture and consumer services.

At Brytebridge, We Give You The Right Tools And Strategies To Grow Your Nonprofit.

Web exemptions offered to other forms of agriculture. Web exemptions for fencing and trailers used in agricultural production effective july 1, 2022, hog wire and barbed wire fencing used in agricultural production on lands classified as. Provide a copy of the determination. The department reviews each exemption certificate sixty (60) days before the current certificate expires.