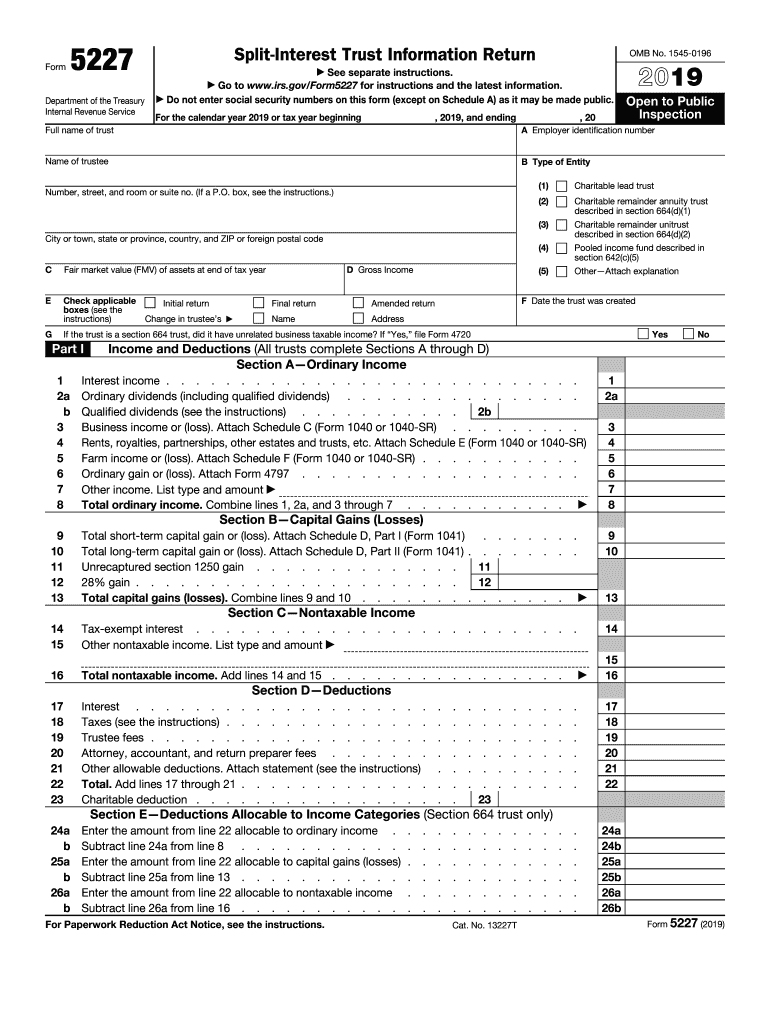

Form 5227 Example

Form 5227 Example - Web form 5227 reporting: Web form 5227 is open to public inspection. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Use schedule a of form 5227 to report: Web identify which line of form 5227 trustee fees should be reported on; Use this screen to enter assets and liabilities for form 5227, part iv balance sheet. Follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer: Recognize which section total assets calculated, with respect to form 5227; 5227 (2022) form 5227 (2022) page. For example, an extension of time for filing a private foundation return will not apply to the return of certain excise taxes on charities (form 4720).

Web generating fiduciary form 5227 for a charitable trust in lacerte. Web how is gross income reported on form 5227, box d calculated? Recognize which section total assets calculated, with respect to form 5227; Use schedule a of form 5227 to report: Jefferson city, mo 65109 visit. Web identify which line of form 5227 trustee fees should be reported on; Select the links below to see solutions for frequently asked questions concerning form 5227. Use this screen to enter assets and liabilities for form 5227, part iv balance sheet. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Enter amounts in the fair market value column only for charitable remainder.

5227 (2022) form 5227 (2022) page. Recognize which section total assets calculated, with respect to form 5227; 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web identify which line of form 5227 trustee fees should be reported on; Use schedule a of form 5227 to report: Web form 5227 is open to public inspection. Follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer: Gross income is all income received in the form of money, property, and services that is not exempt from. We also added text on the penalties imposed on trustees who knowingly fail to file form 5227. •accumulations of income for charitable remainder trusts, •distributions to noncharitable.

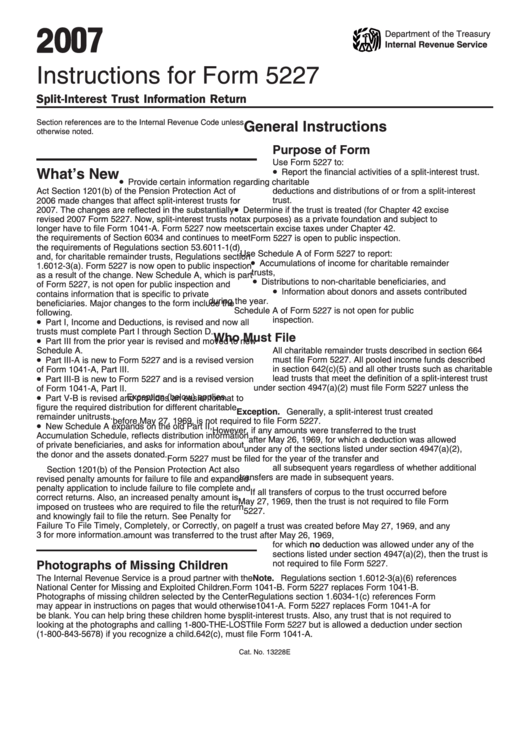

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Web form 5227 is open to public inspection. Web form 5227 is open to public inspection. Use schedule a of form 5227 to report: Gross income is all income received in the form of money, property, and services that is not exempt from. Enter amounts in the fair market value column only for charitable remainder.

3.11.12 Exempt Organization Returns Internal Revenue Service

Select the links below to see solutions for frequently asked questions concerning form 5227. Web common questions about form 5227 in lacerte. We also added text on the penalties imposed on trustees who knowingly fail to file form 5227. Web tax compliance for nicruts, nimcruts, and the flip versions of them is similar to that for crts in general. Web.

Instructions For Form 5227 printable pdf download

Use schedule a of form 5227 to report: Web identify which line of form 5227 trustee fees should be reported on; Web how is gross income reported on form 5227, box d calculated? 5227 (2022) form 5227 (2022) page. Follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer:

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Enter amounts in the fair market value column only for charitable remainder. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). • on page 3, under trust instrument, we. Web common questions about form 5227 in lacerte. For example, an extension of time for filing a private foundation return will not apply to the.

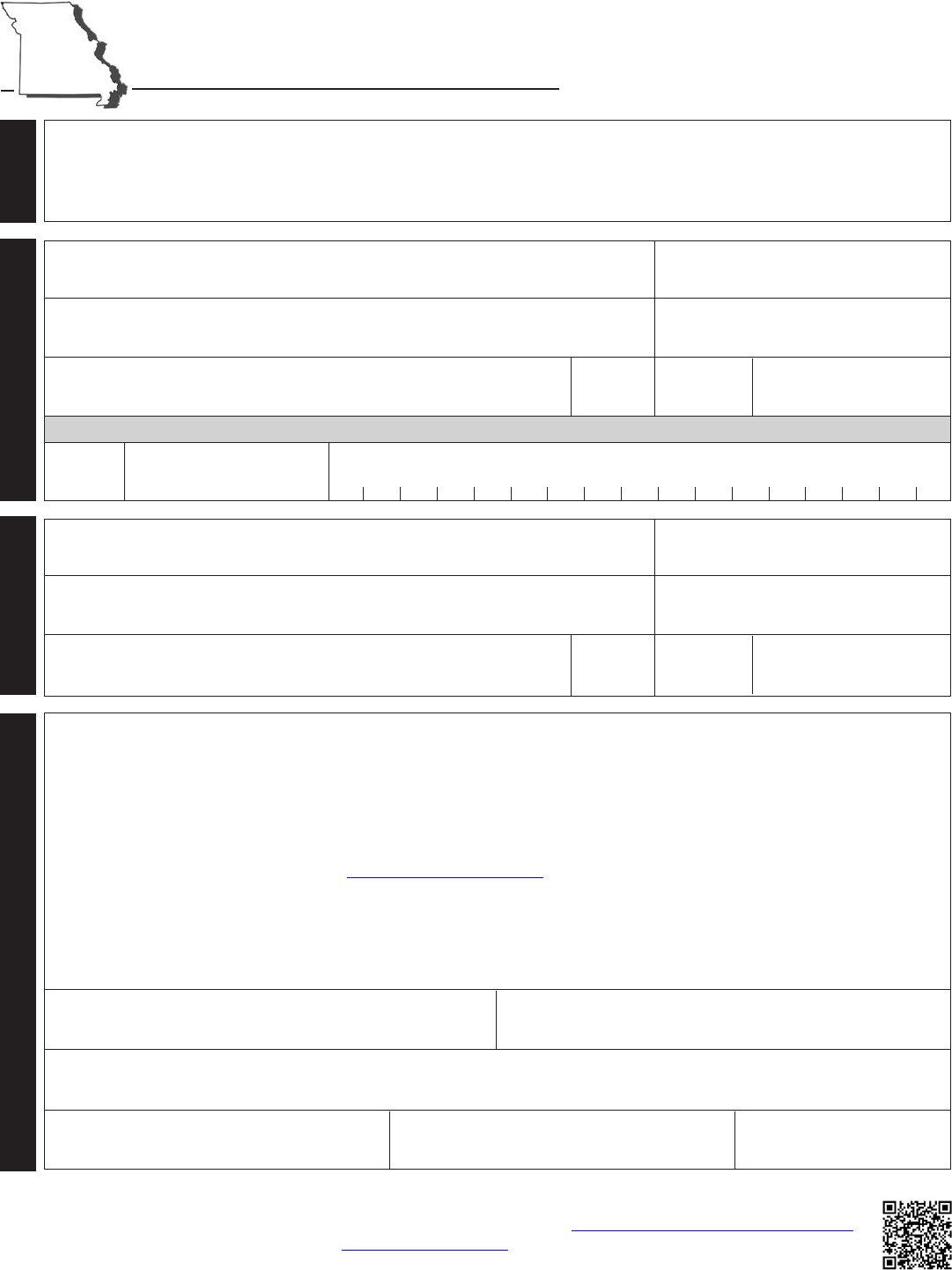

Form 5227 Missouri Department Of Revenue Edit, Fill, Sign Online

Recognize which section total assets calculated, with respect to form 5227; Each of these trusts must file form 5227 on a. Web form 5227 is open to public inspection. Gross income is all income received in the form of money, property, and services that is not exempt from. Web identify which line of form 5227 trustee fees should be reported.

Instructions For Form 5227 printable pdf download

Web form 5227 is open to public inspection. Web tax compliance for nicruts, nimcruts, and the flip versions of them is similar to that for crts in general. •accumulations of income for charitable remainder trusts, •distributions to noncharitable. Each form 8868 filer who. We also added text on the penalties imposed on trustees who knowingly fail to file form 5227.

Instructions For Form 5227 printable pdf download

Recognize which section total assets calculated, with respect to form 5227; Web information on form 5227. Web tax compliance for nicruts, nimcruts, and the flip versions of them is similar to that for crts in general. Gross income is all income received in the form of money, property, and services that is not exempt from. Web generating fiduciary form 5227.

FIA Historic Database

Each of these trusts must file form 5227 on a. Web generating fiduciary form 5227 for a charitable trust in lacerte. Web information on form 5227. Web form 5227 is open to public inspection. Follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer:

Instructions For Form 5227 2016 printable pdf download

Enter amounts in the fair market value column only for charitable remainder. Web generating fiduciary form 5227 for a charitable trust in lacerte. 5227 (2022) form 5227 (2022) page. Web form 5227 is open to public inspection. Web form 5227 is open to public inspection.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Use this screen to enter assets and liabilities for form 5227, part iv balance sheet. 5227 (2022) form 5227 (2022) page. Web form 5227 is open to public inspection. Web form 5227 is open to public inspection. Gross income is all income received in the form of money, property, and services that is not exempt from.

Gross Income Is All Income Received In The Form Of Money, Property, And Services That Is Not Exempt From.

Follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer: We also added text on the penalties imposed on trustees who knowingly fail to file form 5227. Web information on form 5227. For example, an extension of time for filing a private foundation return will not apply to the return of certain excise taxes on charities (form 4720).

Use This Screen To Enter Assets And Liabilities For Form 5227, Part Iv Balance Sheet.

Web form 5227 is open to public inspection. Web generating fiduciary form 5227 for a charitable trust in lacerte. Web how is gross income reported on form 5227, box d calculated? Use schedule a of form 5227 to report:

Select The Links Below To See Solutions For Frequently Asked Questions Concerning Form 5227.

5227 (2022) form 5227 (2022) page. Web form 5227 is open to public inspection. Each of these trusts must file form 5227 on a. Enter amounts in the fair market value column only for charitable remainder.

Web Tax Compliance For Nicruts, Nimcruts, And The Flip Versions Of Them Is Similar To That For Crts In General.

Each form 8868 filer who. Use schedule a of form 5227 to report: 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web form 5227 reporting: