Form 2441 Instructions 2021

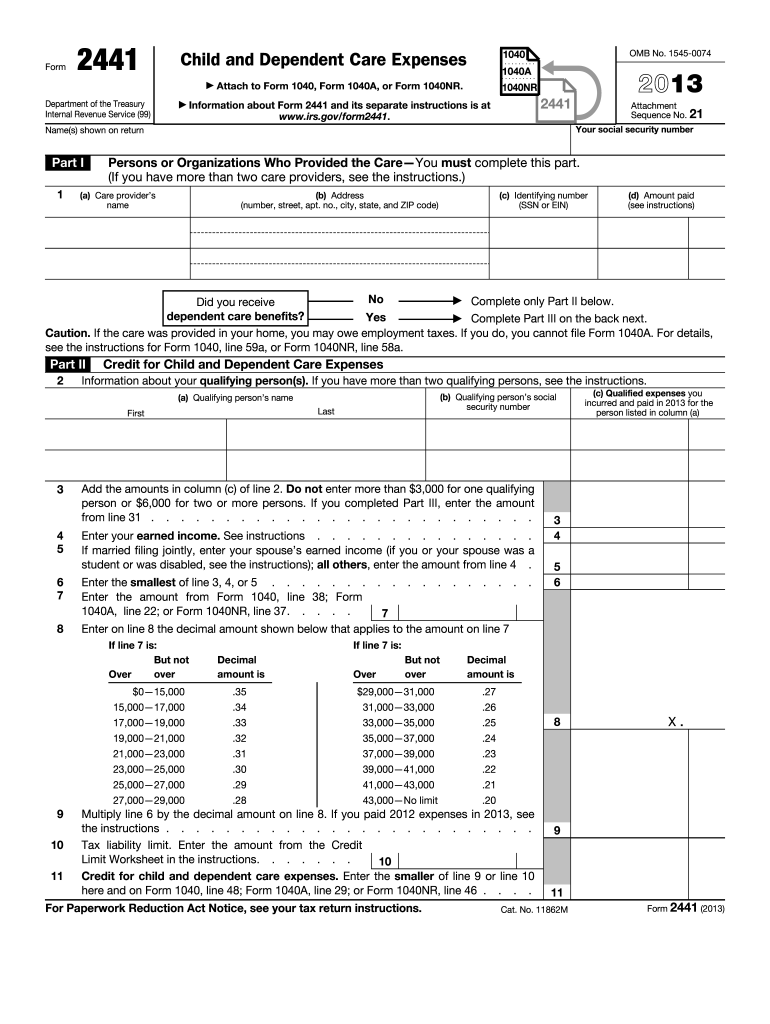

Form 2441 Instructions 2021 - Credit for child or dependent care expenses; The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Web instructions for definitions of the following terms: Form 2441 is used to by. Web irs form 2441 instructions. By reporting these expenses, you may be entitled to a. Try it for free now! Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

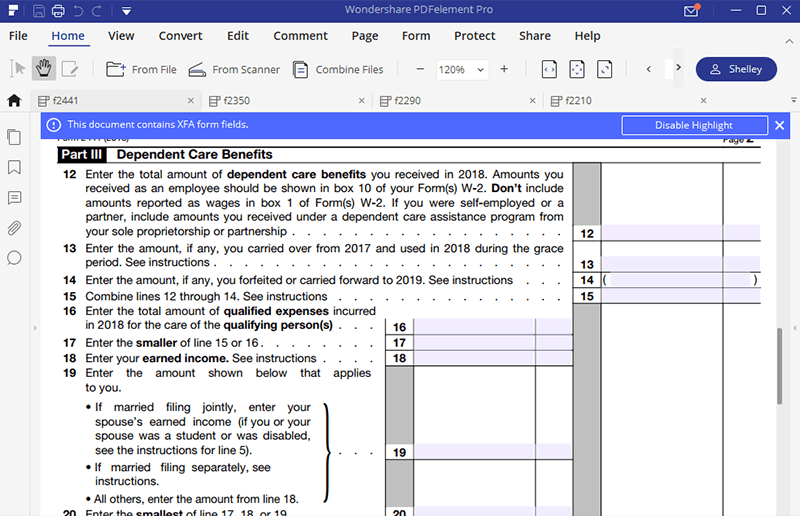

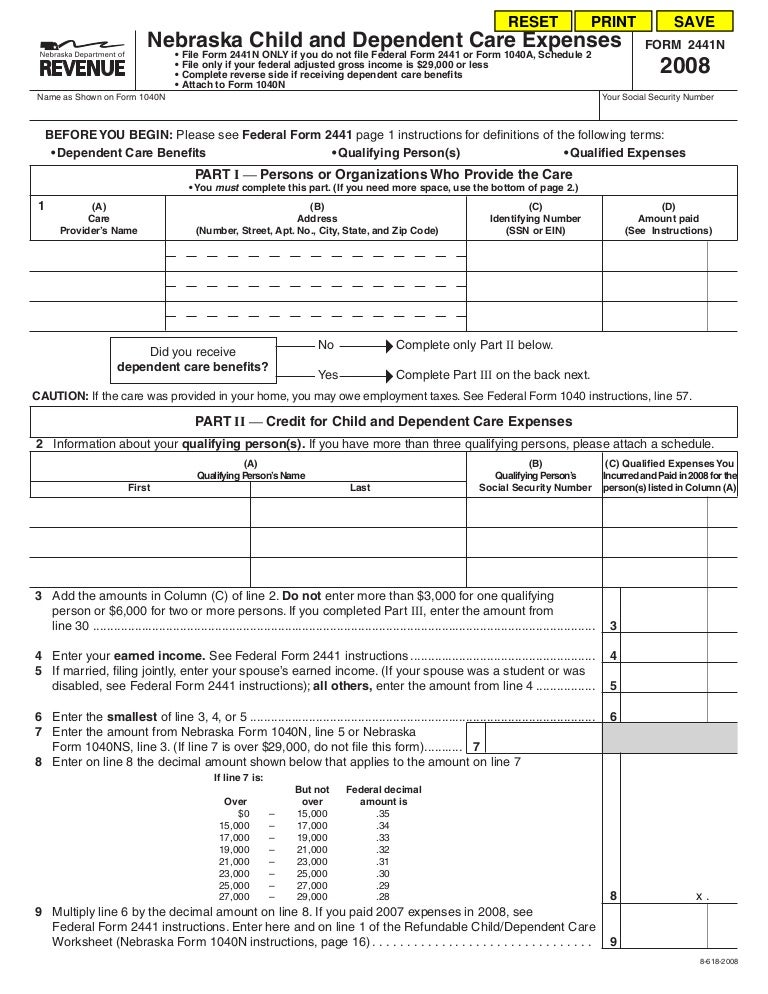

• dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •. The maximum credit percentage has been. The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Web only if your adjusted gross income is $29,000 or less, and you are claiming the nebraska refundable child and dependent care credit. The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. •complete the reverse side of this form if. Credit for child or dependent care expenses; Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

Ad upload, modify or create forms. By reporting these expenses, you may be entitled to a. Complete, edit or print tax forms instantly. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. •complete the reverse side of this form if. For more information refer to form. Web irs form 2441 instructions. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web to complete form 2441 child and dependent care expenses in the taxact program: Complete, edit or print tax forms instantly.

Breanna Form 2441 Instructions Provider Amount Paid

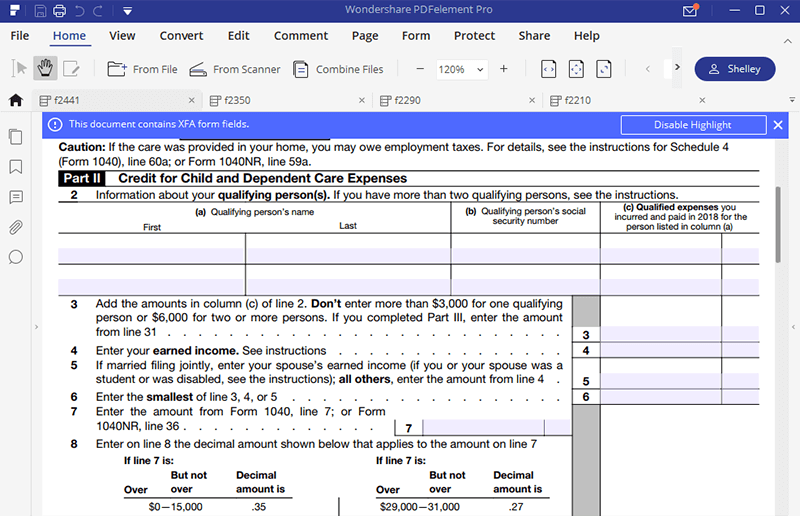

From within your taxact return (online or desktop), click federal (on smaller devices, click in. Credit for child or dependent care expenses; Form 2441 is used to by. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. What’s new the 2021 enhancements to the credit for child and.

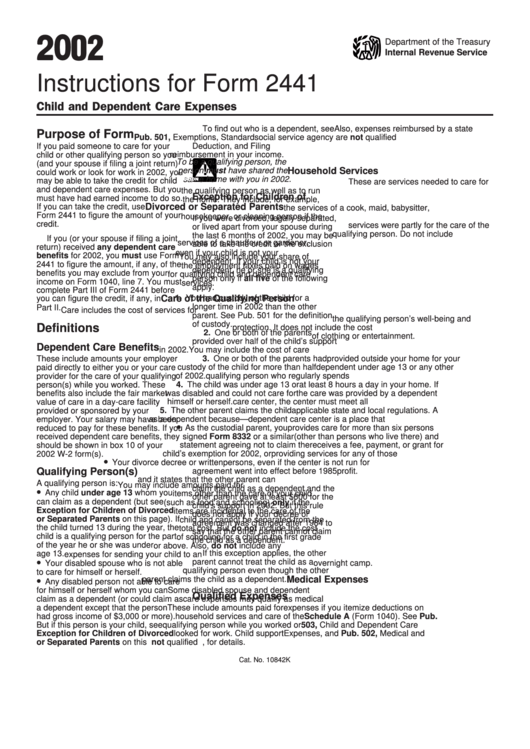

2002 Instructions For Form 2441 printable pdf download

Web instructions for form 2441 child and dependent care expenses department of the treasury internal revenue service reminder married persons filing separately. Form 2441 is used to by. Complete, edit or print tax forms instantly. The maximum credit percentage has been. Persons or organizations who provided the care;

Ssurvivor Form 2441

Web instructions for definitions of the following terms: By reporting these expenses, you may be entitled to a. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web only if your adjusted gross income is $29,000 or less, and you are claiming the nebraska refundable child and dependent.

Breanna Form 2441 Instructions 2016

Web for tax year 2021 only: The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Ad access irs tax forms. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web form 2441 based on the income rules listed in.

Breanna Form 2441 Tax Liability Limit

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and..

Form 2441 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web for tax year 2021 only: Persons or organizations who provided the care; By reporting these expenses, you may be entitled to a.

944 Form 2021 2022 IRS Forms Zrivo

Web instructions for definitions of the following terms: Persons or organizations who provided the care; Form 2441 is used to by. • dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •. The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year.

Form 5695 2021 2022 IRS Forms TaxUni

Try it for free now! Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For.

Breanna Form 2441 Tax

Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. Credit for child or dependent care expenses; Web irs form 2441 instructions. Web for tax year 2021 only: The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

Credit for child or dependent care expenses; What’s new the 2021 enhancements to the credit for child and. Form 2441 is used to by. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web form 2441.

Web For More Information On The Percentage Applicable To Your Income Level, Please Refer To The 2021 Instructions For Form 2441 Or Irs Publication 503, Child And.

•complete the reverse side of this form if. The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Web for tax year 2021 only: Web to complete form 2441 child and dependent care expenses in the taxact program:

The Irs Has Released Form 2441 (Child And Dependent Care Expenses) And Its Accompanying Instructions For The 2021 Tax Year.

By reporting these expenses, you may be entitled to a. Web only if your adjusted gross income is $29,000 or less, and you are claiming the nebraska refundable child and dependent care credit. Try it for free now! Form 2441 is used to by.

Web Only If Your Adjusted Gross Income Is $29,000 Or Less, And You Are Claiming The Aska Refundable Child And Dependent Care Credit.nebr •Complete The Reverse Side Of This Form.

Ad access irs tax forms. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. The maximum credit percentage has been. • dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •.

Web If You Or Your Spouse Was A Student Or Was Disabled During 2022 And You’re Entering Deemed Income Of $250 Or $500 A Month On Form 2441 Based On The Income Rules.

Complete, edit or print tax forms instantly. Ad upload, modify or create forms. Persons or organizations who provided the care; Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)