Form 1065 Federal

Form 1065 Federal - Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. For a fiscal year or a short tax year, fill in the tax year. It reports a partnership's income to the irs, citing gains, losses, credits, and deductions. Complete, edit or print tax forms instantly. And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Most popular online tax filing services like h&r block, turbotax, and. This section of the program contains information for part iii of the schedule k.

Web the irs requires businesses to report the income, gains, losses, deductions, credits, etc., of a domestic business or other entity for any tax year. Return of partnership income, including recent updates, related forms and instructions on how to file. And the total assets at the end of the tax year. Web the easiest way to file a 1065 is to use an online filing service that supports form 1065. Ad access irs tax forms. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Generally, a domestic partnership must file form 1065 u.s. This section of the program contains information for part iii of the schedule k. Web irs form 1065 is an information return. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and.

Return of partnership income, including recent updates, related forms and instructions on how to file. Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Ad get ready for tax season deadlines by completing any required tax forms today. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web where to file your taxes for form 1065. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web the easiest way to file a 1065 is to use an online filing service that supports form 1065.

IRS releases drafts of the new Form 1065, Schedule K1 Accounting Today

And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Web form.

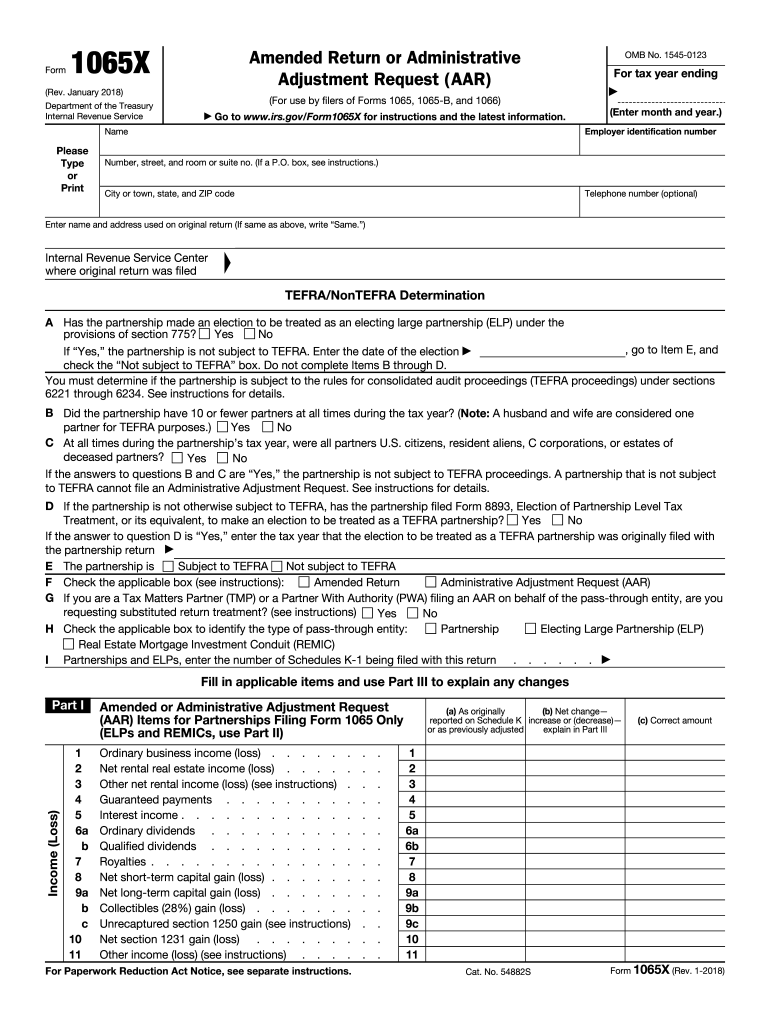

20182020 Form IRS 1065X Fill Online, Printable, Fillable, Blank

Form 1065 is used to report the income of. Form 1065 isn't used to calculate. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Get ready for tax season deadlines by completing any required tax forms today. Web developments related to form 1065 and its.

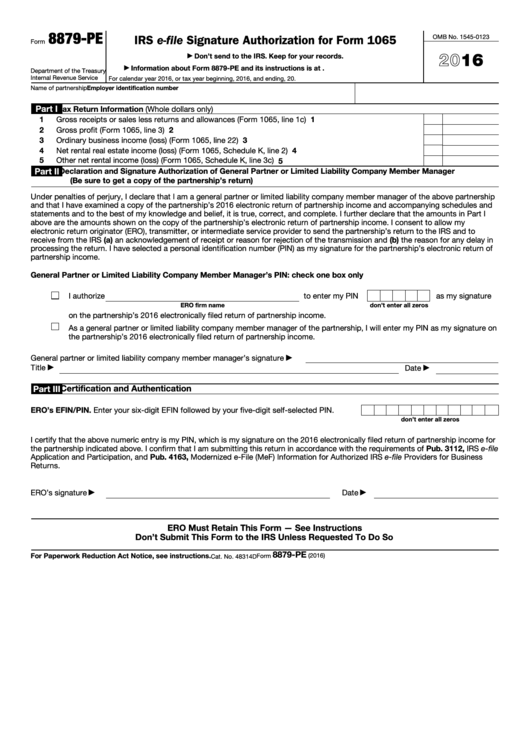

Fillable Form 8879Pe Irs EFile Signature Authorization For Form

Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Web the easiest way to file a 1065 is to use an online filing service that supports form 1065. Form 1065 is used to report the income of. Return of partnership income by the 15th day.

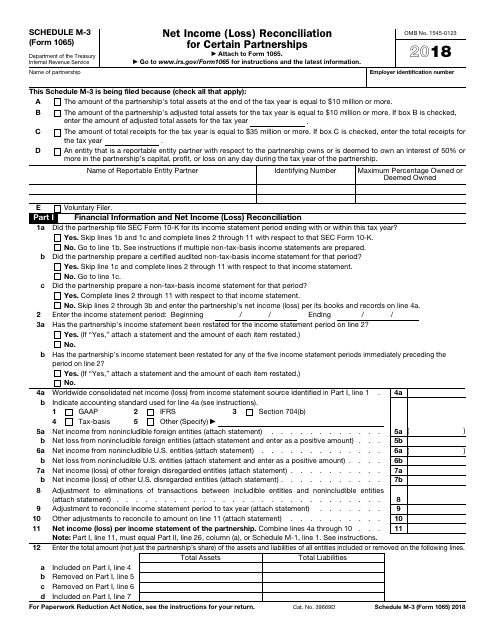

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Complete, edit or print tax forms instantly. Most of the information necessary to. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 1065 is an information return.

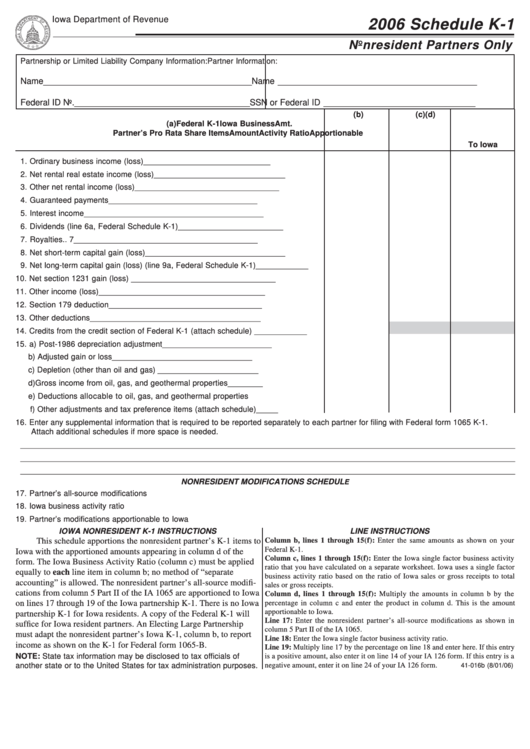

Form Ia 1065 Schedule K1 Nonresident Partners Only 2006

Web a 1065 form is the annual us tax return filed by partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Web the easiest way to file a 1065.

Form 1065 Instructions & Information for Partnership Tax Returns

And the total assets at the end of the tax year. Form 1065 isn't used to calculate. Web irs form 1065 is an information return. Web information about form 1065, u.s. Web the easiest way to file a 1065 is to use an online filing service that supports form 1065.

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Web a 1065 form is the annual us tax return filed by partnerships. It reports a partnership's income to the irs, citing gains, losses, credits, and deductions. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Most popular online tax filing services like h&r block,.

Llc Tax Form 1065 Universal Network

Most popular online tax filing services like h&r block, turbotax, and. Web a 1065 form is the annual us tax return filed by partnerships. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Web where to file your taxes for form 1065. Web 2 quickfinder®.

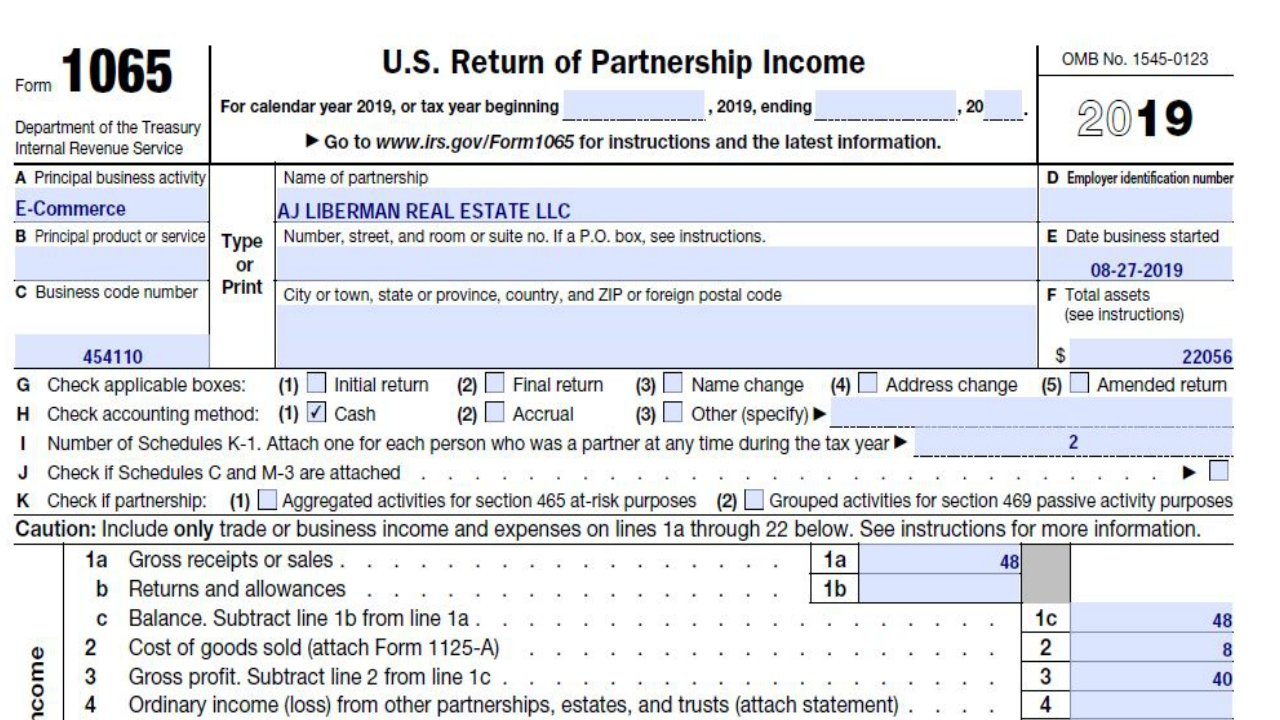

How to Fill Out Form 1065 for a Trade or Business Carrying Inventory

Return of partnership income, including recent updates, related forms and instructions on how to file. Form 1065 isn't used to calculate. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Most popular online tax filing services like h&r block, turbotax, and.

Form 1065 U.S. Return of Partnership (2014) Free Download

Web form 1065, u.s. Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Form 1065 isn't used to calculate. Web information about form 1065, u.s. Most popular online tax filing services like h&r block, turbotax, and.

Generally, A Domestic Partnership Must File Form 1065 U.s.

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web irs form 1065 is an information return. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Most of the information necessary to.

Form 1065 Is Used To Report The Income Of.

Web form 1065, u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Form 1065 isn't used to calculate. Most popular online tax filing services like h&r block, turbotax, and. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

This Section Of The Program Contains Information For Part Iii Of The Schedule K.

It reports a partnership's income to the irs, citing gains, losses, credits, and deductions. For a fiscal year or a short tax year, fill in the tax year. Return of partnership income by the 15th day of the third month following the date its tax. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.