Form 15G Download

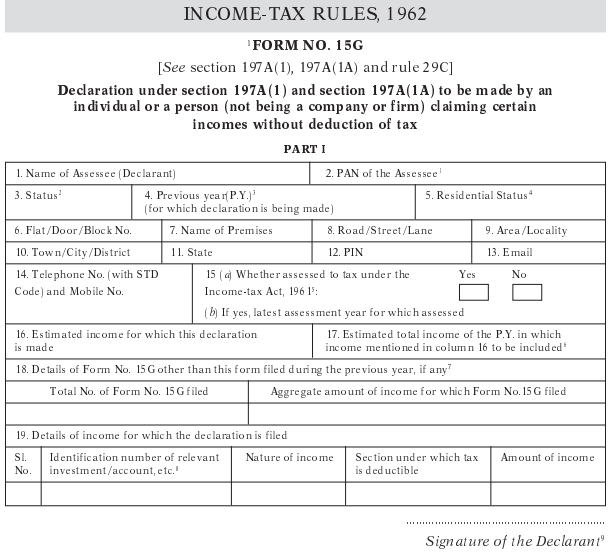

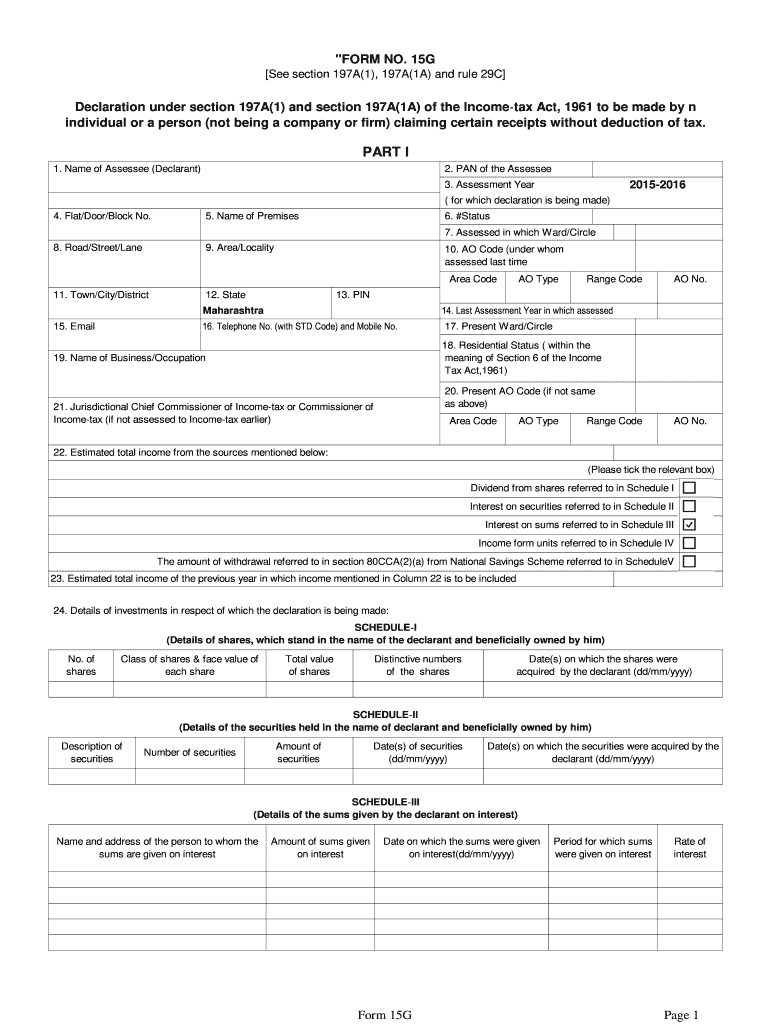

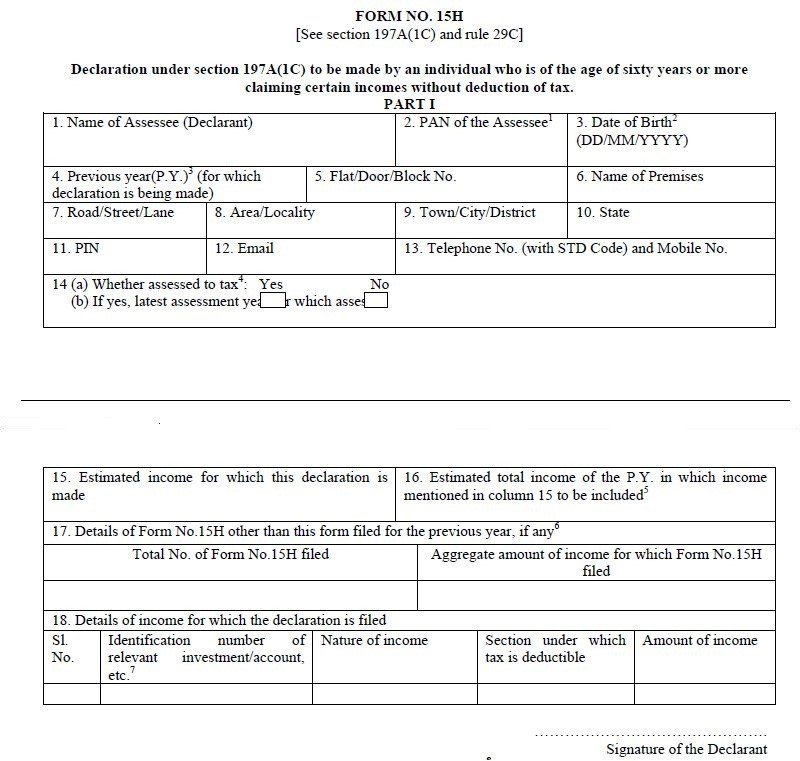

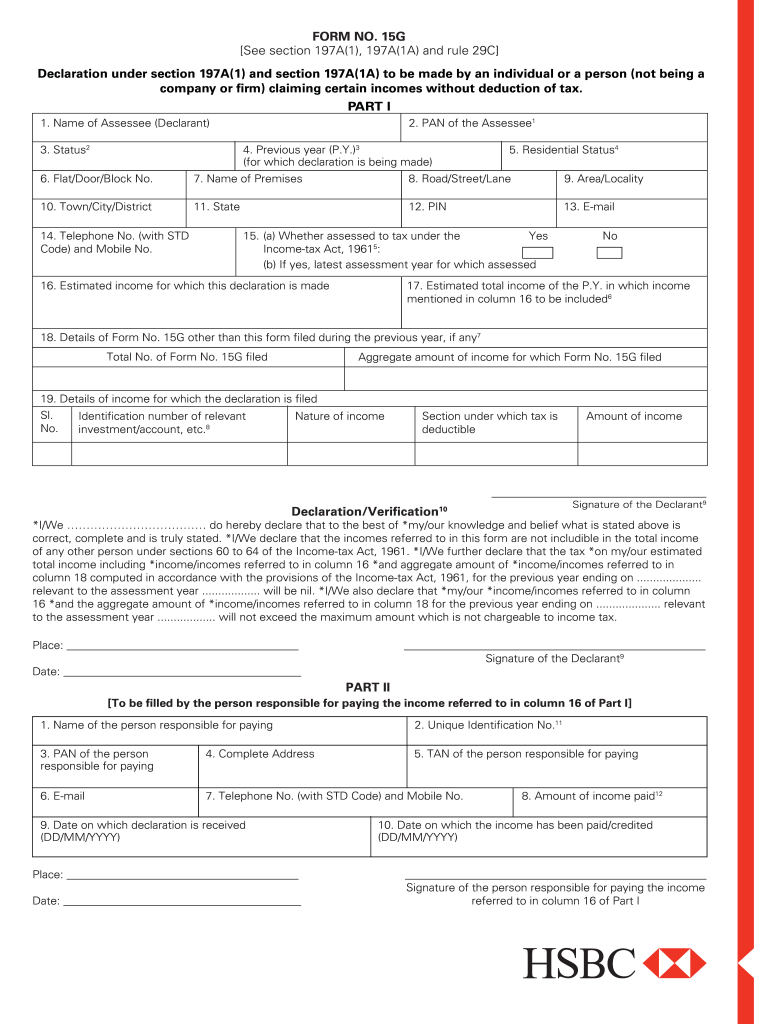

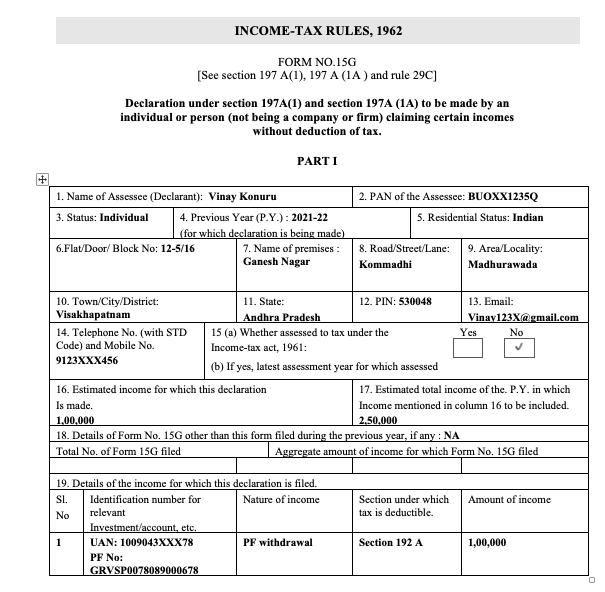

Form 15G Download - Additionally, this form can also be easily downloaded from the income tax department website. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Web you can get form 15g from epfo’s online portal or the websites of major banks. Click on “online services” and then go to “online claim” and fill in the required details. Choose the part you want to fill from the dropdown and click continue. Fill details on the remitter, remittee and remittance details. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act, 1961 to be made ‐ by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article.

Click on “online services” and then go to “online claim” and fill in the required details. Furthermore, you can also visit the income. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Fill details on the remitter, remittee and remittance details. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on the official income tax department website. Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. The general instructions is provided in the utility. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Web you can get form 15g from epfo’s online portal or the websites of major banks.

Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Web you can download pf withdrawal form 15g from the online portal of epfo. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Choose the part you want to fill from the dropdown and click continue. Additionally, this form can also be easily downloaded from the income tax department website. Click on “online services” and then go to “online claim” and fill in the required details. Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Web you can get form 15g from epfo’s online portal or the websites of major banks.

Form 15G How to Download Form 15G Online

Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Click the form 15ca option. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo.

Download Form 15G for PF Withdrawal 2022

Web you can download pf withdrawal form 15g from the online portal of epfo. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. 15g [see section 197a(1c), 197a(1a).

Form 15g Download In Word Format Fill Online, Printable, Fillable

Click the form 15ca option. Web you can get form 15g from epfo’s online portal or the websites of major banks. Fill details on the remitter, remittee and remittance details. Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Web.

Form 15g Taxguru Securities (Finance) Mutual Funds Free 30day

Additionally, this form can also be easily downloaded from the income tax department website. Click the form 15ca option. Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Click on “online services” and then go to “online claim” and fill in the required details. Web you can get form.

What is Form 15G? How to Download & Fill Form Online 15G for PF

Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Web you can download pf withdrawal form 15g from the online portal of epfo. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Form 15g pf withdrawal pdf to.

How To Fill New Form 15G / Form 15H roy's Finance

Part i name of assessee (declarant) pan of the assessee Additionally, this form can also be easily downloaded from the income tax department website. Web you can get form 15g from epfo’s online portal or the websites of major banks. Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Part i name of assessee (declarant) pan of the assessee 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration.

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Click on “online services” and then go to “online claim” and fill in the required details. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. Web you can download pf withdrawal form 15g from the online portal of epfo. Web click here for free form.

New Form 15G & Form 15H New format & procedure

Part i name of assessee (declarant) pan of the assessee Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Web you can get form 15g from epfo’s online portal or the websites of major banks. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section.

New Form 15G in Word Format for AY 202223 Download

Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Furthermore, you can also visit the income. Click on “online services” and then go to “online claim” and fill in the required details. Part i name of assessee (declarant) pan of the assessee.

Web Form 15G Can Be Easily Found And Downloaded For Free From The Website Of All Major Banks In India As Well As The Official Epfo Portal.

Furthermore, you can also visit the income. Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. Part i name of assessee (declarant) pan of the assessee Form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on the official income tax department website.

15G [See Section 197A(1), 197A(1A) And Rule 29C]Declaration Under Section 197A(1) And Section 197A(1A) Of The Income‐Tax Act, 1961 To Be Made By An Individual Or A Person (Not Being A Company Or Firm) Claiming Certain Receipts Without Deduction Of Tax.

Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Fill details on the remitter, remittee and remittance details. Click on “online services” and then go to “online claim” and fill in the required details. Click the form 15ca option.

Web Form 15G For Pf Withdrawal Pdf Read Online Or Download For Free From The Incometaxindia.gov.in Link Given At The Bottom Of This Article.

Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Choose the part you want to fill from the dropdown and click continue. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act, 1961 to be made ‐ by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india.

Web You Can Get Form 15G From Epfo’s Online Portal Or The Websites Of Major Banks.

The general instructions is provided in the utility. Web you can download pf withdrawal form 15g from the online portal of epfo. Additionally, this form can also be easily downloaded from the income tax department website.