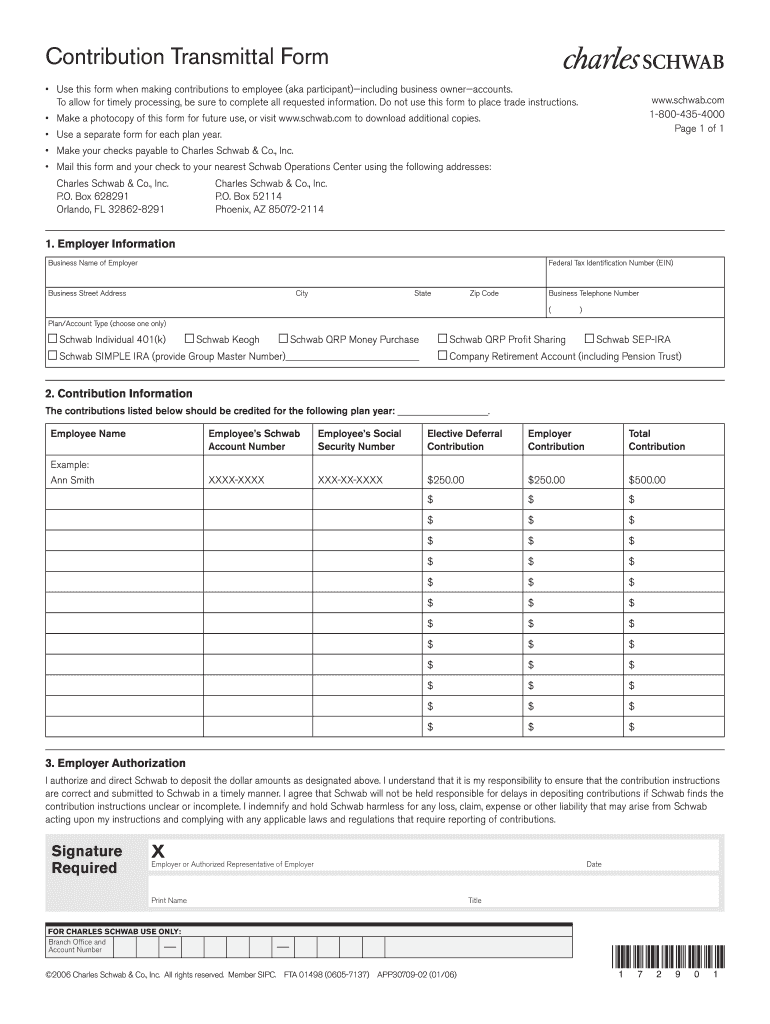

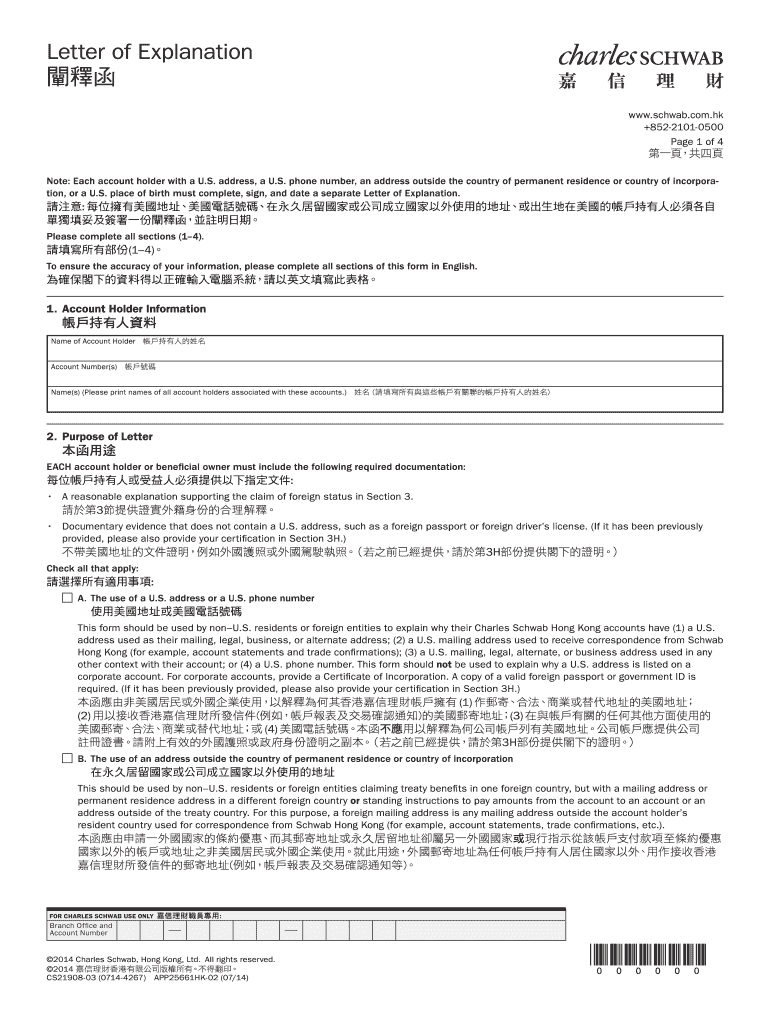

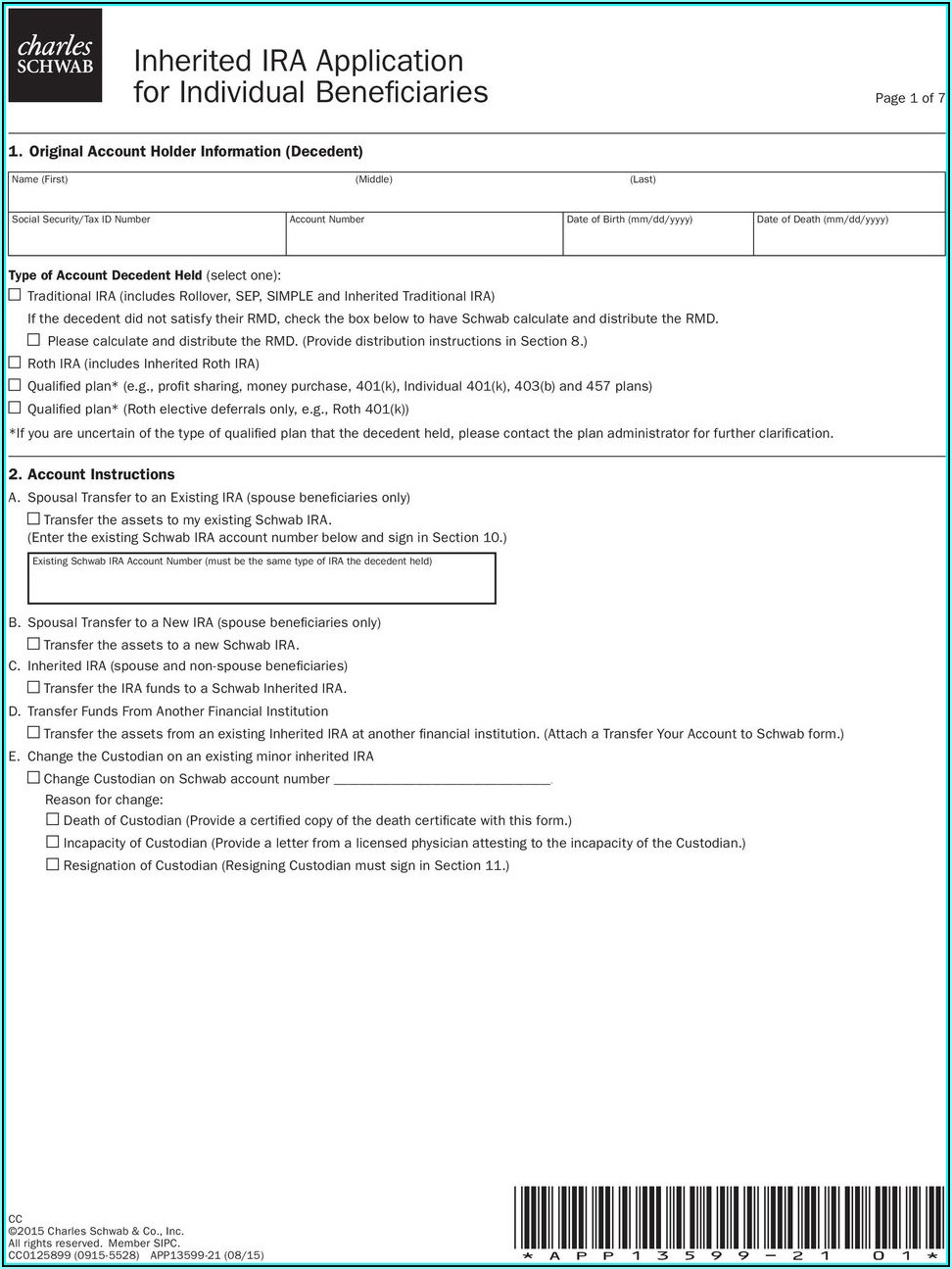

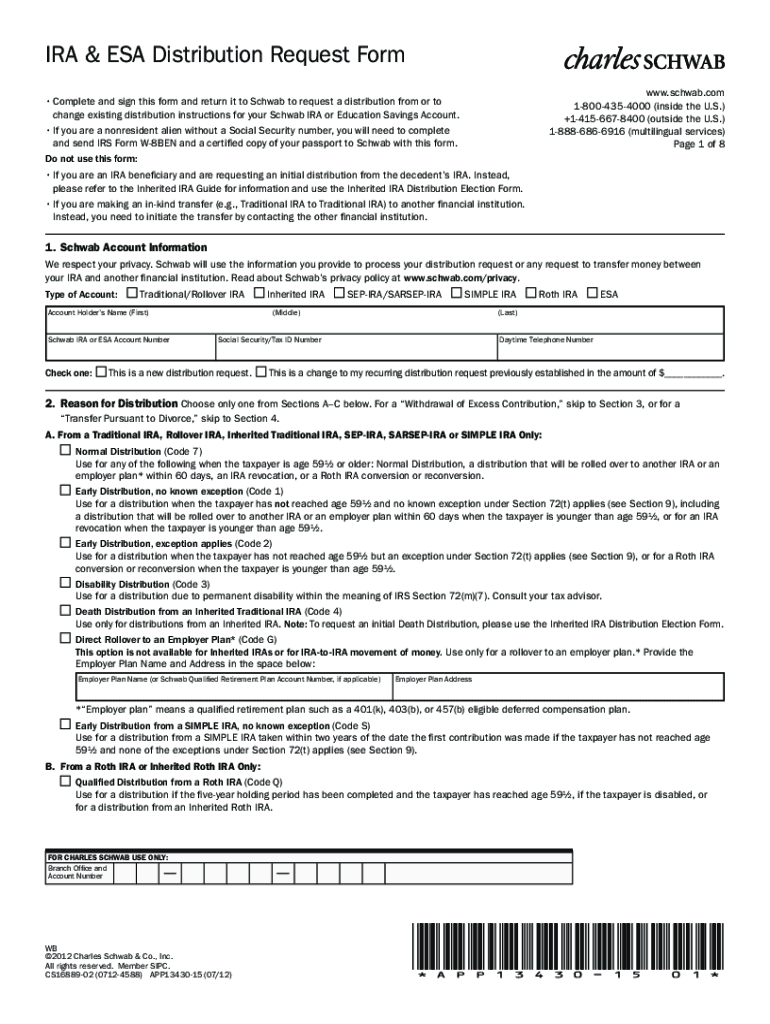

Form 5498 Charles Schwab

Form 5498 Charles Schwab - I filed my taxes months ago. What, if anything, do i need to do now? If you haven’t already, you'll need to create your schwab login id and password first. Form 5498 is for informational purposes only. Web get professional investing advice. Web complete this form to designate or change a financial professional on your account. Web need information to plan or file your taxes? When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Ad discover innovative investment & wealth management solutions from schwab. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing.

The schwab 529 plan is only available to. Power of attorney for schwab one brokerage. Web get professional investing advice. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Web log in below to get started and complete your schwab client profile. Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. Other tax forms (e.g., form. Web who sends the form, and what am i supposed to do with it? What, if anything, do i need to do now? The trustee or custodian of your ira reports.

Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web get professional investing advice. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Power of attorney for schwab one brokerage. (schwab) (member sipc), is registered by the securities and exchange commission (sec) in. The trustee or custodian of your ira reports. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. If applicable, it will include employer contributions and. Schwab offers comprehensive wealth management, including a dedicated advisor backed by an experienced team and professionally.

File 2020 Form 5498SA Online EFile as low as 0.50/Form

Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. What, if anything, do i need to do now? The schwab 529 plan is only available to. I filed my taxes months ago. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year.

form 5498sa instructions 2017 Fill Online, Printable, Fillable Blank

Any state or its agency or. If applicable, it will include employer contributions and. Schwab offers comprehensive wealth management, including a dedicated advisor backed by an experienced team and professionally. Form 5498 is for informational purposes only. Power of attorney for schwab one brokerage.

Schwab Proof of Funds Letter Form Fill Out and Sign Printable PDF

Web complete this form to designate or change a financial professional on your account. Schwab offers comprehensive wealth management, including a dedicated advisor backed by an experienced team and professionally. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. What, if anything, do i need to do now? Form 5498 is for informational.

401k Rollover Form Charles Schwab Form Resume Examples MoYo65B9ZB

Web schwab 529 college savings plan account application • use this application to open a schwab 529 college savings plan account. Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. Web complete this form to designate or change a financial professional on your account. Web application to add a schwab global account™ to an.

Charles Distribution Form Fill Online, Printable, Fillable, Blank

Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. Web application to add a schwab global account™ to.

5498 Software to Create, Print & EFile IRS Form 5498

Web need information to plan or file your taxes? Web schwab 529 college savings plan account application • use this application to open a schwab 529 college savings plan account. Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. Schwab offers comprehensive wealth management, including a dedicated advisor backed by an experienced.

The Purpose of IRS Form 5498

Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. I filed my taxes months ago. If applicable, it will include employer contributions and. The trustee or custodian of your ira reports. Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by.

All About IRS Tax Form 5498 for 2020 IRA for individuals

If applicable, it will include employer contributions and. Power of attorney for schwab one brokerage. Web who sends the form, and what am i supposed to do with it? Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. Form 5498 is for informational purposes only.

Schwab 401k Rollover Form Form Resume Examples X42M7qzYkG

Web log in below to get started and complete your schwab client profile. Web get professional investing advice. Any state or its agency or. Ad discover innovative investment & wealth management solutions from schwab. Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be.

Edward Jones Simple Ira Contribution Transmittal Form Fill Out and

Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. If you haven’t already, you'll need to create your schwab login id and password first. Any state or its agency or. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web who sends the.

Web Log In Below To Get Started And Complete Your Schwab Client Profile.

Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. I filed my taxes months ago. The schwab 529 plan is only available to. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019.

Schwab Offers Comprehensive Wealth Management, Including A Dedicated Advisor Backed By An Experienced Team And Professionally.

Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. If applicable, it will include employer contributions and. Web get professional investing advice. Web application to add a schwab global account™ to an existing schwab one® account.

Ad Discover Innovative Investment & Wealth Management Solutions From Schwab.

The trustee or custodian of your ira reports. Web who sends the form, and what am i supposed to do with it? Other tax forms (e.g., form. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31.

Its Banking Subsidiary, Charles Schwab Bank, Ssb (Member Fdic And An Equal Housing.

Any state or its agency or. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. (schwab) (member sipc), is registered by the securities and exchange commission (sec) in. What, if anything, do i need to do now?

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)