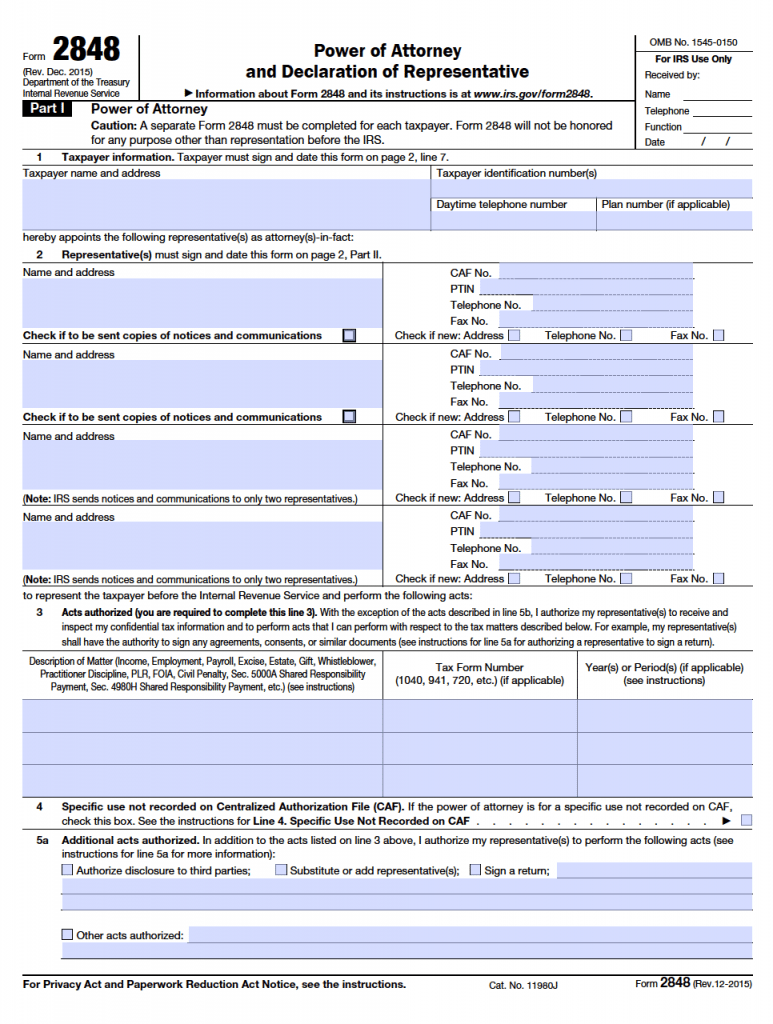

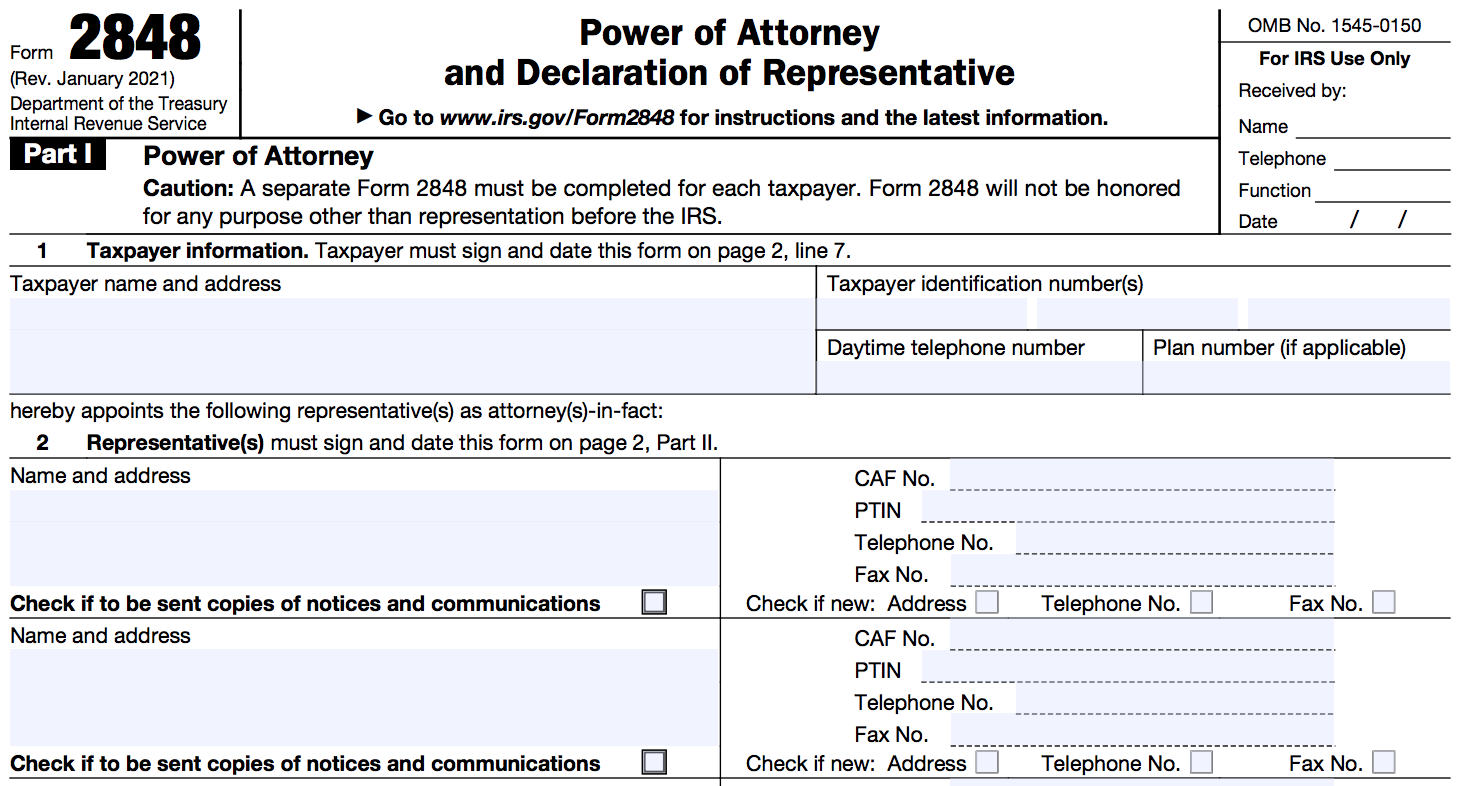

Form 2848 Fax Number

Form 2848 Fax Number - Web (such as an audit) you can mail, email, or fax the sc2848 to the scdor division that is handling the tax matter. Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. The individual you authorize must be a person eligible to practice before the irs. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Web about form 2848, power of attorney and declaration of representative. Mail your form 2848 directly to the irs address in the where to file chart. Upload a completed version of a signed form 8821 or form 2848.

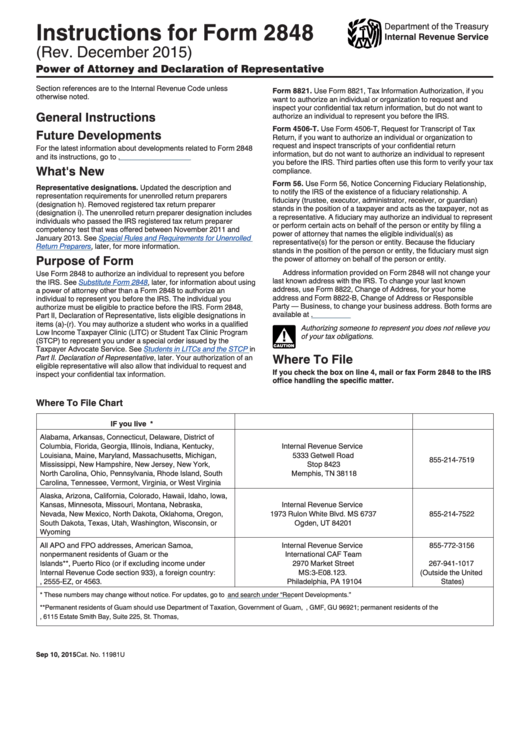

We have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Where to file chart if you live in. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Web you can only submit one form at a time. If form 2848 is for a specific use, mail or fax it to the Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Web (such as an audit) you can mail, email, or fax the sc2848 to the scdor division that is handling the tax matter. Meet all your fax demands with one purchase.

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. Web even better than fax is to submit the form online. Meet all your fax demands with one purchase. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Web you can only submit one form at a time. To submit multiple forms, select “submit another form and answer the questions about the authorization. If form 2848 is for a specific use, mail or fax it to the Fax your form 2848 to the irs fax number in the where to file chart. Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. To submit multiple forms, select “submit another form and answer the questions about the authorization. Web you can only submit one form at.

IRS Power of Attorney Form 2848 Year 2016 Power of Attorney

Covers a dedicted fax phone number with no extra cost. Use form 2848 to authorize an individual to represent you before the irs. If form 2848 is for a specific use, mail or fax it to the Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Meet all your fax demands.

Breanna Form 2848 Fax Number

Upload a completed version of a signed form 8821 or form 2848. Fax number* alabama, arkansas, connecticut, delaware, district of Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. We have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Web.

Breanna Form 2848 Fax Number Irs

To find the service center address, see the related tax return instructions. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. The individual you authorize must be a person eligible to practice before the irs. Web even better than fax is.

Form 2848 Power of Attorney and Declaration of Representative IRS

Web check the appropriate box to indicate if either the address, telephone number, or fax number is new since the caf number was assigned. Web even better than fax is to submit the form online. Mail your form 2848 directly to the irs address in the where to file chart. Covers a dedicted fax phone number with no extra cost..

Form 2848 Example

Mail your form 2848 directly to the irs address in the where to file chart. To submit multiple forms, select “submit another form and answer the questions about the authorization. Web you can only submit one form at a time. Fax number* alabama, arkansas, connecticut, delaware, district of Use form 2848 to authorize an individual to represent you before the.

Instructions For Form 2848 (Rev. 2015) printable pdf download

We have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Web one fax account, unlimited faxes. If form 2848 is for a specific use, mail or fax it to the Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center.

ICANN Application for TaxExempt Status (U.S.) Form 2848 Page 2

Web one fax account, unlimited faxes. Do not submit a form online if you've already submitted it by fax or mail. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Fax.

Breanna Form 2848 Fax Number Irs

Fax number* alabama, arkansas, connecticut, delaware, district of Use form 2848 to authorize an individual to represent you before the irs. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes. You may authorize a student who works.

All About IRS Form 2848 SmartAsset

Meet all your fax demands with one purchase. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. We have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Web about form 2848, power of attorney and declaration.

We Have Provided A List Of Irs Fax Numbers Above On Where To Fax Your Form 2848, Based On Your Residency.

Mail your form 2848 directly to the irs address in the where to file chart. Where to file chart if you live in. Do not submit a form online if you've already submitted it by fax or mail. Meet all your fax demands with one purchase.

Web One Fax Account, Unlimited Faxes.

To find the service center address, see the related tax return instructions. Covers a dedicted fax phone number with no extra cost. Be sure to include the area code followed by the fax number to ensure the fax is sent successfully. Substitute sc2848 the scdor will accept the federal 2848 for south carolina purposes.

To Submit Multiple Forms, Select “Submit Another Form And Answer The Questions About The Authorization.

You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Web you can only submit one form at a time. If form 2848 is for a specific use, mail or fax it to the Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter.

Web (Such As An Audit) You Can Mail, Email, Or Fax The Sc2848 To The Scdor Division That Is Handling The Tax Matter.

Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed. Find contact information on any notices you have received related to the pending tax matter or at dor.sc.gov/contact. Web even better than fax is to submit the form online. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart.