Form 2290 Instructions 2022

Form 2290 Instructions 2022 - However, for owners of newly. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Web if you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of every year. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web the 2290 form is due annually between july 1 and august 31. Web form 2290 is used for: These forms are available right now. Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any. Pay heavy vehicle use taxes (hvut) for highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties.

Easy, fast, secure & free to try. Also, late filers may face a. The current period begins july 1, 2023, and. Web the 2290 form is due annually between july 1 and august 31. Web form 2290 due dates for vehicles placed into service during reporting period. Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv). Month new vehicle is first used. Do your truck tax online & have it efiled to the irs! Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any. Pay heavy vehicle use taxes (hvut) for highway motor vehicles with a taxable gross weight of 55,000 pounds or more.

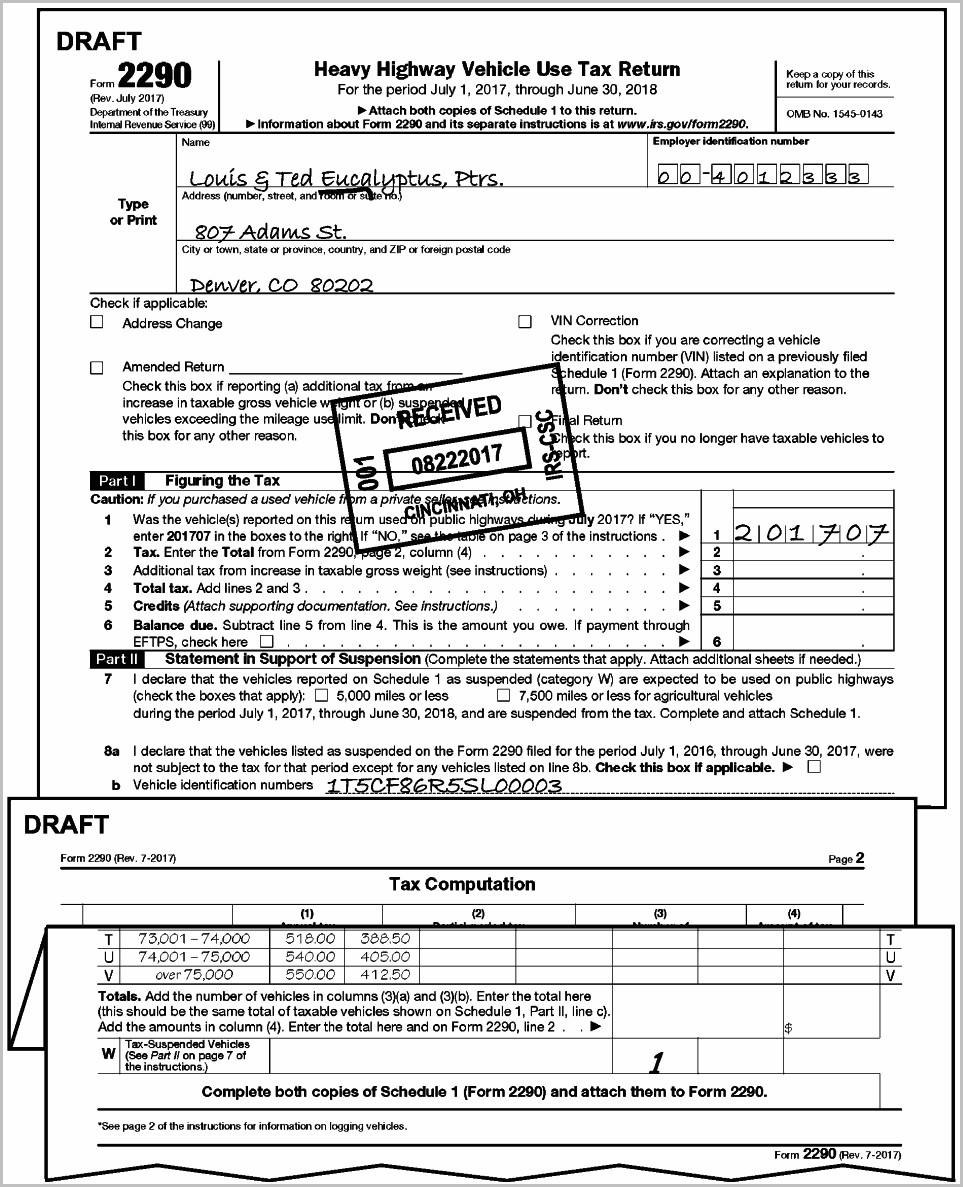

Web form 2290 is used for: Web according to the form 2290 instructions for 2022, the penalty is typically 4.5% of the total tax due, assessed on a monthly basis for up to five months. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. These forms are available right now. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web the form 2290 instructions 2022 apply to the relevant tax year. Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv).

Understanding Form 2290 StepbyStep Instructions for 20222023

Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv). File your 2290 online & get schedule 1 in minutes. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Ad get schedule 1 in minutes, your form 2290 is efiled directly.

Irs Form 2290 Printable Form Resume Examples

Enter the sum you get on page 2, column 4 of form. Month new vehicle is first used. Web according to the form 2290 instructions for 2022, the penalty is typically 4.5% of the total tax due, assessed on a monthly basis for up to five months. July 2023) department of the treasury internal revenue service heavy highway vehicle use.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web form 2290 due dates for vehicles placed into service during reporting period. Easy, fast, secure & free to try. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web the 2290 form is due annually between july 1 and august 31. Web if you own a.

IRS Form 2290 Instructions for 20232024 How to fill out 2290?

Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more. File your 2290 online & get schedule 1 in minutes..

How to file form 2290 Electronically For the Tax Year 20212022 by Form

Web the 2290 form is due annually between july 1 and august 31. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web form 2290 must be filed for the month.

Irs Form 2290 Instructions Form Resume Examples

These forms are available right now. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web december 6, 2022 draft as of form 2290 (rev. Enter the sum you get on page 2, column 4 of form. Web according to the form 2290 instructions for 2022, the penalty is typically 4.5% of the total.

Efiling IRS Form 2290 EFile 2290 for lowest price 6.90

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. These forms are available right now. Web the irs form 2290 is used to: •figure and pay the tax due on highway motor vehicles used during the period with a taxable. Web the 2290 form is due annually.

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

Web the form 2290 is used to pay the heavy vehicle use tax on heavy vehicles (trucks) operating on public highways with a gross weight of 55,000 pounds or more. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. •figure and pay the tax due on highway motor vehicles.

IRS Form 2290 Instructions for 20222023

Also, late filers may face a. This ensures legal operation on public highways. •figure and pay the tax due on highway motor vehicles used during the period with a taxable. Web the irs form 2290 is used to: With accurate form 2290 instructions, you’ll know how to report mileage on taxable vehicles.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Enter the sum you get on page 2, column 4 of form. This ensures legal operation on public highways. Web form 2290 due dates for vehicles placed into service during reporting period. Web the form 2290 instructions 2022 apply to the relevant tax year. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for.

Web Form 2290 Due Dates For Vehicles Placed Into Service During Reporting Period.

Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the tax period claim credit for tax paid on any. Web you may file on paper as soon as the july 2022 form 2290 and instructions are available on irs.gov. Enter the tax year and month you put your vehicles on the road during the tax period. With accurate form 2290 instructions, you’ll know how to report mileage on taxable vehicles.

Also, Late Filers May Face A.

Web december 6, 2022 draft as of form 2290 (rev. Month form 2290 must be filed. The current period begins july 1, 2023, and. Web 2022 form 2290 is essential for registering your heavy vehicle with the department of motor vehicles (dmv).

Pay Heavy Vehicle Use Taxes (Hvut) For Highway Motor Vehicles With A Taxable Gross Weight Of 55,000 Pounds Or More.

These forms are available right now. Month new vehicle is first used. Web the form 2290 instructions 2022 apply to the relevant tax year. Easy, fast, secure & free to try.

Web The Form 2290 Is Used To Pay The Heavy Vehicle Use Tax On Heavy Vehicles (Trucks) Operating On Public Highways With A Gross Weight Of 55,000 Pounds Or More.

Do your truck tax online & have it efiled to the irs! However, for owners of newly. Web form 2290 is used for: File your 2290 online & get schedule 1 in minutes.