Form 13844 Irs

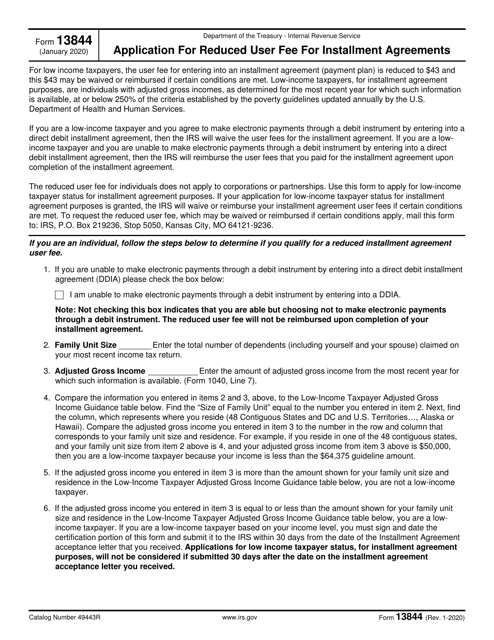

Form 13844 Irs - Web you should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. Not paying your taxes when they are due may cause the filing of a notice of federal tax lien and/or an irs levy action. Web form 13844, application for reduced user fee for installment agreements, is used to request the reduction. Web what is irs form 13844? Start completing the fillable fields and carefully type in required information. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. How do i set up an installment plan? Irs form 13844, application for reduced user fee for installment agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. Use the cross or check marks in the top toolbar to select your answers in the list boxes.

How do i set up an installment plan? Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web what is irs form 13844? Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. The irs is working to automate the application process to calculate the appropriate user fees up front, eventually phasing out form 13844. Web quick steps to complete and design ir's form 13844 online: Not paying your taxes when they are due may cause the filing of a notice of federal tax lien and/or an irs levy action. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Web you should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. Irs form 13844, application for reduced user fee for installment agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges.

Web you should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. The irs is working to automate the application process to calculate the appropriate user fees up front, eventually phasing out form 13844. Web what is irs form 13844? Use the cross or check marks in the top toolbar to select your answers in the list boxes. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Not paying your taxes when they are due may cause the filing of a notice of federal tax lien and/or an irs levy action. 13844 (january 2018) application for reduced user fee for installment agreements. How do i set up an installment plan? Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design ir's form 13844 online:

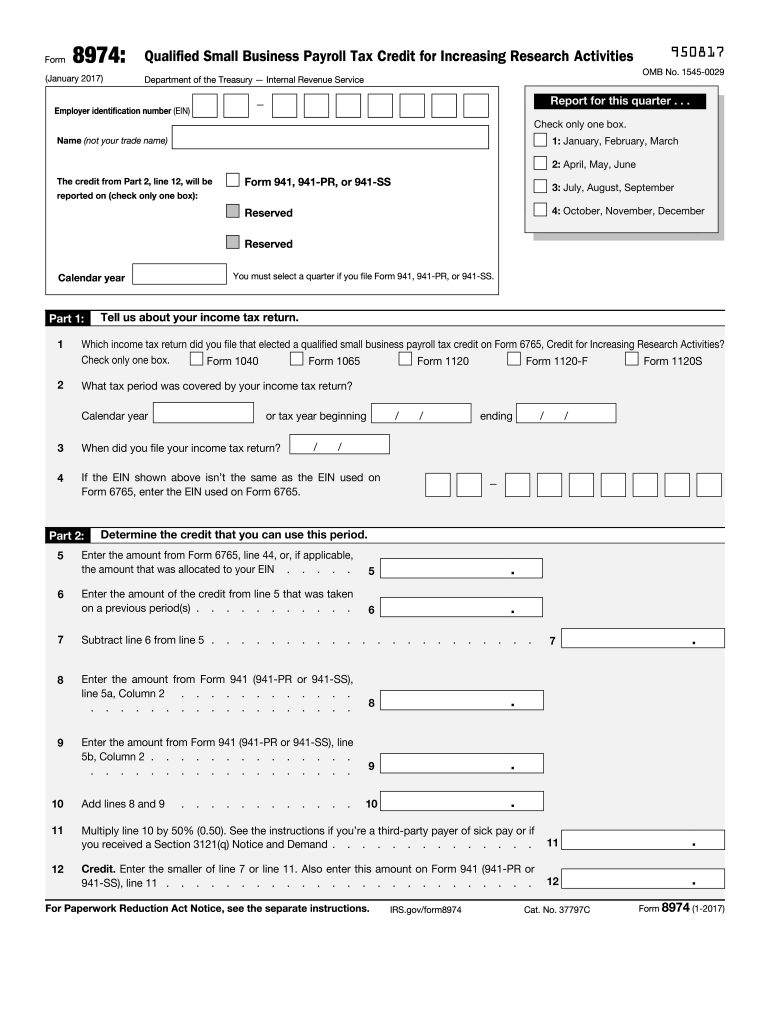

IRS 8974 2017 Fill and Sign Printable Template Online US Legal Forms

How do i set up an installment plan? Web quick steps to complete and design ir's form 13844 online: Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Not paying your taxes when they are due may cause.

IRS Form 13844 Download Fillable PDF or Fill Online Application for

The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Irs form 13844, application for reduced user fee for installment agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. Web what is irs form 13844? Web.

What Is FATCA and What Does It Mean for Investors?

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web what is irs form 13844? 13844 (january 2018) application for reduced user fee for installment agreements. Start completing the fillable fields and carefully type in required information. Irs form 13844, application for reduced user fee for installment agreements, is the tax.

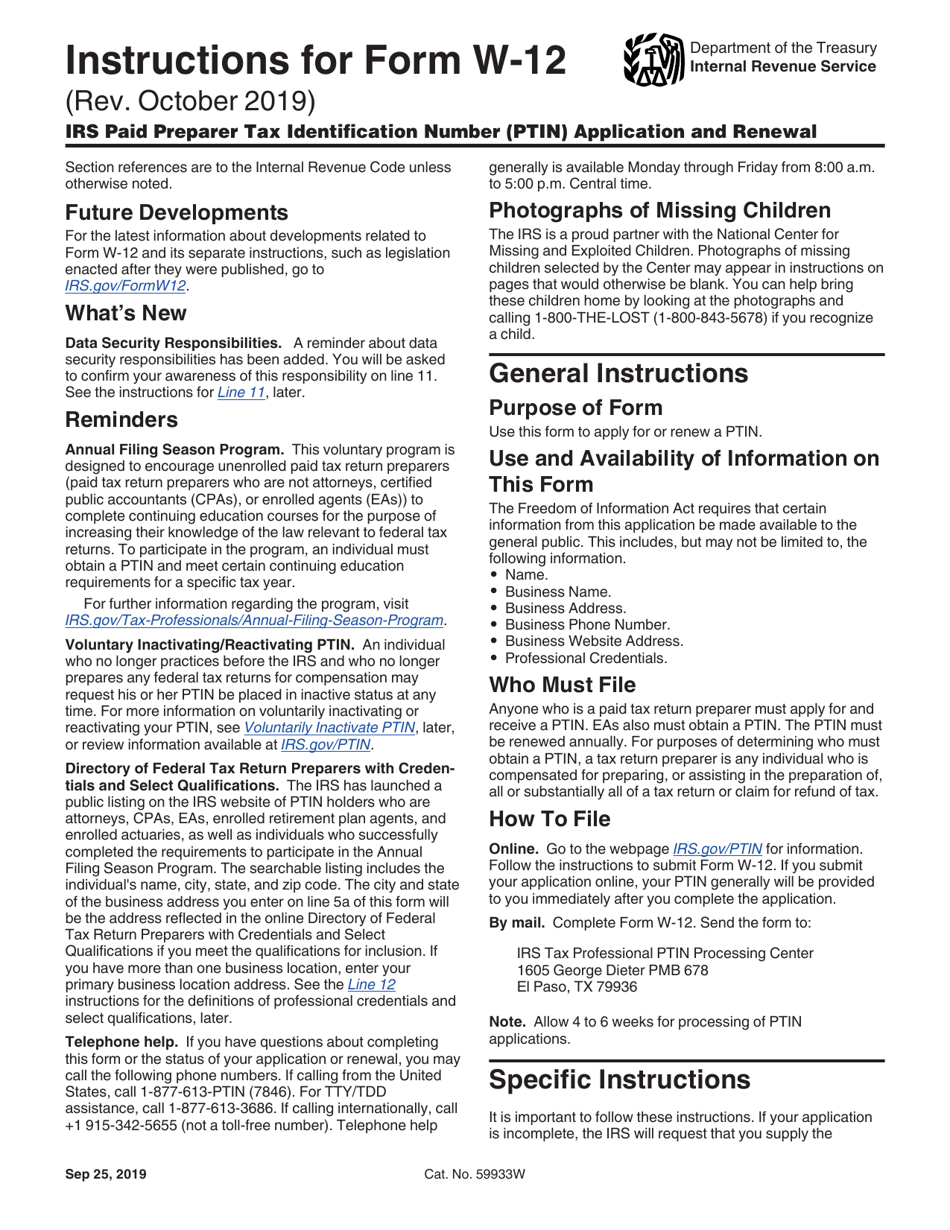

Download Instructions for IRS Form W12 IRS Paid Preparer Tax

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web quick steps to complete and design ir's form 13844 online: Not paying your taxes when they are due may cause the filing of a notice of federal tax lien and/or an irs levy action. The user fee for entering into an.

IRS Instruction 2441 20202022 Fill out Tax Template Online US

Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. The irs is working to automate the application process to calculate the appropriate user fees up front, eventually phasing out form 13844. Web you should request a payment plan.

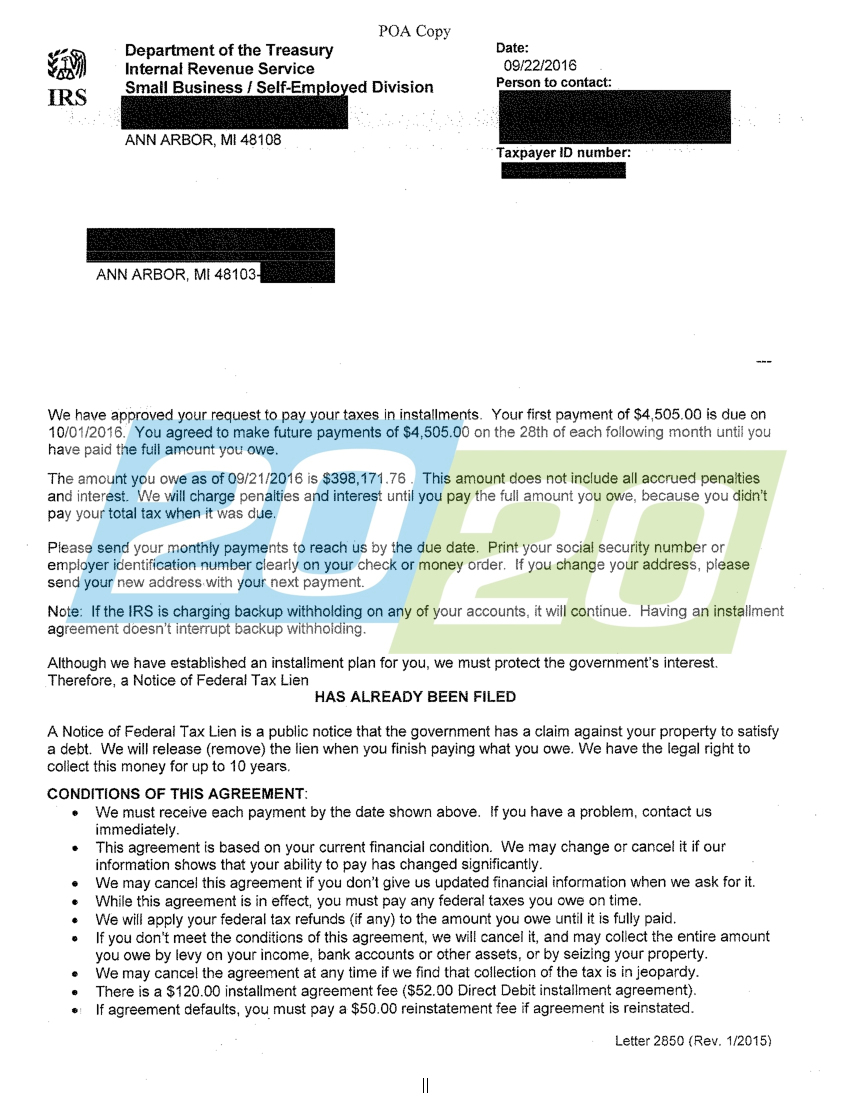

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Irs form 13844, application for reduced user fee for installment agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Use the cross or check marks in.

Fill Free fillable Form 13844 2019 Application Reduced User Fee

Start completing the fillable fields and carefully type in required information. Web what is irs form 13844? The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Web form 13844, application for reduced user fee for installment agreements, is used to request the reduction. Irs form 13844, application for reduced.

IRS Form 13844 Guide to Application for Reduced User Fee Community Tax

13844 (january 2018) application for reduced user fee for installment agreements. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Web form 13844, application for reduced user fee for installment agreements, is used to request the reduction. How do i set up an installment plan? Web we last updated.

Form 13844 Application for Reduced User Fee for Installment

Web you should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. 13844 (january 2018) application for reduced user fee for installment agreements. Web form 13844, application for reduced user fee for installment agreements, is used to request the reduction. Start completing the fillable fields and carefully.

IRS Form 13844 Instructions Reduced User Fee Application

13844 (january 2018) application for reduced user fee for installment agreements. Use the cross or check marks in the top toolbar to select your answers in the list boxes. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Not paying your taxes when they are due may cause the.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Start completing the fillable fields and carefully type in required information. Web what is irs form 13844? Web quick steps to complete and design ir's form 13844 online: The irs is working to automate the application process to calculate the appropriate user fees up front, eventually phasing out form 13844.

The User Fee For Entering Into An Installment Agreement After January 1, 2007 May Be Reduced To $43 For Individuals

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Irs form 13844, application for reduced user fee for installment agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. How do i set up an installment plan? Web you should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame.

Not Paying Your Taxes When They Are Due May Cause The Filing Of A Notice Of Federal Tax Lien And/Or An Irs Levy Action.

13844 (january 2018) application for reduced user fee for installment agreements. Web form 13844, application for reduced user fee for installment agreements, is used to request the reduction. Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022.