Form 3520 Instructions 2022

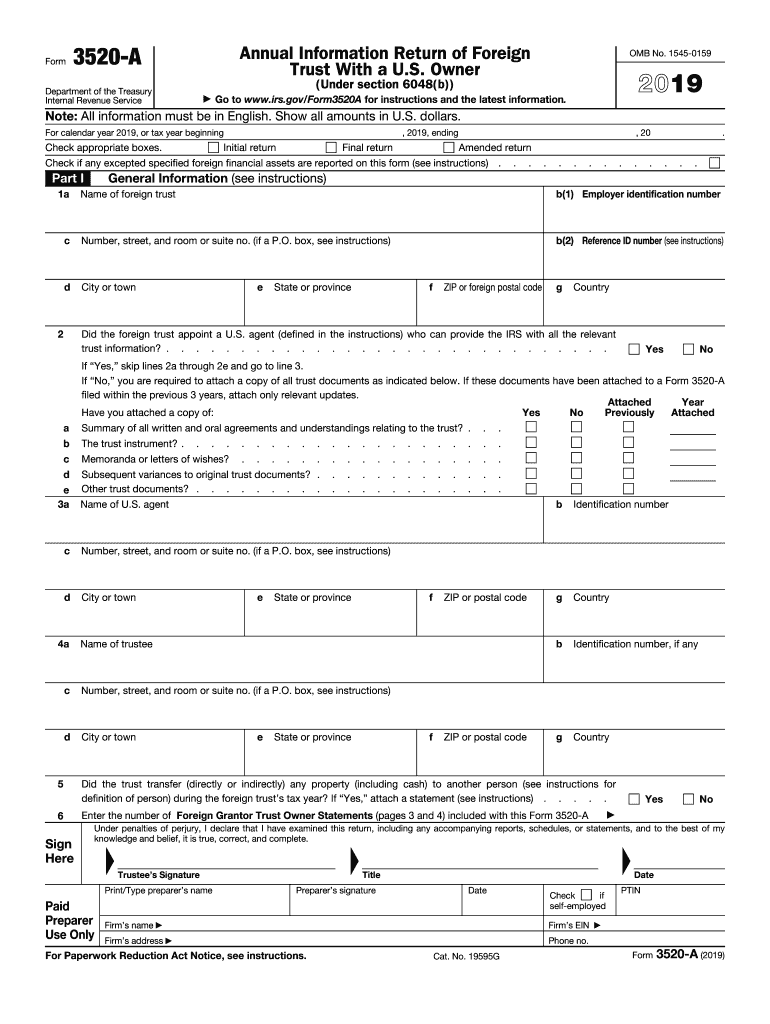

Form 3520 Instructions 2022 - Solved•by intuit•6•updated november 14, 2022. Web form 3520 & instructions: Web the form is due when a person’s tax return is due to be filed. A calendar year trust is due march 15. Reminder exemption from information reporting under section. Owner files this form annually to provide information. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Instructions for form 3520, annual return to report. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a.

Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts) for free from the federal internal. Instructions for form 3520, annual return to report. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner a foreign trust with at least one u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Reminder exemption from information reporting under section. It does not have to be a. Web form 3520 & instructions:

Web the form is due when a person’s tax return is due to be filed. Instructions for form 3520, annual return to report. Web 2022 annual information return of foreign trust with a u.s. Annual information return of foreign trust with a u.s. It does not have to be a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner 2022 12/19/2022 inst 3520: Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web california form 3520 power of attorney identification numbers. Instructions for completing ftb 3520:taxpayer.

F3520 vehicle registration transfer application Australian tutorials

Reminder exemption from information reporting under section. Annual information return of foreign trust with a u.s. Owner files this form annually to provide information. Owner 2022 12/19/2022 inst 3520: Solved•by intuit•6•updated november 14, 2022.

Form 3520 Fill out & sign online DocHub

Owner 2022 12/19/2022 inst 3520: It does not have to be a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner a foreign trust with at least one u.s. Web 2022 annual information return of.

Form 3520 Instructions Fill Out and Sign Printable PDF Template signNow

It does not have to be a. A calendar year trust is due march 15. Owner files this form annually to provide information. Owner 2022 12/19/2022 inst 3520: Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great.

Steuererklärung dienstreisen Form 3520

Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts) for free from the federal internal..

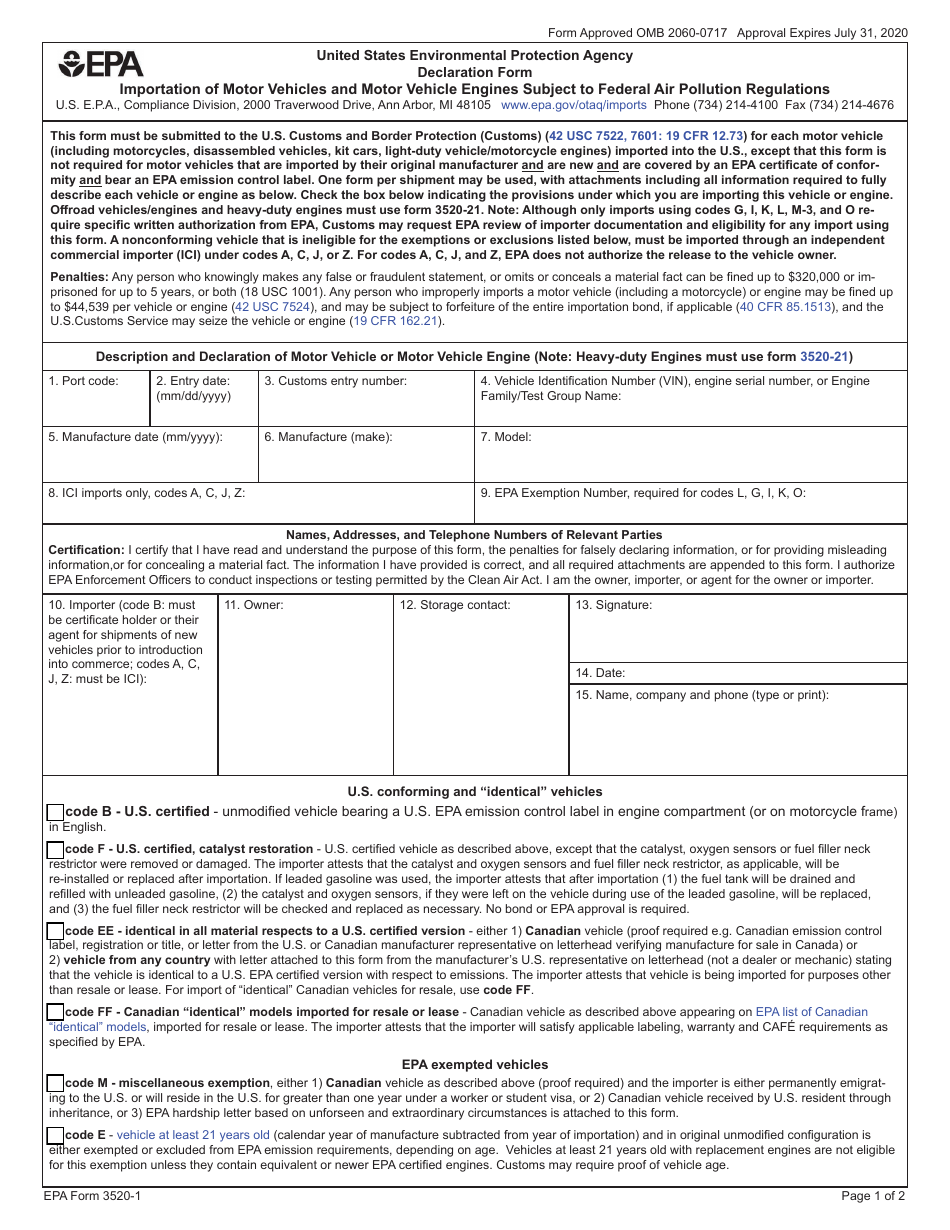

EPA Form 35201 Download Fillable PDF or Fill Online Declaration Form

Owner a foreign trust with at least one u.s. It does not have to be a. Web the form is due when a person’s tax return is due to be filed. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web form 3520 is a tax form that us expats must file.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Instructions for completing ftb 3520:taxpayer. Owner files this form annually to provide information. Web taxes get your taxes done linyi1985 level 2 need help on filing form.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 & instructions: Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign.

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Reminder exemption from information reporting under section. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web form 3520 & instructions: Solved•by intuit•6•updated november 14, 2022. Web 2022 annual information return of foreign trust with a u.s.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Web the form is due when a person’s tax return is due to be filed. Owner 2022 12/19/2022 inst 3520: Owner files this form annually to provide information. Solved•by intuit•6•updated november 14, 2022. Web 2022 annual information return of foreign trust with a u.s.

Instructions For Form 3520, Annual Return To Report.

Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web the form is due when a person’s tax return is due to be filed.

Web 2022 Annual Information Return Of Foreign Trust With A U.s.

Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts) for free from the federal internal. It does not have to be a. A calendar year trust is due march 15. Web california form 3520 power of attorney identification numbers.

Web Form 3520 & Instructions:

Owner a foreign trust with at least one u.s. Owner 2022 12/19/2022 inst 3520: Solved•by intuit•6•updated november 14, 2022. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great.

Annual Information Return Of Foreign Trust With A U.s.

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Reminder exemption from information reporting under section. Owner files this form annually to provide information. Instructions for completing ftb 3520:taxpayer.