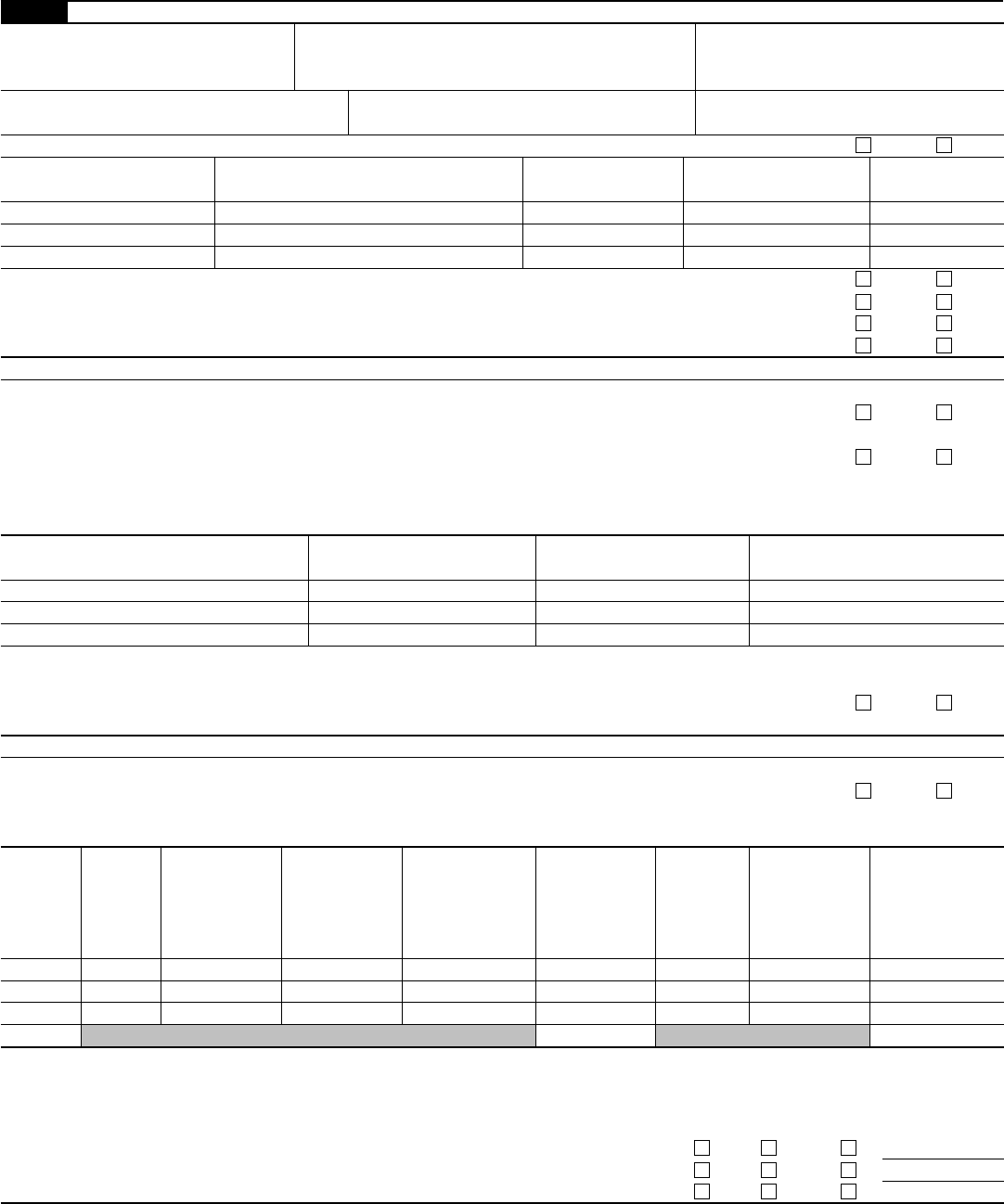

Form 3520 Part Iv Example

Form 3520 Part Iv Example - Penalties for failure to file part iv of form 3520. Person(s) with respect to whom this form 3520 is being filed. Form 3520 is an informational return in which u.s. Web a foreign person includes a nonresident alien individual or foreign corporation, partnership, or estate, as well as a domestic trust that is treated as owned by a. Web file a separate form 3520 for each foreign trust. You may be required to file financial crimes enforcement network. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Use part iv to indicate additional acts your named. Taxpayers report transactions with certain foreign trusts, ownership of. Transferor who, directly or indirectly, transferred money or other property during the.

Taxpayers report transactions with certain foreign trusts, ownership of. Penalties for failure to file part iv of form 3520. See the instructions for part iv. Web identifying information requested below and part iv of the form. Transferor who, directly or indirectly, transferred money or other property during the. You may be required to file financial crimes enforcement network. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign trusts, it is. Web complete the identifying information on page 1 of the form and part iv. Form 3520 is an informational return in which u.s. Use part iv to indicate additional acts your named.

Person(s) with respect to whom this form 3520 is being filed. Web common examples of individuals with foreign gift reporting requirements: Form 3520 is an informational return in which u.s. If part iv of form 3520 is filed late, incomplete, or. Web for example, single year: Taxpayers report transactions with certain foreign trusts, ownership of. Web requested below and part iii of the form. You may be required to file financial crimes enforcement network. Transferor who, directly or indirectly, transferred money or other property during the. Web complete the identifying information on page 1 of the form and part iv.

US Taxes and Offshore Trusts Understanding Form 3520

See the instructions for part iv. A poa declaration gives representatives general privileges listed in part iii. Transferor who, directly or indirectly, transferred money or other property during the. Web common examples of individuals with foreign gift reporting requirements: Person(s) with respect to whom this form 3520 is being filed.

question about form 3520 TurboTax Support

Penalties for failure to file part iv of form 3520. Web file with an advisor what is form 3520? You may be required to file financial crimes enforcement network. Web a foreign person includes a nonresident alien individual or foreign corporation, partnership, or estate, as well as a domestic trust that is treated as owned by a. Web specifically, the.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Web a foreign person includes a nonresident alien individual or foreign corporation, partnership, or estate, as well as a domestic trust that is treated as owned by a. A poa declaration gives representatives general privileges listed in part iii. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign.

Form 3520A Annual Information Return of Foreign Trust with a U.S

A poa declaration gives representatives general privileges listed in part iii. Use part iv to indicate additional acts your named. Web file with an advisor what is form 3520? Web common examples of individuals with foreign gift reporting requirements: Web a foreign person includes a nonresident alien individual or foreign corporation, partnership, or estate, as well as a domestic trust.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Use part iv to indicate additional acts your named. Web complete the identifying information on page 1 of the form and part iv. Web for example, single year: Web common examples of individuals with foreign gift reporting requirements: Transferor who, directly or indirectly, transferred money or other property during the.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Person who, during the current tax year, received certain gifts or bequests from a foreign person. Transferor who, directly or indirectly, transferred money or other property during the. Web file a separate form 3520 for each foreign trust. Person(s) with respect to whom this form 3520 is being filed. Form 3520 is an informational return in which u.s.

Form 3520 Blank Sample to Fill out Online in PDF

Person(s) with respect to whom this form 3520 is being filed. If part iv of form 3520 is filed late, incomplete, or. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign trusts, it is. Use part iv to indicate additional acts.

IRS Form 3520Reporting Transactions With Foreign Trusts

Web complete the identifying information on page 1 of the form and part iv. Web a foreign person includes a nonresident alien individual or foreign corporation, partnership, or estate, as well as a domestic trust that is treated as owned by a. Web identifying information requested below and part iv of the form. Web for example, single year: Transferor who,.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web identifying information requested below and part iv of the form. See the instructions for part iv. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign trusts, it is. Web file with an advisor what is form 3520? Taxpayers report transactions.

Epa form 3520 21 Instructions Brilliant Sl L Eta 11 0271

Person who, during the current tax year, received certain gifts or bequests from a foreign person. Penalties for failure to file part iv of form 3520. And see the instructions for part iv. Form 3520 is an informational return in which u.s. Use part iv to indicate additional acts your named.

Penalties For Failure To File Part Iv Of Form 3520.

Person(s) with respect to whom this form 3520 is being filed. Web requested below and part iii of the form. Check either the “yes” or “no” box below for additional authorizations you. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign trusts, it is.

Web Purpose Of Form 3520 As Its Title States, Form 3520 Is An Information Return By Which Us Persons, As Well As Executors Of The Estates Of Us Decedents, Report:

If part iv of form 3520 is filed late, incomplete, or. Taxpayers report transactions with certain foreign trusts, ownership of. And see the instructions for part iv. See the instructions for part iv.

Web Identifying Information Requested Below And Part Iv Of The Form.

Web common examples of individuals with foreign gift reporting requirements: Transferor who, directly or indirectly, transferred money or other property during the. Web file with an advisor what is form 3520? Web for example, single year:

Use Part Iv To Indicate Additional Acts Your Named.

Form 3520 is an informational return in which u.s. A poa declaration gives representatives general privileges listed in part iii. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign. Web complete the identifying information on page 1 of the form and part iv.