Form 1065 Late Filing Penalty

Form 1065 Late Filing Penalty - Form 5471, information return of u.s. If a partnership has more than 100 partners and is required to file their return electronically and they fail to do so, a penalty of $100.00 for each. Web form 1065 late filing penalties include: Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. When is the deadline to file form 1065? Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Web failure to file or show information on a partnership return (irc sec. 6698)—for partnership taxable years beginning in 2021, a return for purposes of irc. Who must file form 1065?

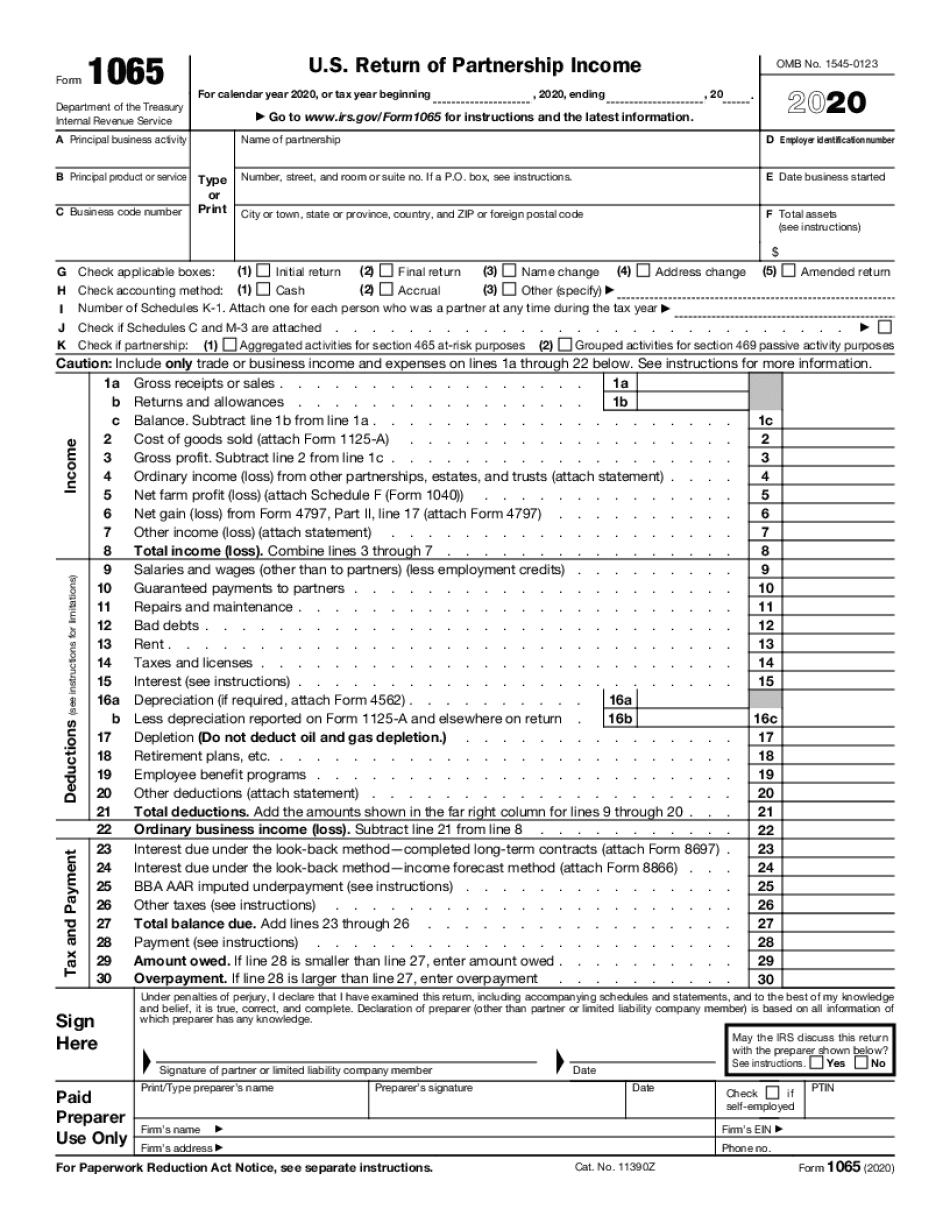

Who must file form 1065? Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied. Web purpose of form.2 definitions.2 who must file.2 termination of the partnership.3 electronic filing.3 when to file.3 where to file.4 who must sign.4. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. If a partnership has more than 100 partners and is required to file their return electronically and they fail to do so, a penalty of $100.00 for each. Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Corporation income tax return, or form 1065, u.s. When is the deadline to file form 1065? Persons with respect to certain foreign corporations; Form 5471, information return of u.s.

Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Persons with respect to certain foreign corporations; Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Web what is the penalty for filing a form 1065 late? Form 5471, information return of u.s. Web currently, the late filing penalty for form 1065 is $220 per month (or part of a month) up to a maximum of twelve months for each partner or shareholder on the. Who must file form 1065? Web if your partnership failed to timely file its irs form 1065 and you get penalized by the irs you should consider seeking relief from or abatement of this. Corporation income tax return, or form 1065, u.s. When is the deadline to file form 1065?

Avoiding Late Penalties On 1065 And 1120S Returns Silver Tax Group

Web what is the penalty for filing a form 1065 late? Form 5471, information return of u.s. Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Web purpose of form.2 definitions.2 who must file.2 termination.

Form 1065 Instructions 2022 2023 IRS Forms Zrivo

Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Who must file form 1065? Persons with respect to certain foreign corporations; If the suppress late filing penalty field is checked there,. Per the irs, the.

4,280 IRS Penalty Abated for LateFiled Form 990 David B. McRee, CPA

Web the penalty for income tax returns is typically assessed at a rate of 5% per month and up to 25% of the unpaid tax when a return is filed late. Web failure to file or show information on a partnership return (irc sec. Web currently, the late filing penalty for form 1065 is $220 per month (or part of.

FBAR Late Filing Penalty How to Submit Late Form 2020 International

Persons with respect to certain foreign corporations; Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Form 5471, information return of u.s. If a partnership has more than 100 partners and.

IRS Form 1065 or Form 1120S FirstTime Late Filing Penalty Abatement

Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or.

Form 1065 Blank Sample to Fill out Online in PDF

Return of partnership income, filing is abated under the. Persons with respect to certain foreign corporations; Who must file form 1065? Can partnerships elected as a business extend the deadline? Form 5471, information return of u.s.

Avoiding Late Penalties On 1065 And 1120S Returns Silver Tax Group

Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to.

IRS Form 990 Penalty Abatement Manual for Nonprofits Published by CPA

Web what is the penalty for filing a form 1065 late? Web form 1065 late filing penalties include: When is the deadline to file form 1065? If the suppress late filing penalty field is checked there,. Web if your partnership failed to timely file its irs form 1065 and you get penalized by the irs you should consider seeking relief.

Penalties for Late Filing of IRS Form 1065 IRS Tax Lawyer

Web what is the penalty for filing a form 1065 late? Form 5471, information return of u.s. Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Return of partnership income, filing.

Form 8 Penalties 8 Easy Ways To Facilitate Form 8 Penalties AH

Web what is the penalty for filing a form 1065 late? Web form 1065 late filing penalties include: If a partnership has more than 100 partners and is required to file their return electronically and they fail to do so, a penalty of $100.00 for each. If the suppress late filing penalty field is checked there,. Who must file form.

Web The Penalty For Income Tax Returns Is Typically Assessed At A Rate Of 5% Per Month And Up To 25% Of The Unpaid Tax When A Return Is Filed Late.

Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for. Corporation income tax return, or form 1065, u.s. Return of partnership income, filing is abated under the. Web currently, the late filing penalty for form 1065 is $220 per month (or part of a month) up to a maximum of twelve months for each partner or shareholder on the.

Web Purpose Of Form.2 Definitions.2 Who Must File.2 Termination Of The Partnership.3 Electronic Filing.3 When To File.3 Where To File.4 Who Must Sign.4.

Persons with respect to certain foreign corporations; If the suppress late filing penalty field is checked there,. Web my client a llc filing as a partnership 1065 got a notice from the irs dated july 19, 2010 for a penalty of $810 for a violation of code section 6698 (a) (1). Web form 1065 late filing penalties include:

When Is The Deadline To File Form 1065?

6698)—for partnership taxable years beginning in 2021, a return for purposes of irc. If a partnership has more than 100 partners and is required to file their return electronically and they fail to do so, a penalty of $100.00 for each. Form 5471, information return of u.s. Web what is the penalty for filing a form 1065 late?

Web Failure To File Or Show Information On A Partnership Return (Irc Sec.

Web if you fail to file form 1065 and do not file an extension, you may incur a late penalty of $200 for each month or part of a month (for a maximum of 12 months) the failure. Who must file form 1065? Web if your partnership failed to timely file its irs form 1065 and you get penalized by the irs you should consider seeking relief from or abatement of this. Per the irs, the penalty is $220 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied.