Form 1120A Instructions

Form 1120A Instructions - Florida corporate income/franchise tax return for 2022 tax year. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. However, an association with a fiscal year ending. Once document is finished, press done. Web florida partnership information return with instructions: Use this form to report the. Easy guidance & tools for c corporation tax returns. Generally, a corporation must file its income tax return by the 15th day of the 4th month after the end of its tax. 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my.

Sign online button or tick the preview image of the document. Web information about form 1120, u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web florida partnership information return with instructions: Corporation income tax return, including recent updates, related forms, and instructions on how to file. To get started on the form, use the fill camp; 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Additions to tax listed on pages 17 and 19 in • frequently requested tax. Use this form to report the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the.

Web 8 capital gain net income (attach schedule d (form 1120)) 8 net gain or (loss) from form 4797, part ii, line 17 (attach form 4797)9 10 other income (see instructions—attach. Use this form to report the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Easy guidance & tools for c corporation tax returns. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web instructions for form 1120s userid: Income tax liability of a foreign. Additions to tax listed on pages 17 and 19 in • frequently requested tax. Web florida partnership information return with instructions: Web for more information, visit irs.gov/ businesses.

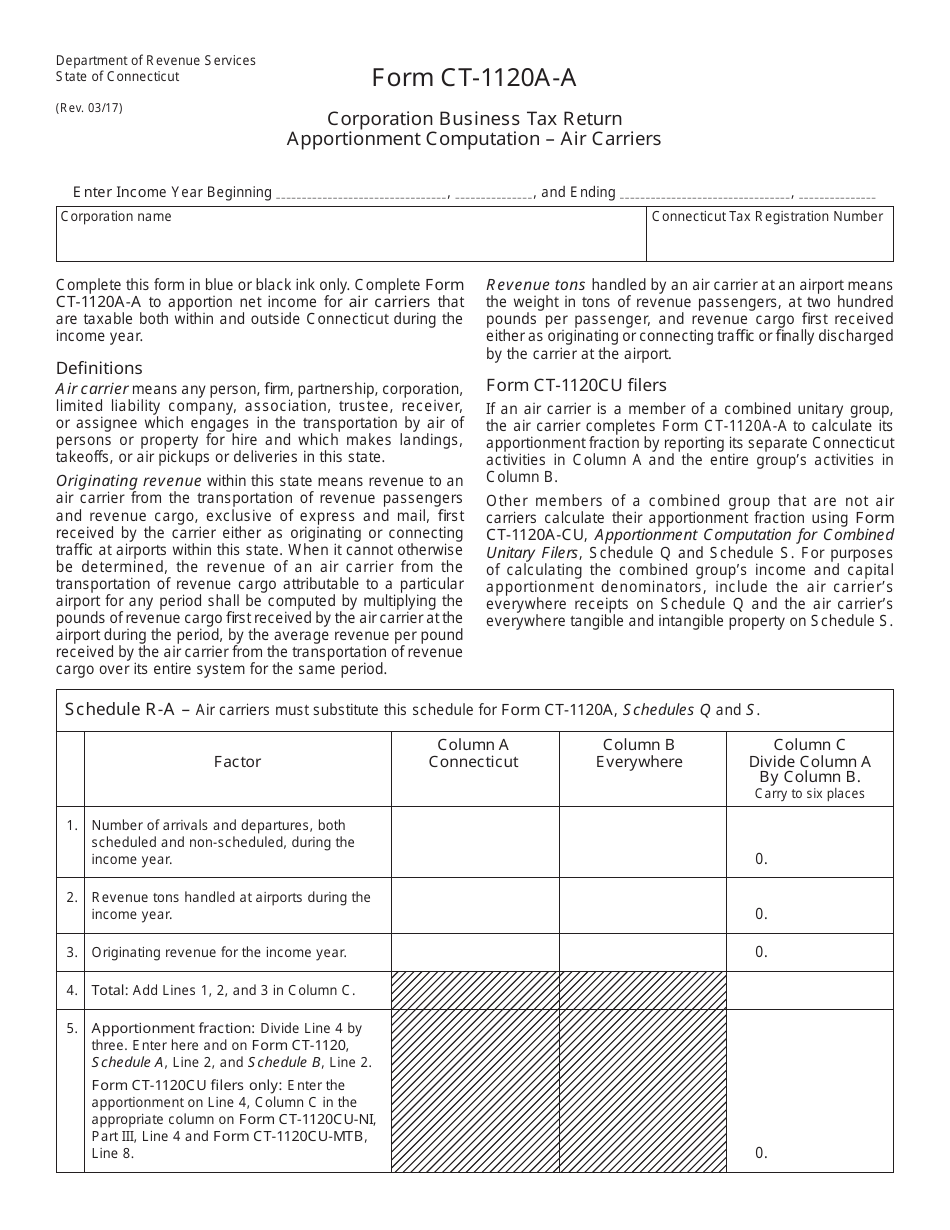

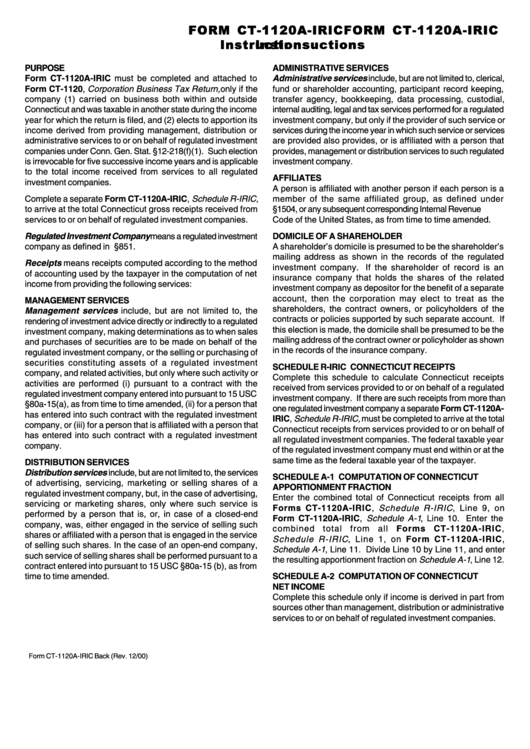

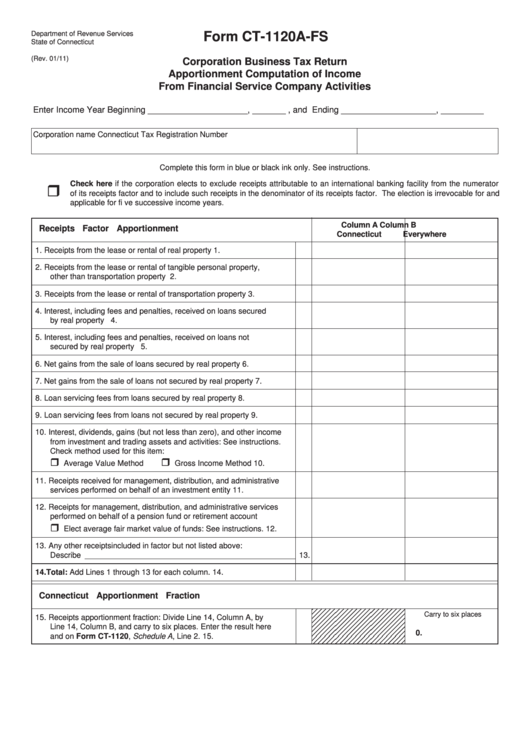

Form CT1120AA Download Printable PDF or Fill Online Corporation

Web instructions for form 1120, schedule j, part i, lines 5a through 5e, or the instructions for the applicable lines and schedule of other income tax returns. Web 8 capital gain net income (attach schedule d (form 1120)) 8 net gain or (loss) from form 4797, part ii, line 17 (attach form 4797)9 10 other income (see instructions—attach. 9.5 draft.

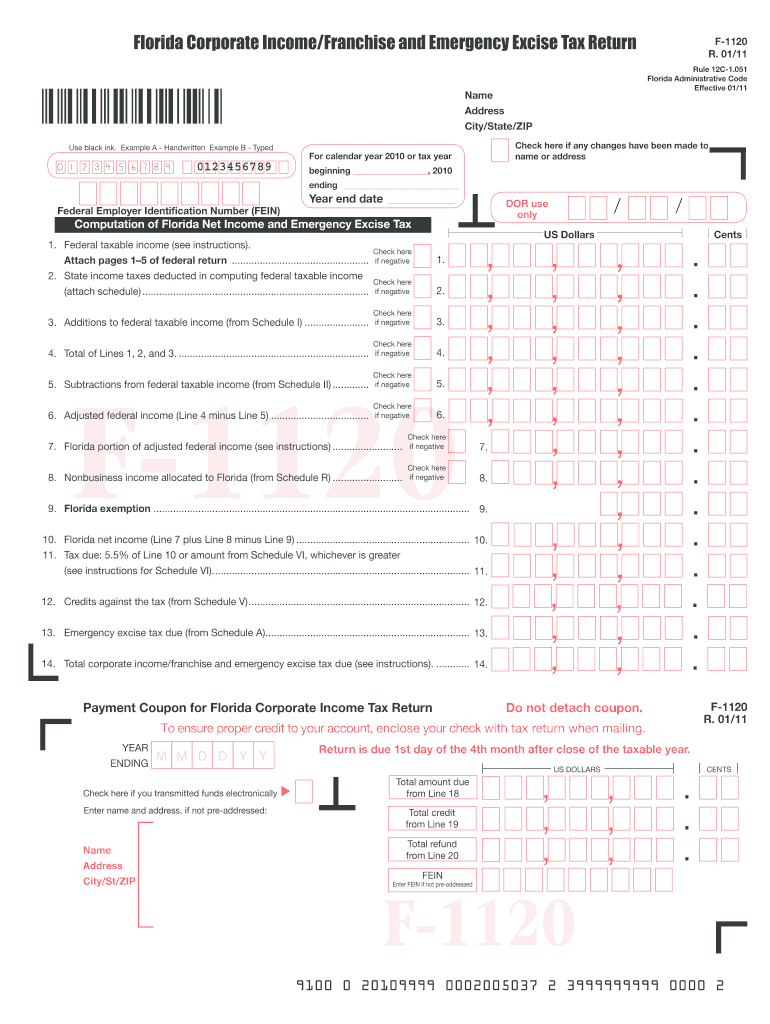

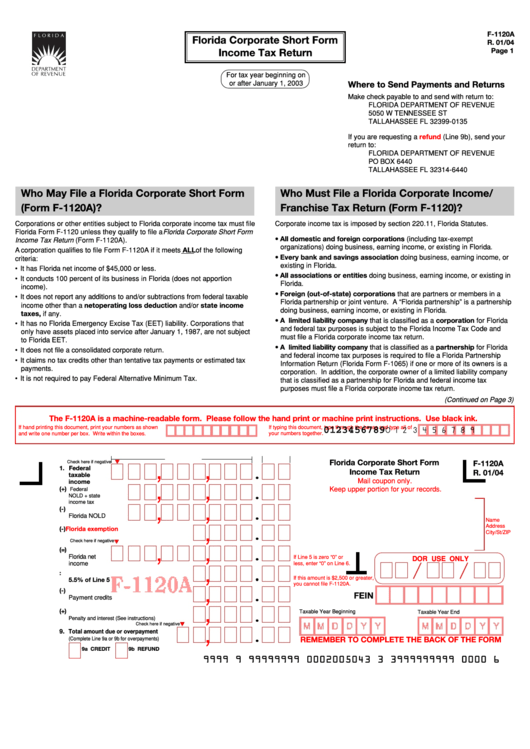

2011 Form FL DoR F1120 Fill Online, Printable, Fillable, Blank pdfFiller

Use this form to report the. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Florida corporate income/franchise tax return for 2022 tax year. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Additions to.

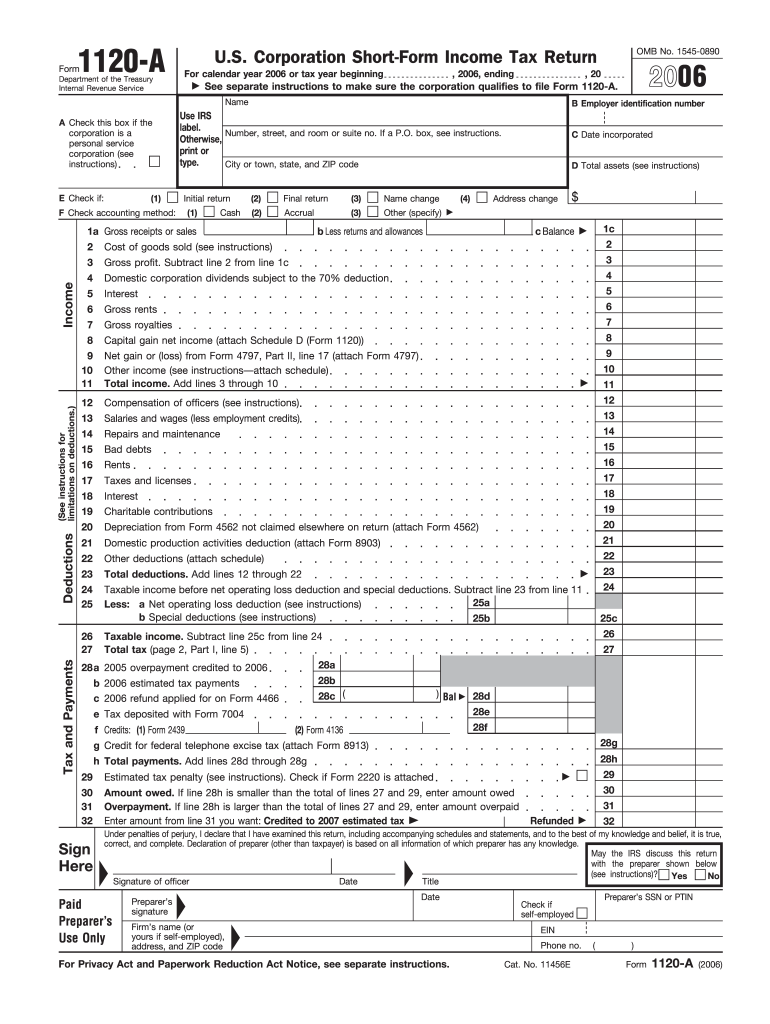

1120A Fill Out and Sign Printable PDF Template signNow

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Sign online button or tick the preview image of the document. However, an association with a fiscal year ending. 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Corporation income tax return, including recent updates, related forms and instructions on how to file.

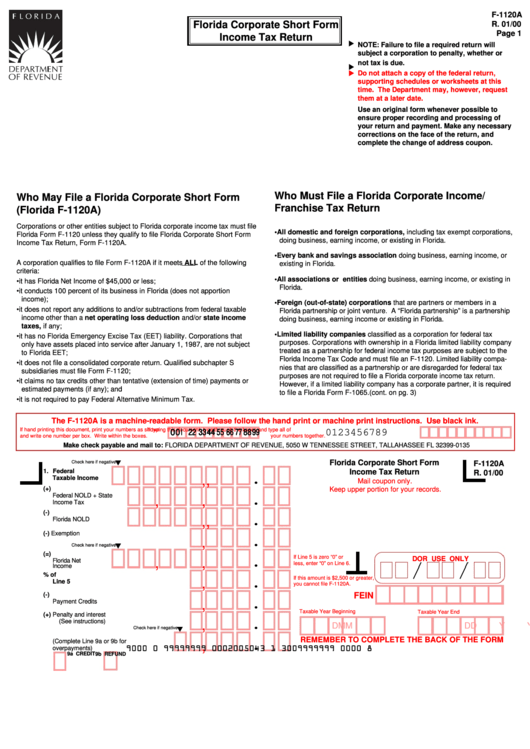

Form F 1120a Florida Corporate Short Form Tax Return printable

Once document is finished, press done. Web florida partnership information return with instructions: However, an association with a fiscal year ending. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Sign online button or tick the preview image of the document.

Form F1120a Florida Corporate Short Form Tax Return printable

Web 8 capital gain net income (attach schedule d (form 1120)) 8 net gain or (loss) from form 4797, part ii, line 17 (attach form 4797)9 10 other income (see instructions—attach. Web information about form 1120, u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Once document is finished, press done..

Form 1120A Edit, Fill, Sign Online Handypdf

Sign online button or tick the preview image of the document. Use this form to report the. Web instructions for form 1120, schedule j, part i, lines 5a through 5e, or the instructions for the applicable lines and schedule of other income tax returns. Additions to tax listed on pages 17 and 19 in • frequently requested tax. 9.5 draft.

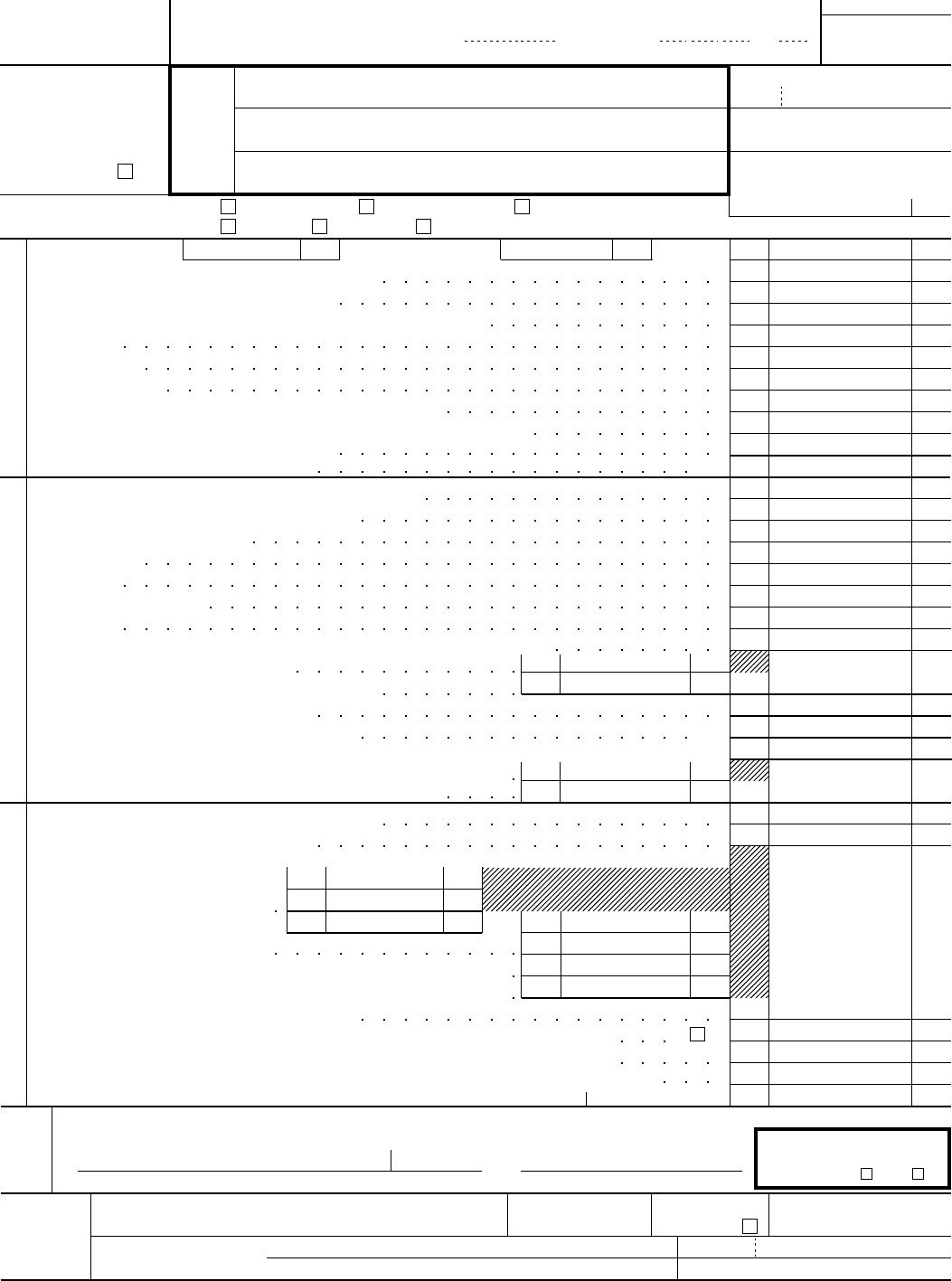

Fillable Form Ia 1120a Iowa Corporation Tax Return Short

Web instructions for form 1120, schedule j, part i, lines 5a through 5e, or the instructions for the applicable lines and schedule of other income tax returns. Web florida partnership information return with instructions: Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. However, an association with a fiscal year ending. Corporation income.

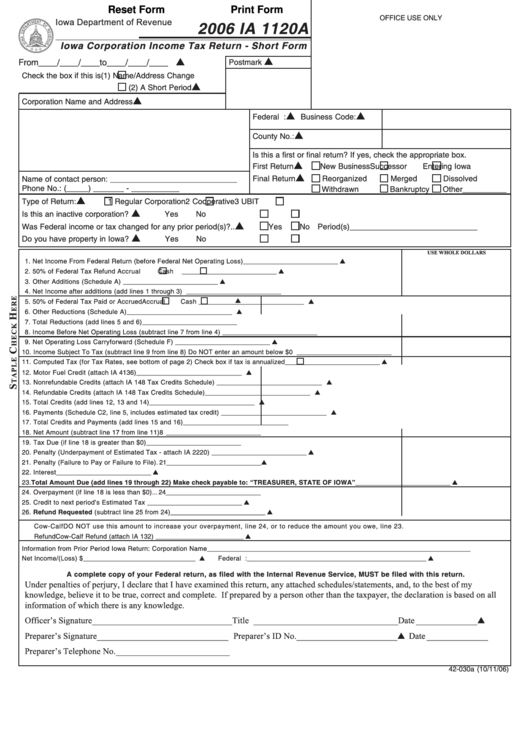

Instructions For Form Ct1120aIric 2000 printable pdf download

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Income tax liability of a foreign. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web information about form 1120, u.s. Web instructions for form 1120, schedule j, part i, lines 5a through 5e, or the instructions.

Form Ct1120aFs Corporation Business Tax Return Apportionment

Generally, a corporation must file its income tax return by the 15th day of the 4th month after the end of its tax. However, an association with a fiscal year ending. 9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web enter on form.

FL F1120A 2019 Fill out Tax Template Online US Legal Forms

Florida corporate income/franchise tax return for 2022 tax year. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Income tax liability of a foreign. Web for more information, visit irs.gov/ businesses. Use this form to report the.

Sign Online Button Or Tick The Preview Image Of The Document.

9.5 draft ok to print pager/xmlfileid:c:\documents and settings\ny3hb\my. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web for more information, visit irs.gov/ businesses. Florida corporate income/franchise tax return for 2022 tax year.

Corporation Income Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Web instructions for form 1120s userid: Income tax liability of a foreign. Corporation income tax return, including recent updates, related forms and instructions on how to file. Easy guidance & tools for c corporation tax returns.

Once Document Is Finished, Press Done.

Web instructions for form 1120, schedule j, part i, lines 5a through 5e, or the instructions for the applicable lines and schedule of other income tax returns. Use this form to report the. However, an association with a fiscal year ending. Web information about form 1120, u.s.

Web 8 Capital Gain Net Income (Attach Schedule D (Form 1120)) 8 Net Gain Or (Loss) From Form 4797, Part Ii, Line 17 (Attach Form 4797)9 10 Other Income (See Instructions—Attach.

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the. Additions to tax listed on pages 17 and 19 in • frequently requested tax. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Generally, a corporation must file its income tax return by the 15th day of the 4th month after the end of its tax.