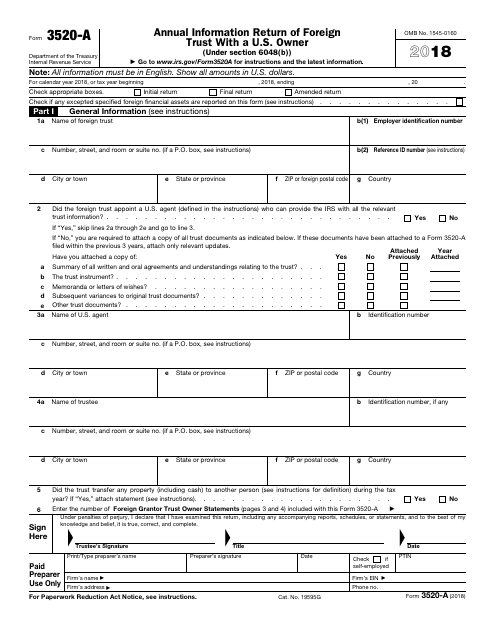

Form 3520-A

Form 3520-A - The form is one of the more complicated reporting vehicles for overseas assets. A foreign trust with at least one u.s. Person who is treated as an owner of any portion of the foreign trust. Person who has any ownership the foreign trust, and also income of the trust. Persons (and executors of estates of u.s. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. The form provides information about the foreign trust, its u.s. Show all amounts in u.s. Certain transactions with foreign trusts. Decedents) file form 3520 with the irs to report:

Owner files this form annually to provide information about: The form is one of the more complicated reporting vehicles for overseas assets. Owner (under section 6048 (b)). Persons (and executors of estates of u.s. Receipt of certain large gifts or bequests from certain foreign persons. Decedents) file form 3520 to report: Certain transactions with foreign trusts. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a for instructions and the latest information omb no. Decedents) file form 3520 with the irs to report: Person who has any ownership the foreign trust, and also income of the trust.

Person who is treated as an owner of any portion of the foreign trust. Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: Certain transactions with foreign trusts. All information must be in english. Persons (and executors of estates of u.s. The form is one of the more complicated reporting vehicles for overseas assets. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Show all amounts in u.s. Owner (under section 6048 (b)).

IRS Form 3520A 2018 2019 Fill out and Edit Online PDF Template

The form provides information about the foreign trust, its u.s. Show all amounts in u.s. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Person who is treated as an owner of any portion of the foreign trust. This information includes its u.s.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Receipt of certain large gifts or. Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. The form provides information about the foreign trust, its u.s. Receipt of certain large gifts or bequests from certain foreign persons. Person who has any ownership the.

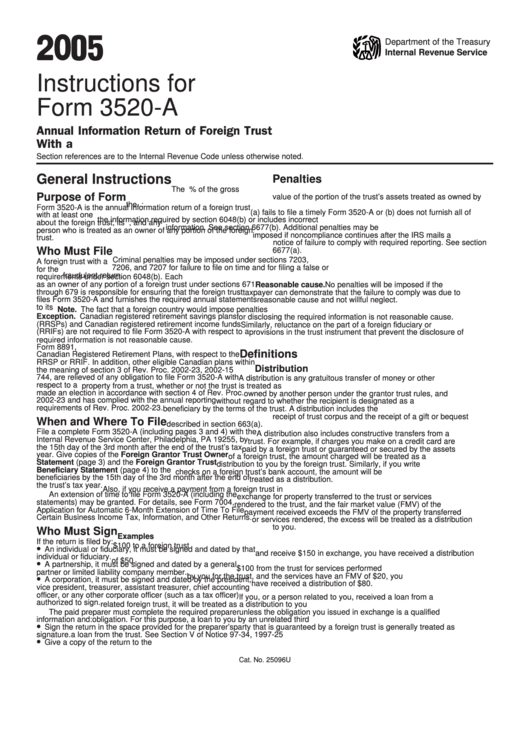

Instructions For Form 3520A Annual Information Return Of Foreign

Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Decedents) file form 3520 to report: It is similar to a financial statement that a u.s. Owner files.

Form 3520A Annual Information Return of Foreign Trust with a U.S

The form is one of the more complicated reporting vehicles for overseas assets. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). The form provides information about the foreign trust, its u.s. Certain transactions with foreign trusts. Owner (under section 6048(b)) department of the treasury internal.

Form 3520a Annual Information Return of Foreign Trust with a U.S

Persons (and executors of estates of u.s. Receipt of certain large gifts or bequests from certain foreign persons. The form is one of the more complicated reporting vehicles for overseas assets. Owner files this form annually to provide information about: It is similar to a financial statement that a u.s.

Tax Audits « TaxExpatriation

Decedents) file form 3520 with the irs to report: Decedents) file form 3520 to report: Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Receipt of certain large gifts or. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a for instructions and the latest information omb.

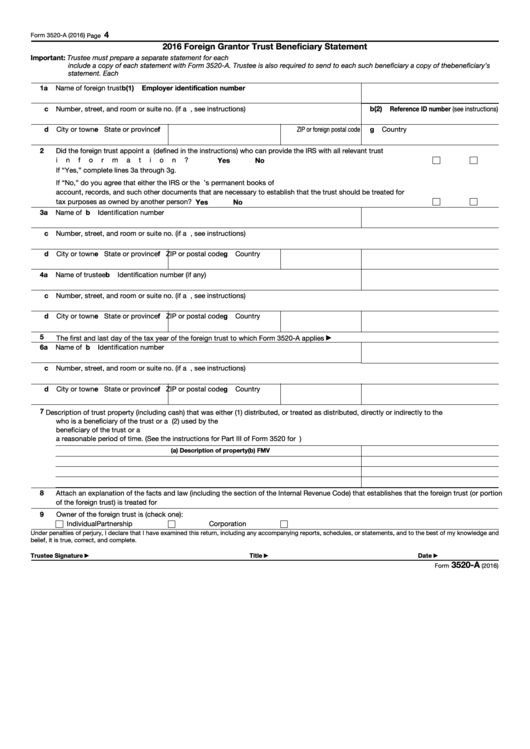

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Decedents) file form 3520 with the irs to report: Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Receipt of certain large gifts or bequests from certain foreign persons. Owner files this form annually to provide information about: Certain transactions with foreign trusts.

Forms 3520 and 3520A What You Need to Know

Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Decedents) file form 3520 with the irs to report: Person who has any ownership the foreign trust, and also income of the trust. Decedents) file form 3520 to report: Person who is treated as an owner of any portion of the foreign.

Form 3520A Annual Information Return of Foreign Trust with a U.S

The form provides information about the foreign trust, its u.s. All information must be in english. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Owner files this form annually to provide information about: Certain transactions with foreign trusts, ownership of foreign trusts under the rules.

The Tax Times IRS Sending SemiAutomated Penalties For Late Filed Form

Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. The form provides information about the foreign trust, its u.s. Decedents) file form 3520 to report: Person who has any ownership the.

Certain Transactions With Foreign Trusts, Ownership Of Foreign Trusts Under The Rules Of Sections 671 Through 679, And.

Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). The form provides information about the foreign trust, its u.s. Show all amounts in u.s. Owner, is an example of a tax document that must be filed every year by taxpayers who are the trustees, beneficiaries, or owners of a foreign trust.

Persons (And Executors Of Estates Of U.s.

Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a for instructions and the latest information omb no. It is similar to a financial statement that a u.s. Owner (under section 6048 (b)). Person who is treated as an owner of any portion of the foreign trust.

The Form Is One Of The More Complicated Reporting Vehicles For Overseas Assets.

Person who has any ownership the foreign trust, and also income of the trust. Decedents) file form 3520 to report: Owner files this form annually to provide information about: This information includes its u.s.

Person Who Is Treated As An Owner Of Any Portion Of The Foreign Trust Under The Grantor Trust Rules (Sections 671 Through 679).

Certain transactions with foreign trusts. All information must be in english. The form provides information about the foreign trust, its u.s. Decedents) file form 3520 with the irs to report: