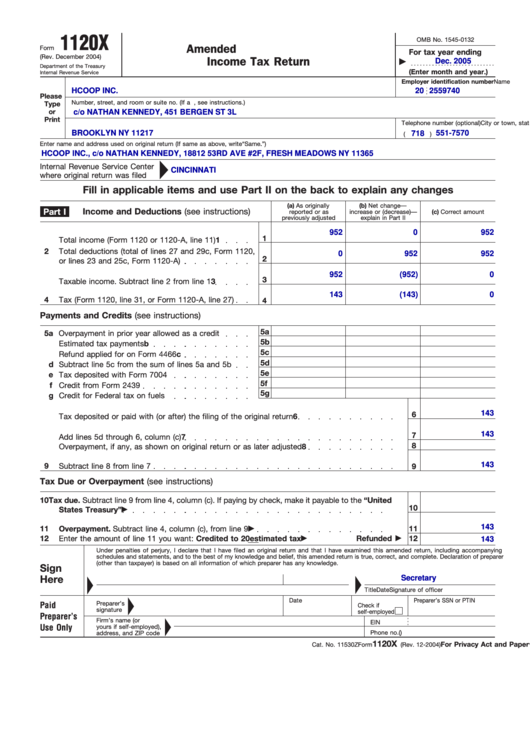

Form 1120-X Instructions

Form 1120-X Instructions - For details, see the instructions for form 2553. See faq #17 for a link to the instructions. Do not use form 1120x to. The program will proceed with the interview questions for you to enter the appropriate information to complete the amended return. Web obtain a tentative refund of taxes due to a net operating loss carryback, a net capital loss carryback, an unused general business credit carryback, or a claim of right adjustment under section 1341 (b) (1) according to the irs, you can use the form to either: And the total assets at the end of the tax year are: Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web mailing addresses for forms 1120. If the corporation’s principal business, office, or agency is located in:

Corporation income tax return, including recent updates, related forms, and instructions on how to file. The program will proceed with the interview questions for you to enter the appropriate information to complete the amended return. Web purpose of form use form 1120x to: And the total assets at the end of the tax year are: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Corporation income tax return, to correct a previously filed form 1120. For details, see the instructions for form 2553. See faq #17 for a link to the instructions. It often takes 3 to 4 months to process form 1120x. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless.

Web mailing addresses for forms 1120. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Photographs of missing children the internal revenue service is a proud partner with the national center for missing & exploited children® (ncmec). For details, see the instructions for form 2553. Do not use form 1120x to. Correct a form 1120 as originally filed See section 6511 for more details and other special rules. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web purpose of form use form 1120x to: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,.

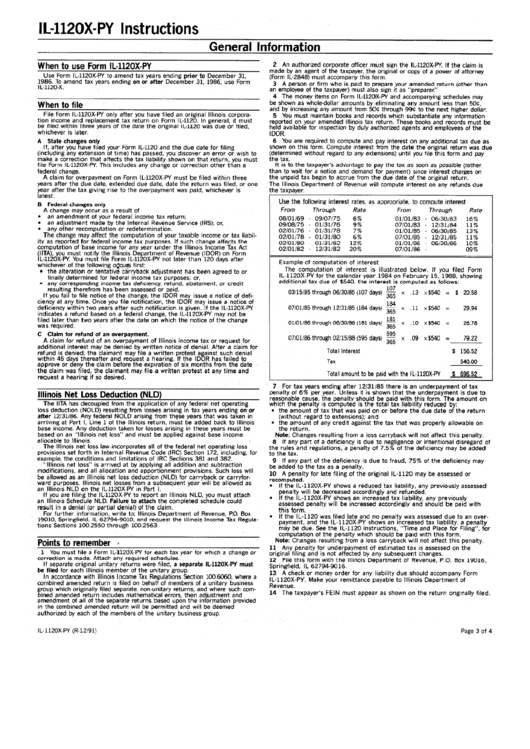

Form Il1120xPy Instructions printable pdf download

Corporation income tax return, to correct a previously filed form 1120. And the total assets at the end of the tax year are: See section 6511 for more details and other special rules. Web obtain a tentative refund of taxes due to a net operating loss carryback, a net capital loss carryback, an unused general business credit carryback, or a.

Form 1120 instructions 2016

For details, see the instructions for form 2553. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security.

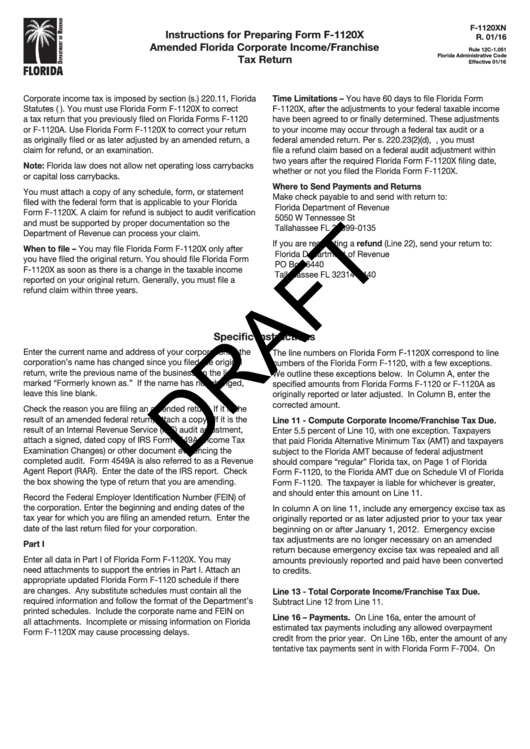

F 1120x Instructions

See section 6511 for more details and other special rules. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. See faq #17 for a link to the instructions. It often takes 3.

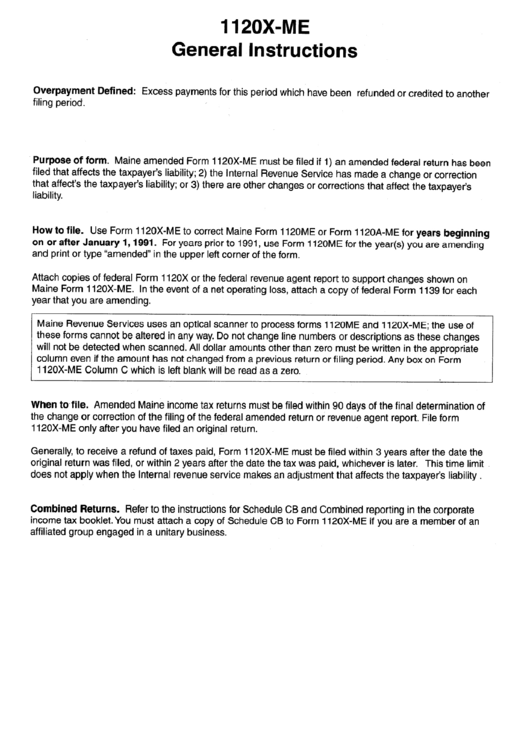

Instructions For Form 1120xMe printable pdf download

See section 6511 for more details and other special rules. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. It often takes 3 to 4 months to process form 1120x. Corporation income.

Instructions For Form F1120x Draft printable pdf download

The program will proceed with the interview questions for you to enter the appropriate information to complete the amended return. It often takes 3 to 4 months to process form 1120x. Web obtain a tentative refund of taxes due to a net operating loss carryback, a net capital loss carryback, an unused general business credit carryback, or a claim of.

Federal Form 1120 Schedule E Instructions Bizfluent

Corporation income tax return, to correct a previously filed form 1120. It often takes 3 to 4 months to process form 1120x. Web mailing addresses for forms 1120. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the.

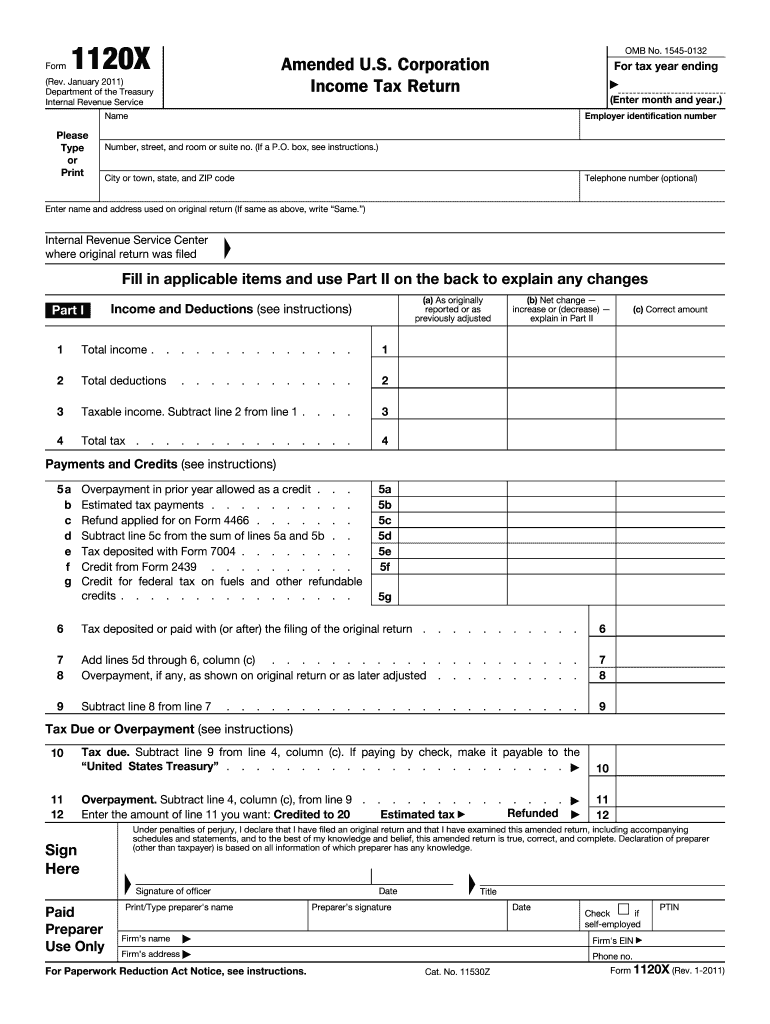

Form 1120X Fill Out and Sign Printable PDF Template signNow

Do not use form 1120x to. The program will proceed with the interview questions for you to enter the appropriate information to complete the amended return. And the total assets at the end of the tax year are: Web purpose of form use form 1120x to: Corporation income tax return, including recent updates, related forms, and instructions on how to.

Form 1120x Amended U.s. Corporation Tax Return printable pdf

For details, see the instructions for form 2553. Web mailing addresses for forms 1120. See section 6511 for more details and other special rules. If the corporation’s principal business, office, or agency is located in: Corporation income tax return, including recent updates, related forms, and instructions on how to file.

Irs Instructions Form 1120s Fillable and Editable PDF Template

For details, see the instructions for form 2553. Photographs of missing children the internal revenue service is a proud partner with the national center for missing & exploited children® (ncmec). Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Corporation income tax return, including recent updates, related forms, and instructions on how.

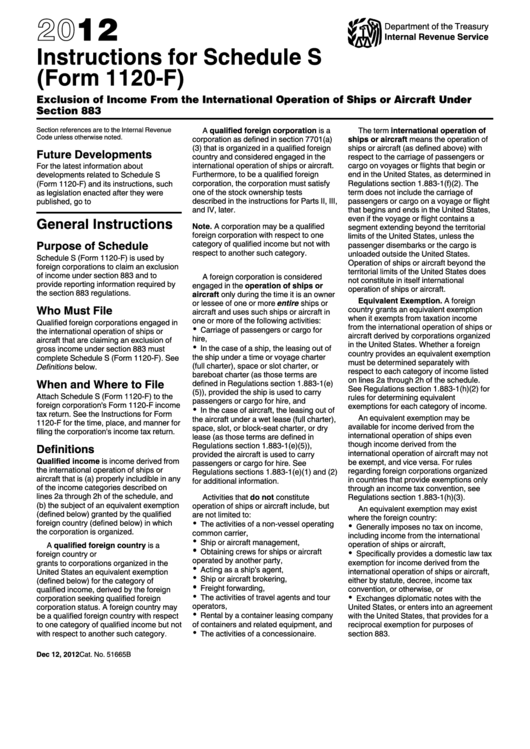

Instructions For Schedule S (Form 1120F) 2012 printable pdf download

If the corporation’s principal business, office, or agency is located in: Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, to correct a previously filed form 1120. Photographs.

See Section 6511 For More Details And Other Special Rules.

It often takes 3 to 4 months to process form 1120x. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. For details, see the instructions for form 2553. Do not use form 1120x to.

Corporation Income Tax Return, To Correct A Previously Filed Form 1120.

And the total assets at the end of the tax year are: Photographs of missing children the internal revenue service is a proud partner with the national center for missing & exploited children® (ncmec). Correct a form 1120 as originally filed Corporation income tax return, including recent updates, related forms, and instructions on how to file.

Web Obtain A Tentative Refund Of Taxes Due To A Net Operating Loss Carryback, A Net Capital Loss Carryback, An Unused General Business Credit Carryback, Or A Claim Of Right Adjustment Under Section 1341 (B) (1) According To The Irs, You Can Use The Form To Either:

Web purpose of form use form 1120x to: If the corporation’s principal business, office, or agency is located in: Web mailing addresses for forms 1120. The program will proceed with the interview questions for you to enter the appropriate information to complete the amended return.

Web A Form 1120X Based On A Bad Debt Or Worthless Security Must Be Filed Within 7 Years After The Due Date Of The Return For The Tax Year In Which The Debt Or Security Became Worthless.

See faq #17 for a link to the instructions.