Form 2555 Pdf

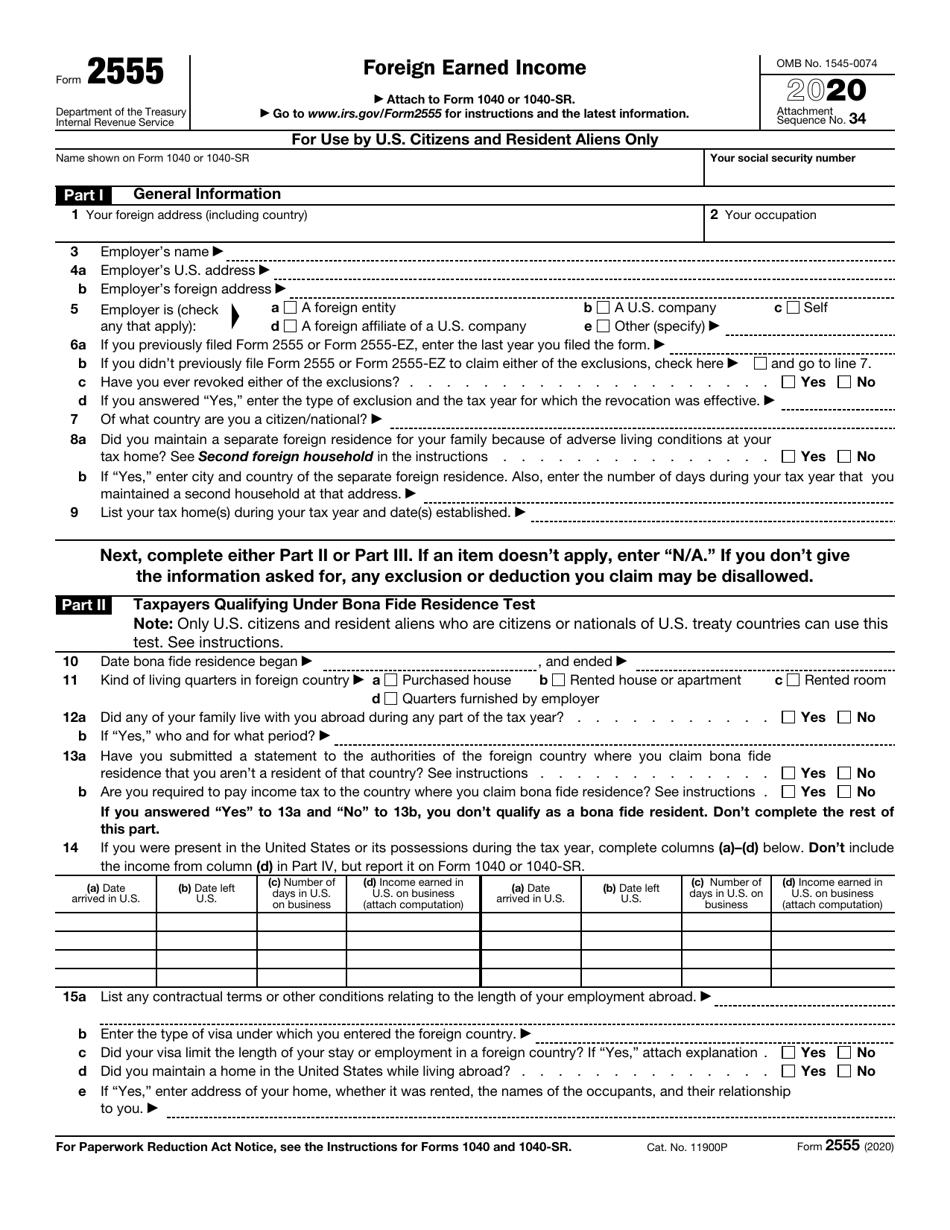

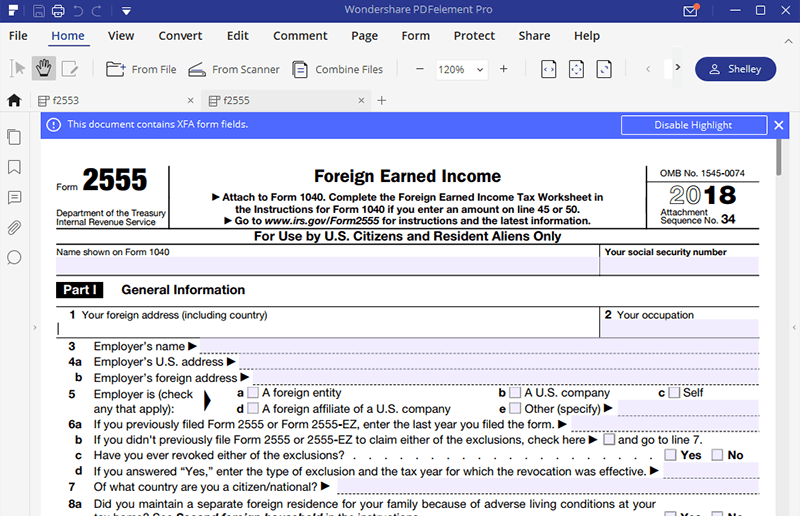

Form 2555 Pdf - Use fill to complete blank online irs pdf forms for free. Go to www.irs.gov/form2555 for instructions and the. Company c self any that apply): Form 2555 is a tax form used by united states taxpayers who qualify for the foreign earned income exclusion (feie). Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Exclude travel between foreign countries that did not involve travel on or. Web 5 employer is (check a a foreign entity b a u.s. Web the irs form 2555 is used to figure out the amount of your foreign earned income exclusion and your housing exclusion or deduction. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web fill online, printable, fillable, blank f2555 2019 form 2555 form.

Complete the foreign earned income tax worksheet. Web what is form 2555? Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Use fill to complete blank online irs pdf forms for free. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Ad access irs tax forms. Web 5 employer is (check a a foreign entity b a u.s. Get ready for tax season deadlines by completing any required tax forms today. Information about form 2555 and its separate instructions is at Company e other (specify) 6 a if you previously filed form 2555 or.

Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Go to www.irs.gov/form2555 for instructions and the. Ad access irs tax forms. D a foreign affiliate of a u.s. Form 2555 is a tax form used by united states taxpayers who qualify for the foreign earned income exclusion (feie). To claim this tax break, the taxpayer must. Web however, it should not be a surprise that there are strings attached to that tax break and that the details are quite complicated. Complete, edit or print tax forms instantly. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Exclude travel between foreign countries that did not involve travel on or.

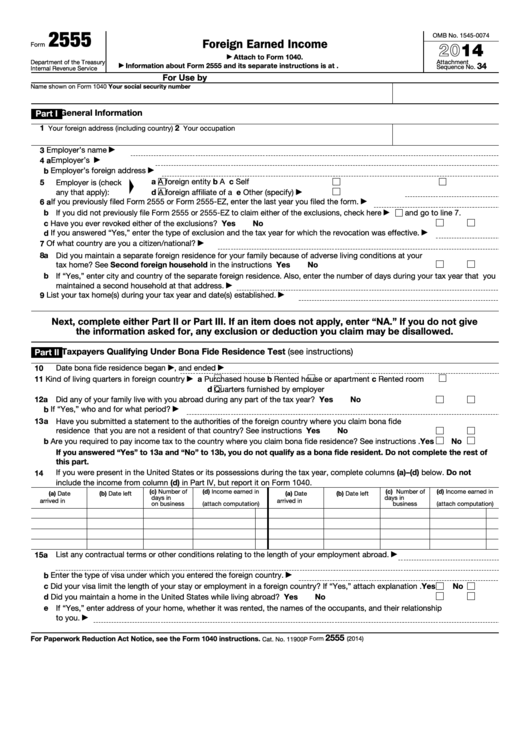

Fillable Form 2555 Foreign Earned 2014 printable pdf download

Use fill to complete blank online irs pdf forms for free. Exclude travel between foreign countries that did not involve travel on or. D a foreign affiliate of a u.s. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

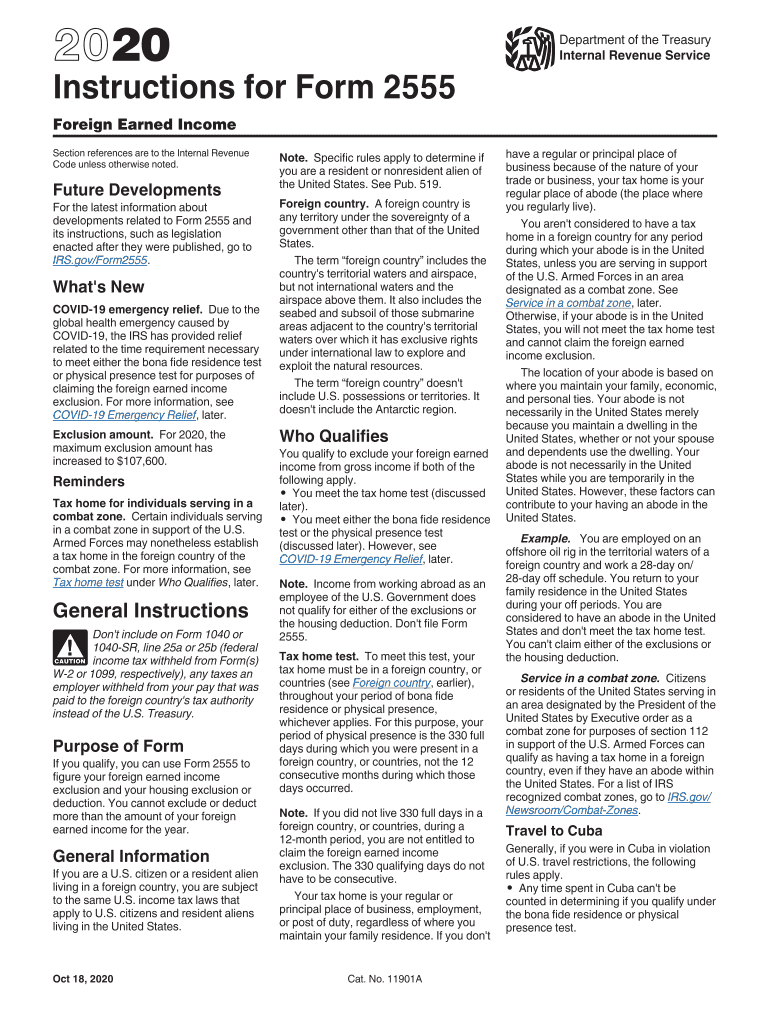

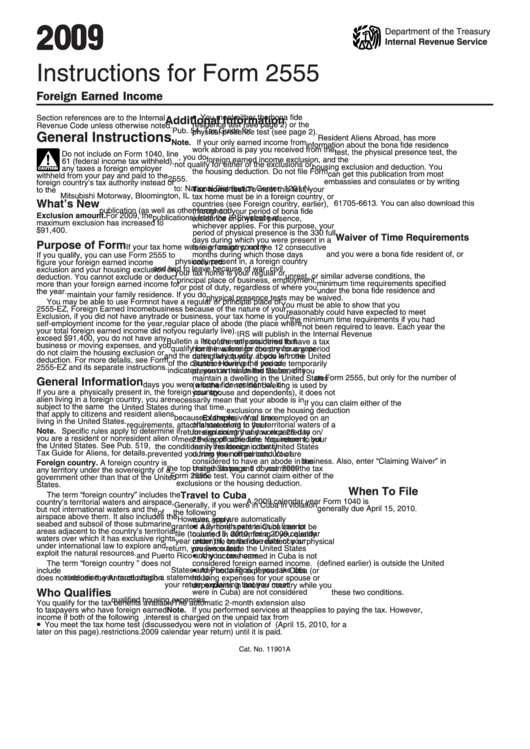

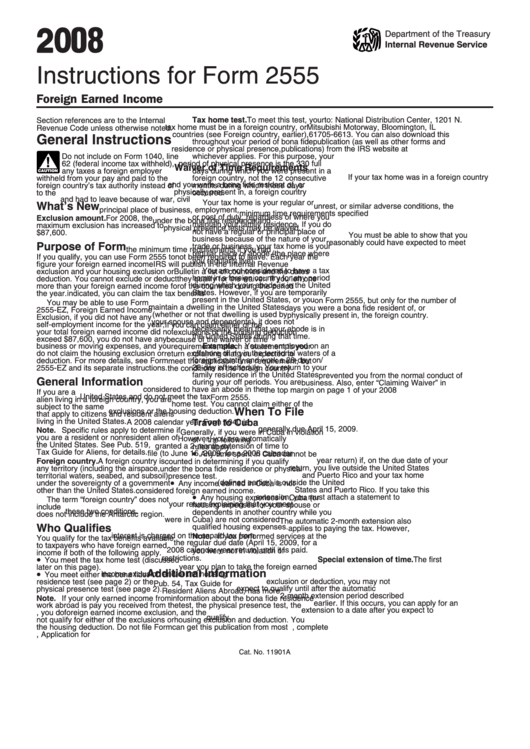

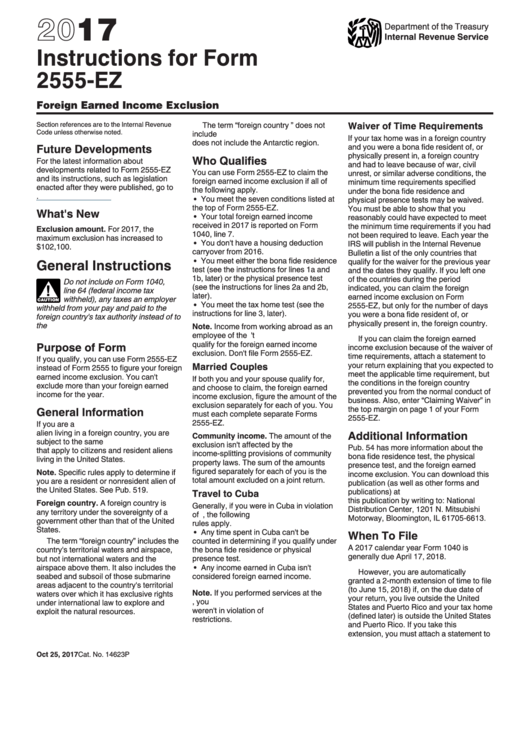

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Once completed you can sign your fillable. If you qualify, you can use form. Web fill online, printable, fillable, blank f2555 2019 form 2555 form. Web form 2555 department of the treasury internal revenue service foreign earned income attach to form 1040. Ad access irs tax forms.

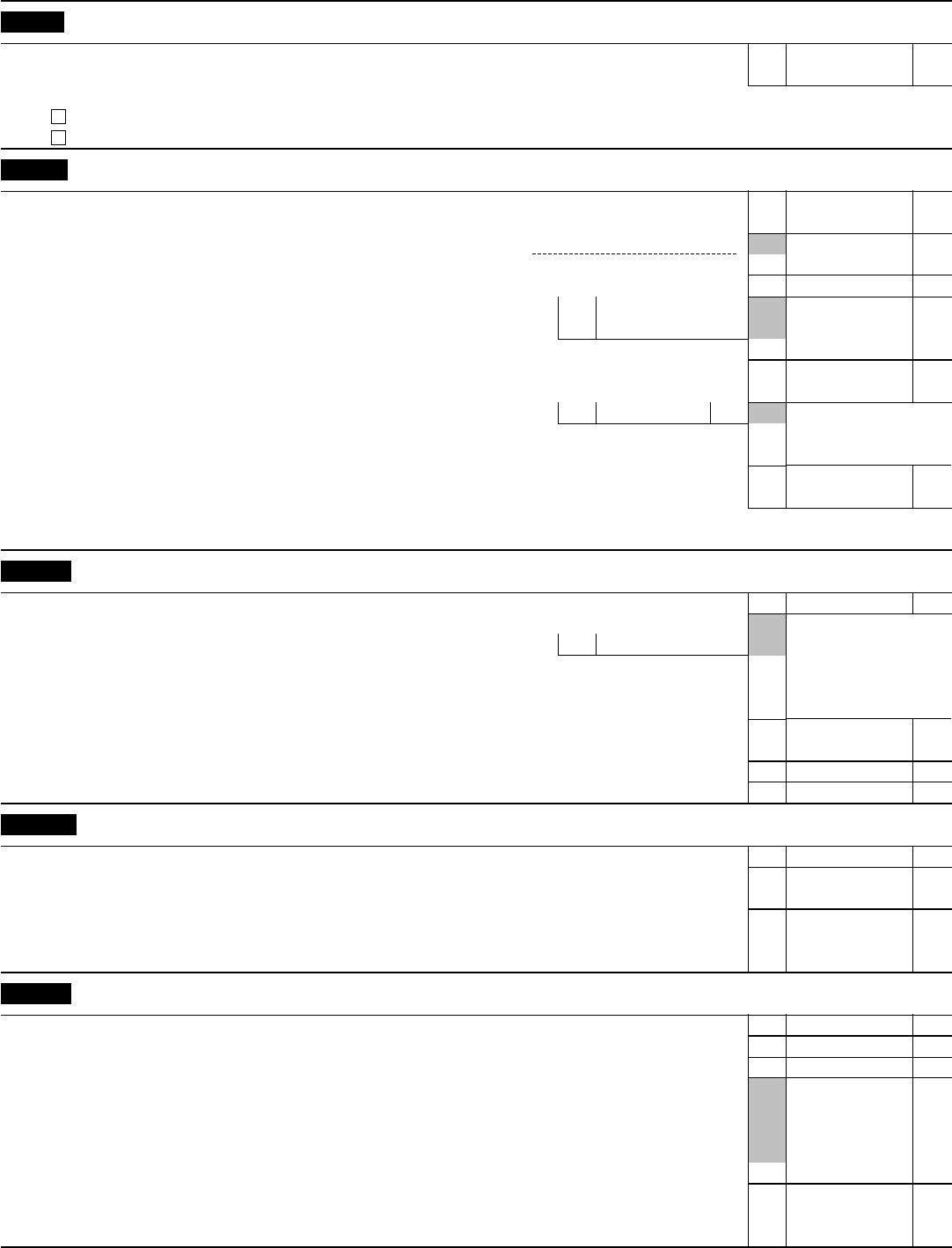

Form 2555 Edit, Fill, Sign Online Handypdf

Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Company c self any that apply): Form 2555 is a tax form used by united states taxpayers who qualify for the foreign earned income exclusion (feie). Use fill to complete blank online irs pdf forms for free. This form helps expats elect to use the foreign.

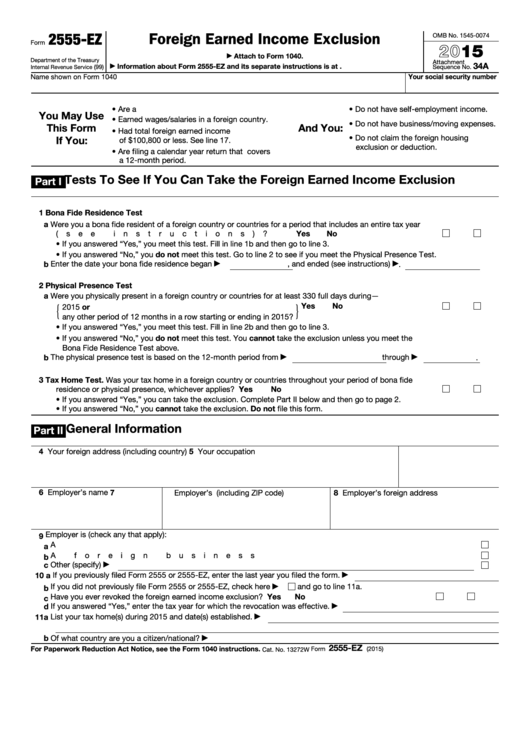

Fillable Form 2555Ez Foreign Earned Exclusion 2015

Go to www.irs.gov/form2555 for instructions and the. Web fill online, printable, fillable, blank f2555 2019 form 2555 form. To claim this tax break, the taxpayer must. Web what is form 2555? Ad access irs tax forms.

Instructions For Form 2555 Foreign Earned Internal Revenue

Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. This form can be filled with. Complete, edit or print tax forms instantly. Web however, it should not be a surprise that there are strings attached to that tax break and that the details are quite complicated. Get ready for tax.

Instructions For Form 2555 Foreign Earned Internal Revenue

Ad access irs tax forms. Web the irs form 2555 is used to figure out the amount of your foreign earned income exclusion and your housing exclusion or deduction. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Irs Fillable Form 1040 / 1040 2020 Internal Revenue Service Robert

Ad access irs tax forms. You can print other federal tax forms here. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Get ready for tax season deadlines by completing any.

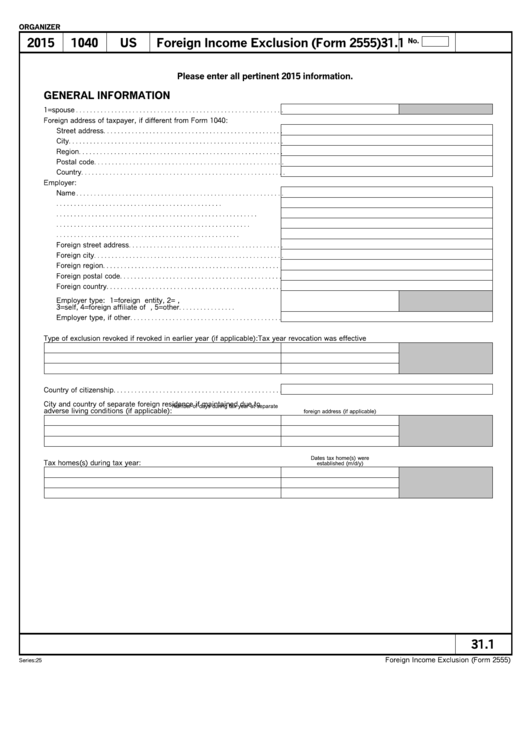

2015 Foreign Exclusion (Form 2555) printable pdf download

Ad access irs tax forms. Exclude travel between foreign countries that did not involve travel on or. To claim this tax break, the taxpayer must. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web form 2555 department of the treasury internal revenue service foreign earned income attach.

Top 16 Form 2555ez Templates free to download in PDF format

Web however, it should not be a surprise that there are strings attached to that tax break and that the details are quite complicated. Use fill to complete blank online irs pdf forms for free. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. You can print other federal tax.

Breanna Sample Form 2555

This exclusion allows eligible taxpayers. Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 2555 is used to figure out the amount of your foreign earned income exclusion and your housing exclusion or deduction. This form can be filled with. If you qualify, you can use form 2555 to figure your foreign.

Once Completed You Can Sign Your Fillable.

Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Form 2555 is a tax form used by united states taxpayers who qualify for the foreign earned income exclusion (feie). Web what is form 2555? Go to www.irs.gov/form2555 for instructions and the.

Web Fill Online, Printable, Fillable, Blank F2555 2019 Form 2555 Form.

Use fill to complete blank online irs pdf forms for free. Go to www.irs.gov/form2555 for instructions and the. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

To Claim This Tax Break, The Taxpayer Must.

Web form 2555 department of the treasury internal revenue service foreign earned income attach to form 1040. You can print other federal tax forms here. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Complete the foreign earned income tax worksheet.

This Exclusion Allows Eligible Taxpayers.

If you qualify, you can use form. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. D a foreign affiliate of a u.s. Web the irs form 2555 is used to figure out the amount of your foreign earned income exclusion and your housing exclusion or deduction.