Form 2210 Schedule Ai

Form 2210 Schedule Ai - Web complete schedule ai to calculate the penalty using the annualized income installment method. You may see a diagnostic warning in a return indicating. Web 1 best answer lisabr new member you can delete this form and this will help you move on to complete your filing. Web 1 best answer marilyng expert alumni this question is asking for the self employment income of the taxpayer. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. Web 2022 ia 2210 schedule ai instructions. In order to make schedule ai available, part ii of form 2210 must be entered. Dispute a penalty if you don’t qualify for penalty removal or. Web form 2210 (2022) page 3 schedule ai—annualized income installment method (see the instructions.) estates and trusts, don’t use the period ending dates shown to the right. Web • complete form ia 2210 and schedule ai.

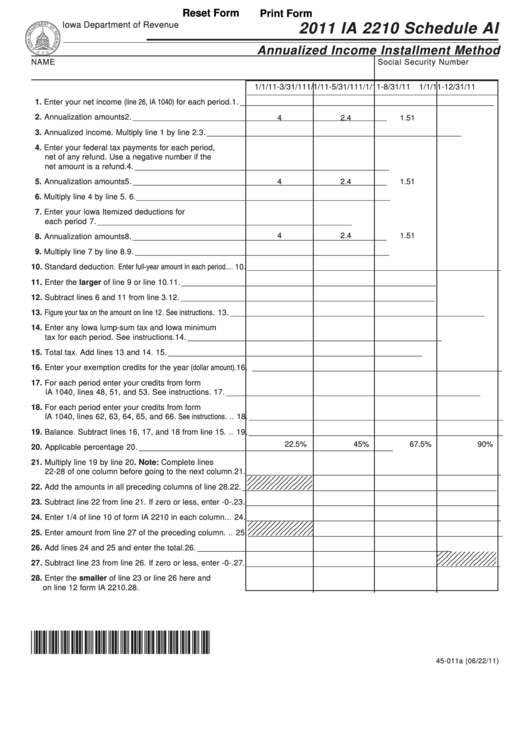

• check the box on the ia 1040, line 71. Web form 2210 (2022) page 3 schedule ai—annualized income installment method (see the instructions.) estates and trusts, don’t use the period ending dates shown to the right. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. Web • complete form ia 2210 and schedule ai. This schedule provides you with the format to report your actual income during. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. And complete schedule ai and part iii, section a. Enter the penalty on form 2210, line. February 14, 2023 12:48 pm 0 reply bookmark icon stife94 returning member it just. Web you may benefit by using the ia 2210 schedule ai (pdf) annualized income installment method if your income varied during the year.

Web enter 25% (0.25) of line 9 on page 1 of form 2210 in each column enter actual wages for the period subject to social security tax or the 6.2% portion of the 7.65% railroad. Web complete schedule ai to calculate the penalty using the annualized income installment method. This schedule provides you with the format to report your actual income during. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. Dispute a penalty if you don’t qualify for penalty removal or. Web • complete form ia 2210 and schedule ai. In order to make schedule ai available, part ii of form 2210 must be entered. February 14, 2023 12:48 pm 0 reply bookmark icon stife94 returning member it just. Check the applicable box(es) in part ii; Web instructions for form 2210 schedule ai tells you exactly what to do.

Help needed for form 2210 Schedule AI tax

Web 2022 ia 2210 schedule ai instructions. Check the applicable box(es) in part ii; You may see a diagnostic warning in a return indicating. February 14, 2023 12:48 pm 0 reply bookmark icon stife94 returning member it just. And complete schedule ai and part iii, section a.

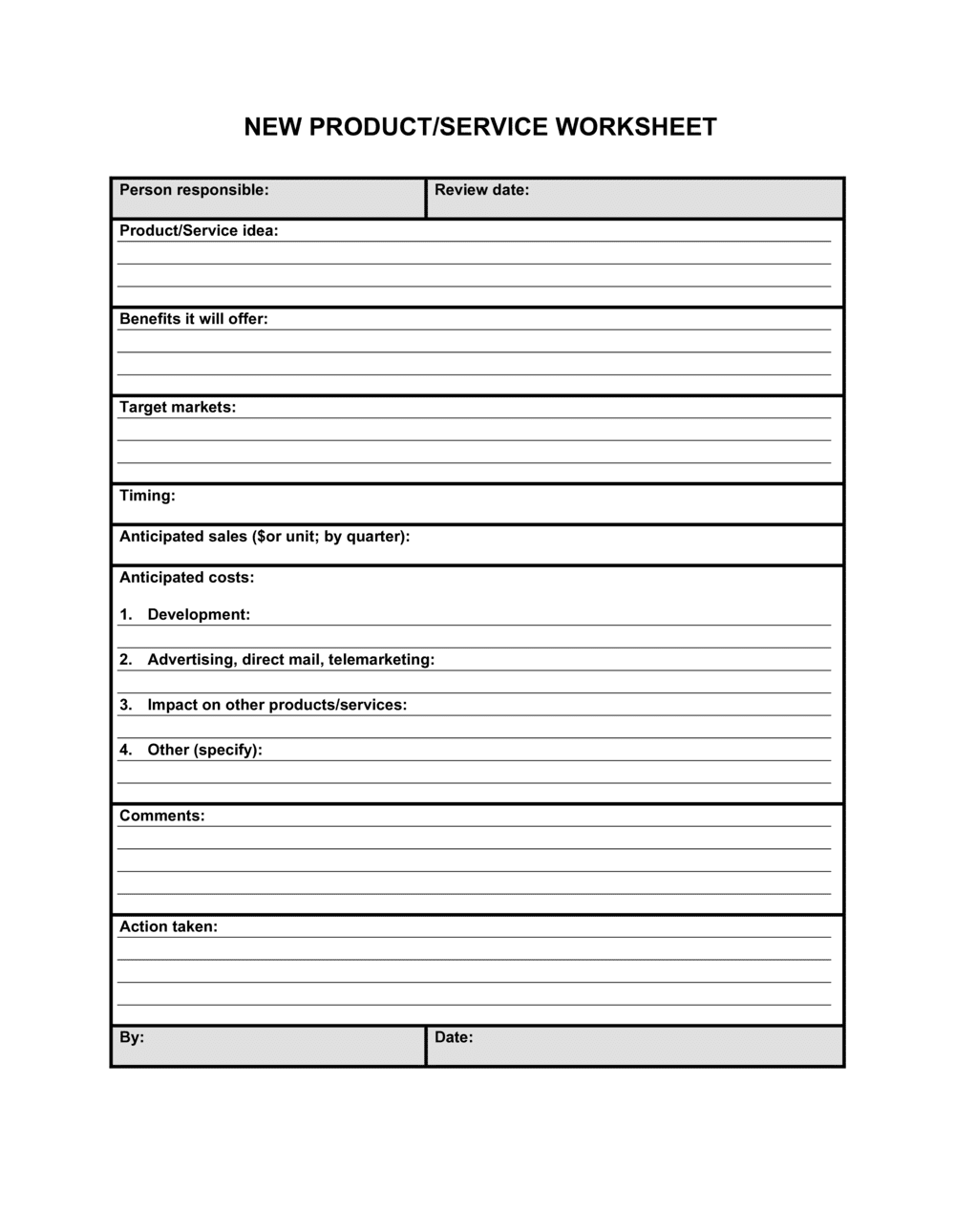

form 2210 worksheet

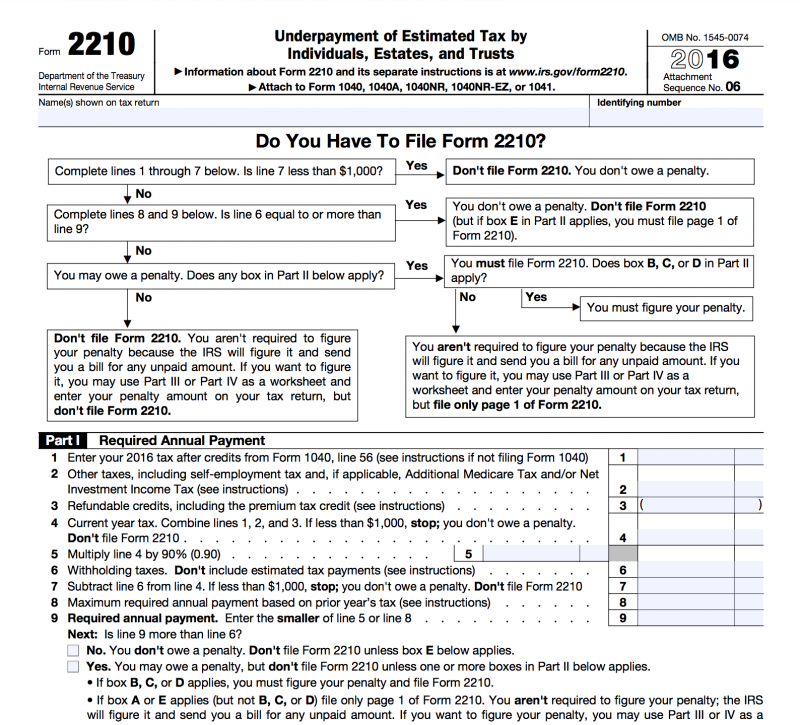

Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. Web 1 best answer lisabr new member you can delete this form and this will help you move on to complete your filing. Enter the amount from each column of line 28 of schedule ai.

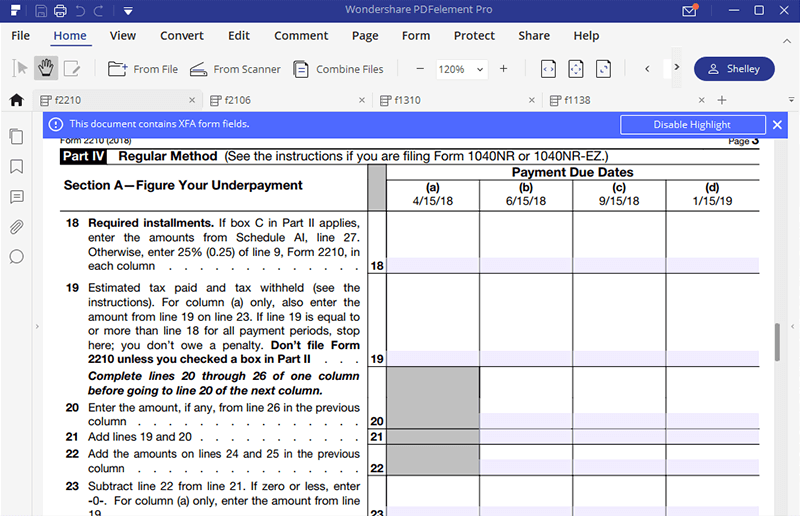

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Web • complete form ia 2210 and schedule ai. This schedule provides you with the format to report your actual income during. Web complete schedule ai to calculate the penalty using the annualized income installment method. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Check.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

• check the box on the ia 1040, line 71. Web 1 best answer lisabr new member you can delete this form and this will help you move on to complete your filing. This article is a guide to completing form 2210 in the. Web enter 25% (0.25) of line 9 on page 1 of form 2210 in each column.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

Web you may benefit by using the ia 2210 schedule ai (pdf) annualized income installment method if your income varied during the year. Web 1 best answer marilyng expert alumni this question is asking for the self employment income of the taxpayer. • check the box on the ia 1040, line 71. Web enter 25% (0.25) of line 9 on.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. Web • complete form ia 2210 and schedule ai. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web instructions for form 2210 schedule ai tells you exactly what.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Web • complete form ia 2210 and schedule ai. Web complete schedule ai to calculate the penalty using the annualized income installment method. Web form 2210 (2022) page 3 schedule ai—annualized income installment method (see the instructions.) estates and trusts, don’t use the period ending dates shown to the right. Enter the penalty on form 2210, line. Web • complete.

Ssurvivor Irs Form 2210 Instructions 2020

Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web form 2210 (2022) page 3 schedule ai—annualized income installment method (see the instructions.) estates and trusts, don’t use the period ending dates shown to the right. Web complete form 2210, schedule ai, annualized income installment method.

Fillable Schedule Ai (Form Ia 2210) Annualized Installment

Web 1 best answer lisabr new member you can delete this form and this will help you move on to complete your filing. February 14, 2023 12:48 pm 0 reply bookmark icon stife94 returning member it just. Web enter 25% (0.25) of line 9 on page 1 of form 2210 in each column enter actual wages for the period subject.

IRS Form 2210 Schedule AI walkthrough YouTube

Web 1 best answer lisabr new member you can delete this form and this will help you move on to complete your filing. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Form 2210 is irs form that relates to. Enter the amount from each column.

Web Schedule Ai, Complete Part Iv, Section A, And The Penalty Worksheet (Worksheet For Form 2210, Part Iv, Section B—Figure The Penalty), Later.

Check the applicable box(es) in part ii; Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure. Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

Form 2210 Is Irs Form That Relates To.

In order to make schedule ai available, part ii of form 2210 must be entered. Web 2022 ia 2210 schedule ai instructions. Web • complete form ia 2210 and schedule ai. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8.

February 14, 2023 12:48 Pm 0 Reply Bookmark Icon Stife94 Returning Member It Just.

Enter the penalty on form 2210, line. You may see a diagnostic warning in a return indicating. • check the box on the ia 1040, line 71. And complete schedule ai and part iii, section a.

Web Enter 25% (0.25) Of Line 9 On Page 1 Of Form 2210 In Each Column Enter Actual Wages For The Period Subject To Social Security Tax Or The 6.2% Portion Of The 7.65% Railroad.

This schedule provides you with the format to report your actual income during. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. • check the box on the ia 1040, line 71. Dispute a penalty if you don’t qualify for penalty removal or.