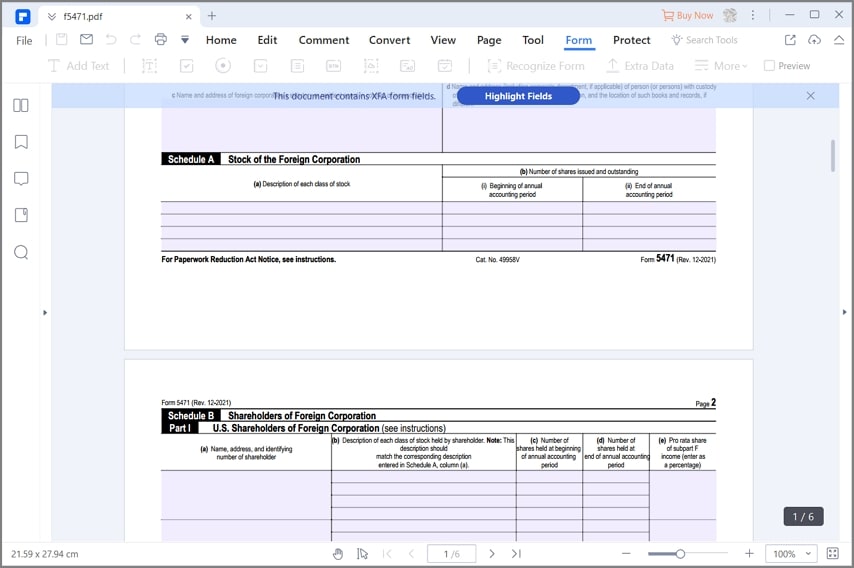

Form 5471 Schedule B

Form 5471 Schedule B - Web if category 3 or 4 isn't checked, schedule b won't generate. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception. Web attach to form 5471. 4 (viii) current year tax on reattributed income from disregarded payments (ix) current year tax on all other disregarded payments. Part i category three and four filers are. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Part 1 and part 2. Web form 5471 schedule b, part i. Citizens should know at a glance if you’re a u.s. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion.

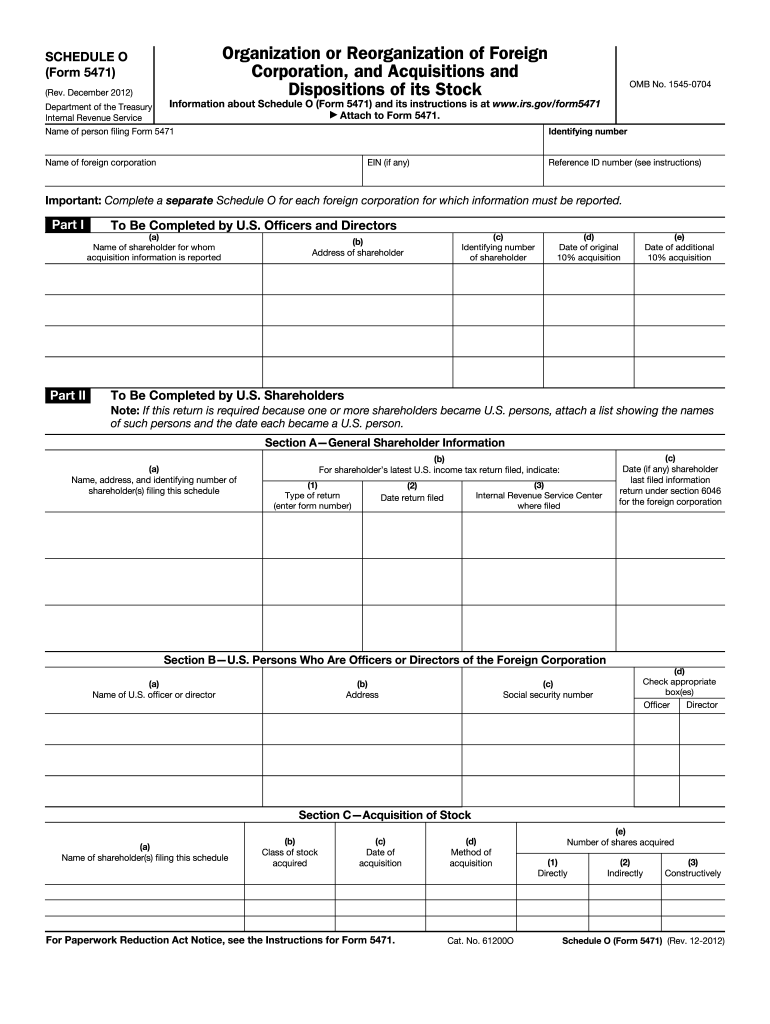

Part i category three and four filers are. Schedule b can be broken down into two parts: Citizen and you have ownership in a foreign. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Web attach to form 5471. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception.

Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. No statement is required to be attached to tax returns for persons claiming the constructive ownership exception. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Web schedule b of the form 5471 asks the filer to list the name, address, and identify the number of shares in the foreign corporation. Web october 25, 2022 resource center forms form 5471: This is the sixth of a series of articles designed. Name of foreign corporation ein (if any) reference id number (see. Schedule b asks you to name the u.s. Web schedule b shareholders of foreign corporation on form 5471.

5471 O Form Fill Out and Sign Printable PDF Template signNow

Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Web schedule b of the form 5471 asks the filer to.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

This is the sixth of a series of articles designed. Web schedule b shareholders of foreign corporation on form 5471. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Web form 5471 schedule.

Form 5471 and Corresponding Schedules SDG Accountant

Web october 25, 2022 resource center forms form 5471: Web if category 3 or 4 isn't checked, schedule b won't generate. Part 1 and part 2. Schedule b asks you to name the u.s. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered.

Worksheet A Form 5471 Irs Tripmart

Web form 5471 to report all of the required information. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b, corporation b will report on line 7, column (h), $50x of ptep as a result of its section 951a inclusion. Web form 5471 schedule b, part i. Web schedule b shareholders of foreign corporation.

5471 Worksheet A

Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Web (form 8992) or schedule b (form 8992).

2012 form 5471 instructions Fill out & sign online DocHub

Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Enter the filer name or. Web october 25, 2022 resource center forms form 5471: Web schedule b of the form 5471 asks the filer.

How to Fill out IRS Form 5471 (2020 Tax Season)

Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. Enter the filer name.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

4 (viii) current year tax on reattributed income from disregarded payments (ix) current year tax on all other disregarded payments. Web october 25, 2022 resource center forms form 5471: Users should complete both parts 1 and 2. Web form 5471 schedule b, part i. Web on schedule p of the form 5471 with respect to cfc1 filed by corporation b,.

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

Name of foreign corporation ein (if any) reference id number (see. Part 1 and part 2. Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of.

IRS Issues Updated New Form 5471 What's New?

Name of foreign corporation ein (if any) reference id number (see. Web schedule b is completed with a form 5471 to disclose the direct and indirect u.s. Web schedule b of the form 5471 asks the filer to list the name, address, and identify the number of shares in the foreign corporation. Web form 5471 to report all of the.

4 (Viii) Current Year Tax On Reattributed Income From Disregarded Payments (Ix) Current Year Tax On All Other Disregarded Payments.

Form 5471 schedule b, part i refers to the different shareholders accounted for on the form that are being reported on the form. Citizen and you have ownership in a foreign. Name of person filing form 5471. Part 1 and part 2.

Citizens Should Know At A Glance If You’re A U.s.

Part i category three and four filers are. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. Users should complete both parts 1 and 2. Web if category 3 or 4 isn't checked, schedule b won't generate.

No Statement Is Required To Be Attached To Tax Returns For Persons Claiming The Constructive Ownership Exception.

Web part i of schedule b is to be completed by category 3 and 4 filers who owned directly or indirectly 10% or more in value or voting power of any class of foreign corporation stock. Web october 25, 2022 resource center forms form 5471: Web form 5471 schedule b, part i. Schedule b asks you to name the u.s.

Web Schedule B Is Completed With A Form 5471 To Disclose The Direct And Indirect U.s.

Web form 5471 to report all of the required information. Schedule b can be broken down into two parts: Web (form 8992) or schedule b (form 8992) with respect to the cfc, the reference id number on form 5471 and the reference id number on schedule a (form 8992) or schedule b. Web schedule b shareholders of foreign corporation on form 5471.