Form 5500 Due Date For 2022

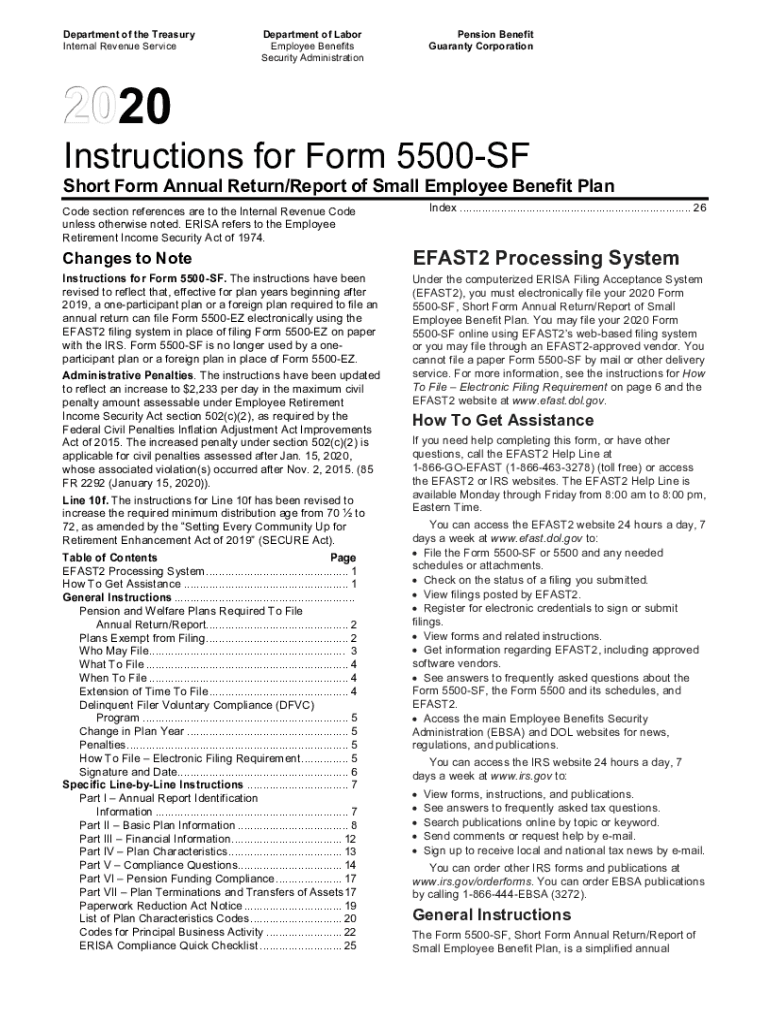

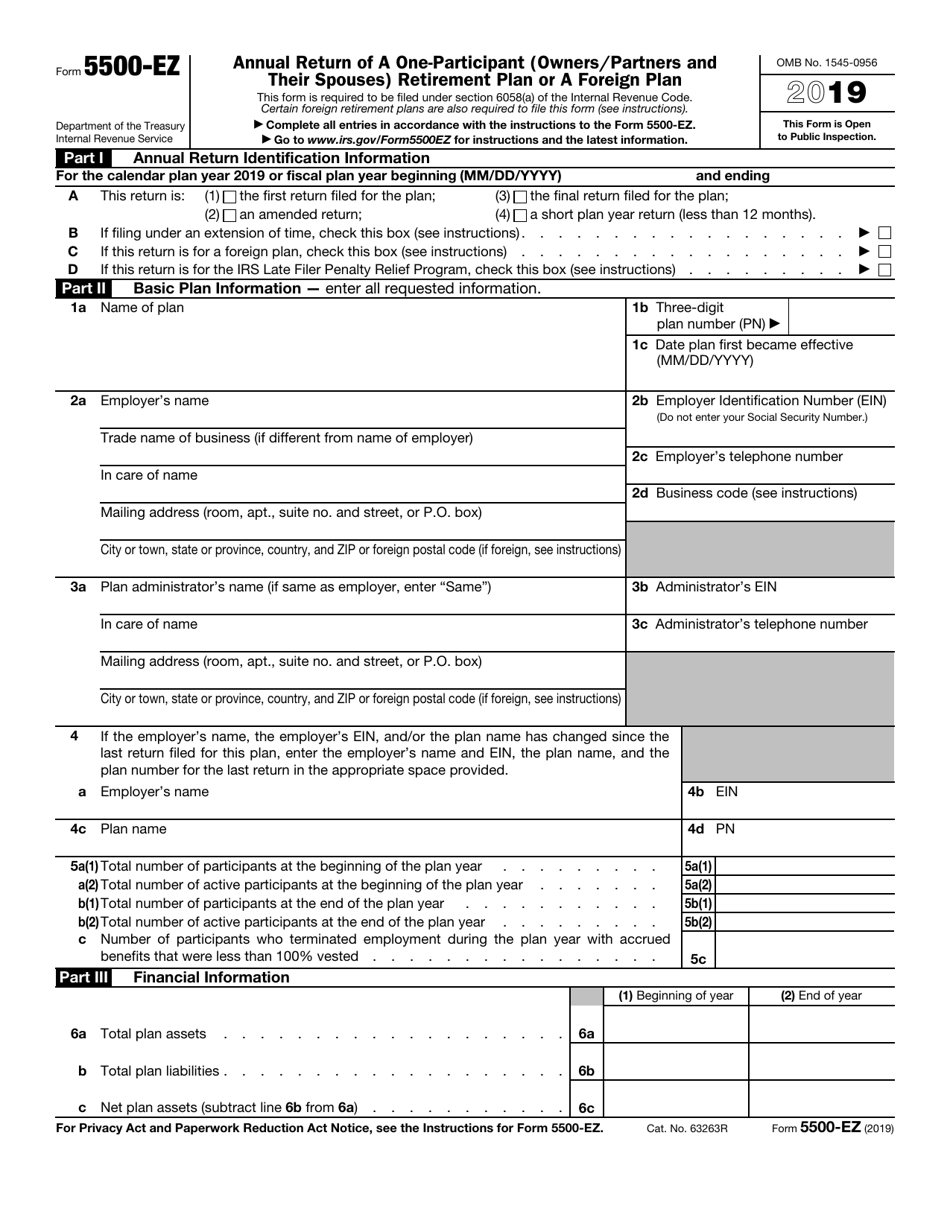

Form 5500 Due Date For 2022 - On december 8, 2022 dol, irs, and pbgc. The form 5500 due date for filing depends on the plan year. 15th, but if the filing due date falls on a. C premiums due but unpaid at the end of the year. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. Other items you may find useful all form 5558 revisions form 5550 corner other. 17 2022) by filing irs form 5558 by aug. The laws and due dates apply based on the number of employees, whether or not. Go to www.irs.gov/form5500ez for instructions and the latest information. Web what is the deadline to file?

Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. 15th, but if the filing due date falls on a. The general rule is that form 5500s must be filed by the last day of the seventh. Go to www.irs.gov/form5500ez for instructions and the latest information. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. Schedule a (form 5500) 2022. Other items you may find useful all form 5558 revisions form 5550 corner other. Who should i contact with questions about a cp216h notice? The form 5500 due date for filing depends on the plan year. (usually due by july 31, which falls on a.

Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. The general rule is that form 5500s must be filed by the last day of the seventh. Web where can i get more information about employee benefit plans? On december 8, 2022 dol, irs, and pbgc. 15th, but if the filing due date falls on a. C premiums due but unpaid at the end of the year. Web the following calendar includes important compliance due dates and reminders for 2022. (usually due by july 31, which falls on a. Web what is the deadline to file?

Form 5500 Is Due by July 31 for Calendar Year Plans

Schedule a (form 5500) 2022. Web form 5500 due date. (updated may 18, 2022) tips for next year be sure to. Web important dates typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web what is the deadline to file?

form 5500 extension due date 2022 Fill Online, Printable, Fillable

17 2022) by filing irs form 5558 by aug. Schedule a (form 5500) 2022. C premiums due but unpaid at the end of the year. Web the following calendar includes important compliance due dates and reminders for 2022. The general rule is that form 5500s must be filed by the last day of the seventh.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. The deadline to file is linked to the last day of the plan year. Web where can i get more information about employee benefit plans? Web if the.

August 1st Form 5500 Due Matthews, Carter & Boyce

Web current revision form 5558 pdf recent developments none at this time. Typically, the form 5500 is due by. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. The laws and due dates apply based on the.

Pin on calendar ideas

The form 5500 due date for filing depends on the plan year. Typically, the form 5500 is due by. Other items you may find useful all form 5558 revisions form 5550 corner other. Web what is the deadline to file? (updated may 18, 2022) tips for next year be sure to.

IRS Form 5500EZ Download Fillable PDF or Fill Online Annual Return of

The deadline to file is linked to the last day of the plan year. (updated may 18, 2022) tips for next year be sure to. 15th, but if the filing due date falls on a. The laws and due dates apply based on the number of employees, whether or not. C premiums due but unpaid at the end of the.

Retirement plan 5500 due date Early Retirement

The form 5500 due date for filing depends on the plan year. Whether a plan maintains a calendar year plan year (12/31) or an off. 15th, but if the filing due date falls on a. Web annual funding notices for small plans must be provided by the earlier of the date the form 5500 is filed or the due date.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web important dates typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 17 2022) by filing irs form 5558 by aug. Web what is the deadline to file? C premiums due but unpaid at the end of the year. The laws and due dates apply based on the number of.

Retirement plan 5500 due date Early Retirement

Web the following calendar includes important compliance due dates and reminders for 2022. Web form 5500 due date. (updated may 18, 2022) tips for next year be sure to. The laws and due dates apply based on the number of employees, whether or not. Who should i contact with questions about a cp216h notice?

How to File Form 5500EZ Solo 401k

The general rule is that form 5500s must be filed by the last day of the seventh. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Web the following calendar includes important compliance due dates and reminders for 2022. Web form 5500 due date. 15th, but if the filing due date falls on.

Web If The Filing Due Date Falls On A Saturday, Sunday Or Federal Holiday, The Form 5500 May Be Filed On The Next Day That Is Not A Saturday, Sunday Or Federal Holiday.

Web current revision form 5558 pdf recent developments none at this time. Schedule a (form 5500) 2022. Go to www.irs.gov/form5500ez for instructions and the latest information. Web form 5500 due date.

Web The Following Calendar Includes Important Compliance Due Dates And Reminders For 2022.

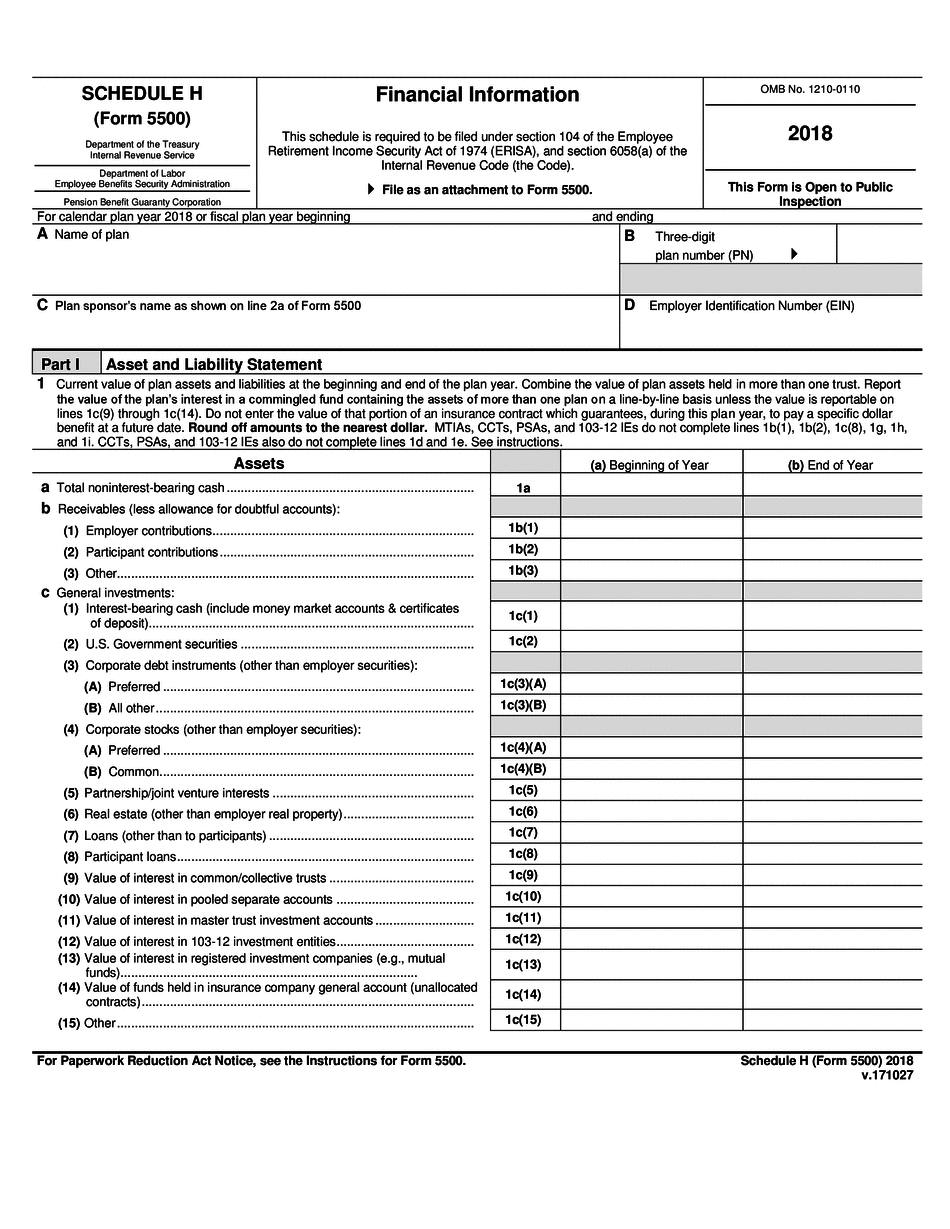

Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect. C premiums due but unpaid at the end of the year. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the.

Who Should I Contact With Questions About A Cp216H Notice?

Typically, the form 5500 is due by. 15th, but if the filing due date falls on a. (usually due by july 31, which falls on a. Whether a plan maintains a calendar year plan year (12/31) or an off.

On December 8, 2022 Dol, Irs, And Pbgc.

The deadline to file is linked to the last day of the plan year. The laws and due dates apply based on the number of employees, whether or not. The general rule is that form 5500s must be filed by the last day of the seventh. The form 5500 due date for filing depends on the plan year.