Form 5500 Due Dates

Form 5500 Due Dates - If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. Complete, edit or print tax forms instantly. Web form 5500 due date. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web 13 rows tip: On december 8, 2022 dol, irs, and pbgc. The irs’s aforementioned form 5500 due date for plans that end on december 31. The form 5500 due date for filing depends on the plan year. Web by the 30th day after the due date. The general rule is that form 5500s must be filed by the last day of the seventh.

Get ready for tax season deadlines by completing any required tax forms today. Web 13 rows tip: Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. On december 8, 2022 dol, irs, and pbgc. The plan year beginning and ending date on all. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. The form 5500 due date for filing depends on the plan year. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The general rule is that form 5500s must be filed by the last day of the seventh.

Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Complete, edit or print tax forms instantly. The plan year beginning and ending date on all. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. This is also the deadline to file form 5558 for those requesting an. Web form 5500 due date. Web 13 rows tip: Get ready for tax season deadlines by completing any required tax forms today. The irs’s aforementioned form 5500 due date for plans that end on december 31. Web by the 30th day after the due date.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Complete, edit or print tax forms instantly. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce..

Form 5500 Is Due by July 31 for Calendar Year Plans

Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Complete, edit or print tax forms instantly. The plan year beginning and ending date on all. Web by the 30th day after the due date.

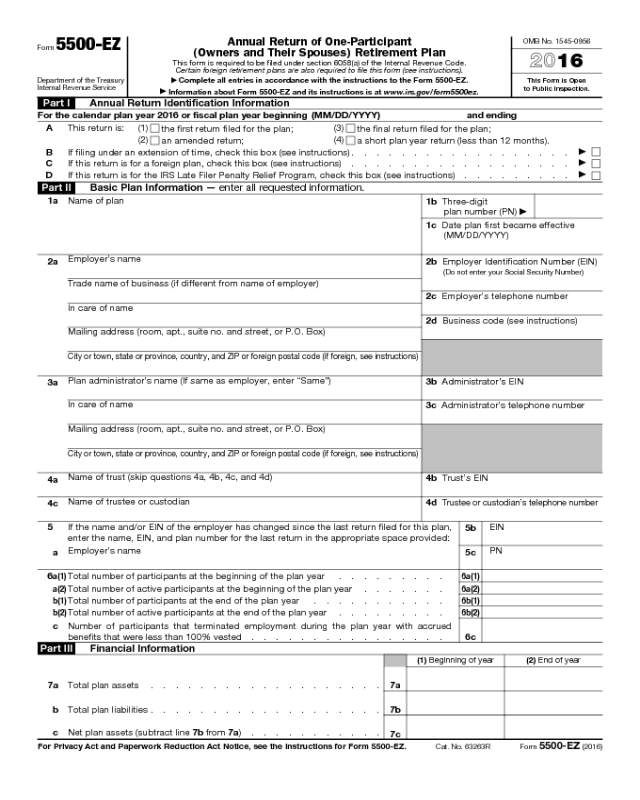

Form 5500EZ Edit, Fill, Sign Online Handypdf

Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Complete, edit or print tax forms instantly. The general rule is that form 5500s must be filed by the last day of the seventh. Get ready for.

How to File Form 5500EZ Solo 401k

Web by the 30th day after the due date. On december 8, 2022 dol, irs, and pbgc. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. The general rule is that form 5500s must be filed by the last day of the seventh. The plan year beginning and ending date on.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

The irs’s aforementioned form 5500 due date for plans that end on december 31. Web by the 30th day after the due date. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. The general rule is that form 5500s must be filed by the last day of the seventh. Department of labor’s.

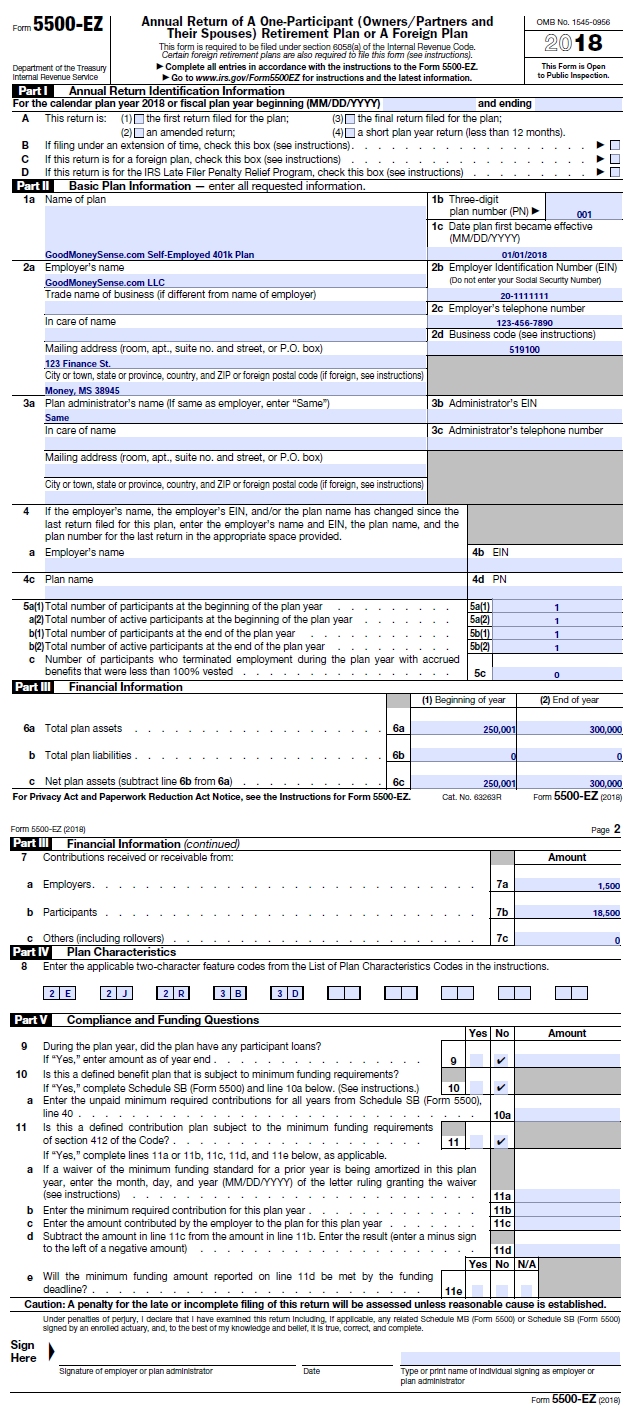

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web form 5500 due date. The plan year beginning and ending date on all. The form 5500 due date for filing depends on the plan.

Retirement plan 5500 due date Early Retirement

The plan year beginning and ending date on all. Complete, edit or print tax forms instantly. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. This is also the deadline to file form 5558 for those requesting an. Get ready for tax season deadlines by completing any required tax forms today.

What is the Form 5500? Guideline

Complete, edit or print tax forms instantly. This is also the deadline to file form 5558 for those requesting an. Web form 5500 due date. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Web form 5500 filing due dates.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

The irs’s aforementioned form 5500 due date for plans that end on december 31. Web form 5500 filing due dates. Complete, edit or print tax forms instantly. Web by the 30th day after the due date. The plan year beginning and ending date on all.

August 1st Form 5500 Due Matthews, Carter & Boyce

The irs’s aforementioned form 5500 due date for plans that end on december 31. Complete, edit or print tax forms instantly. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. Get ready for tax season deadlines by.

The General Rule Is That Form 5500S Must Be Filed By The Last Day Of The Seventh.

Get ready for tax season deadlines by completing any required tax forms today. Web 13 rows tip: On december 8, 2022 dol, irs, and pbgc. The irs’s aforementioned form 5500 due date for plans that end on december 31.

Web Form 5500 Filing Due Dates.

Web form 5500 due date. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Web by the 30th day after the due date. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. The form 5500 due date for filing depends on the plan year. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next.

The Plan Year Beginning And Ending Date On All.

This is also the deadline to file form 5558 for those requesting an. Get ready for tax season deadlines by completing any required tax forms today.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)