Form 2553 Fax Number

Form 2553 Fax Number - Let’s walk through filing form 2553 online with efax. Web use the following address or fax number: Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web this form (2553) can be mailed via certified mail or faxed to the irs. You can file the form either via fax or via mail. Alternatively, the owners/shareholders of that business are taxed via their personal income tax return on the business’ profits and losses. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 fax number. Where to file the irs form 2553?

You can file the form either via fax or via mail. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Web this form (2553) can be mailed via certified mail or faxed to the irs. Open the app and enter the fax number. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas, utah, washington, wyoming. Web form 2553 fax number. Compose an email with the appropriate fax number Where to file the irs form 2553? Web department of the treasury.

If this form is not timely filed it can have serious tax consequences. Under item e, provide an effective date for an election, which is based on the date your corporation first had shareholders, assets, or began doing business. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Let’s walk through filing form 2553 online with efax. Web this form (2553) can be mailed via certified mail or faxed to the irs. Web use the following address or fax number: Open the app and enter the fax number. How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

How to Get Fax Number From Computer or Email

Web form 2553 fax number. We have shared more information about s corp late election (below) that can help you apply for late election relief. Web department of the treasury you can fax this form to the irs. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Under.

Ssurvivor Form 2553 Irs Fax Number

Web department of the treasury. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a).

Steps for Electing Sub S Status for Washington LLC or Corp Evergreen

Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Download and install an online fax app on your device. Web fax form 2553 to irs from an online fax app. Web department of the treasury. If this form is not timely filed it can have serious tax consequences.

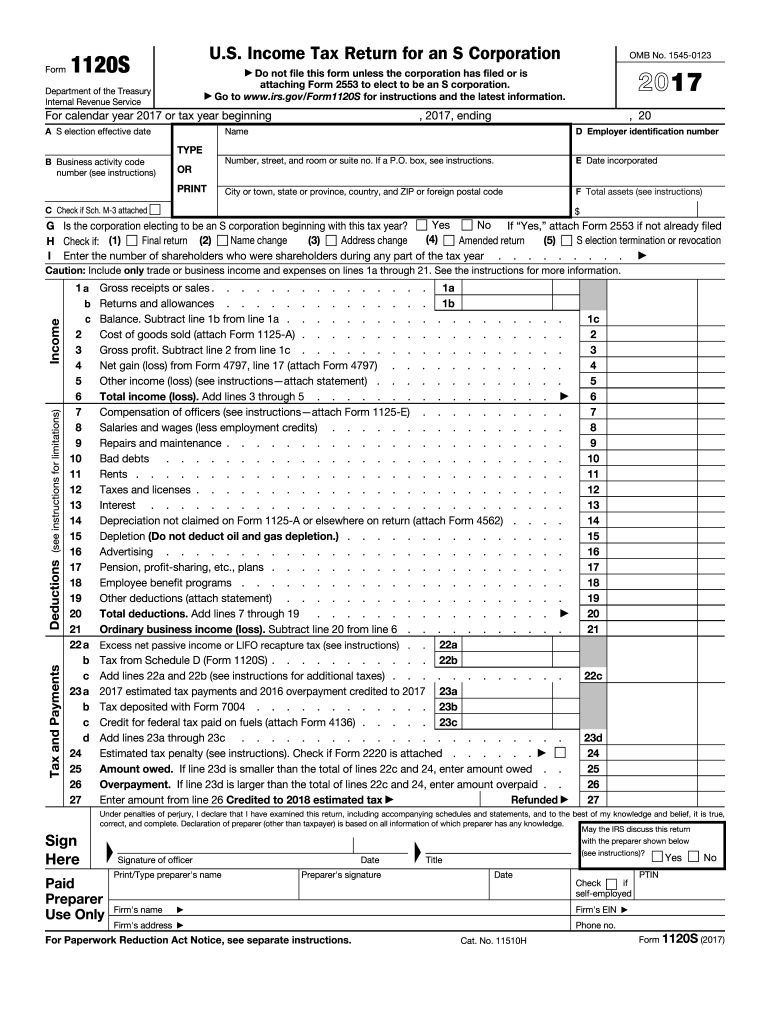

1120S Fill Out and Sign Printable PDF Template signNow

Web use the following address or fax number: Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Let’s walk through filing form 2553 online with efax. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,.

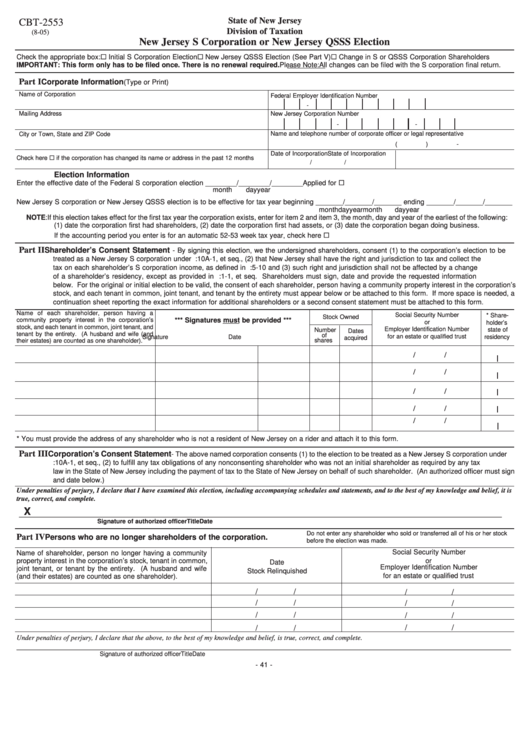

Fillable Form Cbt2553 New Jersey S Corporation Or New Jersey Qsss

Web form 2553 fax number. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Web department of the treasury you can fax this form to the irs. Open the app and enter the fax number. Web use the following address or fax number:

IRS Form 2553 Instructions How and Where to File This Tax Form

Under item e, provide an effective date for an election, which is based on the date your corporation first had shareholders, assets, or began doing business. Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. Web form 2553 is used by qualifying small business corporations and limited liability companies.

Form 2553 Instructions How and Where to File mojafarma

Let’s walk through filing form 2553 online with efax. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Download and install an online fax app on your device. Web form 2553 fax number. If this form.

Ssurvivor Form 2553 Irs Phone Number

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas,.

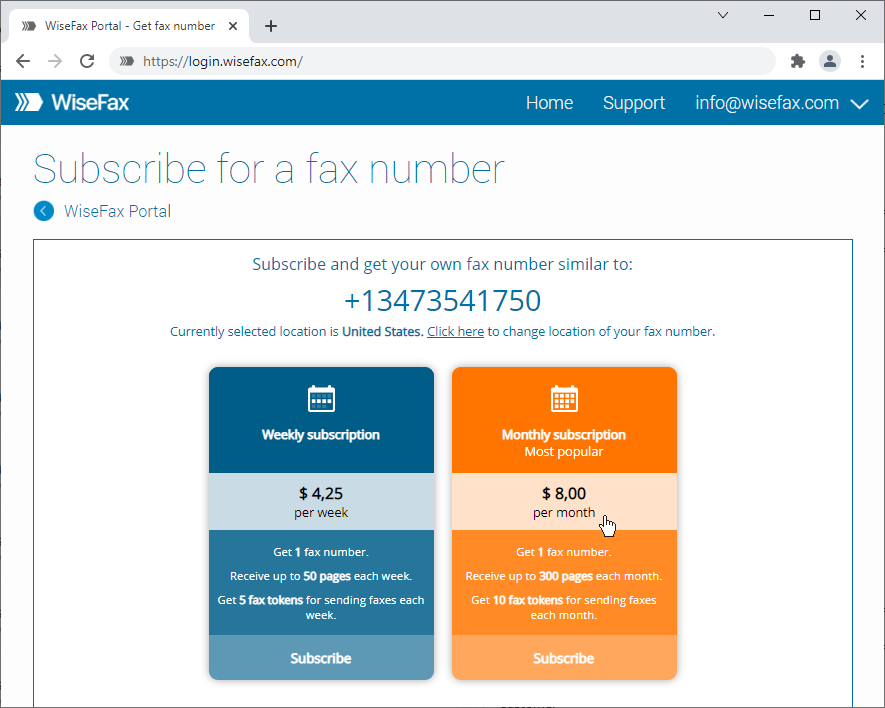

Fax Without a Fax Machine Receive Fax on WiseFax Fax Number

Download and install an online fax app on your device. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Under election information, fill in the corporation's name and address, along with your ein number and date.

What is IRS Form 2553? Bench Accounting

How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web this form (2553) can.

Alternatively, The Owners/Shareholders Of That Business Are Taxed Via Their Personal Income Tax Return On The Business’ Profits And Losses.

Web department of the treasury. Web fax form 2553 to irs from an online fax app. You can file the form either via fax or via mail. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas, utah, washington, wyoming.

Web Use The Following Address Or Fax Number:

Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. Compose an email with the appropriate fax number A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin:

Download And Install An Online Fax App On Your Device.

Web this form (2553) can be mailed via certified mail or faxed to the irs. How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements.

If This Form Is Not Timely Filed It Can Have Serious Tax Consequences.

Under item e, provide an effective date for an election, which is based on the date your corporation first had shareholders, assets, or began doing business. We have shared more information about s corp late election (below) that can help you apply for late election relief. Web form 2553 fax number. Let’s walk through filing form 2553 online with efax.