Form 4797 Instruction

Form 4797 Instruction - • sale of a portion of a macrs asset. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. General instructions purpose of form use form 4797 to report: Web form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a qof within 180 days of the date sold. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: Web assets on form 4797, part i, ii, or iii, as applicable. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. • involuntary conversion of a portion of a macrs asset other than from a casualty or theft.

• involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web assets on form 4797, part i, ii, or iii, as applicable. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. This is not intended as tax advice. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here.

This is not intended as tax advice. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Web assets on form 4797, part i, ii, or iii, as applicable. Web instructions to printers form 4797, page 2 of 2 margins: • sale of a portion of a macrs asset. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Enter the name and identifying. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. • involuntary conversion of a portion of a macrs asset other than from a casualty or theft.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

• sale of a portion of a macrs asset. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Top 13 mm (1⁄ 2), center sides. Web form.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. This might include any property used to generate rental income or even a. Web 4797 department of the.

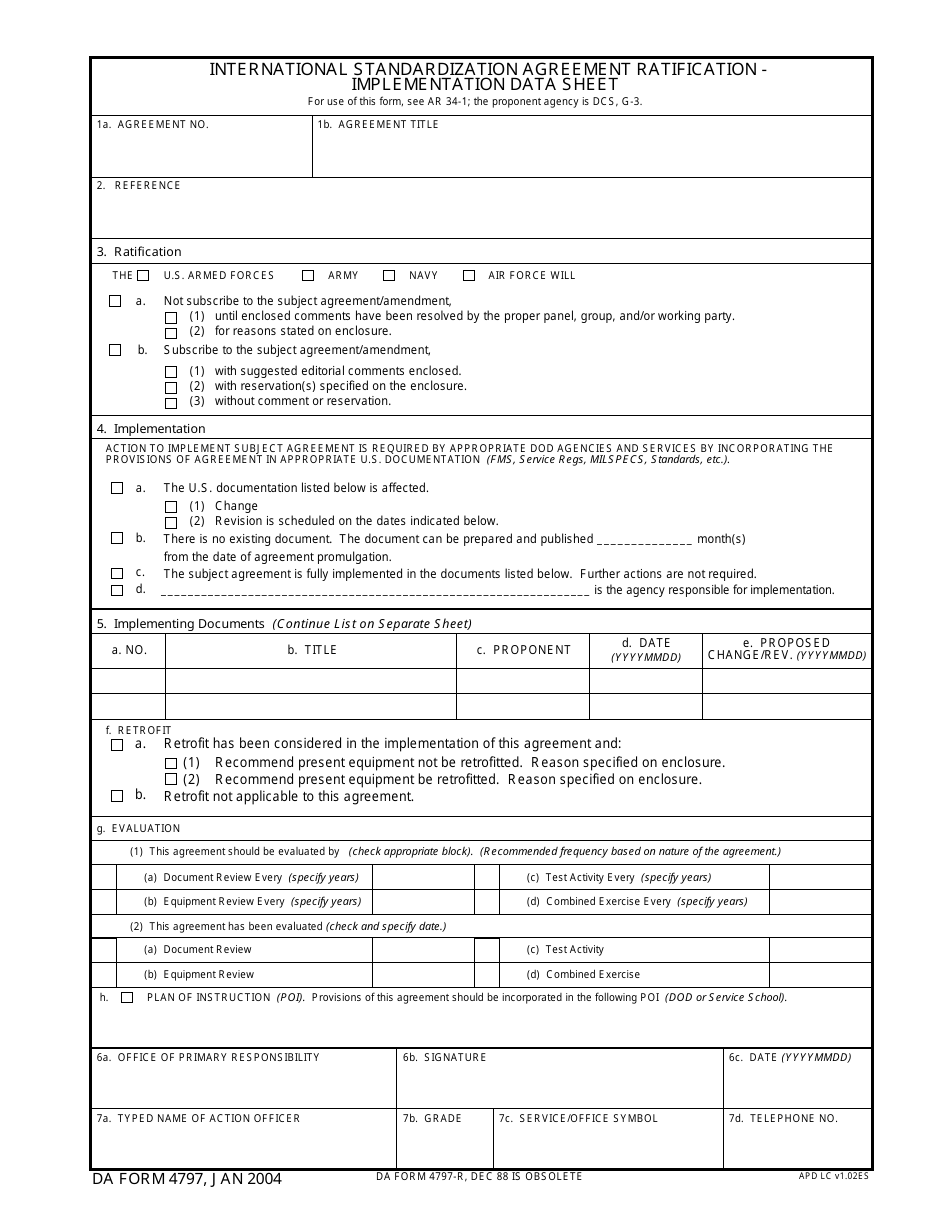

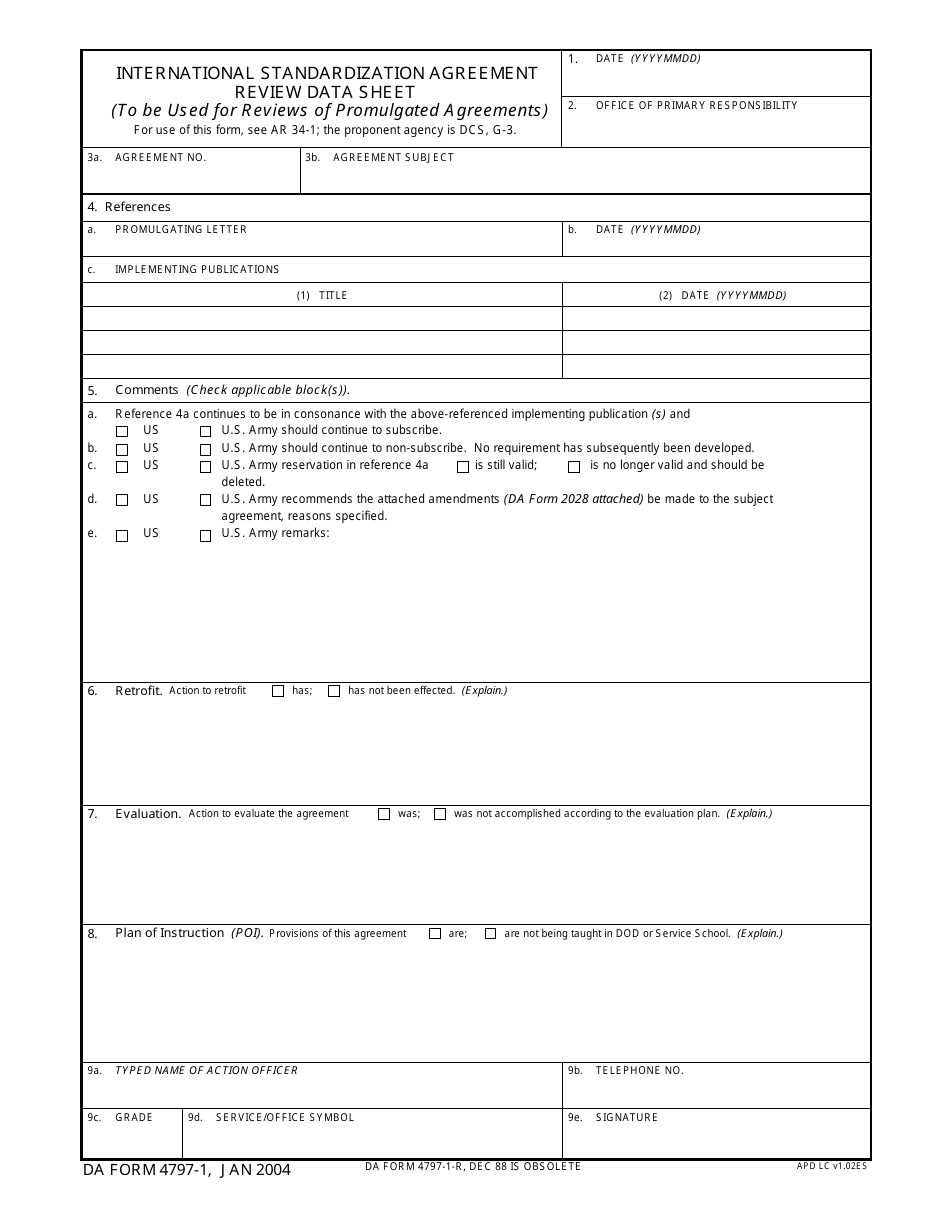

DA Form 4797 Download Fillable PDF or Fill Online International

Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web that may affect form 4797) and make it available for 2017, go to irs.gov/ extenders. Top.

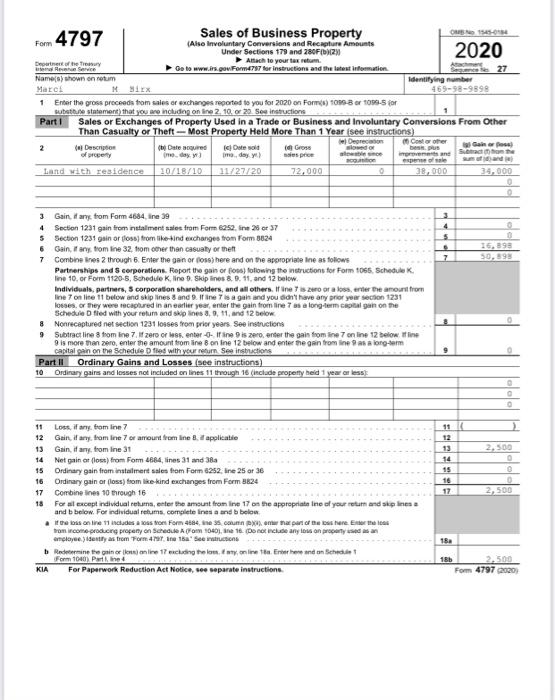

Line 7 of Form 4797 is 50,898At what rate(s) is

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. This might include any property used to generate rental income or even a. Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: General instructions purpose of form use form 4797 to.

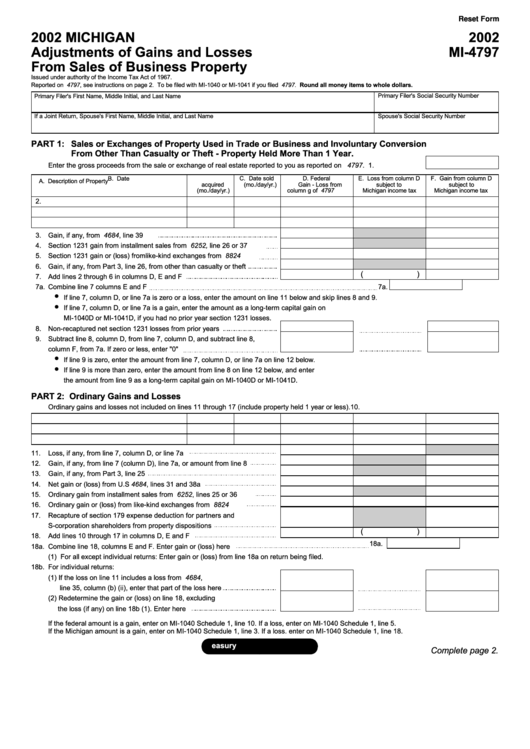

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

• sale of a portion of a macrs asset. General instructions purpose of form. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web developments related to form 4797.

DD Form 47971 Download Fillable PDF or Fill Online International

Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. This might include any property used to generate rental income or even a. • sale of a portion of a macrs asset..

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

General instructions purpose of form. • involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web assets on form 4797, part i, ii, or iii, as applicable. First of all, you can get this form.

TURBOTAX InvestorVillage

Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is.

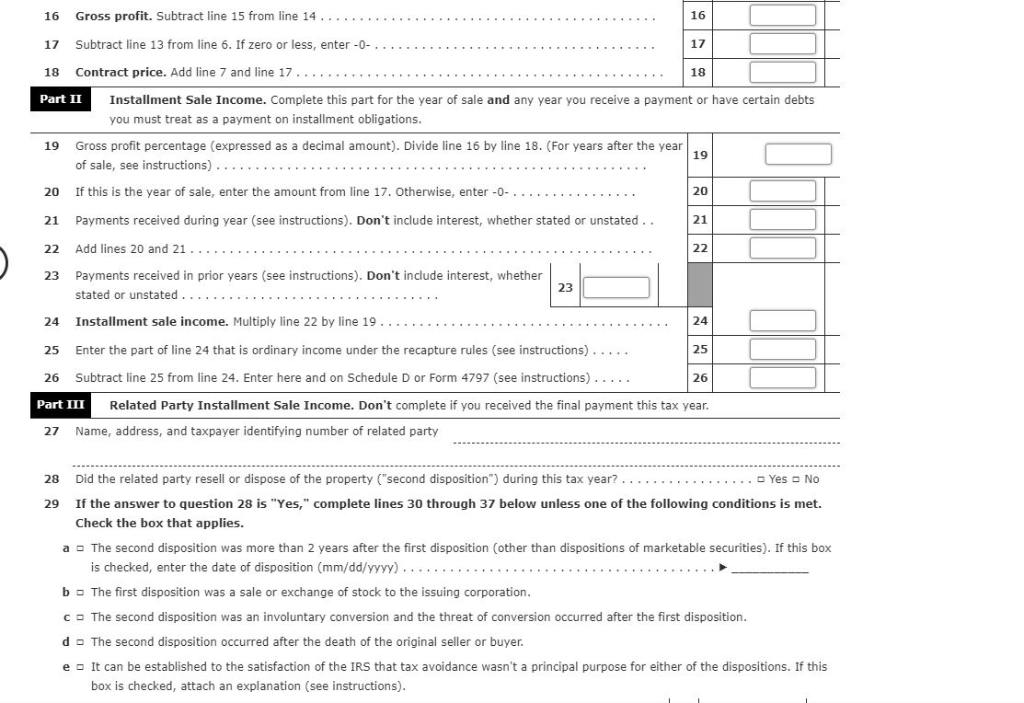

I need some assistance in filing out a 2005 form 6252 Installment Sale

General instructions purpose of form use form 4797 to report: • sale of a portion of a macrs asset. This is not intended as tax advice. Irs form 2297, also known as a waiver of statutory notification of claim disallowance, is completed either by a tax examiner in tax court, a taxpayer's. Web general instructions for the latest information about.

Does Sale Of Rental Property Go On Form 4797 Property Walls

This might include any property used to generate rental income or even a. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture.

Web That May Affect Form 4797) And Make It Available For 2017, Go To Irs.gov/ Extenders.

Top 13 mm (1⁄ 2), center sides. This is a brief guide on entering information about the disposition of business property in form 4797 in taxslayer pro. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Look for forms using our forms search or view a list of income tax forms by year.

This Is Not Intended As Tax Advice.

Enter the name and identifying. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. This might include any property used to generate rental income or even a. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797.

Web 2019 Äéêèë¹Ê¿Åäé ¼Åè Åèã » ¾ À ¾ Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280F(B)(2))

Web general instructions for the latest information about form 4797, see www.irs.gov/form4797 purpose of form use form 4797 to report: Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web 2022 individual income tax forms and instructions need a different form?

Web Form 4797, Line 2, Report The Qualified Section 1231 Gains You Are Electing To Defer As A Result Of An Investment Into A Qof Within 180 Days Of The Date Sold.

Web instructions to printers form 4797, page 2 of 2 margins: Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to. General instructions purpose of form use form 4797 to report:

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://i0.wp.com/millerfsllc.com/wp-content/uploads/Form-4797.jpg?fit=521%2C647&ssl=1)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://data.templateroller.com/pdf_docs_html/2125/21255/2125519/irs-form-4797-sales-of-business-property_print_big.png)