Form 13873 T

Form 13873 T - Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Web video instructions and help with filling out and completing irs tax credit. Web irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Qualifying foreign trade income generally, qualifying. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Any version of irs form 13873 is acceptable, as long as it contains a clear indication. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Any version of irs form 13873 that clearly states that the form is provided to the. So, was the letter clear as to what the irs was. Web there are several versions of irs form 13873 (e.g.

Section a — foreign trade income. So, was the letter clear as to what the irs was. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Get ready for tax season deadlines by completing any required tax forms today. Web we cannot accept the following forms in place of the irs verification of nonfiling letter: Any version of irs form 13873 that clearly states that the form is provided to the individual as. Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. Qualifying foreign trade income generally, qualifying.

Get ready for tax season deadlines by completing any required tax forms today. Attach a tabular schedule to the partially. Complete, edit or print tax forms instantly. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Ad access irs tax forms. Any version of irs form 13873 is acceptable, as long as it contains a clear indication. Any version of irs form 13873 that clearly states that the form is provided to the. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Web irs form 13873t.

하자, 감액, 지체상금확인서 샘플, 양식 다운로드

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g. Get ready for tax season deadlines by completing any required tax forms today.

Irs W9 Forms 2020 Printable Pdf Example Calendar Printable

So, was the letter clear as to what the irs was. Web irs form 13873t. Qualifying foreign trade income generally, qualifying. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Section a — foreign trade income.

Form 1310 Instructions Claiming a Refund on Behalf of a Deceased

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Section a — foreign trade income. So, was the letter clear as to what the irs was. Any version of irs form 13873 that clearly states that the form is provided to the.

34 Which Bank Issued This Deposit Slip Info Uang Online

If you are not using marginal costing, skip part iii and go to part iv. Web there are several versions of irs form 13873 (e.g. Section a — foreign trade income. Web video instructions and help with filling out and completing irs tax credit. Also check box (1) (b) of line 5c.

How to Obtain the NonFiling Letter from the IRS, Students Fill Online

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Web video instructions and help with filling out and completing irs tax credit. Get ready for tax season deadlines by completing any required tax forms today. Web there are several versions of irs form.

Part Number 13873

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Section a — foreign trade income. Attach a tabular schedule to the partially. Ad access irs tax forms. Also check box (1) (b) of line 5c.

Part Number 13873

Any version of irs form 13873 that clearly states that the form is provided to the. Get ready for tax season deadlines by completing any required tax forms today. Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g. Web video instructions and help with filling out and completing irs.

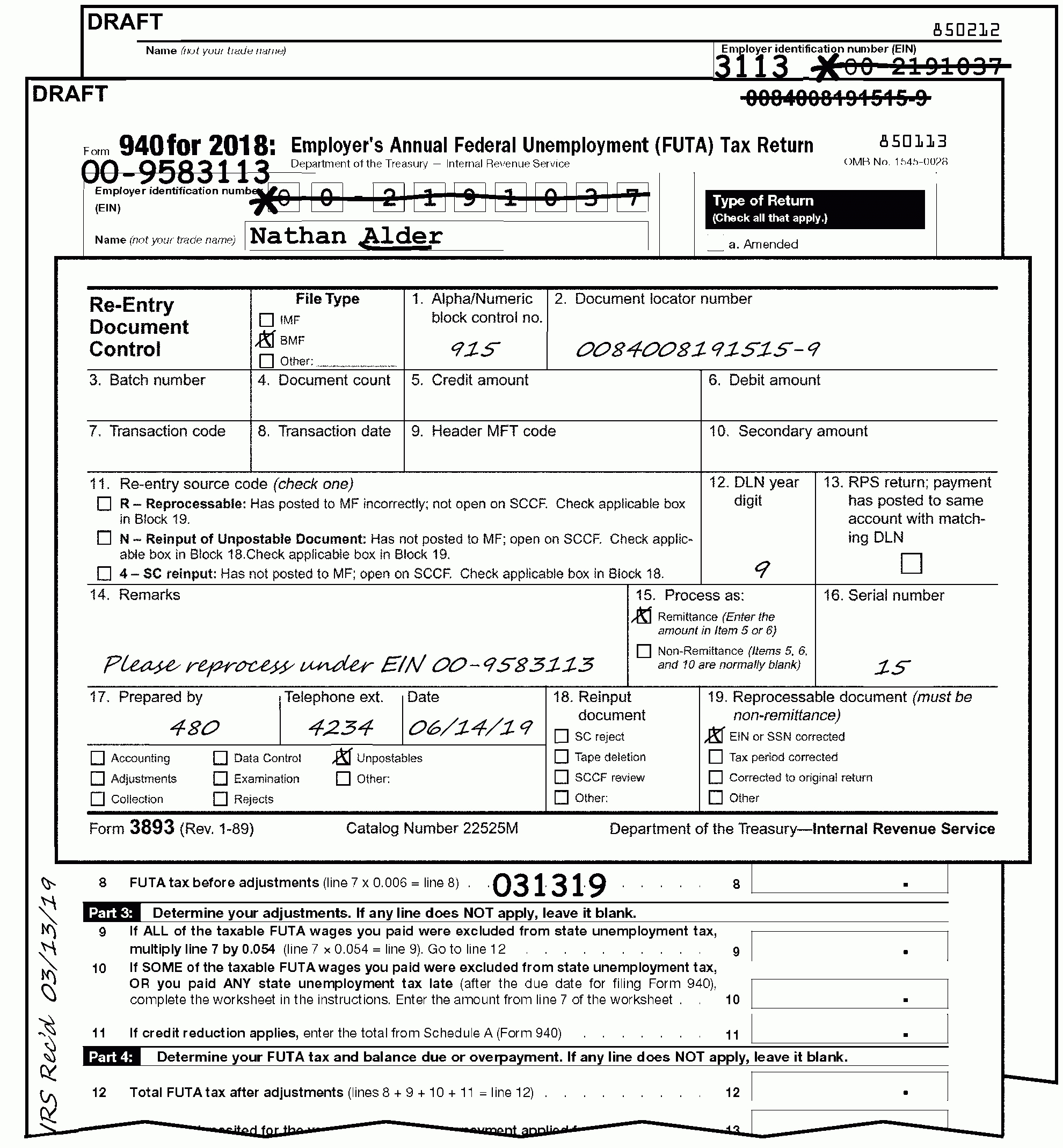

form 13873t Fill Online, Printable, Fillable Blank

So, was the letter clear as to what the irs was. Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web irs form 13873t.

2010 Form IRS 433F Fill Online, Printable, Fillable, Blank PDFfiller

Also check box (1) (b) of line 5c. Section a — foreign trade income. Attach a tabular schedule to the partially. Web irs form 13873t. Get ready for tax season deadlines by completing any required tax forms today.

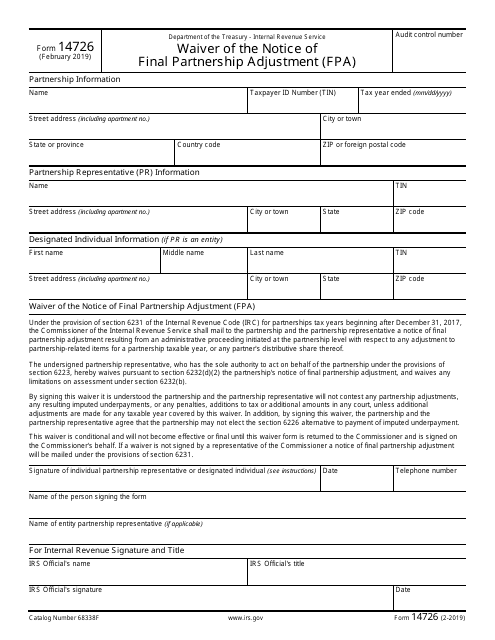

IRS Form 14726 Download Fillable PDF or Fill Online Waiver of the

Section a — foreign trade income. Ad access irs tax forms. Any version of irs form 13873 that clearly states that the form is provided to the individual as. So, was the letter clear as to what the irs was. Attach a tabular schedule to the partially.

Web Irs Taxpayer Assistance Centers New 1040 Form For Older Adults The Irs Has Released A New Tax Filing Form For People 65 And Older.

Also check box (1) (b) of line 5c. Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g. Qualifying foreign trade income generally, qualifying.

Web To Do So, File One Form 8873 Entering Only Your Name And Identifying Number At The Top Of The Form.

Web video instructions and help with filling out and completing irs tax credit. Any version of irs form 13873 that clearly states that the form is provided to the individual as. If you are not using marginal costing, skip part iii and go to part iv. Web we cannot accept the following forms in place of the irs verification of nonfiling letter:

Any Version Of Irs Form 13873 Is Acceptable, As Long As It Contains A Clear Indication.

So, was the letter clear as to what the irs was. Web there are several versions of irs form 13873 (e.g. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower. Ad access irs tax forms.

Any Version Of Irs Form 13873 That Clearly States That The Form Is Provided To The.

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Section a — foreign trade income. Get ready for tax season deadlines by completing any required tax forms today.