Form 05 158 Instructions

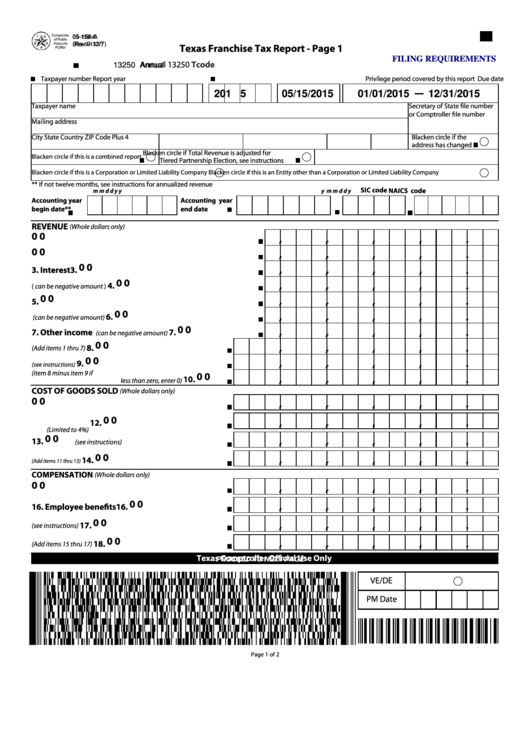

Form 05 158 Instructions - Texas franchise tax reports for 2022 and prior years. Web revenue gross receipts or sales: Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Tax adjustments (dollars and cents) 32. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. No matter which form you file, your texas franchise tax report is due may 15th each year. Web follow the simple instructions below: Pick the template you require from the collection of legal form samples. 2022 report year forms and instructions; Web 2023 report year forms and instructions;

Print or type name area code and phone number date. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Enter gross receipts or sales for the period upon which the tax is based. Click on the get form button to open the document and move to editing. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Web find and fill out the correct form 05 158 a instructions. Web follow the simple instructions below: Web 2023 report year forms and instructions; No matter which form you file, your texas franchise tax report is due may 15th each year. 2022 report year forms and instructions;

Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Print or type name area code and phone number date. No matter which form you file, your texas franchise tax report is due may 15th each year. Web 2023 report year forms and instructions; Tax due before discount (item 31 minus item 32) 33. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Web find and fill out the correct form 05 158 a instructions. (if may 15th falls on a weekend, the due date will be the following business day.) the. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Click on the get form button to open the document and move to editing.

Fillable 05158A, 2015, Texas Franchise Tax Report printable pdf download

Choose the correct version of the editable pdf form from the list and get started filling it out. Web 2023 report year forms and instructions; No matter which form you file, your texas franchise tax report is due may 15th each year. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Tax.

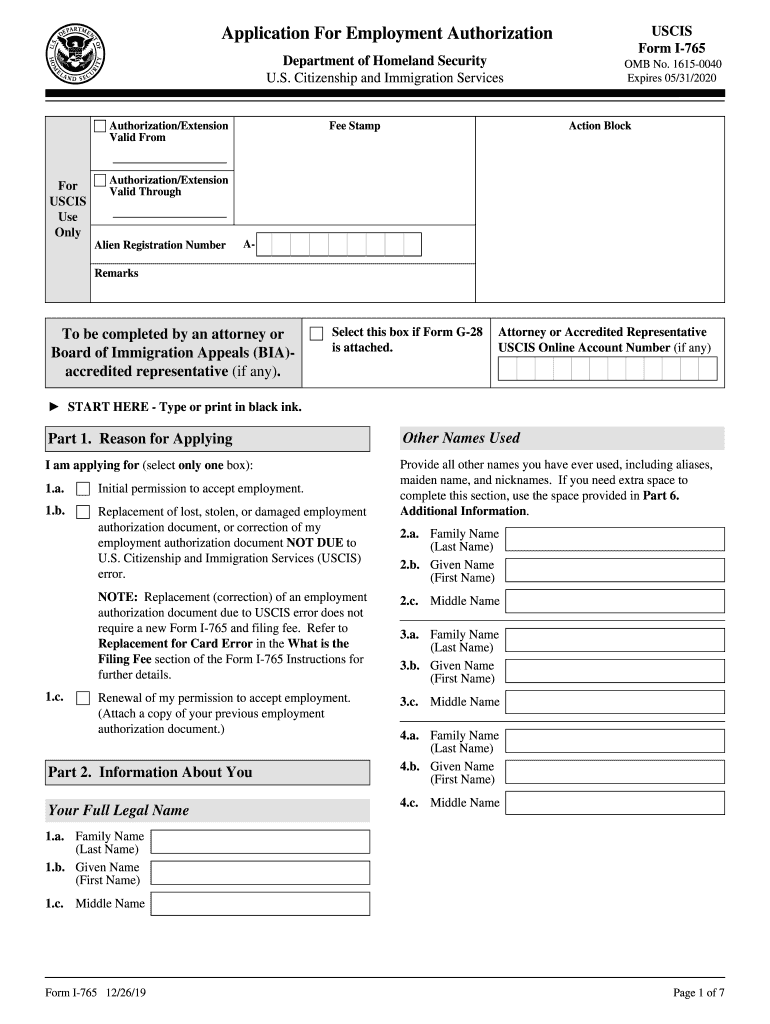

USCIS Notice On Form I 765 Application For Employment Fill Out and

Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Print or type name area code and phone number date. Web find and fill out the correct form 05 158 a instructions. Tax rate (see instructions for determining the.

Revista Colombiana de Bioética by Universidad El Bosque Issuu

Web follow the simple instructions below: Print or type name area code and phone number date. Enter gross receipts or sales for the period upon which the tax is based. Web revenue gross receipts or sales: Texas franchise tax reports for 2022 and prior years.

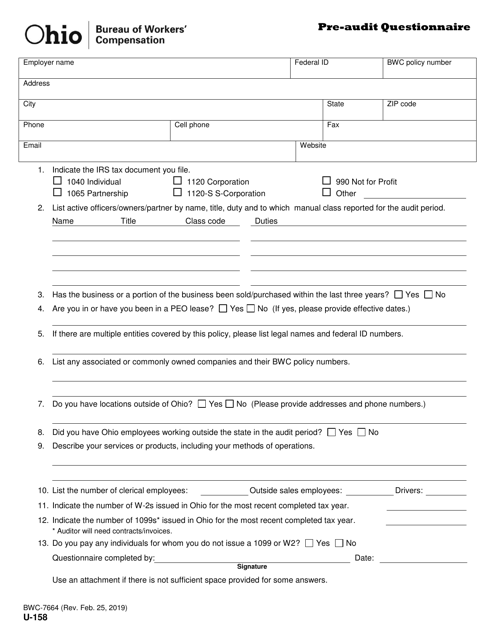

Form U158 (BWC7664) Download Printable PDF or Fill Online Preaudit

Web revenue gross receipts or sales: Choose the correct version of the editable pdf form from the list and get started filling it out. Tax due before discount (item 31 minus item 32) 33. (if may 15th falls on a weekend, the due date will be the following business day.) the. Web any entity that does not elect to file.

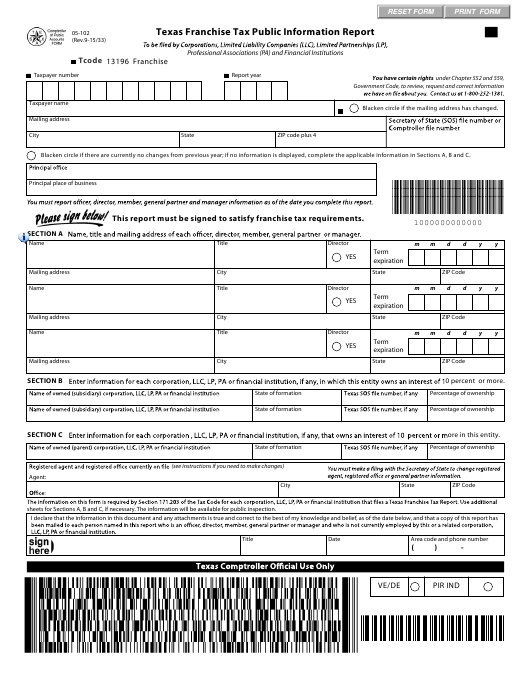

Texas Franchise Tax Report Forms For 2022

Web revenue gross receipts or sales: Click on the get form button to open the document and move to editing. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Enter gross receipts or sales for the period upon which the tax is based. Choose the correct version of the editable pdf form.

Form 05 158 a Fill out & sign online DocHub

Enter dividends for the period upon which the tax is based. (if may 15th falls on a weekend, the due date will be the following business day.) the. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Web any entity that does not elect to file using the ez computation, or that.

TX Comptroller 05391 2009 Fill out Tax Template Online US Legal Forms

Enter gross receipts or sales for the period upon which the tax is based. Tax due before discount (item 31 minus item 32) 33. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Click on the get form button to open the document and move to editing. Print or type name area.

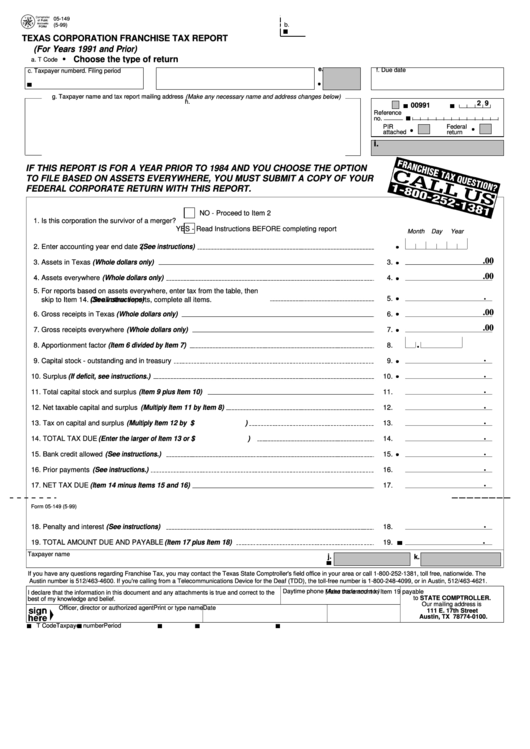

Fillable Form 05364 Texas Corporation Franchise Tax Report printable

Tax adjustments (dollars and cents) 32. Pick the template you require from the collection of legal form samples. Tax due before discount (item 31 minus item 32) 33. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Tax rate (see instructions for determining the appropriate tax rate) x xx x 30.

Form 05 163 For 2016 Fill Online, Printable, Fillable, Blank PDFfiller

Enter gross receipts or sales for the period upon which the tax is based. No matter which form you file, your texas franchise tax report is due may 15th each year. Tax due before discount (item 31 minus item 32) 33. Texas franchise tax reports for 2022 and prior years. Web revenue gross receipts or sales:

Form DS158 Edit, Fill, Sign Online Handypdf

(if may 15th falls on a weekend, the due date will be the following business day.) the. Web revenue gross receipts or sales: Texas franchise tax reports for 2022 and prior years. Tax adjustments (dollars and cents) 32. No matter which form you file, your texas franchise tax report is due may 15th each year.

Print Or Type Name Area Code And Phone Number Date.

Web 2023 report year forms and instructions; Web find and fill out the correct form 05 158 a instructions. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report.

Pick The Template You Require From The Collection Of Legal Form Samples.

Web revenue gross receipts or sales: Web follow the simple instructions below: (if may 15th falls on a weekend, the due date will be the following business day.) the. 2022 report year forms and instructions;

Enter Gross Receipts Or Sales For The Period Upon Which The Tax Is Based.

Click on the get form button to open the document and move to editing. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Choose the correct version of the editable pdf form from the list and get started filling it out. Web fill out texas 05 158 in just a few moments by using the recommendations listed below:

Tax Due Before Discount (Item 31 Minus Item 32) 33.

Enter dividends for the period upon which the tax is based. No matter which form you file, your texas franchise tax report is due may 15th each year. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Tax adjustments (dollars and cents) 32.