Form 1099 Filing Requirements 2022

Form 1099 Filing Requirements 2022 - Not required to file information returns. Web form 1099 filing requirements and new changes for 2022 form 1099 reporting requirements (information returns). A penalty may be imposed for filing forms that cannot be scanned. Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. Web 1099 deadlines, penalties & state filing requirements for 2022/2023 when are 1099s due in 2023: Web the irs requires the payer (the business) to send a copy of the 1099 forms to the payee (freelancer, independent contractor, and vendor) and have the information validated. Medical and health care payments.

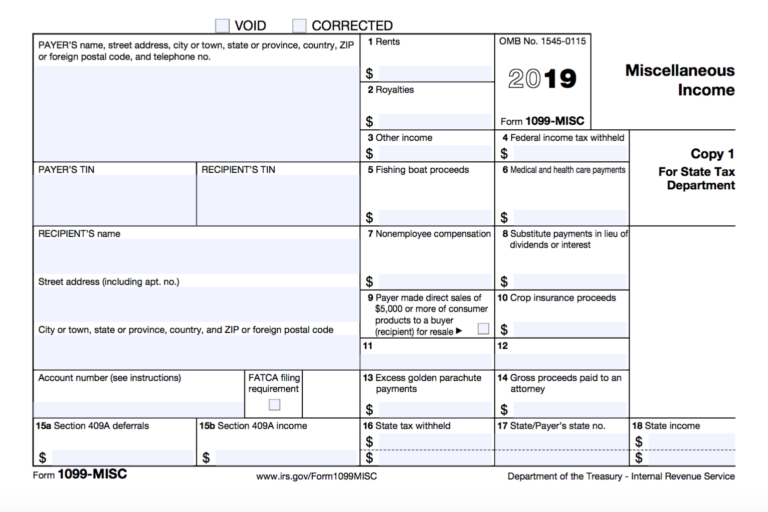

You need not request an allocation of gross proceeds if spouses are the only transferors. Not required to file information returns. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Web for the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. Box number 13 has been assigned to the foreign account tax compliance act (fatca) filing requirement checkbox. Web 1099 deadlines, penalties & state filing requirements for 2022/2023 when are 1099s due in 2023: Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Web the irs requires the payer (the business) to send a copy of the 1099 forms to the payee (freelancer, independent contractor, and vendor) and have the information validated. A penalty may be imposed for filing forms that cannot be scanned.

A penalty may be imposed for filing forms that cannot be scanned. Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). What you need employer identification number (ein) iris transmitter control code (tcc). Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Web the irs requires the payer (the business) to send a copy of the 1099 forms to the payee (freelancer, independent contractor, and vendor) and have the information validated. There are a number of different 1099 forms that report various. Api client id (a2a filers only) sign in to iris for system availability, check iris status. Box number 13 has been assigned to the foreign account tax compliance act (fatca) filing requirement checkbox. Copy a and b should be.

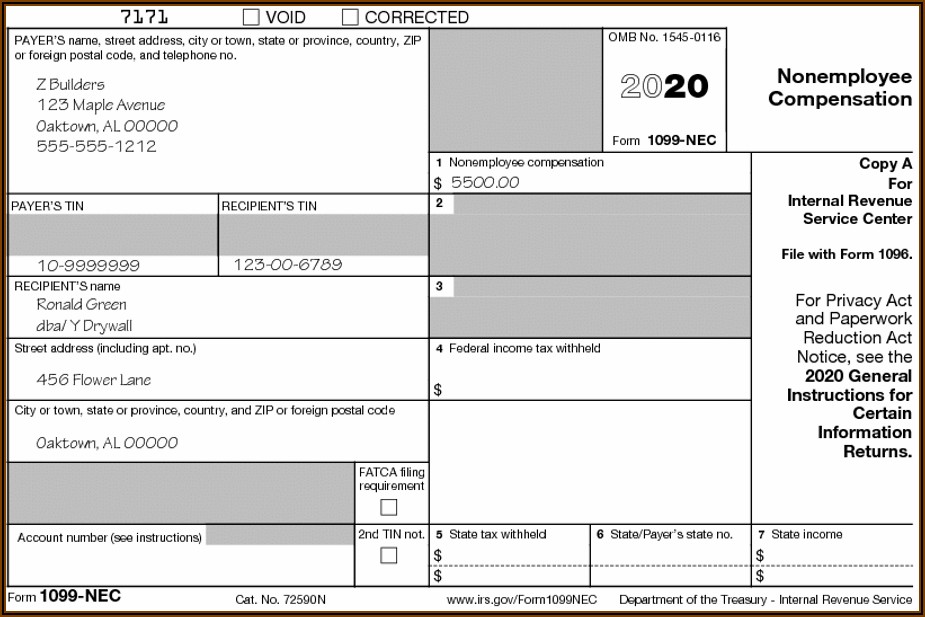

1099NEC vs 1099MISC Do You Need to File Both?

There are a number of different 1099 forms that report various. Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. Not required to file information returns. Web the official printed version of the irs form is scannable, but the online version of it, printed from.

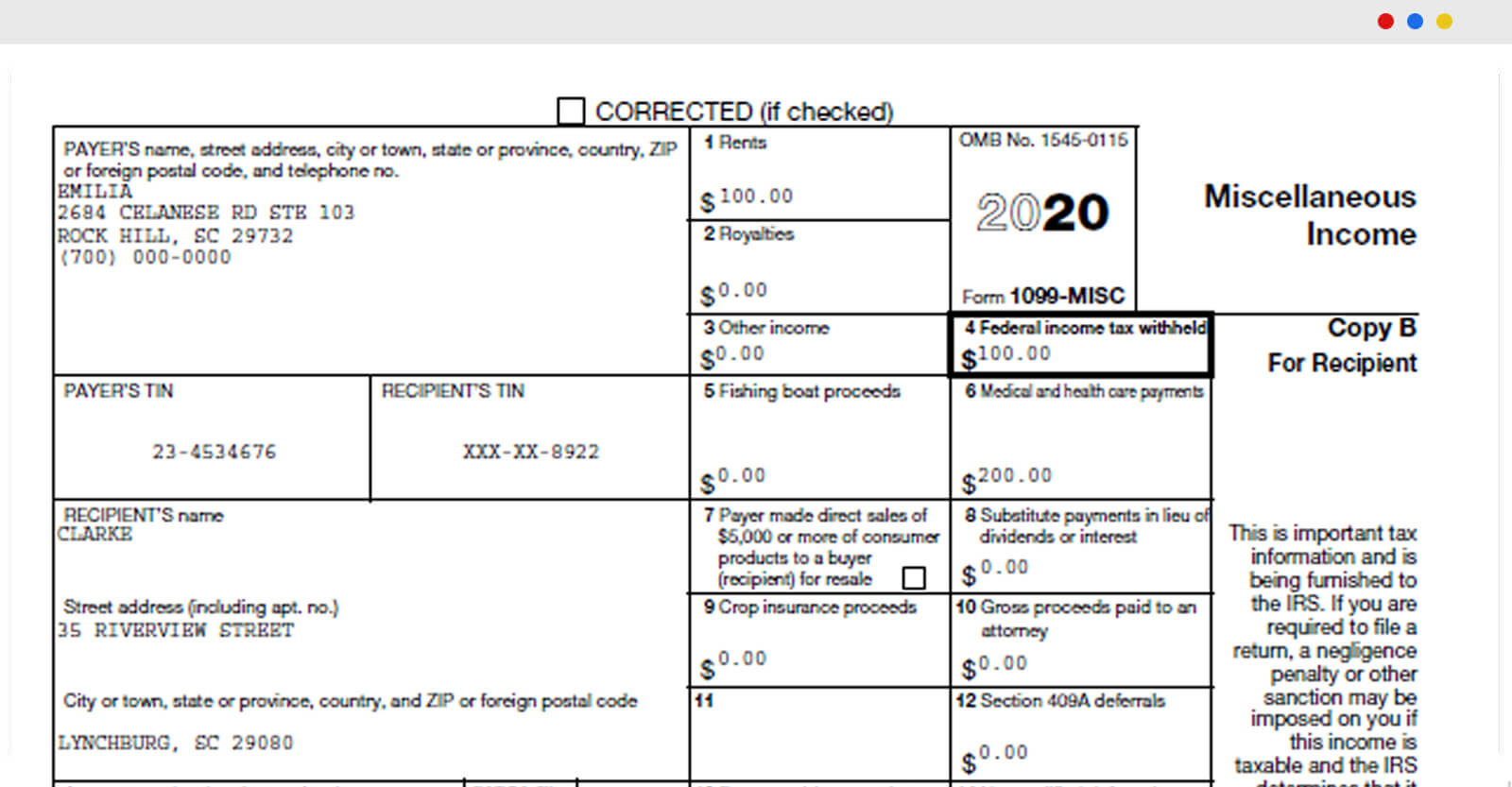

Efile Form 1099 MISC Online How to File 1099 MISC for 2020

A penalty may be imposed for filing forms that cannot be scanned. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Medical and health care payments. What.

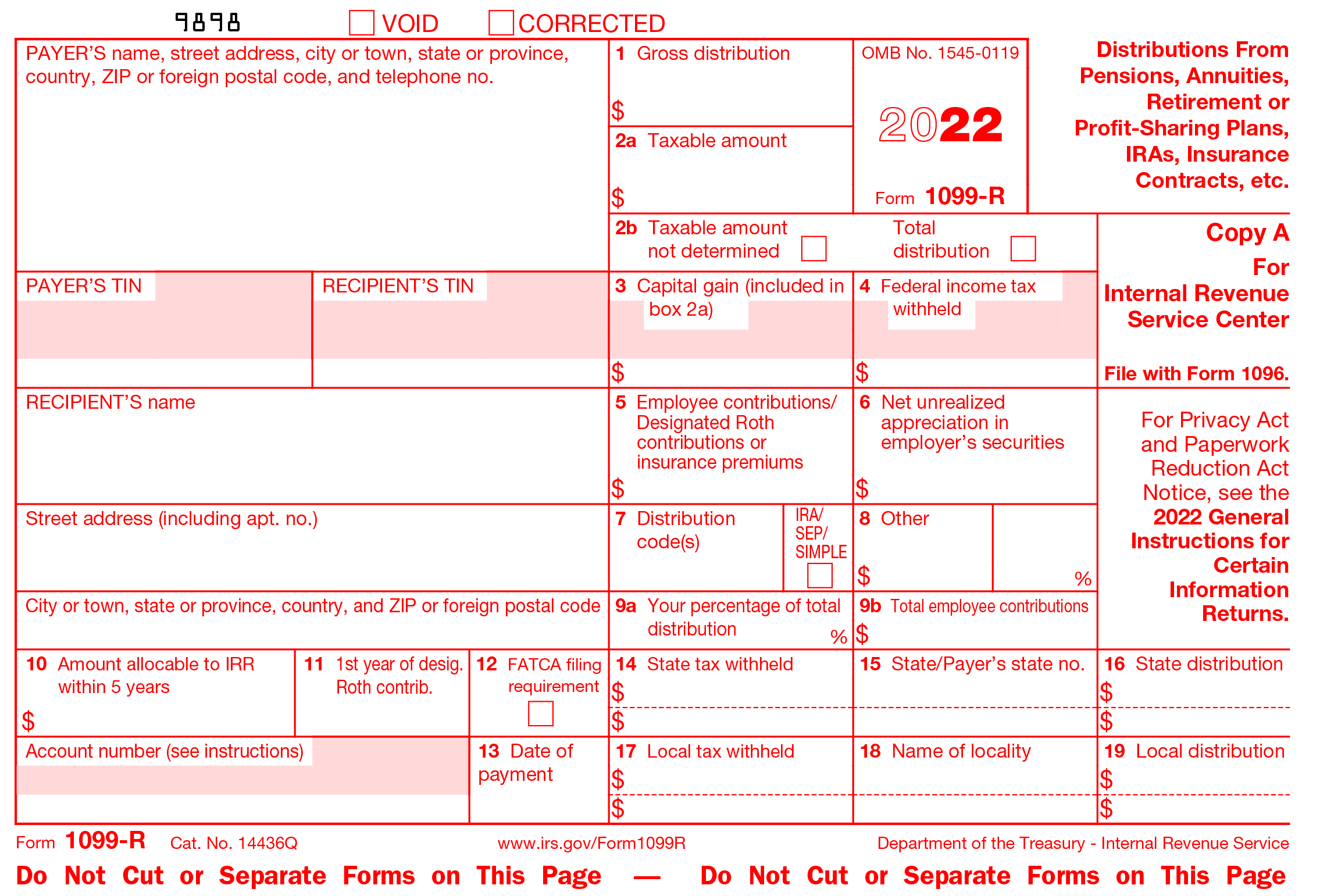

Efile 2022 Form 1099R Report the Distributions from Pensions

Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the.

The 411 On 1099s Who Has To File, And What Happens If You Don't

Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. You need not request an allocation of gross proceeds if spouses are the only transferors. Copy a and b should be. Received a payment and other reporting situations. A penalty may be imposed for filing forms.

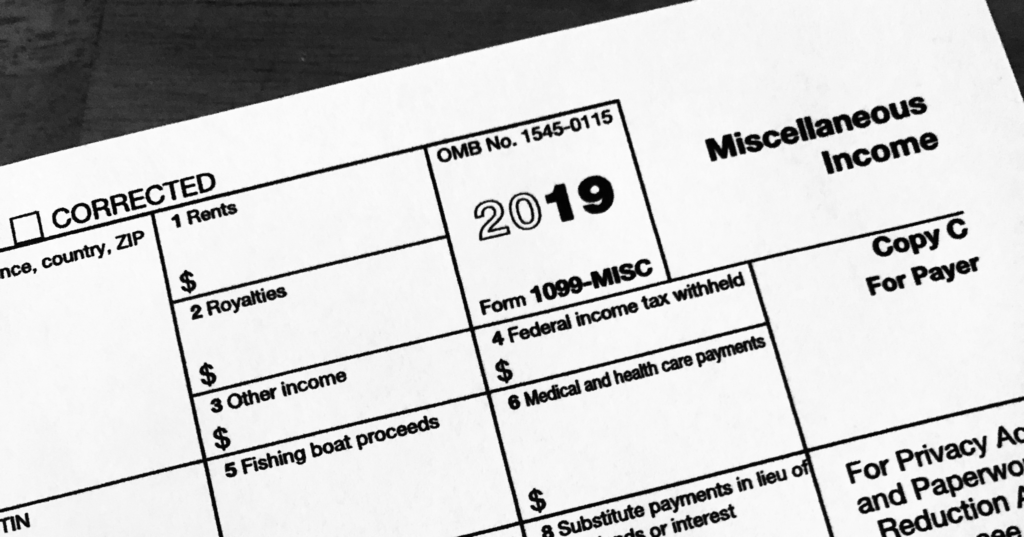

Form 1099 Filing Requirements 2020 Form Resume Examples o7Y31K3o2B

Web the irs requires the payer (the business) to send a copy of the 1099 forms to the payee (freelancer, independent contractor, and vendor) and have the information validated. Not required to file information returns. A penalty may be imposed for filing forms that cannot be scanned. Copy a and b should be. Received a payment and other reporting situations.

1099MISC or 1099NEC? What You Need to Know about the New IRS

Received a payment and other reporting situations. Web form 1099 filing requirements and new changes for 2022 form 1099 reporting requirements (information returns). Web for the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Subsequently, old box numbers 13 through 17.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Medical and health care payments. Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. There are a number of different 1099 forms that report various. Not required to.

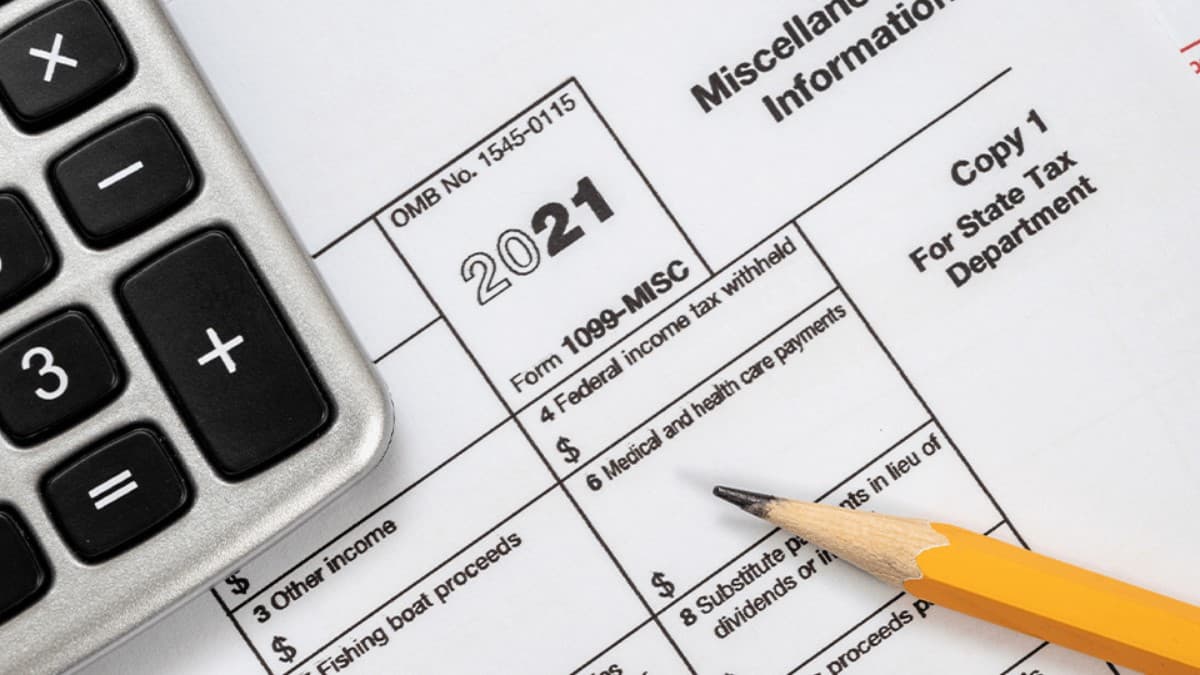

1099MISC Tax Basics

Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Medical and health care payments. A penalty may be imposed for filing forms that cannot be scanned. Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs. Web.

All That You Need To Know About Filing Form 1099MISC Inman

You need not request an allocation of gross proceeds if spouses are the only transferors. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Copy a and b should be. Web the irs requires the payer (the business) to send a copy of the 1099 forms.

1099 Filing Requirements 1099 Forms Zrivo

A penalty may be imposed for filing forms that cannot be scanned. Medical and health care payments. Received a payment and other reporting situations. Web for the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Copy a and b should be.

Web 1099 Deadlines, Penalties & State Filing Requirements For 2022/2023 When Are 1099S Due In 2023:

Received a payment and other reporting situations. Web the official printed version of the irs form is scannable, but the online version of it, printed from the website, is not. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Once, the tax information reported in the 1099 forms is mutually agreed upon by both parties, the payer files the returns with the irs.

Subsequently, Old Box Numbers 13 Through 17 Have Been Renumbered To New Box Numbers 14 Through 18, Respectively.

There are a number of different 1099 forms that report various. You need not request an allocation of gross proceeds if spouses are the only transferors. Copy a and b should be. Web the irs requires the payer (the business) to send a copy of the 1099 forms to the payee (freelancer, independent contractor, and vendor) and have the information validated.

Box Number 13 Has Been Assigned To The Foreign Account Tax Compliance Act (Fatca) Filing Requirement Checkbox.

Web for the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Medical and health care payments. Not required to file information returns. Api client id (a2a filers only) sign in to iris for system availability, check iris status.

Web Form 1099 Filing Requirements And New Changes For 2022 Form 1099 Reporting Requirements (Information Returns).

What you need employer identification number (ein) iris transmitter control code (tcc). A penalty may be imposed for filing forms that cannot be scanned.