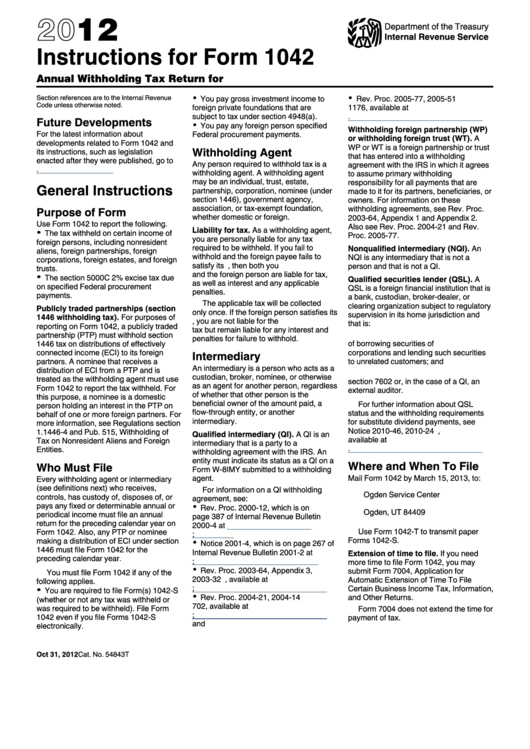

Form 1042-S Instructions

Form 1042-S Instructions - Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Source income subject to withholding) is used to report any payments made to foreign persons. Distributions of effectively connected income by a publicly traded partnership. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Web specific instructions rounding off to whole dollars. Web understanding when u.s. You are required to enter your ein. Chapter 3 and 4 status codes of. Source income of foreign persons) are irs tax forms that deal specifically with payments to nonresident aliens and other foreign persons.

You must round off cents to whole dollars. You are required to enter your ein. Chapter 3 and 4 status codes of. If you are filing form 1042 as a qi, wp, or. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. To round off amounts to the nearest dollar,. Web understanding when u.s. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Distributions of effectively connected income by a publicly traded partnership. Source income subject to withholding) is used to report any payments made to foreign persons.

Source income subject to withholding) is used to report any payments made to foreign persons. Web specific instructions rounding off to whole dollars. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Web understanding when u.s. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. You are required to enter your ein. Chapter 3 and 4 status codes of. If you are filing form 1042 as a qi, wp, or. Source income of foreign persons) are irs tax forms that deal specifically with payments to nonresident aliens and other foreign persons. You must round off cents to whole dollars.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. To round off amounts to the nearest dollar,. Web specific instructions rounding off to whole dollars. Source income subject to.

Instructions For Form 1042 Annual Withholding Tax Return For U.s

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. You are required to enter your ein. Source income of foreign persons) are irs tax forms that deal specifically with.

Irs form 1042 s instructions 2014

Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. To round off amounts to the nearest dollar,. Source income of foreign persons) are irs tax forms that deal specifically with payments to nonresident aliens and other foreign persons. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation.

The Newly Issued Form 1042S Foreign Person's U.S. Source

To round off amounts to the nearest dollar,. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. You are required to enter your ein. Source income subject to withholding) is used to report any payments made to foreign persons. Specified federal procurement payments paid to foreign.

1042 S Form slideshare

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Chapter 3 and 4 status codes of. Web specific instructions rounding off to whole dollars. You are required to enter your ein. Distributions of effectively connected income by a publicly traded partnership.

Instructions for IRS Form 1042S How to Report Your Annual

Web specific instructions rounding off to whole dollars. You are required to enter your ein. If you are filing form 1042 as a qi, wp, or. To round off amounts to the nearest dollar,. Distributions of effectively connected income by a publicly traded partnership.

I received a 1042s what do i do Fill online, Printable, Fillable Blank

Source income subject to withholding) is used to report any payments made to foreign persons. Web specific instructions rounding off to whole dollars. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. If you are filing form 1042 as a qi, wp, or. Specified federal procurement.

Form 1042 s instructions United States guide User Examples

Web specific instructions rounding off to whole dollars. You are required to enter your ein. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Chapter 3 and 4 status codes of. Source income of foreign persons) are irs tax forms that deal specifically with payments to nonresident aliens and other foreign persons.

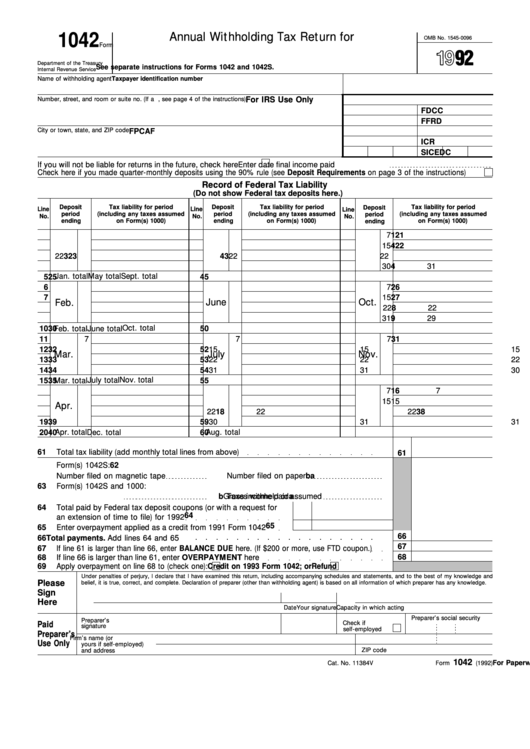

Form 1042 Annual Withholding Tax Return For U.s. Source Of

Web specific instructions rounding off to whole dollars. Distributions of effectively connected income by a publicly traded partnership. You must round off cents to whole dollars. Chapter 3 and 4 status codes of. To round off amounts to the nearest dollar,.

Form Instruction 1042S The Basics

You must round off cents to whole dollars. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Web understanding when u.s. To round off amounts to the nearest dollar,. Web specific instructions rounding off to whole dollars.

You Must Round Off Cents To Whole Dollars.

Web specific instructions rounding off to whole dollars. Distributions of effectively connected income by a publicly traded partnership. Source income subject to withholding) is used to report any payments made to foreign persons. You are required to enter your ein.

Income, Including Income That Is Effectively Connected With The Conduct Of A Trade Or Business In The United States, Must File A U.s.

Source income of foreign persons) are irs tax forms that deal specifically with payments to nonresident aliens and other foreign persons. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. If you are filing form 1042 as a qi, wp, or. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c.

To Round Off Amounts To The Nearest Dollar,.

Chapter 3 and 4 status codes of. Web understanding when u.s.