Form 2210 Waiver Explanation Statement Examples

Form 2210 Waiver Explanation Statement Examples - Subscribe to rss feed i am having the same problem. A statement explaining how the taxpayer. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. These boats were built with a aluminum pontoon; Web see the following irs instruction for waiver of penalty: For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. Web up to 25% cash back form 2210 then can guide you through the process of figuring your penalty amount, which is directly based on the amount of your tax underpayment. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax.

Dispute a penalty if you don’t qualify for penalty removal or. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. Web see the following irs instruction for waiver of penalty: The form doesn't always have to be. Web file only page 1 of form 2210. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. This home is currently not for sale, but it was last sold for $208k in 2021, this home is. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web 610 w grand river ave, williamston, mi 48895 is a 1,000 sqft, 2 bed, 1 bath home. Waiver (see instructions) of your entire penalty.

Waiver (see instructions) of your entire. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. See the estimate, review home details, and search for homes nearby. Web 610 w grand river ave, williamston, mi 48895 is a 1,000 sqft, 2 bed, 1 bath home. Part ii reasons for filing. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web taxes get your taxes done form 2210 waiver explanation statment did you mean: These boats were built with a aluminum pontoon; Web taxpayers can request relief from penalties. Subscribe to rss feed i am having the same problem.

Form 2210 Fill and Sign Printable Template Online US Legal Forms

Waiver (see instructions) of your entire penalty. Web any form 461 filed with the most recently amended income tax return filed before march 27, 2020, for the tax year that began in 2018; This home is currently not for sale, but it was last sold for $208k in 2021, this home is. Web the form can be filed with a.

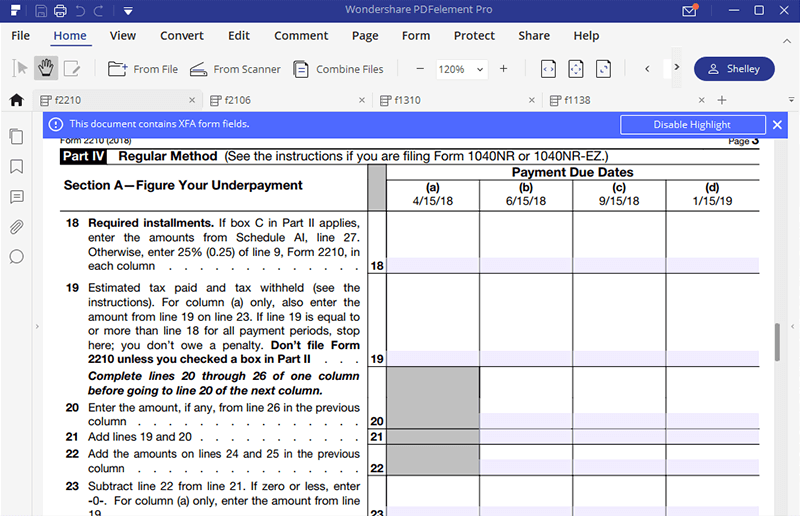

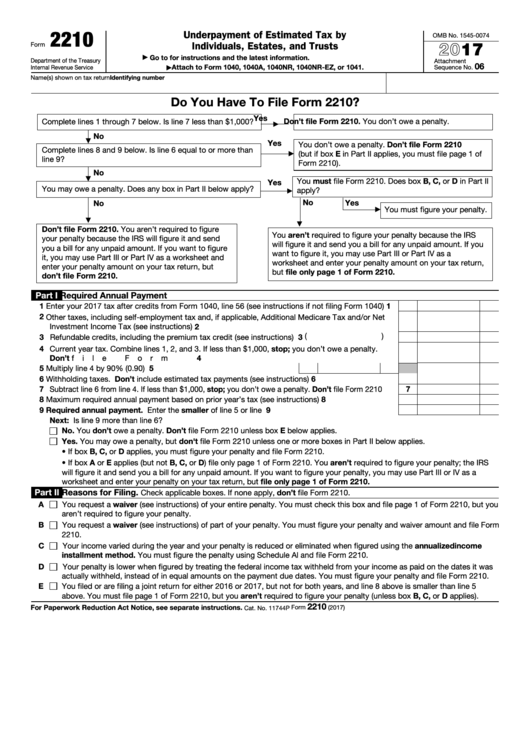

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

These taxpayers should include the statement “80% waiver” next to box a of the form 2210, as. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. Dispute a penalty if you don’t qualify for penalty removal or. Web any form 461 filed with the most recently amended income tax.

Ssurvivor Irs Form 2210 Instructions 2020

Web regard to the waiver, and enter the result on line 19. Part ii reasons for filing. Web taxpayers can request relief from penalties. Web any form 461 filed with the most recently amended income tax return filed before march 27, 2020, for the tax year that began in 2018; Web the form can be filed with a return electronically.

Form 2210 Edit, Fill, Sign Online Handypdf

A statement explaining how the taxpayer. These taxpayers should include the statement “80% waiver” next to box a of the form 2210, as. Web regard to the waiver, and enter the result on line 19. See the estimate, review home details, and search for homes nearby. Web taxpayers can request relief from penalties.

Instructions For Form 2210 Underpayment Of Estimated Tax By

See the estimate, review home details, and search for homes nearby. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web regard to the waiver, and enter the result on line 19. Dispute a penalty if you don’t qualify for penalty removal or. Attach form 2210 and a statement to your return explaining the.

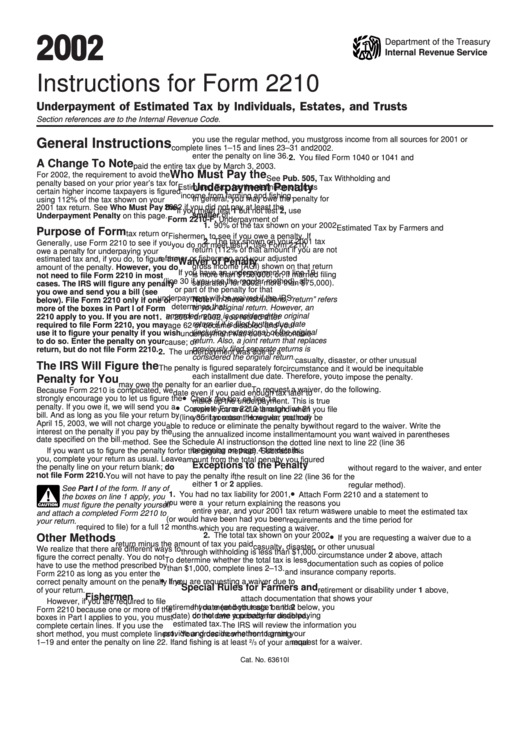

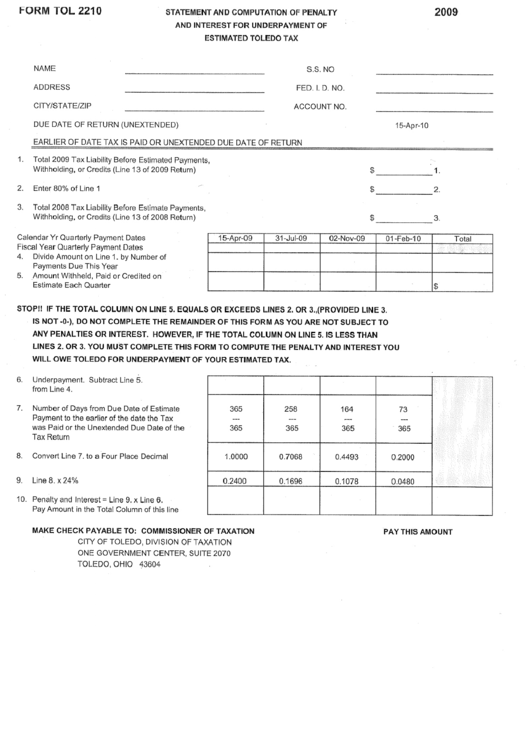

Form Tol 2210 Statement And Computation Of Penalty And Interest

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. See the estimate, review home details, and search for homes nearby. These boats were built with a aluminum pontoon; Since taxpayer prepaid more than 85%. The form doesn't always have to be.

Top 18 Form 2210 Templates free to download in PDF format

Web see the following irs instruction for waiver of penalty: Web file only page 1 of form 2210. Web regard to the waiver, and enter the result on line 19. Waiver (see instructions) of your entire penalty. A statement explaining how the taxpayer.

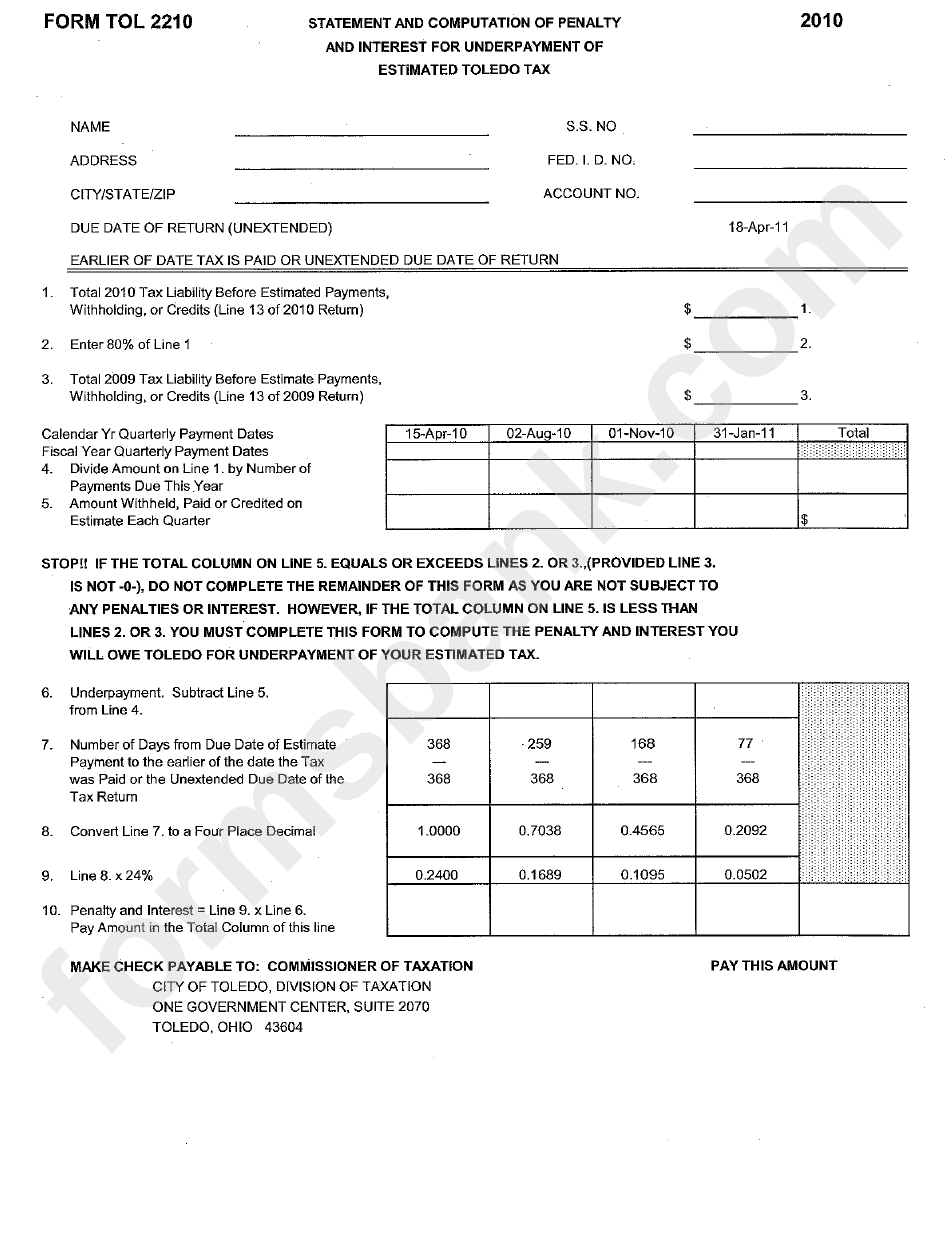

Form Tol 2210 Statement And Computation Of Penalty And Interest

Since taxpayer prepaid more than 85%. Web file only page 1 of form 2210. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web any form 461 filed with the.

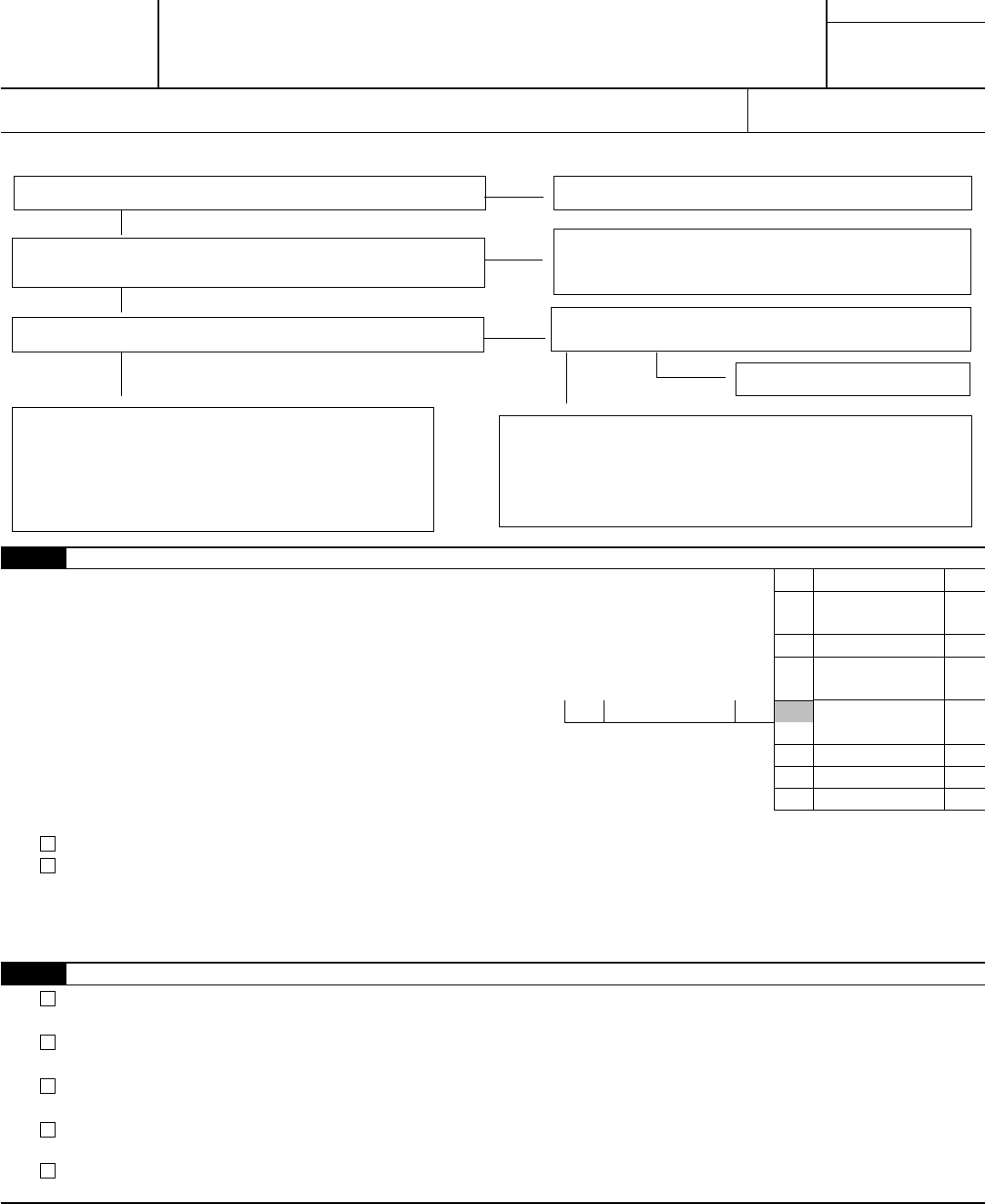

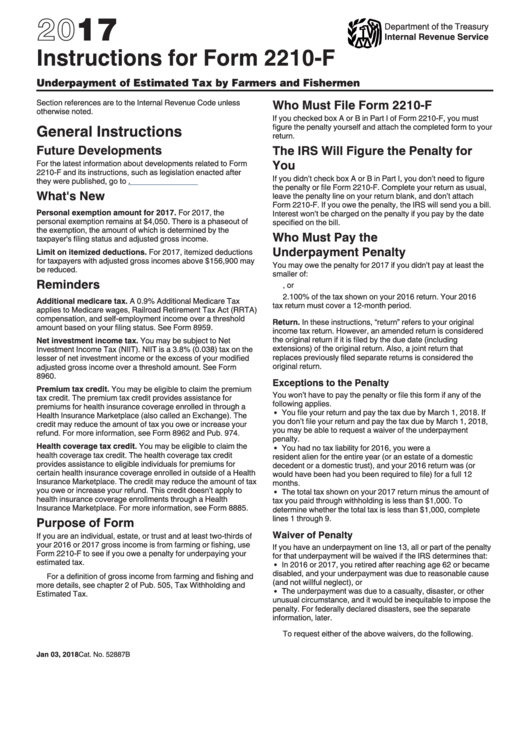

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. A statement explaining how the taxpayer. These taxpayers should include the statement “80% waiver” next to box a of the form 2210, as. Web up to 25% cash back form 2210 then can.

Form Tol 2210 Statement And Computation Of Penalty And Interest For

Since taxpayer prepaid more than 85%. Part ii reasons for filing. 810 e grand river ave, is a single family home. Web 610 w grand river ave, williamston, mi 48895 is a 1,000 sqft, 2 bed, 1 bath home. See the estimate, review home details, and search for homes nearby.

These Taxpayers Should Include The Statement “80% Waiver” Next To Box A Of The Form 2210, As.

Part ii reasons for filing. Web 610 w grand river ave, williamston, mi 48895 is a 1,000 sqft, 2 bed, 1 bath home. If form 2210, part ii, line a checkbox 'waiverofentirepenalty' is checked, the [waiverexplanationstatement] must be attached to form 2210. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

Waiver (See Instructions) Of Your Entire Penalty.

This home is currently not for sale, but it was last sold for $208k in 2021, this home is. For the failure to file or pay penalty, taxpayers can request that the irs “abate” the penalties. Subscribe to rss feed i am having the same problem. Since taxpayer prepaid more than 85%.

Web Regard To The Waiver, And Enter The Result On Line 19.

810 e grand river ave, is a single family home. Web taxpayers can request relief from penalties. Web taxes get your taxes done form 2210 waiver explanation statment did you mean: Waiver (see instructions) of your entire.

Web Form 2210 Is Used By Individuals (As Well As Estates And Trusts) To Determine If A Penalty Is Owed For The Underpayment Of Income Taxes Due.

Web see the following irs instruction for waiver of penalty: Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web file only page 1 of form 2210. Web any form 461 filed with the most recently amended income tax return filed before march 27, 2020, for the tax year that began in 2018;