Form 2848 For Deceased Taxpayer

Form 2848 For Deceased Taxpayer - Spousal consent, signed by both spouses. In part i, line 1 asks for your name, address and phone number. Attach copy of court appointment and. Web how to complete form 2848: Web form 2848 power of attorney omb no. Web filing requirements the filing requirements that apply to individuals will determine if the personal representative must prepare a final individual income tax return. Web form 2848 for returns that are required to be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return, and form 941,. Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Authorizations also expire with the taxpayer's death (proof of death. Ad get ready for tax season deadlines by completing any required tax forms today.

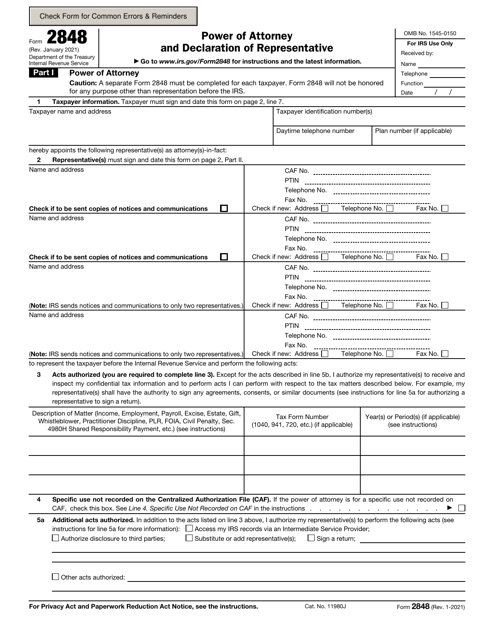

Web how to complete form 2848: Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. Authorizations also expire with the taxpayer's death (proof of death. Ad get ready for tax season deadlines by completing any required tax forms today. Attach copy of court appointment and. Web for decedents with 2023 date of deaths, the filing threshold is $12,920,000. A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Complete, edit or print tax forms instantly. And you need to know that the person who's representing the taxpayer needs to be eligible.

Ad get ready for tax season deadlines by completing any required tax forms today. Web i'm pretty sure there is no such thing as a poa for a deceased person. Web how to complete form 2848: Ad get ready for tax season deadlines by completing any required tax forms today. Your authorization of an eligible representative will also allow that individual to inspect. Your authorization of an eligible representative will also allow that individual to inspect. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Complete, edit or print tax forms instantly. Attach copy of court appointment and. Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821.

Power Of Attorney Tax Return Dividend Aristocrats Best Value

Taxpayer identification number(s) daytime telephone number. Form 2848 for a decedent you asked about the ability of a surviving spouse to authorize the appointment of a representative on form 2848, power of attorney and. Your authorization of an eligible representative will also allow that individual to inspect. The form 706 instructions for the year of the decedent’s death provide the.

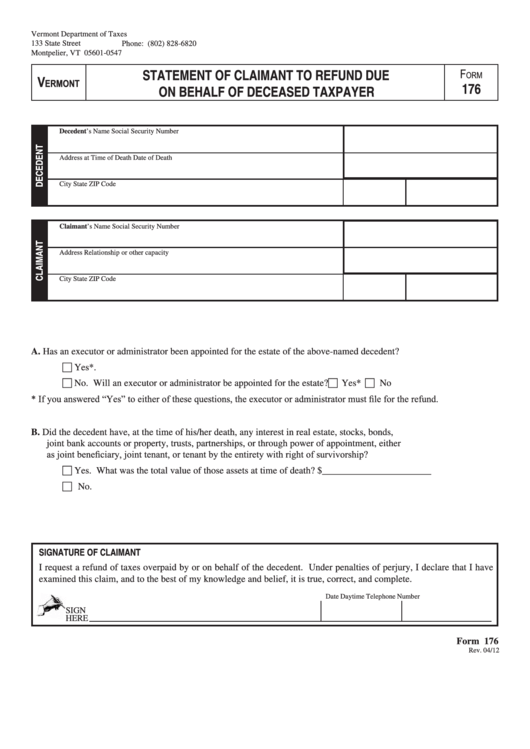

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

Your authorization of an eligible representative will also allow that individual to inspect. Taxpayer identification number(s) daytime telephone number. A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Form 2848 for a decedent you asked about the ability of a surviving spouse to.

Form 2848 Power of Attorney and Declaration of Representative IRS

Form 2848 for a decedent you asked about the ability of a surviving spouse to authorize the appointment of a representative on form 2848, power of attorney and. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. Web a new authorization.

Breanna Form 2848 Fax Number Irs

Attach copy of court appointment and. Web form 2848 power of attorney omb no. In part i, line 1 asks for your name, address and phone number. Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Your authorization of an eligible representative will also allow that individual to inspect.

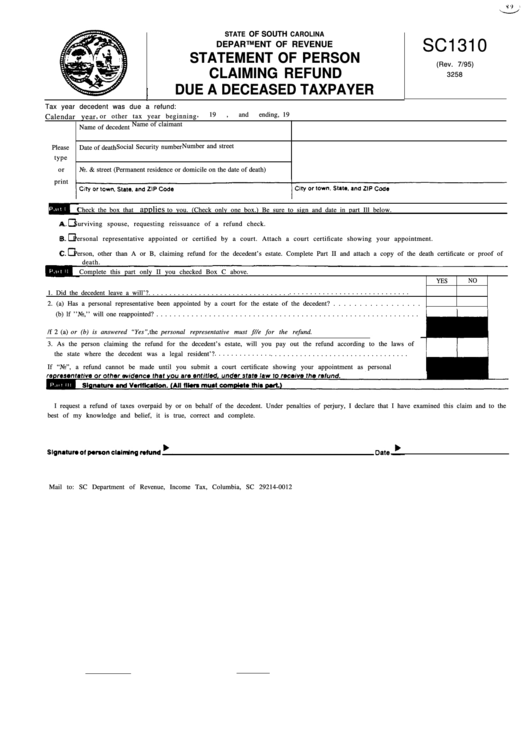

Fillable Form Sc1310 Statement Of Person Claiming Refund Due A

Your authorization of an eligible representative will also allow that individual to inspect. Your authorization of an eligible representative will also allow that individual to inspect. Complete, edit or print tax forms instantly. Authorizations also expire with the taxpayer's death (proof of death. In part i, line 1 asks for your name, address and phone number.

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

Attach copy of court appointment and. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney. Web filing requirements the filing requirements that apply to individuals will determine if the personal representative must prepare a final individual income tax return. Taxpayer must sign and date this form on page 2, line 7. Web form.

Breanna Form 2848 Irsgov

You use form 2848, signed by trustee or personal rep. Taxpayer identification number(s) daytime telephone number. In part i, line 1 asks for your name, address and phone number. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 2848 power of attorney omb no.

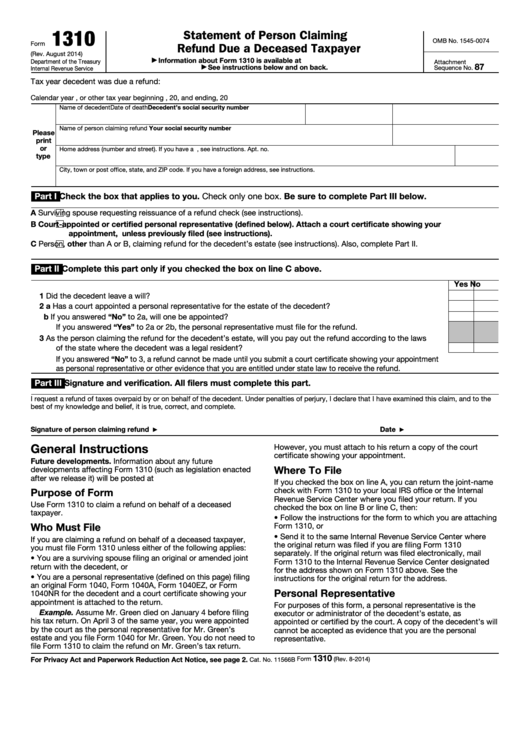

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web i'm pretty sure there is no such thing as a poa for a deceased person. Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. In part i, line 1 asks for your name, address and phone number. Complete, edit or print tax forms instantly. Web form 2848 power of.

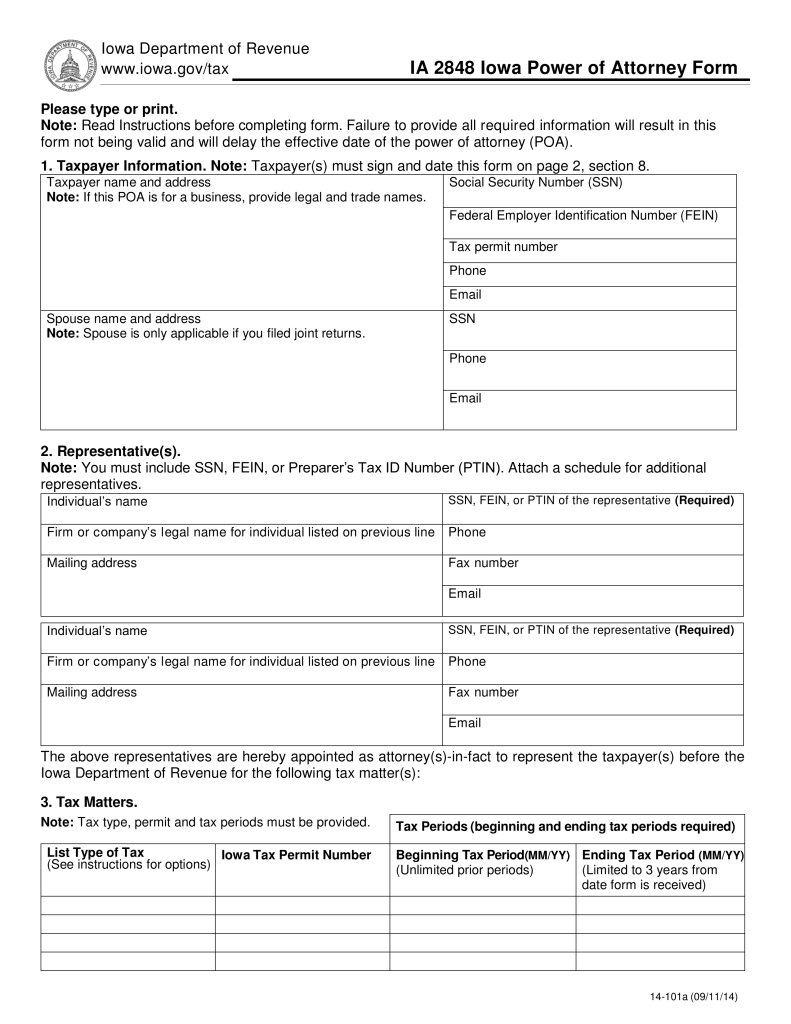

Free Iowa Tax Power of Attorney Form 2848 PDF eForms

Taxpayer identification number(s) daytime telephone number. Web form 2848 for returns that are required to be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return, and form 941,. You use form 2848, signed by trustee or personal rep. Web i'm pretty sure there is no such thing as a poa for a deceased person..

Form 2848 Instructions for IRS Power of Attorney Community Tax

Taxpayer must sign and date this form on page 2, line 7. A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent.

Web Form 2848 For Returns That Are Required To Be Filed Separately From The Consolidated Return, Such As Form 720, Quarterly Federal Excise Tax Return, And Form 941,.

A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Attach copy of court appointment and. Web filing requirements the filing requirements that apply to individuals will determine if the personal representative must prepare a final individual income tax return. You use form 2848, signed by trustee or personal rep.

Web How To Complete Form 2848:

Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. In part i, line 1 asks for your name, address and phone number. Your authorization of an eligible representative will also allow that individual to inspect. Web is 2848 poa still valid upon death of taxpayer?

When Filing The Form, Include A Copy Of.

Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Taxpayer identification number(s) daytime telephone number. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Web i'm pretty sure there is no such thing as a poa for a deceased person. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. The form 706 instructions for the year of the decedent’s death provide the filing.

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)