Form 5329 T Year End Hsa Value

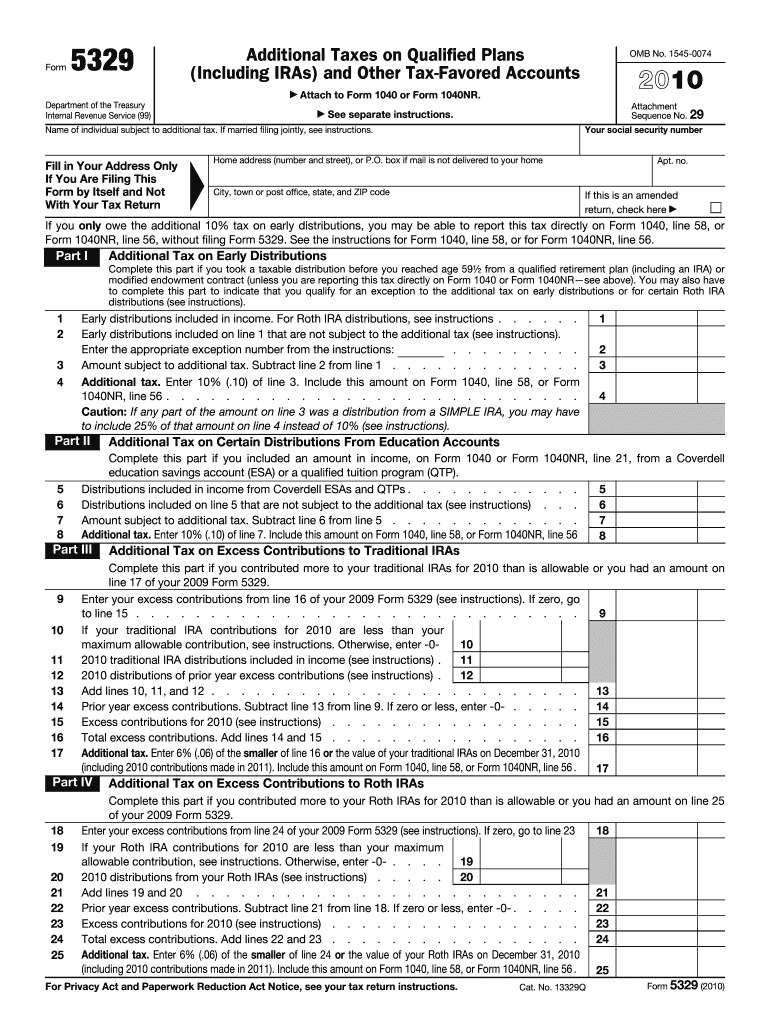

Form 5329 T Year End Hsa Value - Part i additional tax on early distributions. Now that you have gathered the necessary tax forms, it’s time to file! Web amount on line 49 of your 2021 form 5329. 8 part iii additional tax on excess contributions to traditional iras. When and where to file. Enter the excess contributions from line 48 of your 2021 form 5329. Complete this part if you contributed more to your traditional iras for 2020 than is allowable or you had an amount on line 17 of your 2019 form 5329. Web general instructions what’s new qualified disaster distributions. One of the perks of an hsa is that. If zero, go to line 47.

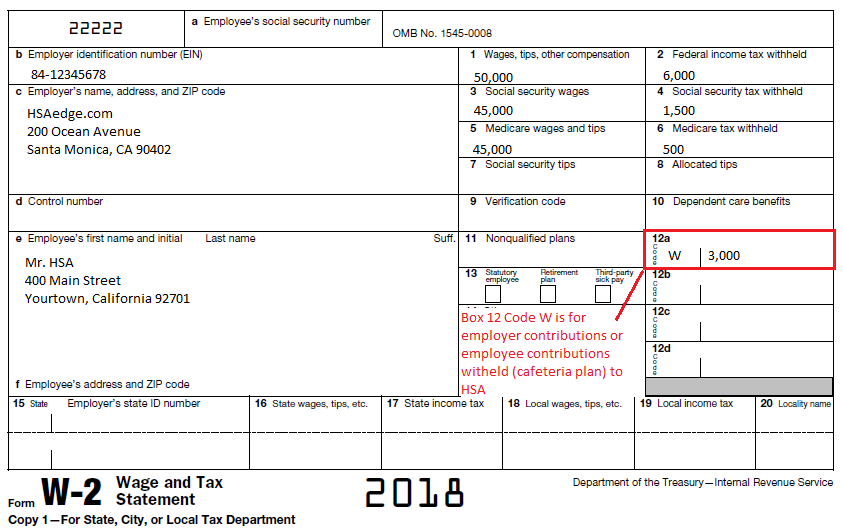

Turbotax premier online posted june 4, 2019 5:09 pm last updated june 04, 2019 5:09 pm 0 1 1,735 reply bookmark icon 1 best answer bmccalpin level 13 Web the tax can't be more than 6% of the combined value of all your iras as of the end of your tax year. Now that you have gathered the necessary tax forms, it’s time to file! If you don’t have to file a 2022 income tax return, complete Web amount on line 49 of your 2021 form 5329. 43 if the contributions to your hsas for 2022 are less than the maximum allowable contribution, see instructions. The types of accounts covered by the form for distributions include: Web general instructions what’s new qualified disaster distributions. Web include this amount on schedule 2 (form 1040), line 6. Enter the excess contributions from line 48 of your 2021 form 5329.

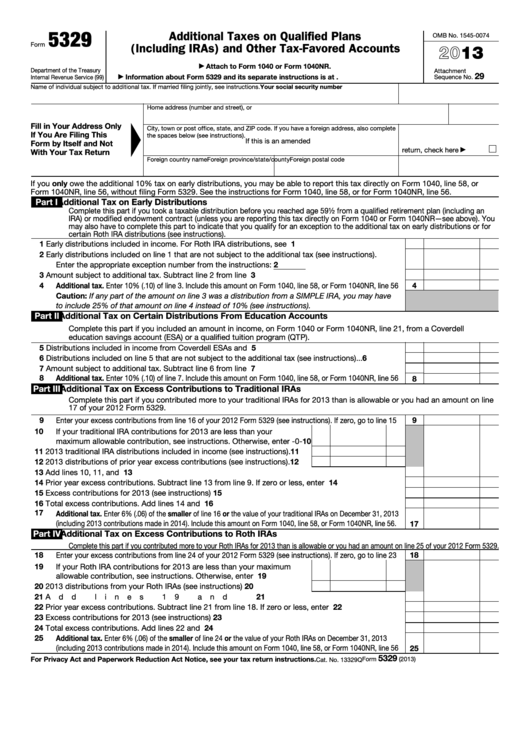

If you don’t have to file a 2022 income tax return, complete Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web the tax can't be more than 6% of the combined value of all your iras as of the end of your tax year. For information on filing form 5329, see reporting additional taxes. When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you withdrew the entire balance. 8 part iii additional tax on excess contributions to traditional iras. Part i additional tax on early distributions. 9 enter your excess contributions from line 16 of your 2019 form 5329. 43 if the contributions to your hsas for 2022 are less than the maximum allowable contribution, see instructions. When and where to file.

2010 5329 form Fill out & sign online DocHub

Web the tax can't be more than 6% of the combined value of all your iras as of the end of your tax year. If zero, go to line 47. Part i additional tax on early distributions. 8 part iii additional tax on excess contributions to traditional iras. The types of accounts covered by the form for distributions include:

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Complete this part if you contributed more to your traditional iras for 2020 than is allowable or you had an amount on line 17 of your 2019 form 5329. If you contributed too much in 2019, you’ll need to fill out form 5329 (the irs charges a 6% tax on the extra amount). Enter the excess contributions from line 48.

Form 5329 Instructions & Exception Information for IRS Form 5329

8 part iii additional tax on excess contributions to traditional iras. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web general instructions what’s new qualified disaster distributions. Web if you overcontributed to your hsa, you will need to fill out tax form 5329 before.

HSA Employer Contributions on W2 Box 12 "W" HSA Edge

Web general instructions what’s new qualified disaster distributions. If zero, go to line 47. If you don’t have to file a 2022 income tax return, complete 9 enter your excess contributions from line 16 of your 2019 form 5329. If you contributed too much in 2019, you’ll need to fill out form 5329 (the irs charges a 6% tax on.

1099R Coding Change

If you don’t have to file a 2022 income tax return, complete Turbotax premier online posted june 4, 2019 5:09 pm last updated june 04, 2019 5:09 pm 0 1 1,735 reply bookmark icon 1 best answer bmccalpin level 13 If zero, go to line 47. 9 enter your excess contributions from line 16 of your 2019 form 5329. 8.

Hsa Value Smart Worksheet

When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you withdrew the entire balance. Web if you overcontributed to your hsa, you will need to fill out tax form 5329 before tax day. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. If you don’t have to.

Tax Form Focus IRS Form 5329 » STRATA Trust Company

The types of accounts covered by the form for distributions include: Complete this part if you contributed more to your traditional iras for 2020 than is allowable or you had an amount on line 17 of your 2019 form 5329. Web the tax can't be more than 6% of the combined value of all your iras as of the end.

Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and

Complete this part if you contributed more to your traditional iras for 2020 than is allowable or you had an amount on line 17 of your 2019 form 5329. If zero, go to line 47. Turbotax premier online posted june 4, 2019 5:09 pm last updated june 04, 2019 5:09 pm 0 1 1,735 reply bookmark icon 1 best answer.

Form 5329 Instructions & Exception Information for IRS Form 5329

If you contributed too much in 2019, you’ll need to fill out form 5329 (the irs charges a 6% tax on the extra amount). The most common purpose for this form is to calculate the 10% additional tax, and any exception to the tax, on early withdrawals from these accounts if you are under age 59 1/2. The types of.

What is Tax Form 5329? Lively

One of the perks of an hsa is that. The additional tax is figured on form 5329. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. When and where to file. Turbotax premier online posted june 4, 2019 5:09 pm last updated june 04, 2019 5:09 pm 0 1 1,735 reply bookmark.

The Most Common Purpose For This Form Is To Calculate The 10% Additional Tax, And Any Exception To The Tax, On Early Withdrawals From These Accounts If You Are Under Age 59 1/2.

The additional tax is figured on form 5329. It’s used by taxpayers who are under age 59.5 that have received a distribution from a qualified plan or similar account. Web include this amount on schedule 2 (form 1040), line 6. Web general instructions what’s new qualified disaster distributions.

If You Don’t Have To File A 2022 Income Tax Return, Complete

When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you withdrew the entire balance. 8 part iii additional tax on excess contributions to traditional iras. Part i additional tax on early distributions. If you contributed too much in 2019, you’ll need to fill out form 5329 (the irs charges a 6% tax on the extra amount).

Web If You Overcontributed To Your Hsa, You Will Need To Fill Out Tax Form 5329 Before Tax Day.

43 if the contributions to your hsas for 2022 are less than the maximum allowable contribution, see instructions. Enter the excess contributions from line 48 of your 2021 form 5329. For information on filing form 5329, see reporting additional taxes. Complete this part if you contributed more to your traditional iras for 2020 than is allowable or you had an amount on line 17 of your 2019 form 5329.

Web On September 7, 2022, You Withdrew $800, The Entire Balance In The Roth Ira.

One of the perks of an hsa is that. Web only owe the additional 10% tax on the full amount of the early distributions, you may be able to report this tax directly on schedule 2 (form 1040), line 8, without filing form 5329. If you aren’t sure how to fill out this form, we’ve created some guidelines to help. Turbotax premier online posted june 4, 2019 5:09 pm last updated june 04, 2019 5:09 pm 0 1 1,735 reply bookmark icon 1 best answer bmccalpin level 13

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at10.46.34AM-28b5a363d4434af7be07ebd3d2b1e6b0.png)