Form 5330 Excise Tax

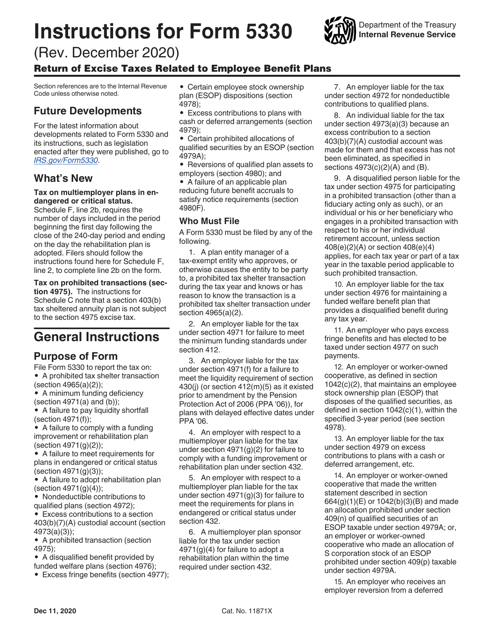

Form 5330 Excise Tax - Discrete other than discrete (a lease or a loan) (iv) form 5330(rev. Ad fill, sign, email irs 5330 & more fillable forms, register and subscribe now! Form 1363, export exemption certificates pdf. •a minimum funding deficiency (section 4971(a) and (b)); Web file form 5330 to report the tax on: Complete, edit or print tax forms instantly. May be subject to an excise tax on contributions, matching contributions to •. Web form 5330 is due by the last day of the 7th month following the close of the plan year in which the excise tax originated. •a prohibited tax shelter transaction (section 4965(a)(2)); Name and address of filer.

Return of excise taxes related to employee benefit plans (under sections 4965, 4971,. Form 1363, export exemption certificates pdf. Web irs form 5330 is a reporting tool commonly used to report excise taxes for 401 (k) plans. Name and address of plan sponsor. Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. If plan sponsors delay a 401 (k) participant’s deposit so it interferes with. In general, an excise tax is a tax is imposed on the sale of specific goods or services, or. Complete, edit or print tax forms instantly. May be subject to an excise tax on contributions, matching contributions to •. Ad complete irs tax forms online or print government tax documents.

Complete, edit or print tax forms instantly. •a prohibited tax shelter transaction (section 4965(a)(2)); Web irs form 5330 is a reporting tool commonly used to report excise taxes for 401 (k) plans. May be subject to an excise tax on contributions, matching contributions to •. Web show sources > form 5330 is a federal other form. Ad complete irs tax forms online or print government tax documents. Web environmental taxes (attach form 6627; You can only complete one section of part i for each form 5330 filed. If you do not file a return by the due date, including extensions, you may have to pay a penalty of 5% of the. Web 1 is the excise tax a result of a prohibited transaction that was (box “a” or box “b” must be checked):

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Web the excise tax to be reported on the form 5330 filed for 2003 would include both the prohibited transaction of july 1, 2002, with an amount involved of $6,000, resulting in a. December 2013) department of the treasury internal revenue service. •a prohibited tax shelter transaction (section 4965(a)(2)); Web to report your excise tax liability, you must: Ad complete.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Taxes that are reported by the last day of the 7th month after the. •a minimum funding deficiency (section 4971(a) and (b)); Web file form 5330 to report the tax on: Name and address of plan sponsor. •a prohibited tax shelter transaction (section 4965(a)(2));

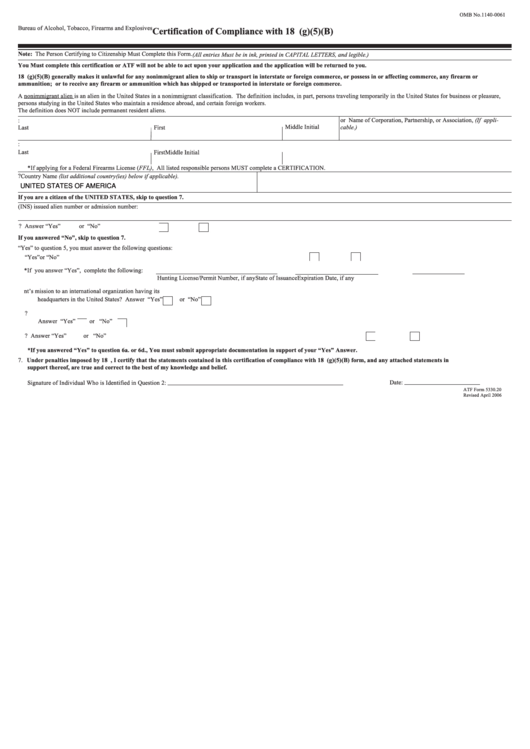

Fillable Atf Form 5330.20 Certification Of Compliance Form printable

Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Complete, edit or print tax forms instantly. Web the excise tax to be reported on the 2022 form 5330 would include both the prohibited transaction of july 1, 2021, with an.

Federal Excise Tax Form 2290 Universal Network

Web form 5330 is due by the last day of the 7th month following the close of the plan year in which the excise tax originated. Complete form 720, quarterly federal excise tax return. In general, an excise tax is a tax is imposed on the sale of specific goods or services, or. Form 730, monthly tax return for wagers.

Form 5330 Everything You Need to Know DWC

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web irs form 5330 is a reporting tool commonly used to report excise taxes for 401 (k) plans. Web the excise tax to be reported on the 2022 form 5330 would include both the prohibited transaction of july 1, 2021, with an amount involved of $6,000,.

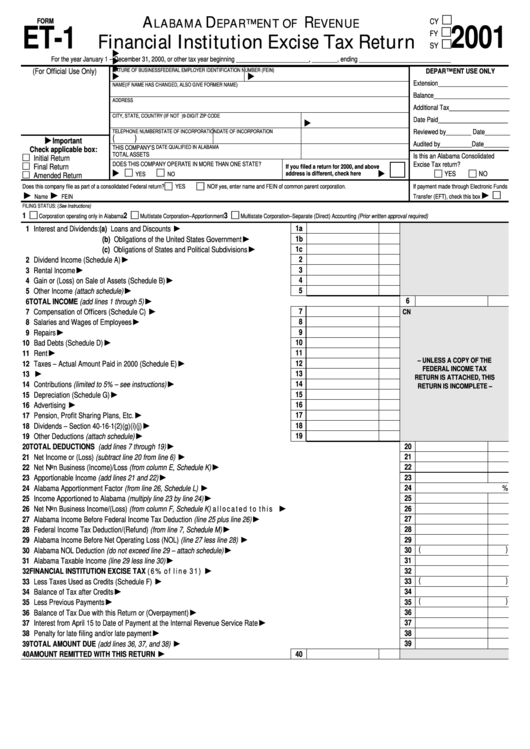

Form Et1 Financial Institution Excise Tax Return 2001 printable

Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. •a prohibited tax shelter transaction (section 4965(a)(2)); Web 1 is the excise tax a result of a prohibited transaction that was (box “a” or box “b” must be checked): •a minimum.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Domestic petroleum oil spill tax 18: Download or email irs 5330 & more fillable forms, register and subscribe now! Name and address of filer. If you do not file a return by the due date, including extensions, you may have to pay a penalty of 5% of the. Web file form 5330 to report the tax on:

The Plain English Guide to Form 5330

You can only complete one section of part i for each form 5330 filed. •a minimum funding deficiency (section 4971(a) and (b)); Complete, edit or print tax forms instantly. File form 720 electronically for immediate acknowledgement of receipt and. Complete, edit or print tax forms instantly.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

File form 720 electronically for immediate acknowledgement of receipt and. Ad fill, sign, email irs 5330 & more fillable forms, register and subscribe now! Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Discrete other than discrete (a lease or.

Download Instructions for IRS Form 5330 Return of Excise Taxes Related

Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Taxes that are reported by the last day of the 7th month after the. •a minimum funding deficiency (section 4971(a) and (b)); Web the excise tax to be reported on the.

If Plan Sponsors Delay A 401 (K) Participant’s Deposit So It Interferes With.

Complete form 720, quarterly federal excise tax return. Return of excise taxes related to employee benefit plans (under sections 4965, 4971,. Web 1 is the excise tax a result of a prohibited transaction that was (box “a” or box “b” must be checked): Form 730, monthly tax return for wagers pdf.

Complete, Edit Or Print Tax Forms Instantly.

Name and address of filer. If you do not file a return by the due date, including extensions, you may have to pay a penalty of 5% of the. Web the excise tax to be reported on the form 5330 filed for 2003 would include both the prohibited transaction of july 1, 2002, with an amount involved of $6,000, resulting in a. Web irs form 5330 is a reporting tool commonly used to report excise taxes for 401 (k) plans.

Web Environmental Taxes (Attach Form 6627;

Taxes that are reported by the last day of the 7th month after the. •a minimum funding deficiency (section 4971(a) and (b)); Ad fill, sign, email irs 5330 & more fillable forms, register and subscribe now! Web to report your excise tax liability, you must:

•A Prohibited Tax Shelter Transaction (Section 4965(A)(2));

In general, an excise tax is a tax is imposed on the sale of specific goods or services, or. Web form 5330 is due by the last day of the 7th month following the close of the plan year in which the excise tax originated. 53 domestic petroleum superfund tax; Web show sources > form 5330 is a federal other form.