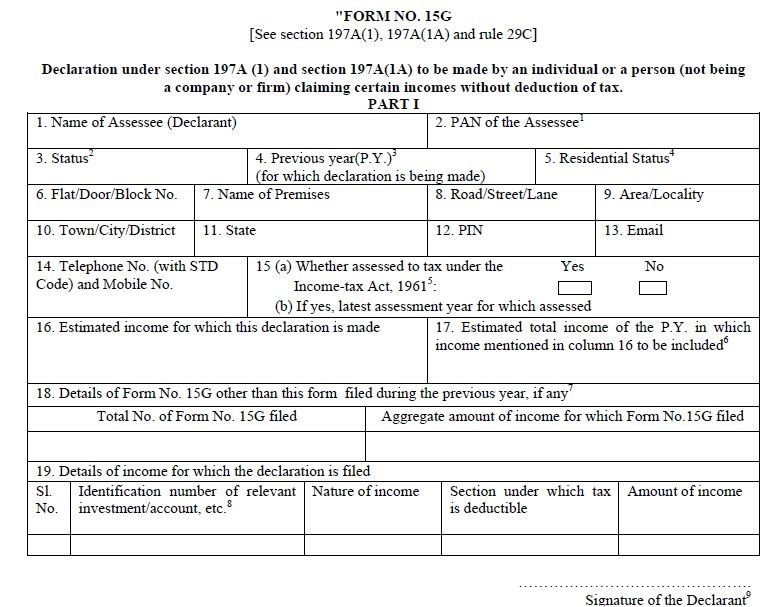

Form 15H And 15G

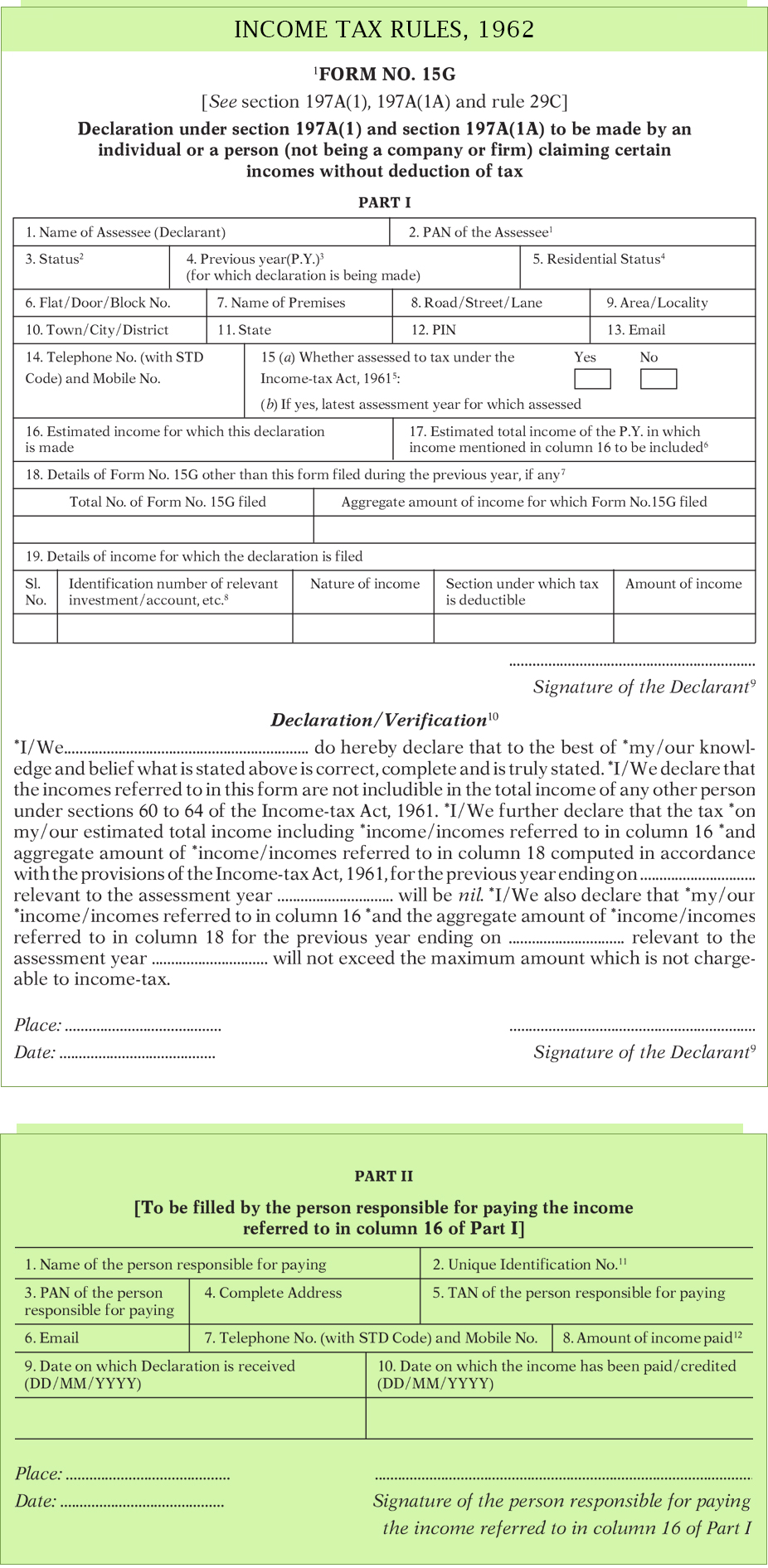

Form 15H And 15G - Web what is the difference between form 15g and form 15h? Web if individuals submit form 15g, they can earn full interest income as banks would not deduct any tds. You must be an indian citizen. Web here are the most important things to know about form 15g and form 15h declaration: Form 15g is a declaration that can be filled out by fixed deposit holders. Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. Web how to file form 15g & form 15h? If your tax liability for a year is zero. To be able to submit form 15g, an individual’s age must be less than 60. Form 15g/ form 15h is used to make sure that tds is not deducted from your income.

Web here are the most important things to know about form 15g and form 15h declaration: Web online filling and submission of form 15g and 15h. Web form 15g and form 15h are the documents that you can submit to make sure tds is not deducted from your income. You must have a pan to furnish these. You should be aged 60 years or above to use form 15h. You must be an indian citizen. Most banks are now offering the facility to fill in form 15g and 15h online. You should be aged below 60 years to use form 15g. Form 15g/ form 15h is used to make sure that tds is not deducted from your income. To be able to submit form 15g, an individual’s age must be less than 60.

If your tax liability for a year is zero. You must have a pan to furnish these. Hindu undivided families can also use form. To be able to submit form 15g, an individual’s age must be less than 60. If you are an nri, you are not eligible to submit these forms. You should be aged below 60 years to use form 15g. You should be aged 60 years or above to use form 15h. Web how to file form 15g & form 15h? Form 15g is a declaration that can be filled out by fixed deposit holders. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the.

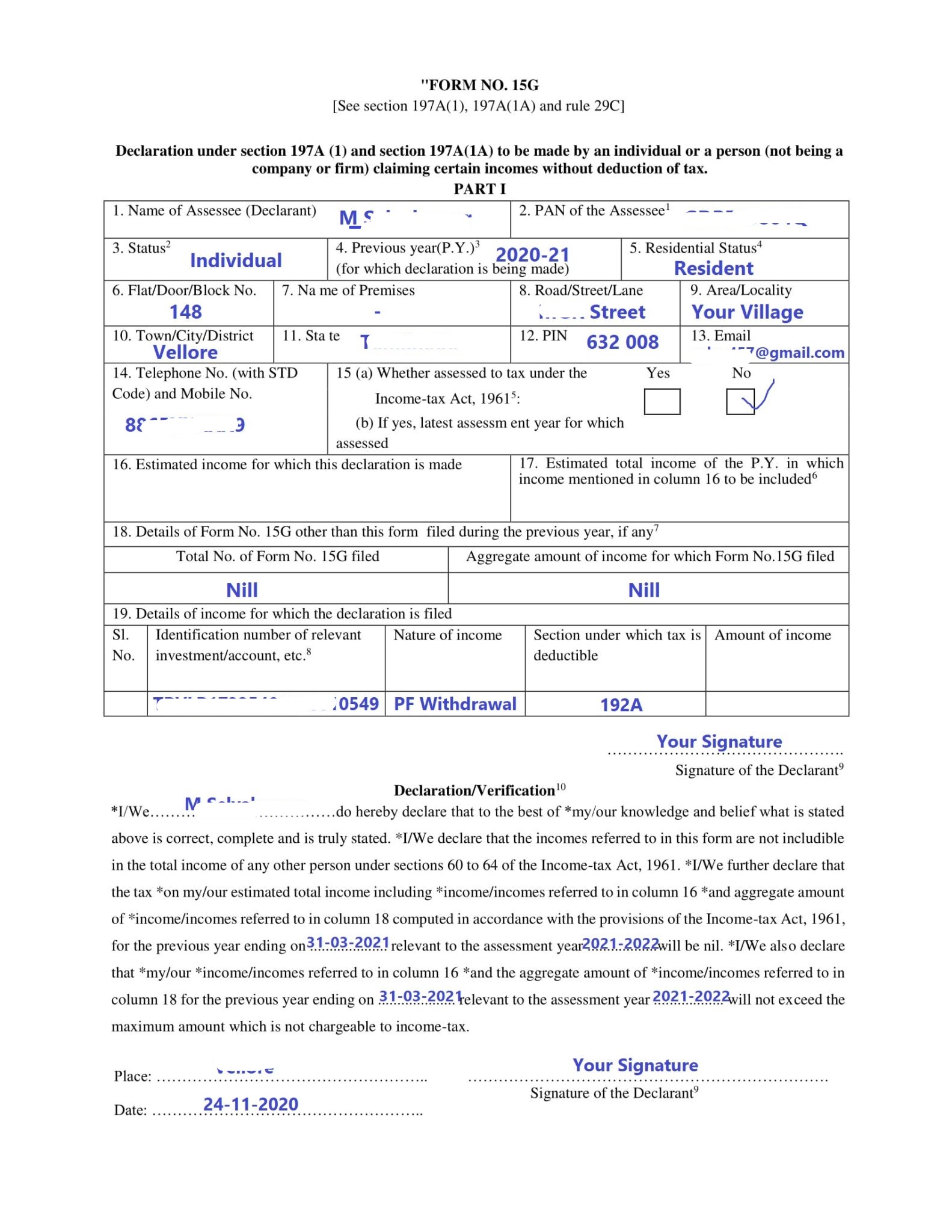

How To Fill New Form 15G / Form 15H roy's Finance

For this, you must have the saving. Web online filling and submission of form 15g and 15h. Web if individuals submit form 15g, they can earn full interest income as banks would not deduct any tds. Web purpose to fill form 15g and 15h. Web how to file form 15g & form 15h?

How To Fill Form 15G And 15H ★ Filled Form 15G Sample ★ Form 15H Sample

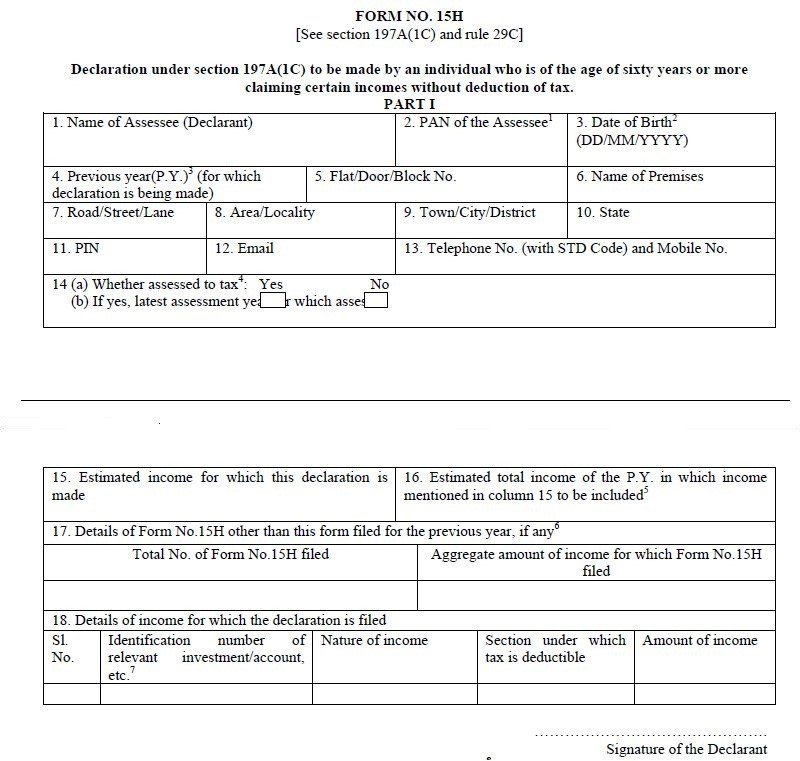

You should be aged below 60 years to use form 15g. Web purpose to fill form 15g and 15h. For this, you must have the saving. On can avoid the tds on incomes. Web form 15h is applicable for the use of individuals only and not for organisations or other group entities.

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

You should be aged below 60 years to use form 15g. You should be aged 60 years or above to use form 15h. Web purpose to fill form 15g and 15h. You must have a pan to furnish these. For this, you must have the saving.

How To Fill New Form 15G / Form 15H roy's Finance

You must have a pan to furnish these. Web form 15h is applicable for the use of individuals only and not for organisations or other group entities. Form 15g/ form 15h is used to make sure that tds is not deducted from your income. You should be aged 60 years or above to use form 15h. Web form 15g and.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Web purpose to fill form 15g and 15h. To be able to submit form 15g, an individual’s age must be less than 60. If you are an nri, you are not eligible to submit these forms. You should be aged 60 years or above to use form 15h. Hindu undivided families can also use form.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

Web what is the difference between form 15g and form 15h? Web if individuals submit form 15g, they can earn full interest income as banks would not deduct any tds. If your tax liability for a year is zero. You should be aged 60 years or above to use form 15h. To be able to submit form 15g, an individual’s.

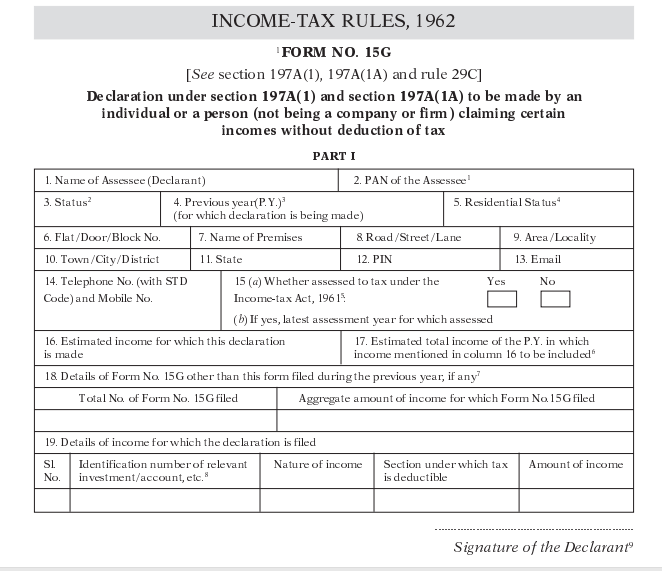

New Form 15G & Form 15H New format & procedure

Web here are the most important things to know about form 15g and form 15h declaration: Hindu undivided families can also use form. You should be aged 60 years or above to use form 15h. You must have a pan to furnish these. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest.

New format of form 15G and 15H with auto fill facility in excel

Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. Most banks are now offering the facility to fill in form 15g and 15h online. To be able to submit form 15g, an individual’s age must be less than 60. If you are an nri, you are not eligible to.

Breanna Withdrawal Form 15g Part 2 Filled Sample

To be able to submit form 15g, an individual’s age must be less than 60. Web how to file form 15g & form 15h? Web online filling and submission of form 15g and 15h. You must have a pan to furnish these. Form 15g is a declaration that can be filled out by fixed deposit holders.

Form 15H (Save TDS on Interest How to Fill & Download

You should be aged below 60 years to use form 15g. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the. Web form 15h is applicable for the use of individuals only and not for organisations or other group entities. On can avoid.

Web If Individuals Submit Form 15G, They Can Earn Full Interest Income As Banks Would Not Deduct Any Tds.

Web here are the most important things to know about form 15g and form 15h declaration: Form 15g/ form 15h is used to make sure that tds is not deducted from your income. Web form 15h is applicable for the use of individuals only and not for organisations or other group entities. Web purpose to fill form 15g and 15h.

For This, You Must Have The Saving.

Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. To be able to submit form 15g, an individual’s age must be less than 60. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the. If your tax liability for a year is zero.

If You Are An Nri, You Are Not Eligible To Submit These Forms.

You must have a pan to furnish these. You should be aged below 60 years to use form 15g. Form 15g is a declaration that can be filled out by fixed deposit holders. Most banks are now offering the facility to fill in form 15g and 15h online.

Web Form 15G And Form 15H Are The Documents That You Can Submit To Make Sure Tds Is Not Deducted From Your Income.

Web how to file form 15g & form 15h? Web what is the difference between form 15g and form 15h? Hindu undivided families can also use form. Web online filling and submission of form 15g and 15h.