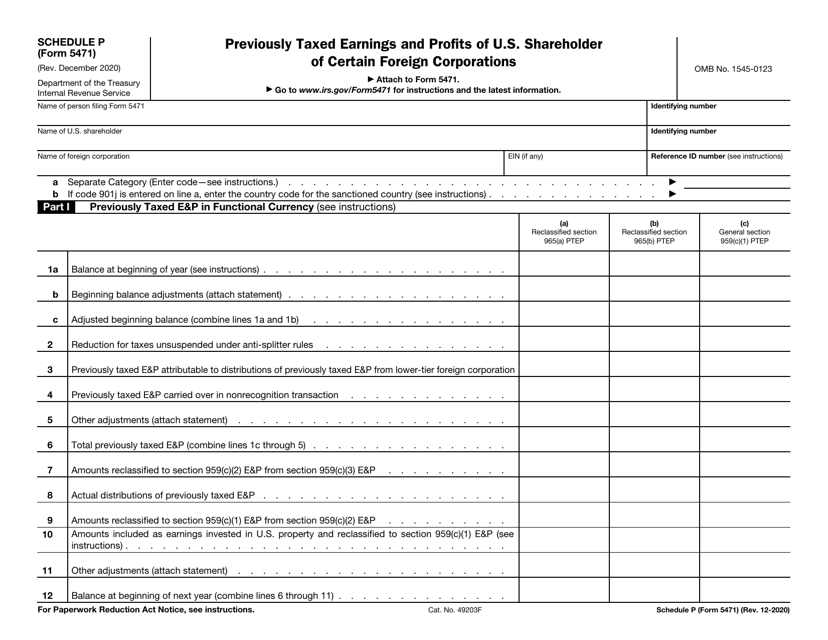

Form 5471 Schedule P

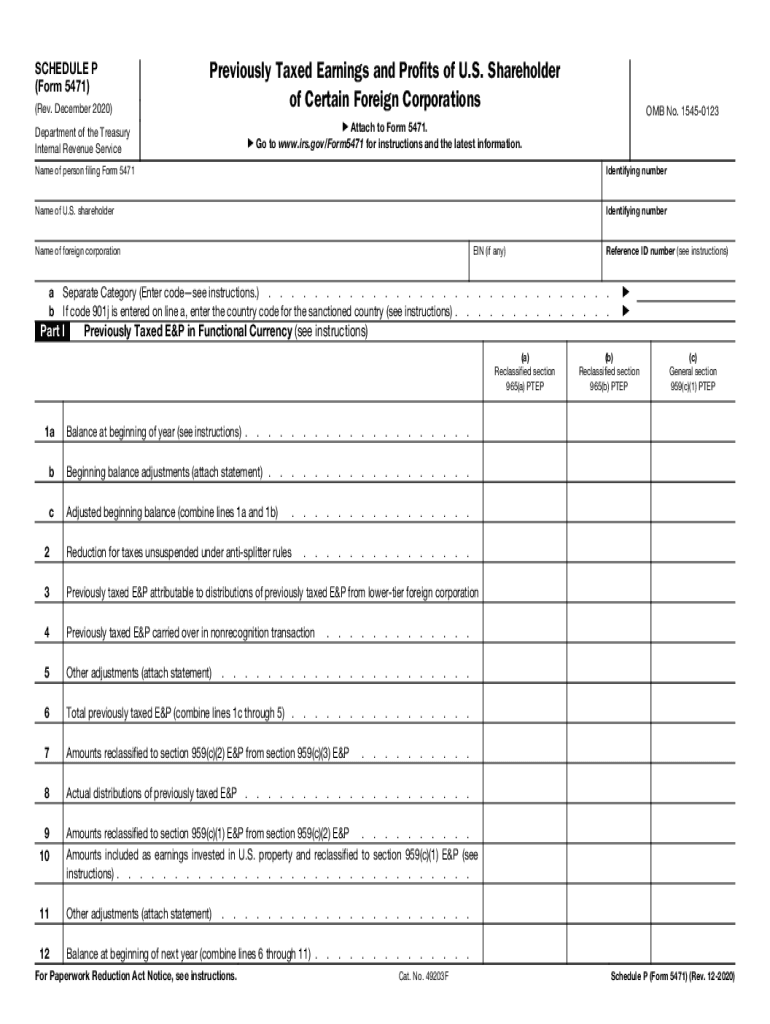

Form 5471 Schedule P - Web schedule p (form 5471), previously taxed earnings and profits of u.s. Previously taxed earnings and profits of u.s. Web schedule p (form 5471) (rev. December 2020) department of the treasury internal revenue service. Shareholder of certain foreign corporations. For instructions and the latest information. Shareholder of certain foreign corporations. Shareholder of certain foreign corporations. For instructions and the latest information. Shareholders are not required to file schedule p.

Name of person filing form. December 2020) department of the treasury internal revenue service. Persons with respect to certain foreign corporations: Previously taxed earnings and profits of u.s. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholders are not required to file schedule p. Shareholder of certain foreign corporations. Line a asks the preparer to enter a “separate category” code. Shareholder of a controlled foreign corporation (“cfc”). Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471.

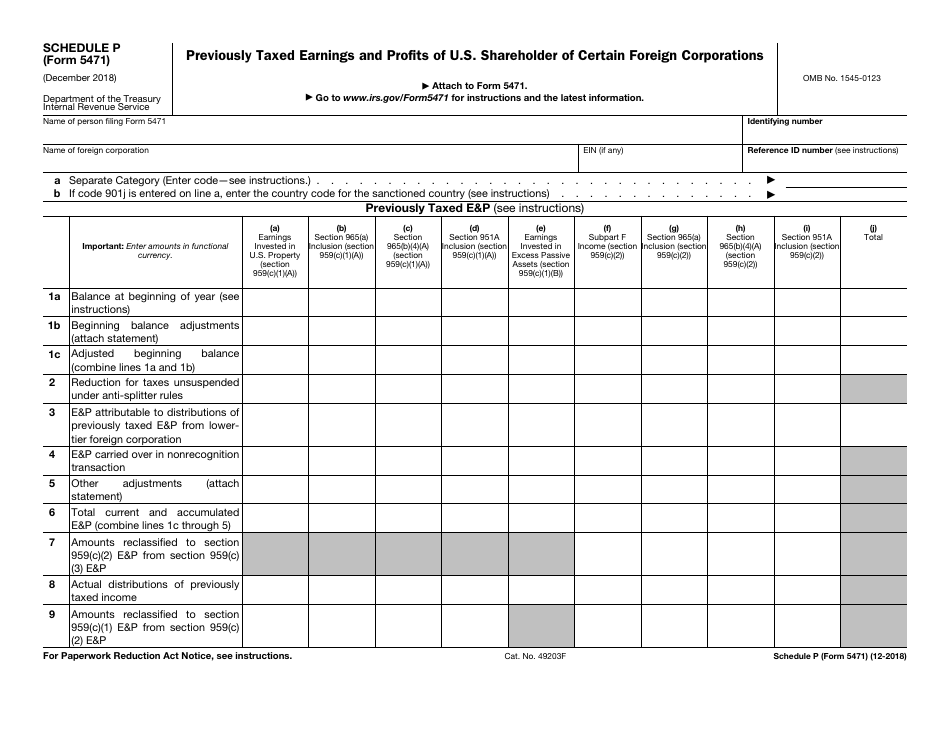

However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholders are not required to file schedule p. Shareholder of certain foreign corporations. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. For instructions and the latest information. If separate category is 901j, enter the sanctioned country: Web schedule p (form 5471), previously taxed earnings and profits of u.s. However, category 1 and 5 filers who are related constructive u.s. For instructions and the latest information.

IRS Form 5471 Schedule H SF Tax Counsel

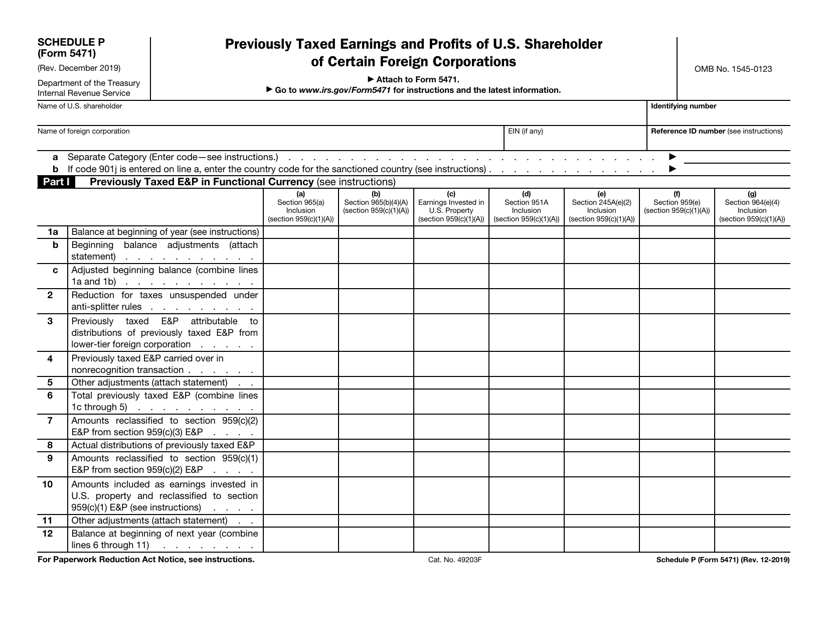

December 2019) department of the treasury internal revenue service. Shareholder of certain foreign corporations. Shareholder of certain foreign corporations schedule q (form 5471), cfc income by cfc income groups schedule r (form 5471), distributions from a foreign corporation other items you may find useful all form 5471 revisions Shareholder of certain foreign corporations. Let’s go through the basics of schedule.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p (form 5471), previously taxed earnings and profits of u.s. December 2020) department of the treasury internal revenue service. Shareholder of certain foreign corporations. Shareholder of certain foreign corporations. For instructions and the latest information.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. Web schedule p (form 5471), previously taxed earnings and profits of u.s. Previously taxed earnings and profits of u.s. For instructions and the latest information. Shareholder of certain foreign corporations.

20202023 Form IRS 5471 Schedule P Fill Online, Printable, Fillable

Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Web schedule p of form 5471 is used to report previously taxed earnings and profits.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

Shareholder of a controlled foreign corporation (“cfc”). Web form 5471 filers generally use the same category of filer codes used on form 1118. Shareholder of certain foreign corporations. Name of person filing form. Shareholder of certain foreign corporations.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web schedule p (form 5471), previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations. For instructions and the latest information. Web schedule p (form 5471) (rev. Persons with respect to certain foreign corporations:

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Web schedule p (form 5471) (rev. For instructions and the latest information. However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts The term ptep refers to earnings and.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p (form 5471) (rev. For instructions and the latest information. Web the reference id number assigned to a foreign corporation on form 5471 generally has relevance only on form 5471, its schedules, and any other form that is attached to or associated with form 5471, and generally should not be used with respect to that foreign corporation on.

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

Previously taxed earnings and profits of u.s. Web schedule p (form 5471), previously taxed earnings and profits of u.s. For instructions and the latest information. Shareholder of certain foreign corporations. December 2019) department of the treasury internal revenue service.

A Deep Dive Into IRS Form 5471 Schedule P SF Tax Counsel

However, category 1 and 5 filers who are related constructive u.s. December 2020) department of the treasury internal revenue service. Previously taxed earnings and profits of u.s. Web the reference id number assigned to a foreign corporation on form 5471 generally has relevance only on form 5471, its schedules, and any other form that is attached to or associated with.

Web Schedule P Of Form 5471 Is Used To Report Previously Taxed Earnings And Profits (“Ptep”) Of A U.s.

Let’s go through the basics of schedule p and ptep: Shareholder of a controlled foreign corporation (“cfc”). Shareholder of certain foreign corporations. Web the reference id number assigned to a foreign corporation on form 5471 generally has relevance only on form 5471, its schedules, and any other form that is attached to or associated with form 5471, and generally should not be used with respect to that foreign corporation on any other irs forms.

Web Schedule P (Form 5471) (Rev.

Previously taxed earnings and profits of u.s. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. Previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations.

For Instructions And The Latest Information.

Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. If separate category is 901j, enter the sanctioned country: Previously taxed earnings and profits of u.s.

Shareholder Of Certain Foreign Corporations.

For instructions and the latest information. Specific schedule p reporting rules December 2019) department of the treasury internal revenue service. December 2020) department of the treasury internal revenue service.